It is possible to get a line of credit without a personal guarantee. A personal guarantee is a promise to pay back any debts with one's personal assets in the event of default. While most traditional lenders require this, many alternative lenders, such as online lenders, don't have requirements that are as strict. A business line of credit with no personal guarantee is a revolving loan that a business can access as needed. Much like a credit card, a business can draw from the line of credit up to a predetermined limit, repay it, and then borrow again. What sets this line of credit apart is the "no personal guarantee" clause. Typically, when a business applies for credit, the lender requires the business owner to personally guarantee repayment. In this case, if the business defaults on the loan, the owner's personal assets can be seized to cover the debt. However, with a business line of credit with no personal guarantee, the business owner's personal assets are not at risk if the business is unable to repay the borrowed amount. One of the most significant features of a business line of credit with no personal guarantee is its flexibility. This type of credit allows businesses to borrow exactly what they need when they need it, up to their credit limit. This eliminates the need to apply for a new loan every time additional funds are needed, and the business only pays interest on the funds that are actually borrowed. A business line of credit with no personal guarantee reduces risk for business owners. Since the personal assets of the owner are not on the line in the event of default, owners can apply for such a line of credit with greater peace of mind. This line of credit encourages clear delineation between personal and business finances. By protecting personal assets from being seized in the event of a business default, it ensures the financial separation of the owner from their business. If the business fails to repay its debts, the personal assets of the business owner remain protected. This significantly reduces the risk for owners and can provide the confidence to invest more boldly in business growth and expansion. Traditional loans often require collateral or personal guarantees that many small businesses may find challenging. In contrast, a business line of credit with no personal guarantee can provide much-needed flexibility and accessibility to funds for small businesses. The revolving nature of a business line of credit allows businesses to better manage their cash flow. Businesses can use the funds to handle unexpected expenses, invest in growth opportunities, or cover temporary cash flow gaps. This can lead to improved financial health and stability of the business. One of the potential downsides of a business line of credit with no personal guarantee is the potentially higher interest rates. Since the lender is taking on more risk by not requiring a personal guarantee, they may charge higher interest rates as a form of compensation. Such a line of credit may come with stricter eligibility requirements. Lenders may need to see a strong business credit history, stable financials, and demonstrated profitability. These strict requirements may make it difficult for some businesses to qualify. Business lines of credit with no personal guarantee often have lower credit limits than those that do require a personal guarantee. This may limit the borrowing capacity of the business, particularly for larger businesses or those with significant funding needs. Lenders often require a detailed credit history evaluation when considering a business for a line of credit without a personal guarantee. This includes examining the business's credit score, repayment history, and any previous defaults or bankruptcies. Lenders will likely scrutinize the financial health of the business closely. They will want to see stable income, manageable levels of existing debt, and sufficient cash flow to cover the potential credit line repayments. Evidence of business stability and profitability will also be crucial for approval. Lenders prefer businesses that have been operating for several years and show a trend of consistent profitability. When applying for a business line of credit with no personal guarantee, it's beneficial to present a comprehensive business plan. This should detail the business's financial history, forecasted revenue, and growth plans. It can help demonstrate the business's ability to repay the credit line. Keeping accurate and up-to-date financial records can improve the chances of approval. Lenders will want to examine these records to assess the financial health and stability of the business. Regular monitoring of both personal and business credit scores can provide early warning signs of potential issues. It can also help businesses understand their creditworthiness and the likelihood of approval for a business line of credit with no personal guarantee. A strong relationship with the lender can also be beneficial. Regular communication and transparency can build trust and may improve the chances of approval or more favorable terms. A business line of credit without a personal guarantee refers to a financing option that allows businesses to access funds without requiring the business owner's personal assets as collateral. It provides flexibility in borrowing and separates personal and business finances. The key features of this type of credit include reduced personal liability, easier access to credit for small businesses, and improved cash flow management. By reducing personal liability, business owners can protect their personal assets in case of default. Moreover, it offers easier access to credit, especially for small businesses that may not have substantial personal assets to pledge as collateral. However, there are also drawbacks to consider. Higher interest rates are associated with this type of credit, as lenders assume more risk without a personal guarantee. Stricter eligibility requirements can make it challenging for some businesses to qualify, and there may be limitations on credit limits, restricting borrowing capacity for larger financing needs.What Is a Business Line of Credit With No Personal Guarantee?

