A lien sale is a public auction held when a property owner fails to pay debts related to the property. The lien serves as collateral for the debt, allowing the lienholder to recover their money if the debtor defaults. Lien sales follow specific legal procedures to ensure fairness and legality, regulated by state and local laws. They occur when a debtor fails to fulfill obligations such as taxes, mortgages, repairs, or storage fees. The lienholder initiates the sale by notifying the debtor, giving them a chance to repay the debt. If repayment doesn't occur, a public auction of the property is arranged. In a tax lien sale, the government auctions off its lien on a property due to unpaid property taxes. The investor who purchases the lien effectively pays the delinquent tax on behalf of the property owner and in return, receives the right to collect the debt with interest from the property owner. If the owner fails to repay within a specified period, the lien holder may foreclose on the property. A mechanics lien sale comes into play when a contractor, sub-contractor, or supplier who has contributed labor, services, or materials to improve a property is not paid for their work. They can file a mechanic's lien against the property, and if the owner still doesn't pay, the lienholder can initiate a lien sale. These types of liens are common in the construction industry and serve to protect the interests of those providing labor or materials. In a storage lien sale, the owner of a self-storage facility can auction off the contents of a storage unit if the renter fails to pay their rent for a certain period. This process is often dramatized in television shows like "Storage Wars," where bidders buy sight-unseen storage units hoping to turn a profit from the contents. There are also several other types of liens that can result in a lien sale, such as judgment liens (from court judgments), homeowners' association liens (for unpaid HOA dues), and IRS liens (for unpaid federal taxes). Each type of lien comes with its own set of laws, procedures, and challenges for both the lienholder and the debtor. The lien holder's claim is essentially the outstanding debt that the lienholder is owed. This could be unpaid taxes, outstanding mortgage payments, unpaid labor or materials, storage fees, or any number of other financial obligations. This claim gives the lienholder the right to sell the debtor's property to recoup their money. It's important to note that lienholders don't typically want to resort to a lien sale. It's usually the last resort when all other attempts to collect the debt have failed. The property or asset involved in a lien sale can be any tangible or intangible asset. This includes real estate, vehicles, equipment, storage unit contents, and even intellectual property. The type of property involved will affect the process and laws surrounding the lien sale. For instance, a property tax lien sale involves a real estate property, whereas a storage lien sale involves personal property stored within a rented space. The debtor, or the individual or entity that owes the debt, is a critical player in a lien sale. It's their failure to pay their debt that instigates the lien sale process. In most cases, debtors have the right to pay off their debt to prevent the sale even after the lien sale process has begun, up until a specified point. However, if they fail to repay the debt within a designated time frame, they stand to lose ownership of their property. The first step in the lien sale process is providing notice to the debtor. The lienholder is required by law to send a notification of the lien to the debtor, usually via certified mail. This notice informs the debtor of the outstanding debt, the nature of the lien, and the intention to sell the property if the debt is not paid. This step provides the debtor with an opportunity to pay the debt and prevent the sale of the property. If the debtor fails to repay the debt within the specified timeframe, the lien sale process proceeds to the next stage. The failure to pay can result from various reasons, from financial hardships to simple oversight. Regardless, once this stage is reached, the consequences for the debtor can be severe, potentially leading to the loss of property. Once the debtor fails to pay the debt, the property is auctioned to the highest bidder in a public sale. The auction can take place in person or online, depending on local regulations and the type of property involved. The proceeds from the sale are used to repay the debt, with any surplus potentially going back to the debtor. However, if the proceeds are insufficient, the debtor may still owe the remaining debt, depending on the local laws and the type of lien. Tax lien sales occur when a property owner fails to pay their property taxes. In these cases, the government (usually a county or municipal government) places a tax lien on the property. The government can then sell the tax lien to an investor at auction to recover the unpaid tax amount. In a tax lien sale, the investor is essentially buying the government's right to collect the owed property taxes plus interest. The property owner then owes the debt to the investor instead of the government. If the property owner fails to pay the debt, the investor can foreclose on the property and become the owner. Investing in tax liens can be lucrative, with interest rates sometimes reaching up to 18% or higher. Additionally, if the property owner can't repay the tax debt, the investor has the opportunity to acquire the property at a fraction of its actual value. However, this type of investment isn't without risks, and potential investors must do their due diligence before participating in a tax lien sale. A mechanics lien sale occurs when a contractor, subcontractor, or supplier isn't paid for work done or materials supplied for a property improvement. The unpaid party can place a mechanics lien on the property, allowing them to sell it if the debt isn't paid. Once the mechanics lien is filed and the property owner fails to pay the debt, the lienholder can initiate a lien sale. The property is auctioned, and the proceeds are used to pay the debt. Mechanics liens are an essential tool for contractors and suppliers to ensure they get paid for their work and materials. In case of non-payment, the mechanics lien gives them the right to initiate a lien sale and recover their money. A storage lien sale happens when a tenant of a storage unit fails to pay their rental fees. The storage facility owner can then auction off the contents of the unit to recover the unpaid rent. Storage lien sales