A Business Equity Line of Credit (BELOC) is a financing option for businesses that allows them to borrow money based on the equity in their commercial real estate. A business equity line of credit allows a business to leverage the equity of their commercial or residential real estate for a revolving line of credit. These lines of credit have terms ranging from 12 to 180 months, making them useful for both short and long-term financing. Much like a home equity line of credit, a BELOC provides a credit limit that the business can borrow against, as and when required, rather than receiving a lump sum at once. A BELOC is a vital financial tool for businesses, offering flexibility and liquidity to meet a wide range of needs, such as inventory procurement, equipment purchases, operational expenses, expansion initiatives, or unforeseen financial demands. It provides businesses with access to funds based on the value of their equity, thereby utilizing an existing asset for financial gains. To qualify for a BELOC, a business must own commercial real estate and have a considerable amount of equity in it. Equity is the difference between the market value of the property and any outstanding debts or liens against it. The greater the equity, the larger the potential line of credit. A minimum credit score is often required to qualify for a BELOC. While requirements may vary by lender, businesses with higher credit scores generally receive more favorable terms. Additionally, lenders consider the financial stability of the business, evaluating profitability, cash flow, and debt-to-income ratios to ensure the business can manage the additional debt. The commercial property serves as the collateral for the BELOC, which means the lender can seize the property if the business fails to repay the borrowed amount. The required documentation usually includes financial statements, tax returns, lease agreements, and property-related documents, among others. The Loan-to-Value (LTV) ratio is a critical factor in determining the maximum credit limit of a BELOC. It is the proportion of the property's value that is financed through debt. A lower LTV ratio is generally more favorable and represents less risk to the lender. One of the key advantages of a BELOC is its flexibility. Businesses can draw from the line of credit whenever necessary, making it a valuable tool for managing unpredictable or seasonal cash flow needs. BELOCs typically offer lower interest rates than unsecured business loans, as the line of credit is secured against commercial property. This cost-effectiveness makes BELOCs an attractive financing option for businesses. With a BELOC, businesses have immediate access to funds, providing a safety net for unforeseen expenses or new investment opportunities. It essentially offers a reservoir of funds that the business can tap into as needed. Interest payments on a BELOC might be tax-deductible, provided the borrowed funds are used for business purposes. Businesses should consult with a tax advisor to understand how these potential tax benefits might apply to them. Applying for a BELOC will likely involve a hard credit check, which might cause a temporary dip in the business's credit score. Additionally, how the business manages its BELOC can also affect its credit score. BELOCs typically have variable interest rates that fluctuate with market conditions. Therefore, if rates increase, so too will the interest costs of the BELOC, potentially straining the business's finances. The convenience and accessibility of a BELOC might lead to overborrowing. Drawing too much from the line of credit can lead to significant debt, which could burden the business and potentially risk the commercial property used as collateral. If a business defaults on its BELOC repayments, the lender can seize the commercial property used as collateral. The property could then be sold to recoup the owed funds, which could disrupt the business operations and potentially lead to its closure. Choosing the right lender is an important first step in the application process for a BELOC. Businesses should research various lenders, consider their terms and conditions, interest rates, and reputation in the market. After selecting a lender, the business must gather and prepare the necessary documentation. This might include financial statements, tax returns, documents related to the commercial property, and other pertinent records. Once all documentation is prepared, the business submits the application. This can often be done online, although some lenders might require a physical submission or a meeting with a loan officer. Upon submission, the application undergoes an underwriting process, where the lender reviews the provided documents, verifies the information, and assesses the creditworthiness of the business. If the application is approved, the lender will provide the terms of the BELOC, including the credit limit and interest rate. A business can draw funds from its BELOC as needed, up to the established credit limit. This can often be done via online banking, writing a check, or using a special credit card provided by the lender. The repayment terms of a BELOC typically involve a draw period, during which the business can borrow from the line of credit, and a repayment period, during which borrowed funds must be repaid. Businesses should understand these terms, including the minimum payments required and the implications of early repayment. Monitoring a BELOC carefully helps to control interest costs. Because interest only applies to the borrowed amount, businesses can minimize interest costs by borrowing only what they need and repaying it as quickly as possible. A Business Equity Line of Credit is a flexible and potentially cost-effective financing option that allows businesses to borrow against the equity in their commercial property. It serves as a financial safety net that businesses can draw from as needed. Eligibility for a BELOC is based on the business's equity in commercial real estate, credit score, financial stability, and other factors. A thorough understanding of these requirements is crucial for businesses considering a BELOC. While a BELOC offers several advantages like flexibility, accessibility of funds, lower interest rates, and potential tax benefits, it also carries risks including potential impacts on credit scores, variable interest rates, the danger of overborrowing, and the severe consequences of default. What Is a Business Equity Line of Credit?

