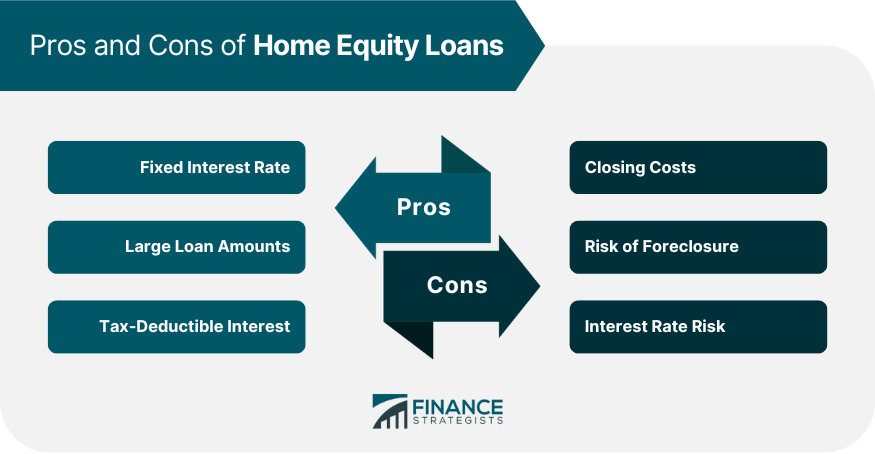

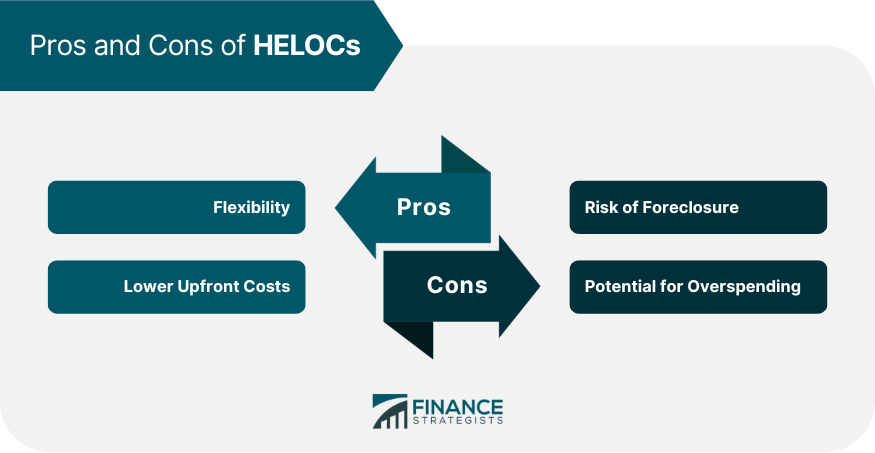

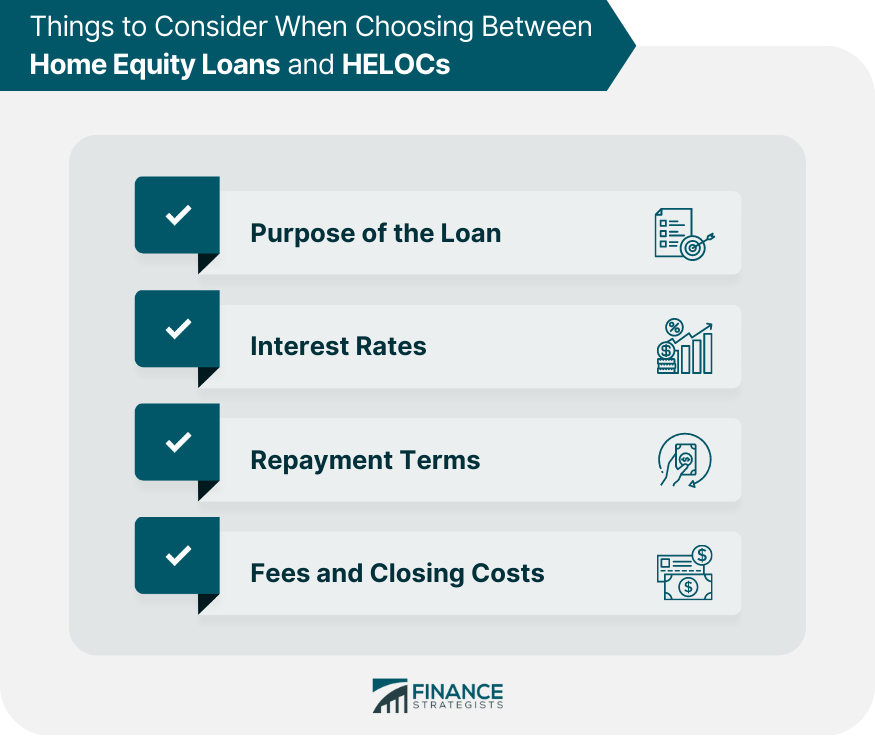

Home equity loans and home equity lines of credit (HELOCs) are two popular types of loans that allow homeowners to access the equity in their homes. Equity is the difference between the current value of a home and the amount owed on its mortgage. Homeowners can use their equity as collateral to secure a loan or line of credit. Both types of loans have their own pros and cons, and choosing the right one depends on your financial situation and borrowing needs. A home equity loan is a type of loan that allows homeowners to borrow against the equity in their homes. It is also known as a second mortgage, as it is a separate loan in addition to the primary mortgage. Home equity loans are typically fixed-rate loans with a set repayment term, usually ranging from 5 to 30 years. The amount that can be borrowed is based on the equity in the home, with the maximum loan amount being 80% to 90% of the home's value, minus any outstanding mortgage balance. Home equity loans can be a useful financial tool for homeowners who need to access a large amount of cash, but they also come with risks and drawbacks that should be carefully considered. Home equity loans typically have a fixed interest rate, which means the rate will not change over the life of the loan. This makes budgeting and planning for payments easier and more predictable. Additionally, home equity loans allow homeowners to borrow a large amount of money, up to 80% to 90% of the home's value, minus any outstanding mortgage balance. In some cases, the interest paid on a home equity loan may be tax-deductible, making it a more cost-effective borrowing option. On the other hand, like any mortgage, home equity loans come with closing costs, which can include application fees, appraisal fees, and attorney fees. These costs can add up and make the loan more expensive than expected. Furthermore, because a home equity loan is secured by the home, failure to make payments can result in foreclosure, putting the homeowner's ownership of the home at risk. While a fixed interest rate can be a pro, it can also be a con if interest rates drop after the loan is taken out. The homeowner would then be stuck paying a higher interest rate than what is currently available. A home equity line of credit is a type of revolving credit that allows homeowners to borrow against the equity in their homes. It is also a second mortgage, but unlike a home equity loan, the borrower is not given a lump sum of money upfront. Instead, the borrower is given a line of credit that they can draw from as needed, up to a certain limit. HELOCs typically have a variable interest rate that is tied to a benchmark rate, such as the prime rate. Below are some of the advantages of HELOCs. Flexibility: HELOCs offer more flexibility than home equity loans because the borrower can draw from the line of credit as needed, up to the maximum limit. This can be useful for expenses that are ongoing or unpredictable, such as home renovations or medical bills. Lower Upfront Costs: HELOCs typically have lower upfront costs than home equity loans because they do not require an appraisal or other closing costs. Below are some of the disadvantages of HELOCs. Risk of Foreclosure: Like a home equity loan, a HELOC is also secured by the home, and failure to make payments can result in foreclosure and loss of the home. Potential for Overspending: Because HELOCs are a revolving line of credit, there is a potential for overspending and accumulating too much debt. It is important for borrowers to carefully manage their spending and repayment of the loan. Home equity loans and home equity lines of credit are two popular options for homeowners who want to tap into the equity in their homes, and there are several similarities between these two types of loans. Both home equity loans and HELOCs are secured loans, meaning they are backed by the equity in the borrower's home. This means that failure to make payments can result in