A business line of credit is a financing solution that allows businesses to borrow money up to a predetermined limit, similar to a credit card. A business line of credit is like an unsecured credit card businesses get from banks; they have a spending limit, which the bank decides, and they can spend up to that limit per month. The funds accumulate interest until paid off. Businesses often use lines of credit for short term funding. Unlike a term loan, where a business receives a lump sum of money upfront, a line of credit offers the flexibility to draw funds as needed. This financial tool can be particularly advantageous for businesses facing fluctuating capital needs. As the business repays the borrowed amount, the available credit replenishes, ensuring continuous access to funds. A distinguishing feature of a business line of credit is its flexibility. Businesses can use it for a variety of purposes, including inventory purchase, payroll, or even unexpected expenses. This means that as a business repays the drawn amount, the available credit returns to its original limit. For instance, if a business has a $50,000 line of credit and draws $20,000, they'll have $30,000 left. However, after repaying the $20,000, the available credit goes back to $50,000. This revolving mechanism ensures continuous access to funds, eliminating the need to apply for a new loan every time capital is needed. A credit limit is the maximum amount a business can borrow under its line of credit. The determination of this limit is based on several factors, including the business's creditworthiness, financial history, and the lender's policies. While some lines of credit might offer limits in the tens of thousands, others can extend into the millions. It's essential for businesses to understand their limits and ensure they don't exceed them, as penalties and fees can apply. One of the significant advantages of a business line of credit is the ease of accessing funds. Typically, once approved, businesses can draw funds as needed without additional approval processes. This can be done via online transfers, writing checks, or even using a card provided by the lender. Such quick access to capital ensures that businesses can respond promptly to financial needs without unnecessary delays. Repayment for a business line of credit is typically more flexible than term loans. Minimum monthly payments are usually required, covering the interest and a portion of the principal amount. However, businesses can choose to pay more than the minimum, accelerating the replenishment of their available credit. Additionally, if managed well, businesses can reduce interest costs by repaying the borrowed amount swiftly. A secured line of credit requires businesses to provide collateral, such as real estate, equipment, or inventory, to back the borrowed amount. This reduces the risk for the lender, often resulting in lower interest rates for the borrower. However, businesses must be aware that in cases of default, the lender has the right to seize the collateral to recover their funds. Unlike the secured variant, an unsecured line of credit doesn't require collateral. This makes it more accessible for many businesses, especially startups or those without substantial assets. However, because the lender takes on more risk, interest rates are usually higher. Moreover, businesses might need a strong credit history and financial record to qualify for an unsecured line of credit. The advent of technology has given rise to online lenders, offering lines of credit to businesses. These digital platforms often have quicker application processes and approval times compared to traditional banks. However, traditional lenders might offer larger credit limits and potentially better interest rates due to their established financial infrastructures. Businesses should weigh the pros and cons of each before deciding. A no doc business line of credit is like a line of credit offered by banks but it requires less paperwork. These lines of credit are offered by alternative lenders that operate differently from traditional banks. These lenders also tend to offer a number of other short-term financing solutions for small businesses. A stated income business line of credit is a revolving credit line for which there is no income check requirement. These lines of credit offer businesses with limited income history an opportunity to receive businesses financing. These lines of credit often come with higher interest rates and a collateral requirement. To get a business line of credit, you must first compare your options and check their requirements. Once you find one you qualify for, you must gather certain financial documents, such as bank statements, financial statements, and some legal