usually involve selling the entire contents of a storage unit as a single lot. Bidders usually can't inspect the contents in detail before the auction, adding a level of risk and excitement to the process. Storage lien sales allow storage facility owners to quickly recover unpaid rent and free up space for new tenants. These auctions can attract a wide range of buyers, from professional dealers to casual bargain hunters, helping to ensure competitive bidding. One of the primary rights of a debtor in a lien sale is the right of redemption. This means the debtor can pay the outstanding debt, including any additional costs and interest, to halt the lien sale process and reclaim their property. The period for redemption varies by jurisdiction and type of lien, and in some cases, may extend even after the lien sale has occurred. Another crucial right is the ability to contest the lien. If a debtor believes the lien to be invalid or the debt inaccurately calculated, they can challenge it in court. However, this process can be time-consuming and costly, requiring legal counsel. A lien sale can significantly impact the debtor, primarily through the loss of their property. It can also negatively affect their credit score and make it difficult to obtain future credit or loans. If the lien sale doesn't cover the total debt, the debtor may still be responsible for the remaining balance. The lien holder has specific responsibilities in a lien sale, including notifying the debtor of the lien, accurately calculating the debt, and conducting the lien sale in accordance with local laws. It's also their responsibility to use the sale proceeds to pay off the debt and return any surplus to the debtor. The lien holder has the right to initiate a lien sale when the debtor defaults on their payment. They also have the right to recover their money through the lien sale and apply any excess funds towards any other debts owed by the debtor. The buyer's responsibilities at a lien sale include understanding the terms and conditions of the sale, conducting due diligence on the property, and making timely payment if they win the bid. They're also responsible for any actions required to take possession of the property, such as eviction procedures if the property is occupied. The buyer has the right to participate in the auction, ask questions, inspect the property (if permitted), and place bids. If they win the auction, they acquire the rights to the property subject to local laws and any existing senior liens. Navigating the waters of lien sales can be a tricky endeavor. To successfully invest in these sales, understanding the potential pitfalls and opportunities is essential. This understanding enables buyers to manage their risk exposure while maximizing the potential benefits. Lien sales, while potentially profitable, come with a set of inherent risks that any potential investor should consider. These risks fall into various categories. Often in a lien sale, buyers have limited access to inspect the property before bidding. This limitation could leave buyers unaware of potential property issues, such as structural damage, environmental hazards, or zoning restrictions. Therefore, buyers might end up with a property that requires costly repairs or modifications, impacting the overall profitability. A property might have multiple liens against it. If the buyer is not purchasing the senior-most lien, they might face a risk of their lien being wiped out by a senior lien foreclosure. It’s crucial for the buyer to conduct a thorough title search to understand the hierarchy of existing liens and avoid this pitfall. If the property in question is a residential property, it may still be occupied by the original owner or a tenant. If the occupant is uncooperative, the buyer may face legal hurdles and costs associated with eviction. Most jurisdictions allow a period for the debtor to pay off their debt and reclaim their property, known as the right of redemption. This period can extend even after the property has been sold at a lien sale. If the debtor exercises this right, the buyer might lose ownership of the property, leading to unexpected losses. Despite the risks, lien sales present a wealth of opportunities for both investors and lien holders. These opportunities can offer substantial returns if approached correctly. One of the most significant draws of lien sales is the opportunity to acquire properties at a fraction of their market value. Since lien sales aim to recover the owed debt rather than the full property value, winning bidders often get properties at significantly reduced prices. Particularly in the case of tax lien sales, investors can earn a high interest rate on their investment. The property owner is obligated to pay the owed taxes, the winning bid amount, plus a high interest rate. Thus, if the debtor redeems the property, the investor stands to make a substantial return. For lien holders, lien sales provide a legal method to recover unpaid debts. The lien sale process, while potentially time-consuming, ensures that the lien holder can recoup at least a portion, if not all, of the owed money. If successful, a lien sale can turn a non-performing asset into a source of recovered funds. Preparation involves researching upcoming lien sales, understanding local lien laws, inspecting properties (if permitted), and arranging funds for potential bids. Participation often involves registering for the auction, whether online or in-person, placing bids, and adhering to the auction rules. Post-auction responsibilities include paying for the winning bid, taking possession of the property, and dealing with any remaining issues such as eviction or property maintenance. Buyers should also prepare for the possibility of the debtor redeeming the property. A lien sale is a legal method creditors use to sell a debtor's property to recoup unpaid debts. These sales can be categorized as a tax lien, mechanics lien, or storage lien sales, each with its own specific rules and procedures. The primary elements of a lien sale include the lien holder's claim, the debtor, and the property involved. The process often involves alerting the debtor, auctioning the property if the debt remains unpaid, and then applying the proceeds to the outstanding debt. Participation in a lien sale requires understanding local lien laws, investigating upcoming sales, and securing funds for potential bids. Despite their risks, lien sales can provide investment opportunities and debt recovery. Due to their complexity, professional advice from a mortgage broker or legal advisor is advisable.What Are Lien Sales?

