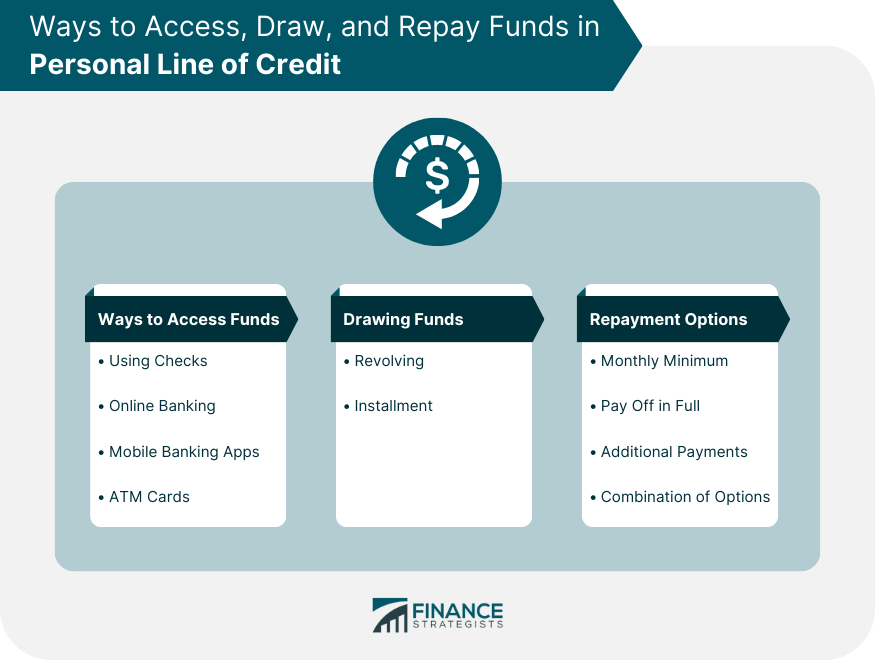

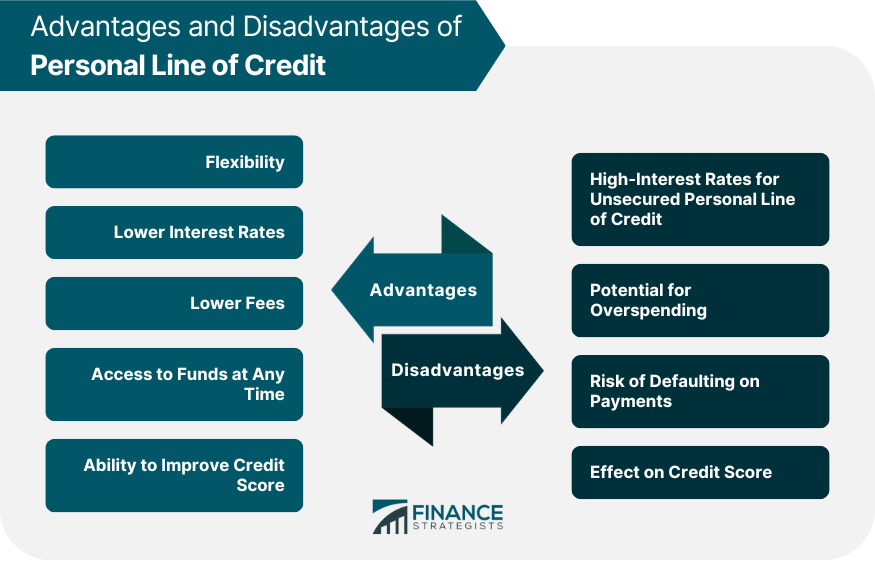

A personal line of credit is a flexible loan option that allows you to borrow money up to a predetermined limit. This type of loan is unsecured, meaning it does not require any collateral to secure the loan. It is important to note that personal lines of credit differ from personal loans in that you only pay interest on the amount you borrow, not the total loan amount. Personal lines of credit are typically used for short-term financing needs, such as unexpected expenses or to cover cash flow shortages. You can access your funds in various ways, such as using checks, online banking, mobile banking apps, or ATM cards. Repayment options include making minimum monthly payments, paying off the balance in full, making additional payments, or a combination of these options. To apply for a personal line of credit, you will need to provide the lender with personal and financial information, including your income, employment status, and credit score. The lender will use this information to determine whether you qualify for a personal line of credit and, if so, how much you can borrow. Once you have been approved for a personal line of credit, you can access your funds in a few different ways. Many lenders will provide you with a set of checks that you can use to access your funds. You can write a check for the amount you need and deposit it into your bank account. Most lenders also offer online banking, which allows you to access your personal line of credit from your computer or mobile device. You can transfer funds from your personal line of credit to your bank account or make payments online. Some lenders also offer mobile banking apps that allow you to access your personal line of credit from your smartphone. With a mobile banking app, you can view your account balance, transfer funds, and make payments from anywhere at any time. Many lenders also provide an ATM card that you can use to withdraw cash from your personal line of credit. It is important to note that using your personal line of credit to withdraw cash from an ATM can result in higher fees and interest charges. There are two main ways to draw funds from your personal line of credit: revolving credit and installment credit. Revolving credit allows you to borrow and repay funds on an ongoing basis. As you repay the funds you have borrowed, you can borrow them again up to your borrowing limit. Revolving credit is a flexible way to borrow money because you can access funds whenever you need them. Installment credit allows you to borrow a fixed amount of money and repay it over a set period of time. Installment credit is typically used for larger purchases, such as home renovations or car purchases. With installment credit, you make fixed monthly payments until the loan is paid off. When it comes to repaying your personal line of credit, you have several options. Minimum monthly payments are the amount you must pay each month to keep your account current. The minimum payment is typically a percentage of your balance, and it is important to note that making only minimum payments can result in a high amount of interest charges over time. Paying off the balance in full is the best way to avoid interest charges and save money in the long run. If you have the means to pay off your personal line of credit in full, it is recommended to do so as soon as possible. Making additional payments can help you pay off your personal line of credit faster and save money on interest charges. If you have extra money available, consider making additional payments to reduce your balance. If you miss a payment or make a late payment, you may be charged a late fee and your credit score may be negatively impacted. It is important to make payments on time to avoid penalties and protect your credit score. There are two main types of personal lines of credit: secured and unsecured. Secured Personal Line of Credit: Requires collateral, such as a car or home, to secure the loan. The amount of money you can borrow is typically determined by the value of the collateral. Unsecured Personal Line of Credit: This does not require collateral, but the amount you can borrow is based on your creditworthiness. Personal lines of credit have a few key features that set them apart from other types of loans. These features include borrowing limits, interest rates, repayment terms, and credit