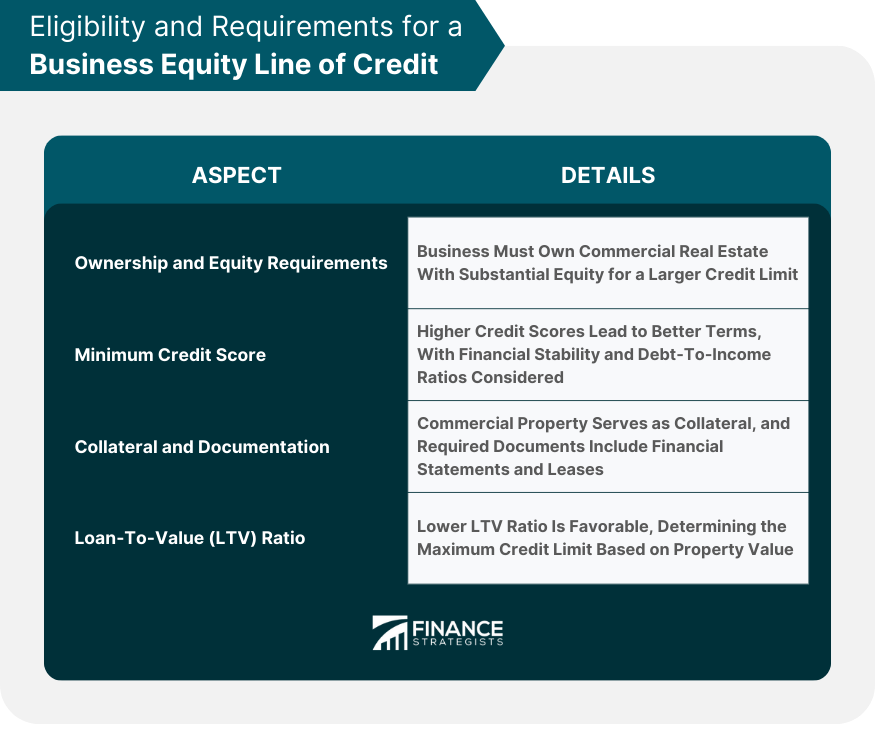

Eligibility and Requirements for a Business Equity Line of Credit

Business Ownership and Equity Requirements

Minimum Credit Score and Financial Stability

Collateral and Documentation Needed

Loan-to-Value (LTV) Ratio Considerations

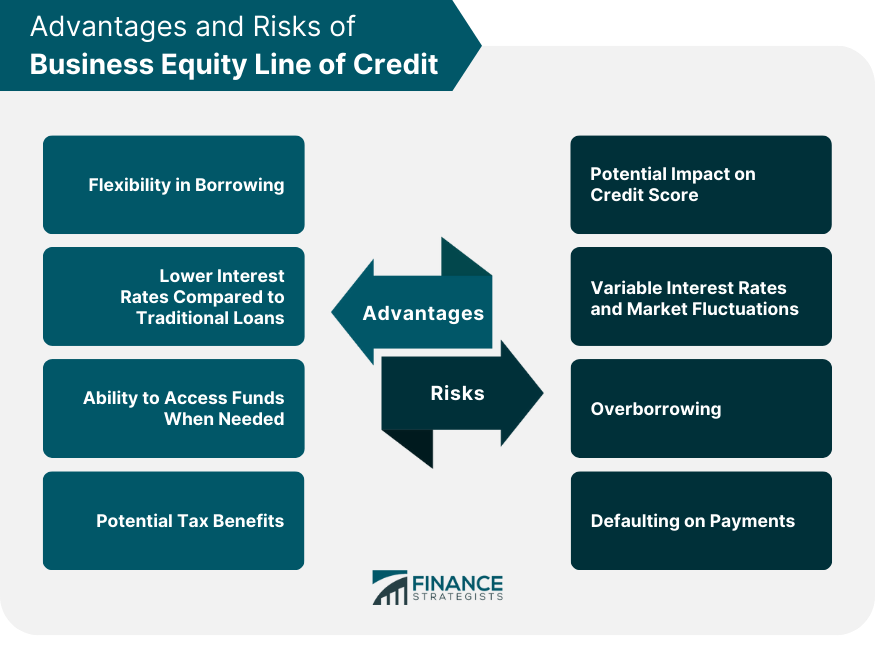

Advantages of a Business Equity Line of Credit

Flexibility in Borrowing

Lower Interest Rates Compared to Traditional Loans

Ability to Access Funds When Needed

Potential Tax Benefits

Risks of a Business Equity Line of Credit

Potential Impact on Credit Score

Variable Interest Rates and Market Fluctuations

Overborrowing

Defaulting on Payments

Application Process for a Business Equity Line of Credit

Researching and Choosing a Lender

Preparing the Necessary Documents

Submitting the Application

Underwriting and Approval Process

Managing a Business Equity Line of Credit

Drawing Funds from the Line of Credit

Repayment Options and Terms

Monitoring and Controlling Interest Costs

Conclusion

Business Equity Line of Credit FAQs

A Business Equity Line of Credit (ELOC) is a type of revolving credit line offered by financial institutions to business owners, secured by the equity in their property or other assets. It allows businesses to access funds for short-term needs such as working capital and equipment purchases.

A Business ELOC works much like a personal line of credit or home equity loan, where the borrower has established limits on how much money they can borrow within that limit. The borrower can draw from the line up to this limit, make payments during the term, and then reuse those funds once they have been repaid.

The main benefit of a Business ELOC is its flexibility. A borrower can draw funds when they need them and then pay them back at their own pace. Additionally, because these loans are typically secured by assets such as property or other collateral, they usually have lower interest rates than unsecured business loans.

Most types of businesses can benefit from a Business ELOC, including start-ups, established businesses looking to expand their operations, and those needing working capital for day-to-day expenses.

Qualifying for a Business ELOC typically requires a detailed business plan, proof of revenue and income, financial statements, and other documents that demonstrate to the lender that the borrower will be able to make timely payments. Additionally, borrowers must have sufficient collateral to secure the loan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.