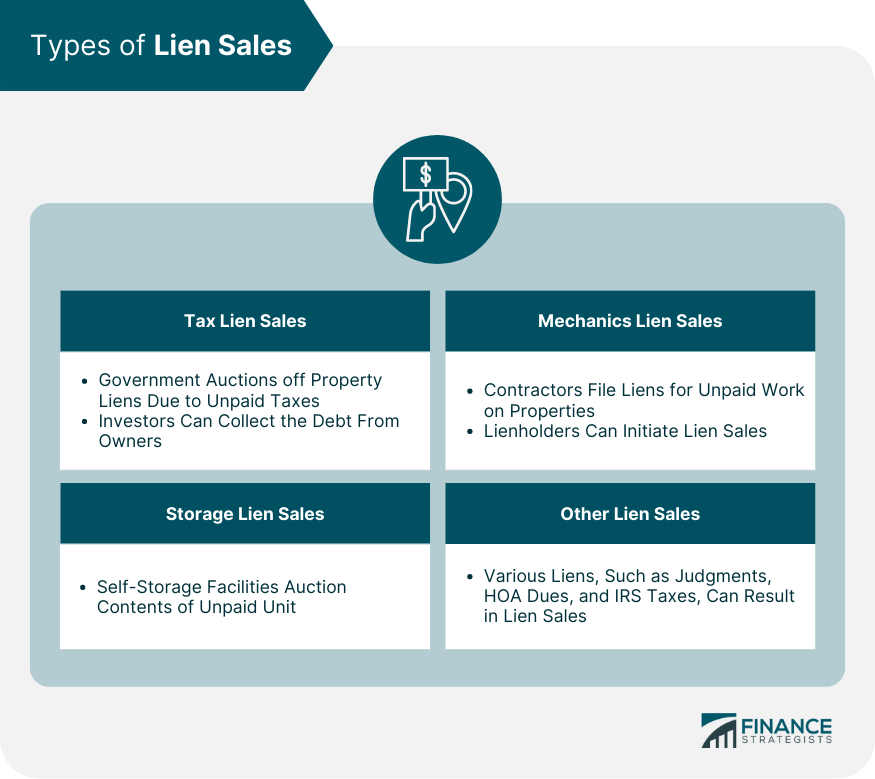

Types of Lien Sales

Tax Lien Sales

Mechanics Lien Sales

Storage Lien Sales

Other Lien Sales

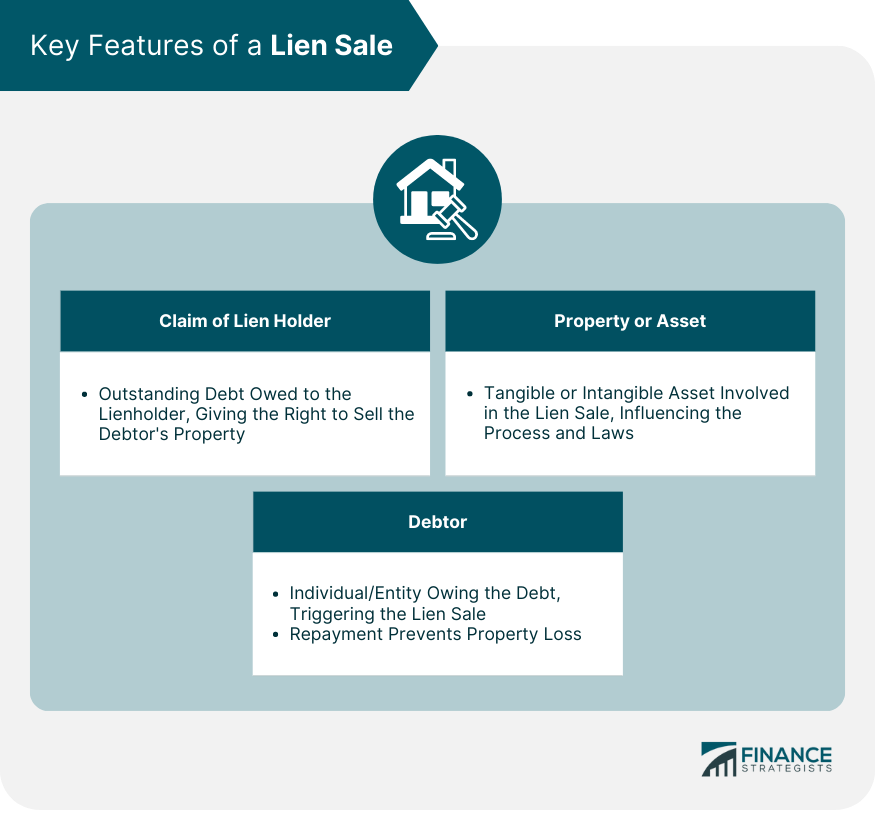

Key Features of a Lien Sale

Claim of the Lien Holder

Property or Asset Involved

Debtor or the Person Who Owes the Debt

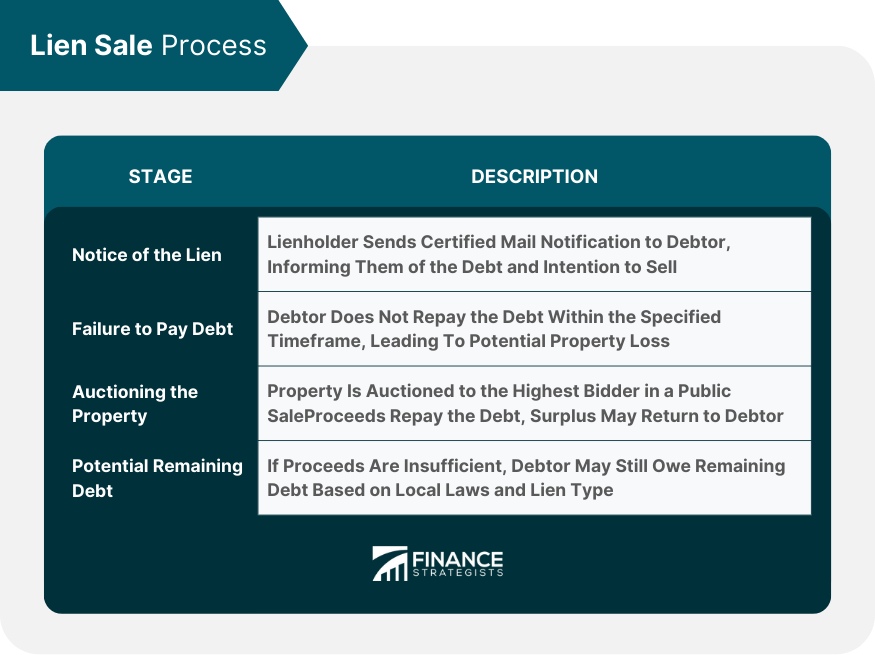

Lien Sale Process

Notice of the Lien to the Debtor

Failure of the Debtor to Pay the Debt

Auctioning the Property

Tax Lien Sales in Detail

What are Tax Lien Sales?

How Do Tax Lien Sales Work?

Potential Benefits for Investors

Mechanics Lien Sales in Detail

What are Mechanics Lien Sales?

How Do Mechanics Lien Sales Work?

Potential Benefits for Contractors and Suppliers

Storage Lien Sales in Detail

What are Storage Lien Sales?

How Do Storage Lien Sales Work?