score requirements. The borrowing limit for a personal line of credit is determined by the lender and is based on your creditworthiness, income, and other financial factors. The borrowing limit for a personal line of credit can range from a few thousand dollars to tens of thousands of dollars. The interest rate for a personal line of credit is typically variable and is based on the prime rate, which is the interest rate that banks charge their most creditworthy customers. The interest rate for a personal line of credit is typically lower than that of a credit card but higher than that of a personal loan. Personal lines of credit have flexible repayment terms. You can make minimum monthly payments, pay off the balance in full, or make additional payments at any time. It is important to note that making only minimum monthly payments can result in a high amount of interest charges over time. To qualify for a personal line of credit, you typically need a good credit score. Your credit score is a numerical representation of your creditworthiness and is based on your credit history, including your payment history, credit utilization, and length of credit history. A good credit score is typically considered to be above 700. Using a personal line of credit has various advantages, including: Flexibility: A personal line of credit offers flexibility that other types of loans do not. You can access funds whenever you need them, and you only pay interest on the amount you borrow. Lower Interest Rates: Personal lines of credit typically have lower interest rates than credit cards, making them a more affordable way to borrow money. Lower Fees: Personal lines of credit typically have lower fees than credit cards, making them a more cost-effective way to borrow money. Access to Funds at Any Time: With a personal line of credit, you can access funds whenever you need them, making it a great option for unexpected expenses. Ability to Improve Credit Score: Making on-time payments on your personal line of credit can help improve your credit score over time. Using a personal line of credit also has some drawbacks, such as: High-Interest Rates for Unsecured Personal Line of Credit: Unsecured personal lines of credit typically have higher interest rates than secured lines of credit or other types of loans. Potential for Overspending: Because a personal line of credit offers flexibility, there is a potential to overspend and accumulate debt. Risk of Defaulting on Payments: If you miss payments or make late payments on your personal line of credit, you risk defaulting on the loan, which can negatively impact your credit score and result in additional fees and penalties. Effect on Credit Score: Applying for a personal line of credit can result in a hard inquiry on your credit report, which can temporarily lower your credit score. Additionally, missing payments or defaulting on the loan can have a negative impact on your credit score. Personal lines of credit can be beneficial for a variety of individuals, including: Individuals With Fluctuating Income: If your income fluctuates from month to month, a personal line of credit can provide you with the flexibility to access funds when you need them. Individuals With Unexpected Expenses: If you have unexpected expenses, such as a medical bill or home repair, a personal line of credit can provide you with the funds you need to cover the cost. Individuals With Poor Credit Scores: If you have a poor credit score, a personal line of credit can provide you with an opportunity to improve your credit score over time by making on-time payments. Business Owners: Business owners can use a personal line of credit to cover short-term financing needs, such as inventory purchases or equipment repairs. Personal lines of credit offer a flexible and affordable way to borrow money when you need it. Understanding how personal lines of credit work and who can benefit from them is important when considering this type of loan. A personal line of credit provides multiple means to access your funds, such as checks, online banking, convenience of mobile apps or ATM cards. You can opt for minimal monthly payments, pay off the full balance at once, or choose a combination of both. You can also make extra payments any time. It is important to use personal lines of credit responsibly and make on-time payments to avoid penalties and protect your credit score.What Is a Personal Line of Credit?