documents. Once you have your documentation and a willing lender, you can apply. Before applying, businesses should thoroughly review their financial statements, ensuring they have a clear understanding of their revenues, expenses, and overall profitability. Lenders will scrutinize these records to gauge the business's ability to repay the borrowed amount. A strong financial record can lead to better terms and higher credit limits. It's essential for businesses to shop around and compare offers from multiple lenders. Factors to consider include interest rates, fees, credit limits, and terms of use. Engaging in this research ensures that businesses find a line of credit that aligns with their financial needs and capabilities. The application process for a line of credit usually requires businesses to submit financial statements, tax returns, and other pertinent documents. Ensuring these are accurate and up-to-date can expedite the approval process. Additionally, some lenders might request a business plan or projections, highlighting the intended use of the funds. The requirements for a business line of credit are different from lender to lender. In general, most lenders require having been in business for at least 6 months, at least $25,000 in annual revenue, and a credit score of around 500. However, some traditional lenders may have steeper requirements. Once approved, businesses must exercise caution and prudence. Drawing funds only when necessary and making timely repayments can foster a positive relationship with the lender. This responsible management can pave the way for better terms in future financial engagements. A primary benefit of a business line of credit is its inherent flexibility. Businesses can draw funds as and when they need them, ensuring they're not borrowing (and paying interest on) more than necessary. This dynamic structure can be particularly beneficial for businesses with fluctuating capital needs. Every business encounters times when revenues lag, but expenses remain constant or even spike. A line of credit can bridge this cash flow gap, ensuring businesses can meet their financial obligations even in lean times. This can be especially valuable for seasonal businesses or enterprises with irregular revenue streams. While long-term investments might be better suited for term loans, a line of credit is ideal for addressing short-term financial needs. Whether it's unexpected equipment repairs, an unplanned inventory purchase, or a sudden business opportunity, a line of credit provides quick access to funds without the rigidity of term loans. Since interest is charged only on the amount drawn and not the entire credit limit, businesses can potentially save on interest expenses. If managed well, this structure can be more cost-effective than other financing solutions. Though a line of credit can offer potential interest savings, it's not without its costs. Depending on the lender and the business's creditworthiness, interest rates can be high. Prolonged borrowing without prompt repayment can lead to substantial interest expenses. Just like any other form of borrowing, mismanagement of a business line of credit can adversely affect a business's credit score. Late payments or maxing out the credit limit can lead to credit score dips, impacting future borrowing capabilities. The easy access to funds can sometimes lead businesses to borrow more than necessary. Over-borrowing can strain a business's financial health, leading to challenges in repayment and increased interest costs. For secured lines of credit, businesses risk losing their collateral in cases of default. Whether it's valuable equipment, real estate, or other assets, the potential loss can have long-term repercussions on the business's operations and growth. A Business Line of Credit is a versatile financing solution allowing businesses to borrow up to a set limit, akin to a credit card, offers flexibility, enabling businesses to draw funds as needed, making it suitable for dynamic capital requirements. Effectively managing cash flow, addressing short-term needs, and the potential for interest savings are its major benefits. However, there are inherent risks, including the potential for high interest costs, adverse impact on credit scores due to mismanagement, the risk of over-borrowing, and collateral requirements for secured lines of credit. To obtain and utilize this tool responsibly, businesses must carefully assess their financials, research and select lenders, adhere to application requirements, and manage their credit line diligently. Overall, a Business Line of Credit serves as a valuable resource for businesses, providing immediate financial support while demanding prudence and careful planning.What Is a Business Line of Credit?

