A commercial line of credit is a type of financing that provides businesses with access to funds on an ongoing basis. It is a flexible source of credit that enables businesses to manage their cash flow, inventory, or purchasing equipment. This type of financing is essential for businesses to maintain liquidity and grow their operations. To be eligible for a commercial line of credit, there are several factors that a lender may consider, including: Lenders use financial statements to evaluate a business's financial stability and credit history. They want to have a guarantee that businesses have the financial capacity to repay the loan, which is why they closely examine financial statements before approving a commercial line of credit. Business owners should ensure that their financial statements accurately reflect their business's financial health and profitability to increase their chances of obtaining a commercial line of credit. Lenders use the credit score as an indicator of the business owner's ability to repay the loan. A low credit score can result in higher interest rates or even a denial of the application. Therefore, it is essential for business owners to maintain a good credit score to increase their chances of obtaining financing and access to credit. A business's time in operation is an important factor that lenders consider when evaluating eligibility for a commercial line of credit. Lenders generally view businesses that have been operating for at least a year or two as less risky. Still, the requirement for a minimum amount of time in business may vary depending on the lender and the type of credit. Newer businesses may need to provide additional documentation and financial information to demonstrate their creditworthiness to lenders. Collateral is an essential factor that lenders consider when evaluating a business's eligibility for a commercial line of credit. It provides lenders with additional security and ensures that they can recover their investment if the borrower defaults on the loan. Businesses should carefully consider the collateral requirements before applying for a commercial line of credit and ensure that they can meet the lender's requirements to avoid the risk of losing their assets. There are two main types of commercial lines of credit: secured and unsecured. This type of line of credit requires collateral to be put up as security against the loan. If the borrower defaults, the lender can seize the collateral to recover the funds. Secured lines of credit are typically easier to obtain than unsecured lines, as they present less risk to the lender. However, businesses must carefully evaluate the risks and benefits of providing collateral before applying for a secured line of credit. This type of line of credit does not require collateral to be put up as security. Unsecured lines of credit are typically more difficult to obtain than secured lines, as they present more risk to the lender. However, for businesses with established credit histories and strong financials, an unsecured line of credit can be an attractive option to access financing. A revolving line of credit is a flexible financing option that is similar to a credit card. The borrower is given a credit limit that can be used as needed, and the funds can be repaid and borrowed again repeatedly. Revolving lines of credit offer flexibility in managing cash flow and can be an attractive option for businesses with fluctuating cash flow needs. However, businesses must be careful not to rely too heavily on revolving lines of credit to avoid falling into a cycle of debt. A non-revolving line of credit is a commercial line of credit similar to a traditional loan. The borrower receives a fixed amount of funds upfront and repays it over a set period of time. Non-revolving lines of credit are suitable for businesses that need a lump sum of funds for a specific purpose but may not be suitable for businesses that need ongoing access to funds. There are several benefits of a commercial line of credit, including: Flexibility and Convenience of Borrowing. A commercial line of credit provides businesses with access to funds on an ongoing basis. It enables businesses to manage their cash flow and expenses as they arise. Lower Interest Rates Compared to Credit Cards or Other Loans. Commercial lines of credit typically have lower interest rates than credit cards or other loans, making them a more cost-effective way to borrow money. Opportunity to Establish a Credit History for Your Business. By obtaining a commercial line of credit and making timely payments, businesses can establish a positive credit history for their business. Before obtaining a commercial line of credit, there are several risks and considerations that a business owner should be aware of, including: Default Risk. If a business is unable to repay the line of credit, it may face severe consequences, including damage to its credit rating or legal action. Collateral Requirements. If a lender requires collateral to secure the line of credit, the business owner must understand the risks involved in putting their assets at risk. High Interest Rates and Fees. The interest rates and fees associated with a commercial line of credit may be higher than other types of financing, resulting in higher costs for the business. There are several costs associated with obtaining a commercial line of credit, including: Interest Rates and Fees. The interest rate and fees associated with a commercial line of credit may vary depending on the lender and the terms of the loan. It is essential to review the terms and conditions of the loan before accepting the offer. Repayment Terms and Conditions. The repayment terms and conditions of a commercial line of credit may vary depending on the lender and the terms of the loan. Applying for a commercial line of credit involves several steps, including: Before applying for a commercial line of credit, a business owner should ensure they have all the necessary documentation and information required to complete the application process. This may include financial statements, tax returns, and business plans. The specific documents required may vary depending on the lender but typically include financial statements, tax returns, business plans, and bank statements. The application process typically involves submitting an application, providing documentation, and undergoing a credit check. The lender may also require a personal guarantee or collateral to secure the line of credit. A commercial line of credit is a flexible and convenient financing option for businesses looking to manage their cash flow, inventory, or purchasing equipment. There are several commercial lines of credit types, including secured, unsecured, revolving, and non-revolving. The benefits of a commercial line of credit include lower interest rates, flexibility, and the opportunity to establish a credit history for the business. However, obtaining a commercial line of credit is just one aspect of managing your business's finances. To ensure that you are making the most of your resources and opportunities, working with a qualified financial advisor is essential. A financial advisor can provide expert guidance and support to help you navigate the complexities of business financing and develop a comprehensive financial plan that aligns with your goals and priorities. You may also consult with a mortgage broker for other loan or credit alternatives, especially when purchasing a commercial property.What Is a Commercial Line of Credit?

