A line of credit is a flexible loan arrangement from a bank or financial institution that allows a borrower to draw funds up to a predetermined limit. It's a revolving credit agreement, which means borrowers can access funds, repay them, and then access them again. This borrowing method is different from traditional loans where the entire amount is disbursed at once, and repayment starts immediately. Line of credit is generally used by individuals, businesses, and governments to help manage cash flow fluctuations, finance ongoing operational expenses, or capitalize on investment opportunities. It can be secured (backed by collateral such as a home or a business asset) or unsecured (with no collateral requirement, but typically with higher interest rates). How long it takes to get approved for a line of credit depends on what kind of line of credit it is. For a regular credit card, often the individual will be approved in minutes. This is due to the fact that approval is based on an algorithm and inputs from the user. Home equity lines of credit, or HELOC, are usually approved within 2 - 6 weeks. A business line of credit can take anywhere between a few weeks to a few months. This is due to the fact that business lines of credit are often "collateralized," meaning the loan is given to the business with the business's assets used as collateral. Assigning the appropriate valuation to the assets and submitting proper documentation, such as tax returns, a balance sheet, and independent valuations of assets can take quite a bit of time. In general, collateralized loans have a much lower interest rate than non-collateralized loans. Understanding the timeline for line of credit approval is essential for proactive financial planning. The borrower must provide relevant financial information, which could include income, existing debts, and details of assets and liabilities. This step is crucial as it forms the foundation for the approval process. The time taken in this step can vary based on the borrower's preparedness. If all required documents and details are on hand, it could take a few hours to a few days. However, gathering the needed information might take longer if the borrower is not well prepared. Once the application is submitted, the lender begins the process of credit evaluation and verification. During this phase, the lender verifies the information provided in the application, assesses the borrower's creditworthiness, and determines the line of credit amount and terms. The timeline for this step can vary widely based on the lender's processes and the specifics of the application. Some lenders may take a few days to a week for this process, while others might take several weeks. After the credit evaluation and verification, the lender makes a decision on the line of credit application. If approved, the lender will inform the borrower of the decision, along with the credit limit, interest rate, and other terms and conditions. The lender usually communicates the decision immediately after making it. This could be the same day they make the decision or the following business day. The total time from application to decision can range from a few days to several weeks. Applicants with high credit scores and a history of responsible credit use are generally considered low risk, which can expedite the approval process. Conversely, applicants with low credit scores or a history of missed payments may require additional review, extending the approval time. In addition, the amount of credit the applicant is requesting can impact the timeline. Larger lines of credit often require more in-depth credit analysis, extending the approval process. Some lenders may require extensive documentation, including financial statements, tax returns, and legal documents, which can take time to compile and review. Inaccurate or incomplete documentation can further delay the process, as the lender may need to request additional information or clarifications. Some lenders have streamlined processes and can provide quick decisions, while others may take more time due to thorough due diligence procedures or bureaucratic hurdles. The lender's current workload can also affect the timeline. If the lender has a high volume of applications to review or a backlog, it can delay the approval process. One of the most effective ways to expedite the approval process is by providing complete and accurate information in the initial application. This includes detailed financial information, any required documentation, and prompt responses to any lender inquiries. Incomplete or inaccurate applications can delay the approval process, as the lender will need to request additional information or clarifications. Therefore, taking the time to complete the application accurately and thoroughly can save time in the long run. A high credit score is an indicator of low credit risk, which can make the lender's decision easier and quicker. Therefore, consistent, responsible credit use and timely debt repayments can help ensure a swift approval process. Furthermore, checking your credit report for errors before applying can prevent unnecessary delays. If you spot errors, you can dispute them and have them removed, improving your credit score and helping speed up the approval process. Building a strong relationship with your lender can also help expedite the approval process. If you have a history of responsible borrowing with the lender, they may be more inclined to expedite your application. This is particularly true for small businesses, where establishing a solid relationship with a local bank or credit union can lead to quicker credit decisions. These relationships can enable the lender to understand your financial situation better, leading to quicker assessments and decisions. Incomplete documentation is one of the most common causes of delays in the approval process. If a lender does not receive all the necessary documents, they will need to request the missing information, which can extend the approval timeline. For this reason, it is crucial to review all application requirements carefully and ensure all necessary documents are included in the initial application. This includes all financial statements, tax returns, and other legal documents the lender requires. If the lender identifies any issues with your credit history, such as missed payments, they may need to conduct additional reviews, which can extend the timeline. Additionally, discrepancies between the information provided in the application and the information in the credit report can lead to delays. This is why it's crucial to ensure all information in the application is accurate and matches the information in your credit report. Sometimes, delays in approval can be due to circumstances beyond the borrower's control. If the lender has a high volume of loan applications to process, it can lead to delays. Similarly, a lender backlog due to staffing issues or internal procedures can extend the approval timeline. While these factors are out of the borrower's control, understanding that they can influence the timeline can help manage expectations. The time it takes to get a line of credit approved can vary based on the type of credit and several factors. Regular credit card applications can be approved within minutes, while home equity lines of credit typically take 2 to 6 weeks. Business lines of credit may require a few weeks to a few months due to collateral requirements and extensive documentation. The approval process consists of three main steps: initial application submission, credit evaluation and verification, and the decision and notification. Factors such as the applicant's creditworthiness, documentation requirements, and the lender's internal processes can affect the approval timeline. To expedite the process, providing complete and accurate information, maintaining a good credit score, and building a relationship with the lender are recommended. Possible delays may occur due to incomplete documentation, credit issues, or high loan volume. Understanding the timeline and taking proactive steps can help individuals and businesses plan their financial future effectively.What Is a Line of Credit?