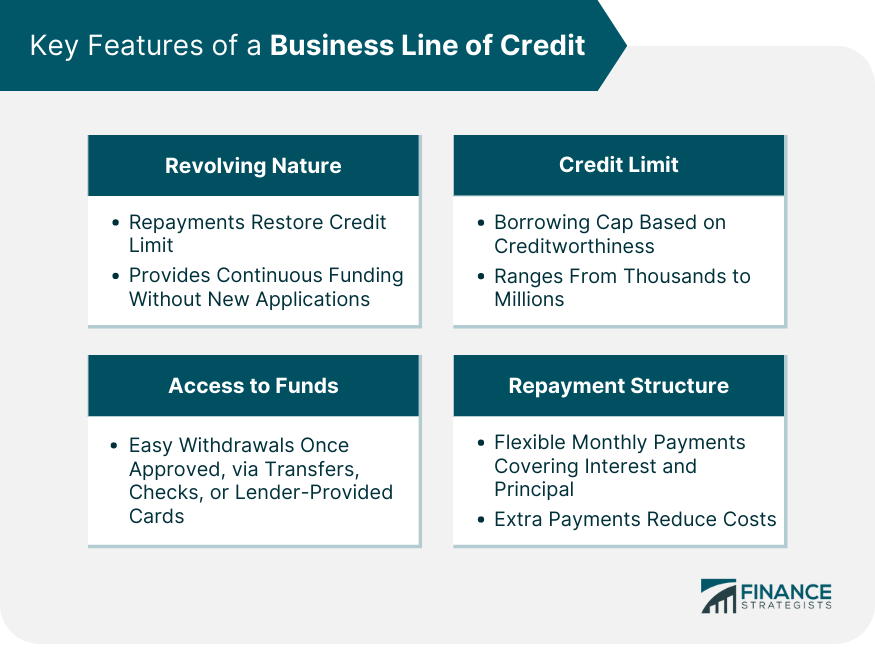

Key Features of a Business Line of Credit

Revolving Nature

Credit Limit

Access to Funds

Repayment Structure

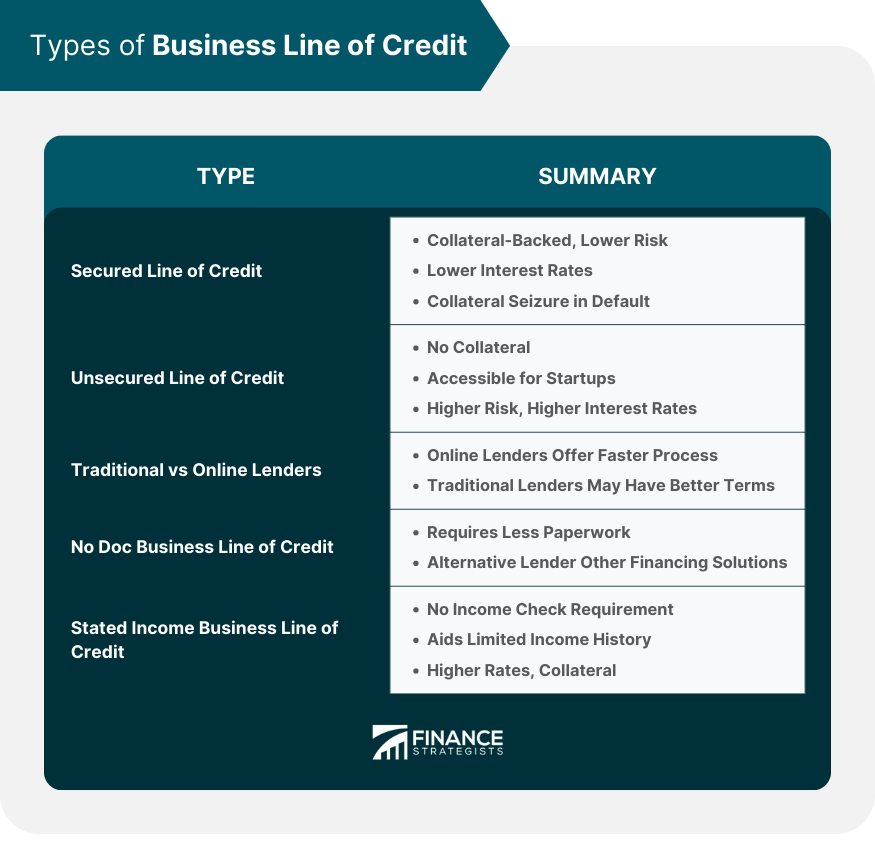

Types of Business Line of Credit

Secured Line of Credit

Unsecured Line of Credit

Traditional vs Online Lenders

No Doc Business Line of Credit

Stated Income Business Line of Credit

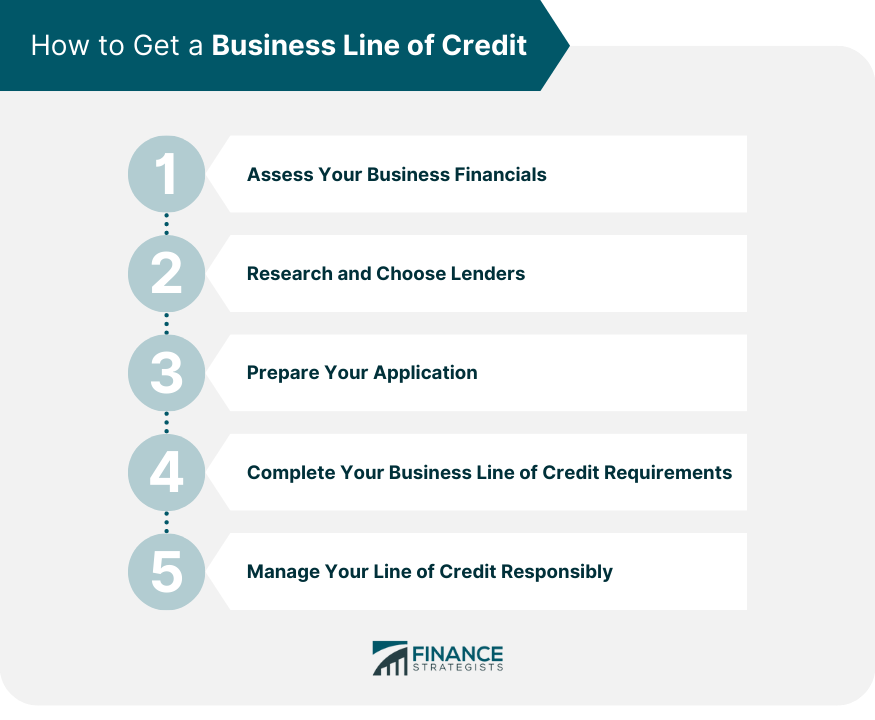

How to Get a Business Line of Credit

Assess Your Business Financials

Research and Choose Lenders

Prepare Your Application

Complete Your Business Line of Credit Requirements

Manage Your Line of Credit Responsibly

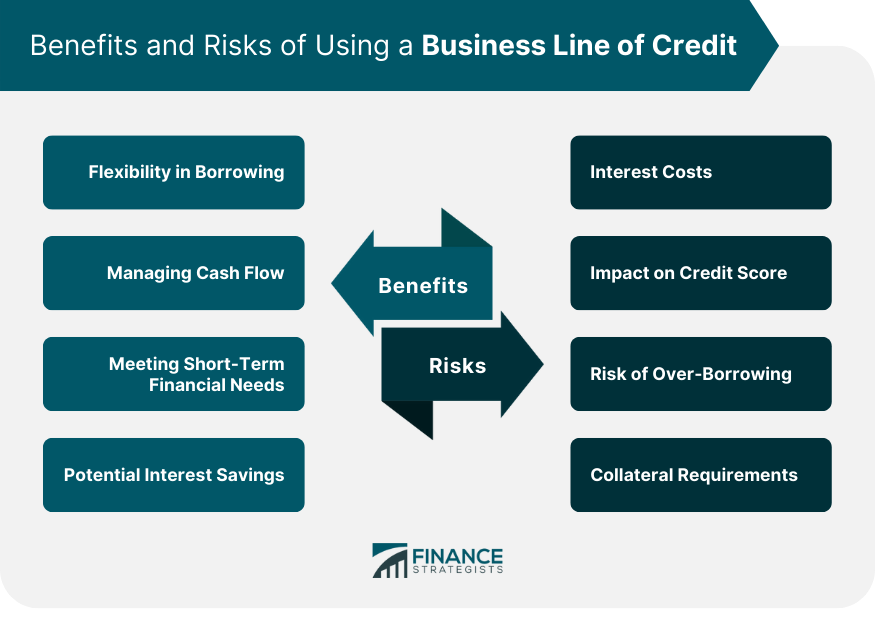

Benefits of Using a Business Line of Credit

Flexibility in Borrowing

Managing Cash Flow

Meeting Short-Term Financial Needs

Potential Interest Savings

Risks of Using a Business Line of Credit

Interest Costs

Impact on Credit Score

Risk of Over-Borrowing

Collateral Requirements

Conclusion

Business Line of Credit FAQs

A business line of credit (LOC) is a type of financing that provides companies with flexible access to funds as needed, up to an approved amount. It acts like in-house revolving credit and allows businesses to borrow money when they need it and repay the loan over time, rather than all at once with a lump sum loan.

A business line of credit can be used for many purposes including working capital, inventory purchases, utility bills, seasonal gaps in cash flow, paying staff salaries, or for other costs related to running your business such as marketing expenses or equipment purchases.

Yes. To be eligible, most lenders will require your business to be in operation for at least one year and have an annual revenue of $50,000 or more. Your personal credit score is also taken into consideration when applying for a business LOC.

The amount that you are able to borrow depends on the lender and the type of line of credit you apply for. Generally, loan amounts range from $10,000 to $500,000 depending on your qualifications and industry sector.

Most business lines of credit require monthly payments based on the outstanding balance. Interest rates vary, but are usually lower than those of a business loan. Additionally, you may be responsible for additional fees such as origination and closing costs. All repayment terms will be outlined in the credit agreement when your line of credit is approved. It’s important to review all terms carefully before signing a contract or agreeing to any commitments with a lender.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.