A business line of credit (BLOC) is a form of financing that provides businesses with a set amount of money that can be accessed as needed. With this type of loan, businesses can draw upon the funds whenever necessary, but only pay back what they use and the associated interest fees. This type of financing is an excellent option for businesses to cover short-term costs and build their financial strength over time. Unlike a traditional loan, which requires one large lump-sum payment to be repaid on an agreed-upon due date, a business line of credit works like a credit card in that it allows businesses to draw against the total available amount as needed and only pay back what they use plus interest. The application process typically requires detailed financial documents such as balance sheets, profit-and-loss statements, cash flow reports, income statements, and other financial information. After the lender reviews the documents, they will decide whether or not to approve the line of credit. Once approved, a limit is set on how much money can be borrowed at any given time. When borrowing funds from the BLOC, businesses are only responsible for repaying what they've used plus any interest fees that may apply. Business lines of credit provide businesses with flexible access to capital when needed without having to take out new loans each time additional funds are required. This can help businesses manage their finances more easily by providing immediate access to necessary funds without having to borrow large amounts upfront. BLOCs can provide businesses with many advantages, including flexible payments, low-interest rates, fast access to capital, and the option to pay off early without penalty. BLOCs typically have more flexible payment terms than traditional loans, allowing businesses to make monthly payments based on the amount they borrowed. This allows businesses to adjust their payment schedule over time in order to better manage their cash flow. BLOCs are usually offered at lower interest rates than alternative financing options such as long-term loans or credit cards, which can save businesses money in the long run. When approved for a BLOC, businesses are able to draw against the total available amount as needed and only repay what they use plus any applicable interest fees. This makes it easy for businesses to access funds when needed without having to take out a new loan each time additional funds are required. Most lenders allow business lines of credit to be paid off early without any penalty or additional fees, unlike traditional loans which may penalize borrowers for paying them off before their due date. Some of the potential downsides include high costs of borrowing, limited funds available, fees for unused credit lines, and constant monitoring of credit scores. While BLOCs typically have lower interest rates than alternative financing options, this cost can still be quite significant over time. Additionally, some lenders may charge additional fees such as origination or annual maintenance fees which can add to the total cost of borrowing. Most lenders will limit the amount available for a business line of credit based on the financial documents provided and the applicant’s credit score. There may not be enough funds available for businesses that need larger amounts of capital. Some lenders may charge businesses an annual fee if they don’t fully utilize their BLOCs or maintain certain levels of activity on their accounts. This means that businesses must make sure to use their lines of credit regularly or pay potentially large fees. Since BLOCs are based on a borrower’s creditworthiness, it is crucial to continuously monitor and maintain a good credit score in order to keep access to these capital sources open. A decline in the business's financial health can result in decreased access or changes in terms by lenders. Business lines of credit can provide businesses with access to capital on an as-needed basis while also offering attractive interest rates, flexible payment terms, and the option to pay off early without penalty. For this reason, they are often considered to be a good financing option for many businesses, particularly those that need access to funds quickly or have limited financial resources. However, there are some potential drawbacks that should be taken into consideration when deciding if a BLOC is a right choice for your business. Businesses should always compare different financing options before making any decisions in order to ensure they receive the best terms available. Understanding these requirements and having all the necessary documents ready prior to applying for a BLOC can help increase one’s chances of approval from prospective lenders or banks. Most lenders will require applicants to have at least 300-850 FICO scores in order to consider them for a BLOC. This demonstrates the borrower’s trustworthiness when it comes to repaying debts. Additionally, some lenders may also look at factors such as cash flow, debt-to-income ratio, and other indicators in order to make their decision about whether or not someone qualifies for a business line of credit. Many lenders will want proof that your business is profitable or has been profitable in the past before approving granting you access to funds through a BLOC. Evidence that you are generating revenue from customers can demonstrate your ability to repay these funds over time. It is significant to have a comprehensive business plan with accurate financial projections in order to increase your chances of qualifying for a BLOC. The lender will likely evaluate your financial projections carefully in order to determine if your business is likely able to generate enough revenue over time to make debt repayments. Some lenders may require borrowers to provide personal guarantees in order to secure approval for a BLOC. This means that if the debt is not paid off by the company itself, then you could be held personally responsible for repayment. Therefore, it is important to understand the potential risks associated with providing this type of guarantee before signing any agreements with lenders. When it comes to financing solutions for businesses, there are many options available in addition to business lines of credit. These include bank loans, merchant cash advances, invoice financing, and crowdfunding. Bank loans provide businesses with a lump sum of money that needs to be repaid over an agreed-upon period of time. They generally offer lower interest rates than BLOCs but require higher credit scores and may have longer approval processes. Merchant cash advances are short-term solutions that allow companies to borrow against future revenue. They offer fast access to capital but the repayment terms are usually expensive when compared to other types of loans. Invoice financing is a unique way for businesses to receive funds fast by providing their unpaid invoices as collateral. This type of financing typically has shorter repayment periods, which can be beneficial for small and medium-sized businesses that need quick access to capital. Crowdfunding is another option for businesses that need access to funds quickly or do not meet the requirements for traditional lending products such as bank loans or BLOCs. Both are viable options for businesses who need access to capital quickly, but there are important differences to consider before settling on a particular financing solution. Payment Structure: Business lines of credit provide businesses with ongoing access to funds, allowing them to use and repay money as needed. Interest Rates: BLOCs typically offer higher interest rates than short-term loans, but the rates can vary based on factors such as the borrowing company’s credit score and the duration of the loan. Collateral Requirements: Many lenders will not require collateral when issuing a BLOC, while most lenders will require some form of security for short-term loans. Approval Process/Timeline: BLOCs generally have shorter approval processes, while short-term loan applications may take longer due to their stricter requirements. Business Lines of Credit can be a great option for businesses that need access to short-term financing. By providing flexible repayment plans and potentially lower interest rates, BLOCs can provide businesses with the funds they need without being too burdensome. However, there are also certain downsides to keep track of, like the high costs of borrowing, having limited funds available, the fees for unused credit lines, and the constant monitoring of the borrower’s credit score. It is vital to compare all financing options before making a final decision as each type of loan comes with its own set of pros and cons.What Is a Business Line of Credit?