How Long Is the Approval Time

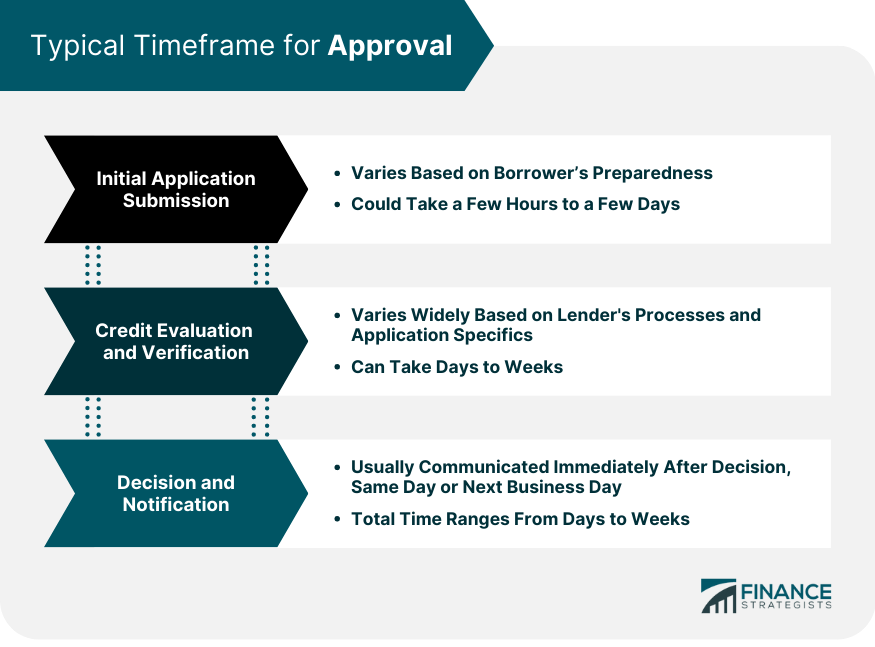

Typical Timeframe for Approval

Initial Application Submission

Credit Evaluation and Verification

Decision and Notification

Factors Affecting Approval Time

Applicant's Creditworthiness

Documentation Requirements

Lender's Internal Processes

Ways to Expedite the Approval Process

Provide a Complete and Accurate Information

Maintain a Good Credit Score

Build a Relationship With the Lender

Possible Delays in Approval

Incomplete Documentation

Credit Issues or Discrepancies

High Loan Volume or Lender Backlog

Conclusion

How Long Does It Take To Get a Line of Credit Approved? FAQs

The approval process and timeline for a line of credit approval may vary depending on the lender, but typically takes anywhere from two days to one week.

In order to apply for a line of credit, you will typically need to provide information such as your income and expenses, employment history, personal financial records, and other documents.

Factors that may affect the approval process for a line of credit include your credit score, income, and debt-to-income ratio.

If you are denied a line of credit, it is important to understand why in order to take steps to improve your chances for approval in the future. You can reach out to the lender for more information and read up on how to improve your credit score.

Yes, most lenders will charge an application fee when you apply for a line of credit. Additionally, some may also require you to pay additional fees such as processing or annual fees. It is important to review the terms and conditions of your line of credit before signing any agreements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.