Home equity lines of credit (HELOCs) provide homeowners with access to funds based on the equity they have in their homes. It is a form of revolving credit, meaning you can use it and pay it off as many times as needed throughout the loan period. With a HELOC, the borrower only pays interest on the money they use. The amount someone can borrow and how long depends on how much equity they have in their home, as well as other factors like income and credit score. When using a HELOC, it is important to understand all of the terms associated with the loan, such as fees or variable interest rates that may apply. HELOCs allow homeowners to borrow money against the equity they have in their homes. The lender reviews the borrower's credit score, income, and how much equity they have in their home to calculate how much money they can access with a HELOC. The loan amount can be used for anything, from making repairs on the home, debt consolidation, college tuition, or any other purpose. Once approved, borrowers can draw out funds as needed during the term of the loan. There are usually limits associated with this type of loan, such as a maximum limit of withdrawals or total amount available. As payments or cash advances are made, more funds become available again up to the credit limit set at initial approval. Like other forms of revolving loans, borrowers pay interest only on what is actually borrowed and not on what is accessible through the line of the credit agreement. Before you decide to increase your HELOC, there are a few things that you should consider: Evaluate whether or not increasing your HELOC is the right choice for you and your financial situation. Look into the terms of your current loan, as well as any potential fees associated with increasing your line of credit. Consider any other debts that you may have and how taking out additional funds could affect them. Compare all available options - such as loan modification and refinancing - so that you can get the best deal possible. There are several different options available to help increase your HELOC, including the following: A loan modification involves negotiating with your lender to change the terms of your current mortgage agreement—usually involving a reduction in monthly payments or an extension on the repayment period. When considering a loan modification, there are several factors to keep in mind: interest rate negotiation, fees charged by the lender, eligibility requirements, and potential tax implications associated with such changes. Remember that many lenders have specific requirements for modifications, so it’s crucial to work closely with them throughout the process. Refinancing is one of the most common strategies for increasing a HELOC. By refinancing your mortgage, you can get a new loan with significantly lower interest rates and improved repayment terms. This can result in lower monthly payments as well as additional capital that can be used for other expenses or investments. When refinancing a mortgage, it’s important to compare lenders and different types of loans before making a decision. Also, consider any closing costs associated with the process and whether or not they outweigh the potential benefits of a refinance. There is a handful of benefits that you get by increasing your HELOC: A higher HELOC limit can enable you to finance larger expenses such as renovations, college tuition fees, or even a new car. This can help organize and streamline all your payments into one single loan with one payment schedule, which could potentially save you money over time depending on the interest rate offered on the loan. This affords you access to extra funds for emergency situations or investments that could give you a financial boost in the future. Being able to customize payment possibilities allows for greater control over how much is borrowed and when you need to pay it back. Using the extra money wisely can be beneficial in terms of increasing the value of your home if it is used towards projects such as repairs, remodeling, new insulation, or energy-efficient appliances. There are also potential risks and drawbacks to take into account before making any changes: Taking out a larger loan or refinancing could result in additional costs such as appraisal fees, closing costs, or points which could increase your overall expenses. In some cases, the interest rate on a HELOC may be adjustable, so depending on the conditions of the market, you might see an increase in interest over time, making it more expensive to borrow money. Depending on how much you increase your line of credit, this could affect your credit score since lenders will see that you’re taking on more debt than you previously had and might think that you’re at risk for defaulting. Borrowing too much extra money and spending it carelessly may lead to regret in the future if not used responsibly for investments that have long-term benefits. Having access to extra funds can sometimes distract us from our initial savings strategies by diverting our attention away from other important short-term goals such as saving for retirement or college tuition fees. Home equity lines of credit can be a great financial tool for homeowners to access additional funds against the equity they have in their homes. You can further increase HELOCs through loan modifications or refinancing. It is vital to evaluate any potential benefits and risks associated with increasing your HELOC so that you can make an informed decision as to whether or not it is the right move for you. Increasing your HELOC can enable you to consolidate debt, finance larger expenses, or increase the value of your home by investing in renovations. However, there may also be fees and higher interest rates associated with taking out a loan or refinancing, which could affect your overall expenses and credit score. Weighing all these factors carefully will help ensure that the added borrowing power aligns with both short-term and long-term goals for maximum return on investment. Speak to a lender or financial advisor to find out what your options are for increasing your HELOC.Definition of Home Equity Line of Credit (HELOC)

