Business credit and financing are crucial components for any organization seeking to grow and succeed. Business credit refers to a company's creditworthiness, which is determined by factors such as payment history, credit utilization, and length of credit history. Business financing, on the other hand, refers to the various funding options that businesses can use to finance their operations and growth. The importance of credit and financing in business growth cannot be overstated. Without adequate funding, businesses may not have the resources they need to hire staff, invest in equipment and technology, or expand into new markets. On the other hand, without good credit, businesses may struggle to secure funding or may have to pay higher interest rates or accept unfavorable loan terms. A business credit score is a numerical representation of a company's creditworthiness, similar to an individual's personal credit score. Factors influencing these scores include payment history, credit utilization, length of credit history, and public records. Credit reporting agencies such as Dun & Bradstreet, Experian, and Equifax assess these factors to generate scores. Maintaining a good business credit score is essential for several reasons: Lower interest rates: Lenders are more likely to offer lower interest rates to businesses with strong credit scores. Better financing terms: Favorable credit scores can result in extended payment terms and higher credit limits. Increased credibility: A good credit score can enhance a company's reputation, making it more attractive to potential investors, partners, and customers. Debt financing involves borrowing money that must be repaid over time, often with interest. Bank loans: Traditional bank loans are the most common form of debt financing, with terms and interest rates varying based on factors such as credit score and collateral. Small Business Administration (SBA) loans: These government-backed loans are designed to support small businesses, offering competitive terms and interest rates. Lines of credit: Businesses can access a flexible line of credit, allowing them to borrow and repay funds as needed. Equity financing involves exchanging ownership or shares in a business for capital. Venture capital: Venture capitalists invest in early-stage companies with high growth potential, offering funding in exchange for equity. Angel investors: Wealthy individuals or groups provide capital to startups in exchange for equity or convertible debt. Crowdfunding: Companies can raise funds from a large pool of individual investors, often through online platforms, in exchange for equity, rewards, or other incentives. Alternative financing options are non-traditional sources of capital. Invoice factoring: Businesses can sell their unpaid invoices to a third party at a discount, receiving immediate cash flow. Merchant cash advances: Companies receive a lump sum in exchange for a percentage of future credit card sales. Peer-to-peer lending: Businesses can borrow funds directly from individual investors, often through online platforms, bypassing traditional financial institutions. Interest rates and repayment terms can significantly impact a business's ability to repay the loan and the total cost of borrowing. It is essential to compare interest rates and terms offered by different lenders to find the best financing option that fits the business's cash flow and profitability. It's also essential to consider any potential fees and penalties that may apply, such as prepayment penalties or origination fees. Lenders and investors usually have specific qualification criteria that businesses must meet to access financing. For example, lenders may require a specific credit score, minimum revenue, or collateral to secure the loan. Businesses should carefully evaluate the qualification requirements for different financing options and choose an option that they can realistically qualify for. The repayment structure is an essential factor to consider when choosing financing. Businesses should evaluate the repayment terms, such as the length of the repayment period and the frequency of payments, to determine whether it's suitable for their cash flow. Some lenders may offer more flexibility in repayment, such as deferment periods or interest-only payments, which can help businesses manage their cash flow. Equity financing options, such as venture capital and angel investments, may require businesses to give up a portion of ownership and control in exchange for funding. Businesses should carefully evaluate the potential impact on their ownership and control before choosing an equity financing option. On the other hand, debt financing options, such as bank loans and lines of credit, may not impact ownership and control but come with interest payments that need to be repaid. One of the critical steps in building good business credit is to separate personal and business credit. Businesses should establish separate credit profiles and use business credit for all business-related expenses. Mixing personal and business credit can lead to confusion, errors, and lower credit scores, as personal credit mistakes can impact business credit. Businesses should establish credit accounts with suppliers, vendors, and lenders to build credit history. Paying bills on time and in full can help businesses establish a positive payment history and improve their credit scores over time. Additionally, having a diverse mix of credit accounts, such as revolving credit, installment loans, and lines of credit, can also improve credit scores. Paying bills on time is one of the most critical factors in maintaining good credit. Late payments can lead to penalties, fees, and negative marks on credit reports, which can impact credit scores. Businesses should prioritize making timely payments and establish a system to ensure that bills are paid on time. Businesses should regularly monitor their credit reports to ensure that they are accurate and up-to-date. Errors, disputes, or fraudulent activity can negatively impact credit scores and limit access to financing. By monitoring credit reports, businesses can identify and address issues promptly, ensuring that their credit profiles remain healthy. Governments at various levels offer loan and grant programs to support small and medium-sized businesses. For example, the Small Business Administration (SBA) provides a range of loan options and resources for entrepreneurs and small business owners. Private organizations such as business incubators and accelerators provide funding, mentorship, and resources to startups and early-stage companies. These programs often come with networking and learning opportunities that can help businesses grow and succeed. Some governments, organizations, and corporations offer grants, tax credits, or other incentives to support specific industries or initiatives. These funding options can be attractive to businesses seeking capital without the burden of repayment. Business credit and financing are crucial components of building and maintaining a successful enterprise. By understanding the different types of financing available, evaluating their specific needs and goals, and implementing strategies to maintain good credit, businesses can make informed decisions and secure the funding necessary to grow and thrive. Additionally, by taking advantage of government and private programs and incentives, businesses can access additional resources and support to reach their full potential. However, it's important to remember that financing decisions should be made with care and consideration. While access to capital can be crucial to achieving business goals, borrowing or giving up equity can also come with risks and consequences. It's crucial for businesses to carefully evaluate their options, seek professional advice when necessary, and monitor their finances to ensure they can meet their obligations and maintain financial health.What Is Business Credit and Financing?