Eligibility for Commercial Lines of Credit

Business Financials

Credit Score

Time in Business

Collateral

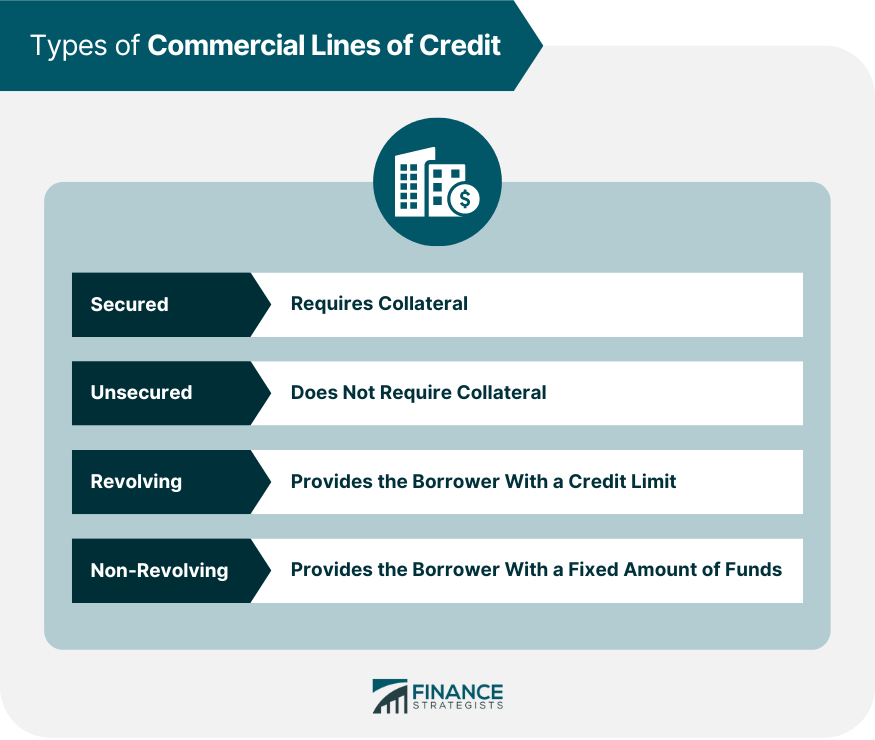

Types of Commercial Lines of Credit

Secured Commercial Line of Credit

Unsecured Commercial Line of Credit

Revolving Line of Credit

Non-Revolving Line of Credit

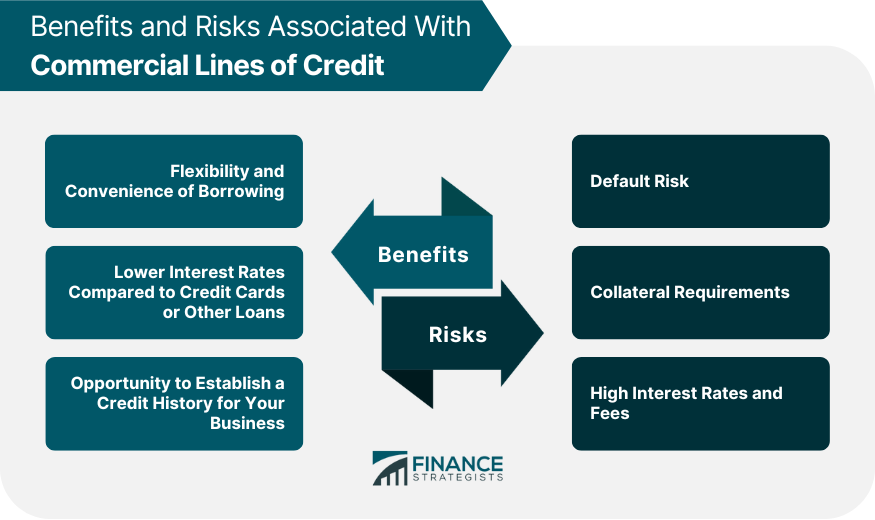

Benefits of Commercial Lines of Credit

Risks and Considerations of Commercial Lines of Credit

Costs Associated With Commercial Lines of Credit

It is essential to review the terms and conditions of the loan before accepting the offer.How to Apply for a Commercial Line of Credit

Preparing for the Application Process

Documents Required for the Application

Steps Involved in the Application Process

Conclusion

Commercial Line of Credit FAQs

A commercial line of credit is a type of financing that provides businesses with access to funds on an ongoing basis. It allows businesses to manage their cash flow, inventory, or purchasing equipment.

Eligibility requirements for a commercial line of credit may vary depending on the lender but typically include factors such as business financials, credit score, time in business, and collateral.

The benefits of a commercial line of credit include lower interest rates, flexibility, and the opportunity to establish a credit history for the business.

To apply for a commercial line of credit, a business owner must prepare the necessary documentation, including financial statements, tax returns, and business plans. They will then submit an application, provide documentation, and undergo a credit check.

The risks associated with a commercial line of credit include default risk, collateral requirements, and higher interest rates and fees than other financing forms. It is essential to understand these risks before obtaining a commercial line of credit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.