How HELOCs Work

Things to Consider Before Increasing Your HELOC

Options for Increasing Your HELOC

Loan Modification

Refinancing

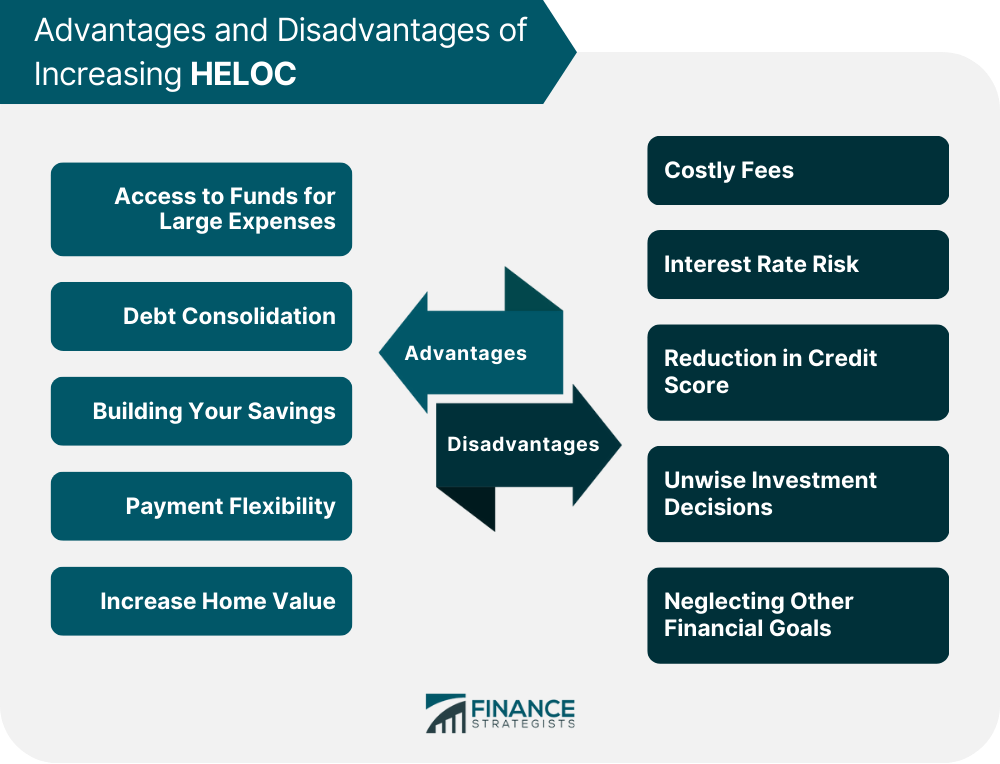

Advantages of Increasing Your HELOCAccess to Funds for Large Expenses

Debt Consolidation

Building Your Savings

Payment Flexibility

Increase Home Value

Disadvantages of Increasing Your HELOC

Costly Fees

Interest Rate Risk

Reduction in Credit Score

Unwise Investment Decisions

Neglecting Other Financial Goals

Final Thoughts

Increasing HELOC FAQs

A home equity line of credit (HELOC) is a loan product that enables you to borrow against your home’s value and use the funds for whatever expenses you may have. The loan works like a revolving line of credit with variable interest rates, so you can pay back what you spend and borrow more as needed.

The amount you can increase your HELOC to will depend on the lender and your particular financial situation. It will also depend on how much equity you have built up in your home and what other debts you have to pay off.

Yes, depending on the lender, you may need to pay for an appraisal or closing costs in order to increase your HELOC. You may also need to pay points if the interest rate is adjustable.

Taking out a larger loan or refinancing could have an impact on your credit score as lenders might see that you’re taking on more debt than before and view you as a greater risk for default.

Potential risks include rising interest rates which could make it more expensive to borrow money, unnecessary spending which may lead to regret down the line, and neglecting other financial goals which could prevent you from furthering other investments that may be beneficial in the long run.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.