foreclosure and loss of the home. Both home equity loans and HELOCs come with closing costs, though HELOCs typically have lower upfront costs. Likewise, there are also key differences between home equity loans and HELOCs. Home equity loans have a fixed interest rate, while HELOCs have a variable interest rate. Home equity loans are installment loans, meaning the borrower receives a lump sum of money upfront and makes fixed payments over a set period of time. HELOCs are revolving loans, meaning the borrower can draw from the line of credit as needed and make payments on the balance as they go. When choosing between a home equity loan and a HELOC, there are several factors to consider, including: What are you borrowing the money for? If you need a lump sum of money for a one-time expense, such as a home renovation or debt consolidation, a home equity loan may be the better option. If you need ongoing access to funds for expenses that are unpredictable or ongoing, such as medical bills or college tuition, a HELOC may be the better option. Do you prefer a fixed or variable interest rate? If you prefer a fixed interest rate that won't change over the life of the loan, a home equity loan may be the better option. If you're comfortable with a variable interest rate that may change over time, a HELOC may be the better option. Do you prefer a fixed repayment term with set payments, or do you prefer the flexibility of making payments on a revolving balance? If you prefer a fixed repayment term, a home equity loan may be the better option. If you prefer more flexibility, a HELOC may be the better option. Both home equity loans and HELOCs come with fees and closing costs, so it is important to compare these costs and factor them into your decision. Both Home Equity Loans and HELOCs can be useful tools for homeowners looking to access equity in their homes. However, it is important to carefully consider your borrowing needs, financial situation, and repayment ability before choosing a loan. It is also important to shop around and compare rates and terms from multiple lenders to ensure you're getting the best deal.Home Equity Loan vs Home Equity Line of Credit: Overview

What Is a Home Equity Loan?

Pros and Cons of Home Equity Loans

What Is a Home Equity Line of Credit (HELOC)?

Pros and Cons of HELOCs

Pros

Cons

Similarities Between Home Equity Loans and HELOCs

Secured Loans

Closing Costs

Differences Between Home Equity Loans and HELOCs

Fixed vs Variable Rate Loans

Installment vs Revolving Debt

Things to Consider When Choosing Between Home Equity Loans and HELOCs

Purpose of the Loan

Interest Rates

Repayment Terms

Fees and Closing Costs

Final Thoughts

Home Equity Loan vs Home Equity Line of Credit FAQs

It may be more difficult to get approved for a home equity loan or HELOC with bad credit, but it is not impossible. You may need to shop around and consider lenders that specialize in bad credit loans or consider other options, such as a personal loan.

While you can use the funds from a home equity loan or HELOC for anything you want, it is important to consider your borrowing needs and repayment ability. It is also important to avoid using the loan to fund unnecessary or frivolous expenses.

The approval process for a home equity loan or HELOC can vary depending on the lender and the borrower's financial situation. Generally, the process can take anywhere from a few days to several weeks. It is important to have all necessary documentation ready, such as proof of income, credit score, and home value, to speed up the approval process.

Yes, borrowers can typically pay off a home equity loan or HELOC early without penalty. However, it is important to check with the lender to confirm whether any prepayment penalties apply.

In some cases, the interest paid on a home equity loan or HELOC may be tax-deductible, but it depends on the borrower's specific financial situation. It is important to consult with a tax professional to determine whether you qualify for a tax deduction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.