Understanding Business Credit

Business Credit Scores

Benefits of Good Business Credit

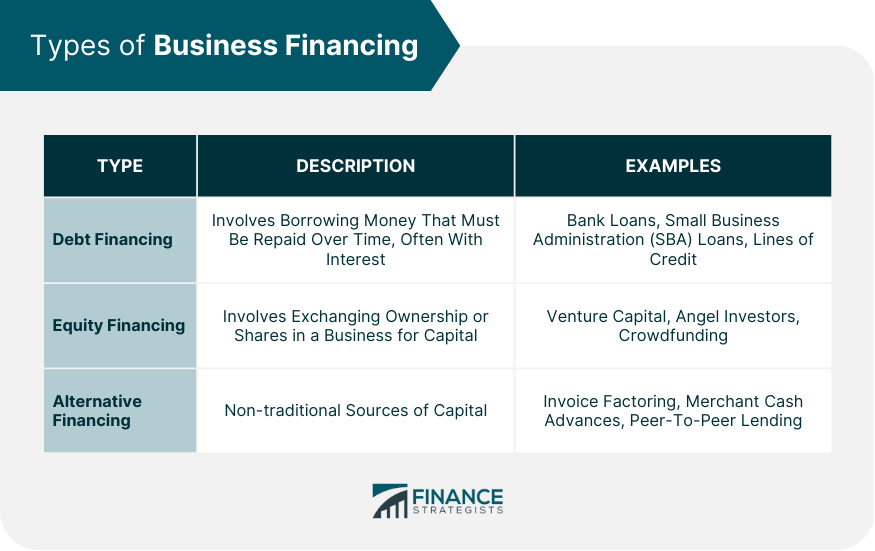

Types of Business Financing

Debt Financing

Equity Financing

Alternative Financing

Factors to Consider When Choosing Business Financing

Interest Rates and Terms

Qualification Requirements

Flexibility of Repayment

Impact on Ownership and Control

Strategies to Improve Business Credit

Separating Personal and Business Credit

Establishing Credit Accounts

Timely Payments

Monitoring Business Credit Reports

The Role of Government and Private Organizations in Supporting Business Financing

Government-Backed Loans and Programs

Private Organizations and Incubators

Grants and Incentives

Conclusion

Business Credit and Financing FAQs

Business credit is the ability of a company to obtain financing or other credit-based services based on its creditworthiness and financial history, separate from the personal credit of its owners.

Business credit is established through the company's payment history, financial statements, and other factors that demonstrate its ability to repay debt. Companies can establish business credit by opening accounts with vendors and suppliers, obtaining a business credit card, and maintaining a good payment history.

Businesses can access a variety of financing options, including term loans, lines of credit, equipment financing, and commercial real estate loans. The type of financing a business needs depends on its specific needs and goals.

When applying for business financing, lenders typically consider the company's credit history, financial statements, collateral, and industry trends. The business owner's personal credit history may also be considered, particularly for newer businesses with limited credit history.

To improve business credit and increase the chances of securing financing, businesses should establish a strong payment history, regularly monitor credit reports, maintain accurate financial records, and limit the amount of debt the company takes on. It's also important to research and compare financing options to find the best fit for the business's needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.