Potential Benefits for Storage Facility Owners

Rights of the Debtor in a Lien Sale

Right to Pay the Debt and Redeem the Property

Right to Contest the Lien

Impact of a Lien Sale on the Debtor

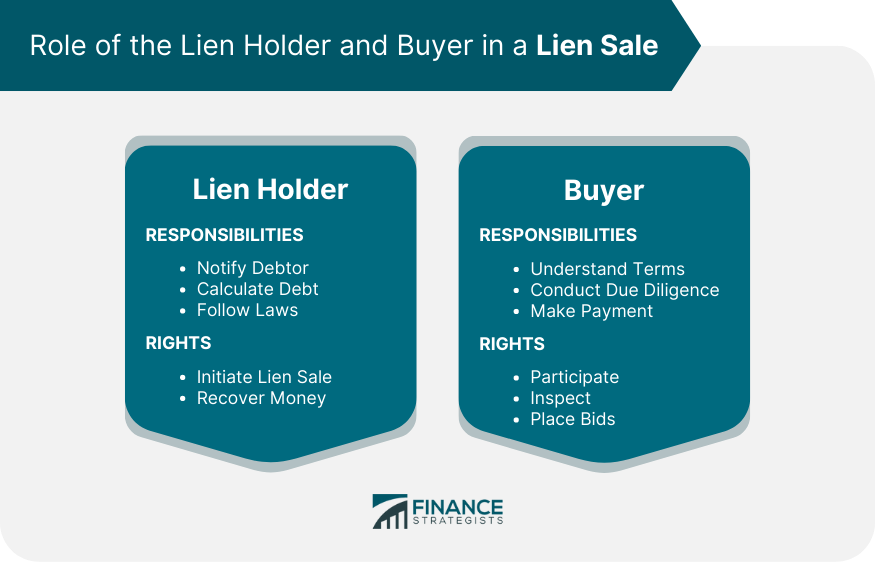

Role of the Lien Holder in a Lien Sale

Responsibilities of the Lien Holder

Rights of the Lien Holder

Role of the Buyer in a Lien Sale

Responsibilities of the Buyer

Rights of the Buyer

Risks in Lien Sales

Confronting Unknown Property Conditions

Contending With Existing Senior Liens

Dealing With Uncooperative Occupants

Anticipating Right of Redemption

Opportunities Presented by Lien Sales

Acquiring Property at Reduced Cost

Earning High Interest on Investment

Recovering Debts for Lien Holders

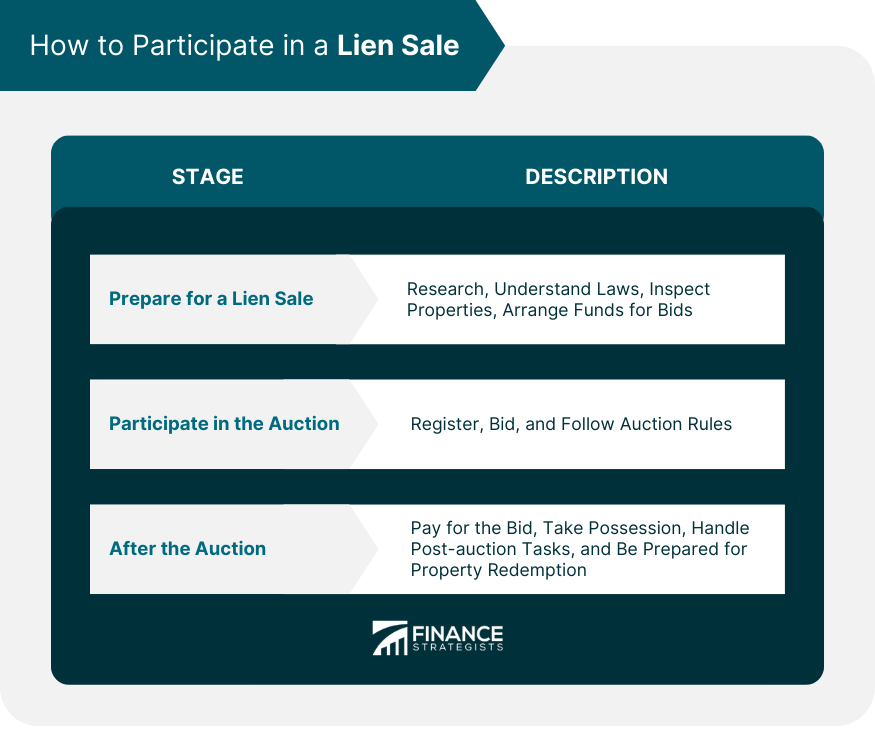

How to Participate in a Lien Sale

Preparing for a Lien Sale

Participating in the Auction

After the Auction

Final Thoughts

Lien Sales FAQs

A lien sale is a legal process where a lien holder sells a debtor's property to recover unpaid debts. This process occurs when the debtor fails to pay off the debt, prompting the lien holder to auction the property.

The types of lien sales include tax lien sales, mechanics lien sales, and storage lien sales. Each type corresponds to different kinds of debts—property taxes, unpaid work or materials, and unpaid storage rental fees, respectively.

The key features of a lien sale include the claim of the lien holder, the property or asset involved, and the debtor who owes the debt.

The process typically begins with the lien holder notifying the debtor about the lien. If the debtor fails to pay, the property is auctioned, and the sale proceeds are used to pay off the debt.

To participate in a lien sale, you need to prepare by researching upcoming sales, understanding local lien laws, and arranging funds for potential bids. Then, you can participate in the auction, bid, and, if successful, complete post-auction responsibilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.