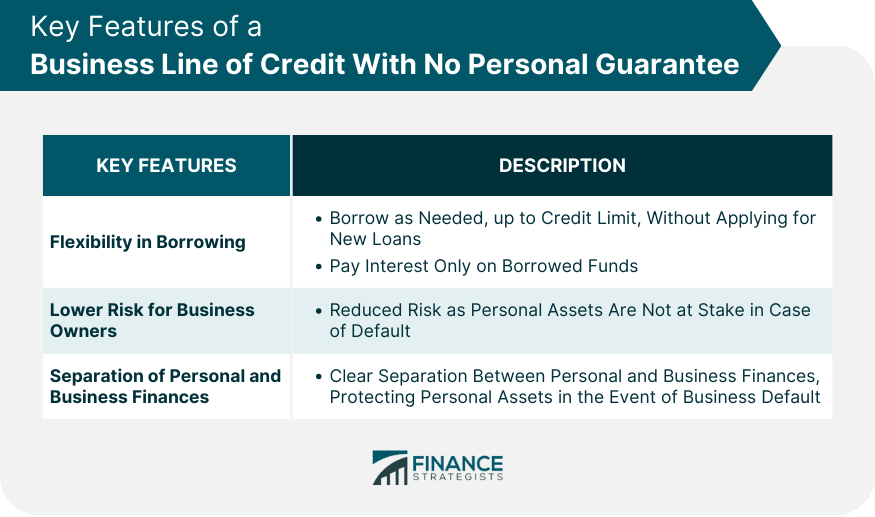

Key Features of a Business Line of Credit With No Personal Guarantee

Flexibility in Borrowing

Lower Risk for Business Owners

Separation of Personal and Business Finances

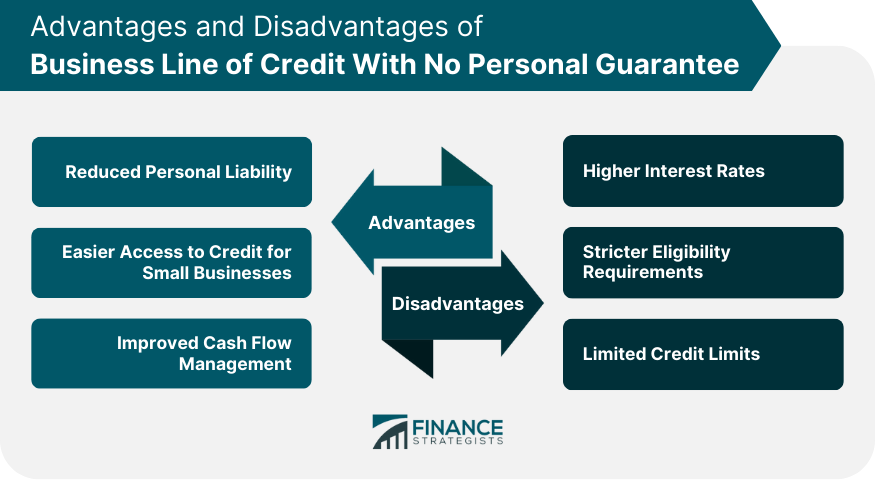

Advantages of a Business Line of Credit With No Personal Guarantee

Reduced Personal Liability

Easier Access to Credit for Small Businesses

Improved Cash Flow Management

Disadvantages of a Business Line of Credit With No Personal Guarantee

Higher Interest Rates

Stricter Eligibility Requirements

Limited Credit Limits

Eligibility Criteria for a Business Line of Credit With No Personal Guarantee

Detailed Credit History Evaluation

Strong Business Financials

Demonstrated Business Stability and Profitability

Tips for Applying and Managing a Business Line of Credit With No Personal Guarantee

Prepare a Comprehensive Business Plan

Maintain Accurate Financial Records

Regularly Review and Monitor Credit Scores

Develop a Strong Relationship With the Lender

Conclusion

Business Line of Credit - No Personal Guarantee FAQs

A business line of credit without personal guarantee is a type of financing that provides businesses with access to capital with no requirement for the owners or officers to personally guarantee repayment.

This type of funding works by offering businesses access to financing up to an approved amount, which they can draw from as needed, and repay over time with no need for a personal financial guarantee from the borrower.

Businesses that are in good standing and have been operating for at least two years typically qualify for this type of financing. The lender will assess the business's financial position as well as its credit history to determine eligibility.

The borrower can draw from their approved line of credit amount and repay it in small increments over time, or in one lump sum when convenient. The payments are typically due on a monthly basis and can be paid online or via checks sent through the mail.

Yes, lenders may charge setup fees and annual maintenance fees for this type of financing, as well as additional interest on late payments. It’s important to read all terms and conditions carefully before signing up for a business line of credit without personal guarantee.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.