How Does a Personal Line of Credit Work?

Applying for a Personal Line of Credit

Accessing Personal Line of Credit

Using Checks

Using Online Banking

Using Mobile Banking Apps

Using ATM Cards

Drawing Funds From Personal Line of Credit

Revolving Credit

Installment Credit

Repaying Personal Line of Credit

Minimum Monthly Payments

Paying off the Balance in Full

Making Additional Payments

Penalties for Late Payments

Types of Personal Line of Credit

Features of Personal Line of Credit

Borrowing Limit

Interest Rate

Repayment Terms

Credit Score Requirements for Personal Line of Credit

Advantages of Personal Line of Credit

Disadvantages of Personal Line of Credit

Who Can Benefit From a Personal Line of Credit?

Conclusion

How Does Personal Line of Credit Work? FAQs

A personal line of credit is a type of loan that allows you to borrow money up to a predetermined limit. It offers flexibility in accessing funds and only requires you to pay interest on the amount you borrow.

You can access your personal line of credit in a few different ways, such as using checks, online banking, mobile banking apps, or ATM cards. Once you have been approved for a personal line of credit, the lender will provide you with instructions on how to access your funds.

Personal lines of credit have flexible repayment terms. You can make minimum monthly payments, pay off the balance in full, make additional payments, or a combination of these options. It is important to make payments on time to avoid penalties and protect your credit score.

The interest rate for a personal line of credit is typically variable and based on the prime rate. The interest rate for a personal line of credit is typically lower than that of a credit card but higher than that of a personal loan.

Personal lines of credit can be beneficial for individuals with fluctuating income, individuals with unexpected expenses, individuals with poor credit scores, and business owners. It is important to use personal lines of credit responsibly and make on-time payments to avoid penalties and protect your credit score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.