How Does a Business Line of Credit Work?

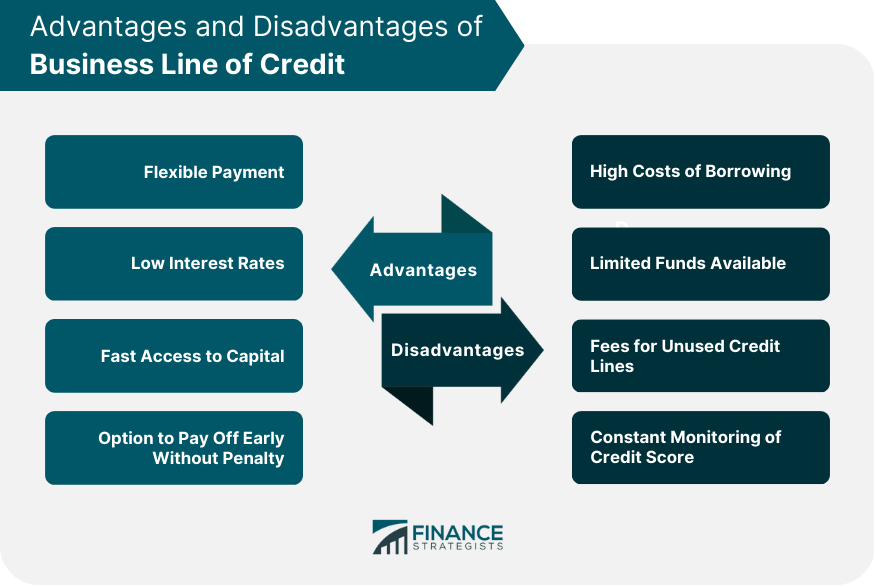

Advantages of a Business Line of Credit

Flexible Payment Terms

Low-Interest Rates

Fast Access to Capital

Option To Pay Off Early Without Penalty

Disadvantages of a Business Line of Credit

High Costs of Borrowing

Limited Funds Available

Fees for Unused Credit Lines

Constant Monitoring of Credit Score

Is a Business Line of Credit a Good Idea?

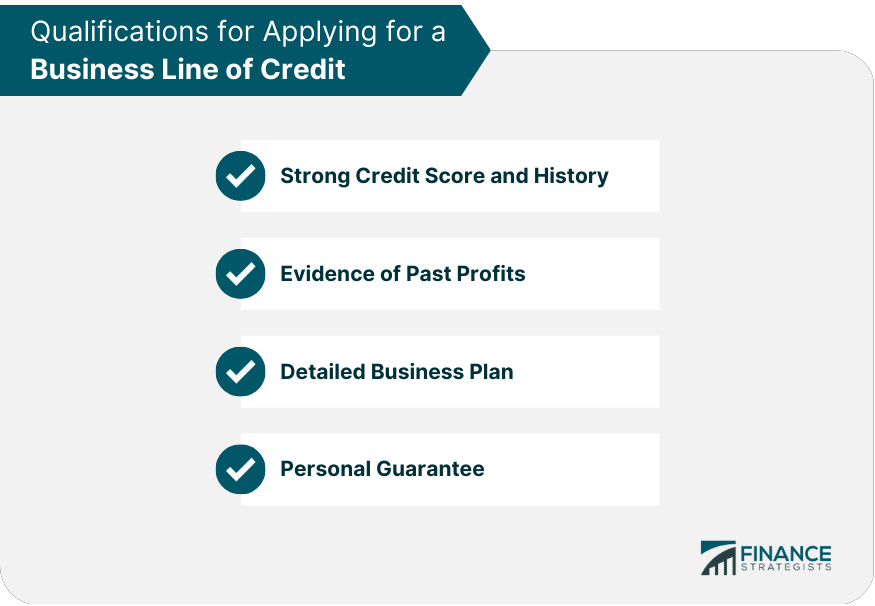

How to Qualify for a Business Line of Credit

Strong Credit Score and History

Evidence of Past Profits

Detailed Business Plan

Personal Guarantee

Alternatives to a Business Line of Credit

Bank Loans

Merchant Cash Advances

Invoice Financing

Crowdfunding

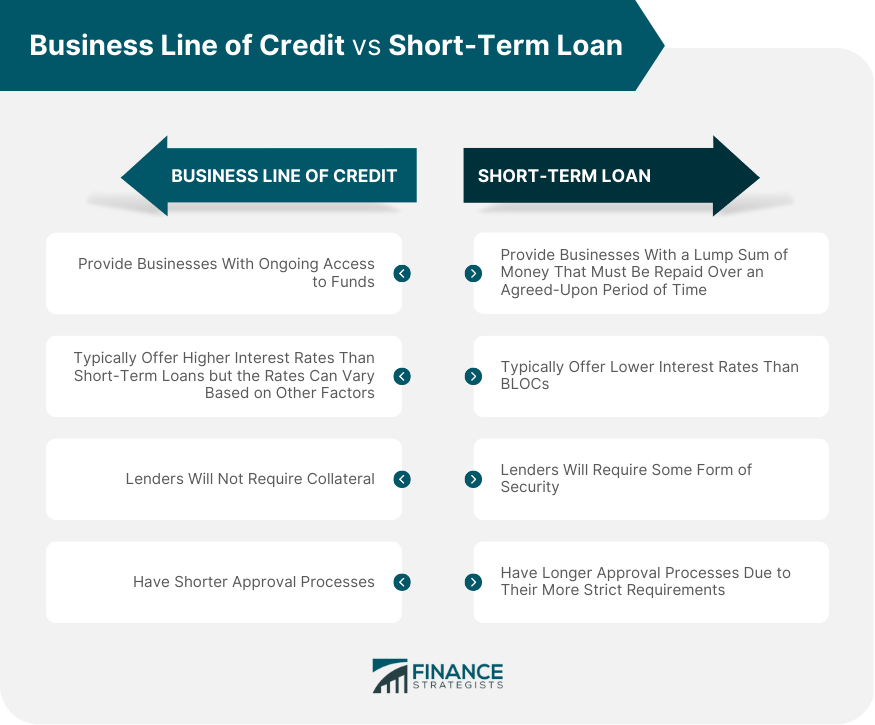

Business Line of Credit vs Short-Term Loan

Short-term loans provide businesses with a lump sum of money that must be repaid over an agreed-upon period of time.The Bottom Line

Is a Business Line of Credit a Good Idea? FAQs

A Business Line of Credit (BLOC) is a type of loan that provides businesses with ongoing access to funds, allowing them to use and repay money as needed.

The main benefit of a business line of credit is its flexible repayment plan and potential lower interest rates than other types of loans. It also allows businesses to access the funds they need without having to reapply each time.

Many lenders do not require collateral when issuing a BLOC, but it is best to check with your lender as certain factors may affect their decision.

The approval process for BLOCs generally takes less time than short-term loan applications due to their more relaxed requirements.

Yes, it is essential to compare all financing options before making a final decision as each type of loan comes with its own set of pros and cons.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.