Medical lines of credit, or MLOCs, are financial products specifically crafted to cover healthcare-related expenses. Unlike general-purpose credit cards or personal loans, these lines are exclusively for medical needs. Their unique design ensures that medical professionals often acknowledge and occasionally favor MLOCs over other forms of payment. These lines simplify the payment process for both the patient and the provider, ensuring efficient and timely medical services without financial hindrances. Medical lines of credit bridge the gap between an individual's immediate healthcare needs and their available resources. With the increasing unpredictability of medical costs, many find it challenging to manage sudden or substantial bills. MLOCs offer a way to mitigate these unplanned expenses. By having a financial solution in place, patients can focus on their health rather than the burden of immediate payments. This not only eases the immediate financial strain but also alleviates the stress associated with medical treatments. At its core, a medical line of credit functions similarly to a credit card. It offers a set credit limit, and consumers borrow against this limit for their medical expenses. The primary distinction lies in the purpose; MLOCs are specifically tailored for healthcare costs. The flexibility offered by this setup means patients can address their health concerns as they arise without waiting for loan approvals or tapping into their savings. The variable nature of medical treatments makes this flexibility invaluable, especially when costs aren't fixed or clear upfront. The repayment aspect of MLOCs generally requires users to adhere to minimum monthly payments, akin to many credit card systems. However, it's the accruing interest on remaining balances that consumers should be mindful of. The outstanding balance attracts interest, and if only the minimum amount is paid, the principal remains largely untouched. Over time, this can increase the total repayment amount. Hence, understanding the repayment terms and keeping a close watch on balances can save considerable money in the long run. Obtaining a medical line of credit isn't automatic; there's a vetting process. Lenders will scrutinize credit scores, review financial histories, and examine the applicant’s overall financial stability. A solid credit score and a consistent history of repaying debts timely can not only increase approval chances but might also result in favorable interest rates. Prospective borrowers should prepare for the application process by gathering essential documentation, such as proof of income and existing financial obligations. MLOCs present borrowers with unparalleled financial flexibility, especially when unpredictable medical needs arise. This revolving credit setup ensures patients don't overextend themselves and only borrow what's essential. With an MLOC, patients have the power to address health concerns promptly without financial bottlenecks. This is especially beneficial when dealing with treatments where costs might escalate or vary based on the treatment course. Emergencies are inherently unpredictable. An accident, sudden diagnosis, or any unforeseen medical situation can result in hefty bills. Having an MLOC means there’s always a financial fallback. Furthermore, a pre-approved credit line might enable smoother negotiations with healthcare providers, potentially leading to better payment terms or even cost reductions. Such advantages underscore the importance of financial preparedness in health emergencies. Medical lines of credit can, in certain circumstances, offer competitive interest rates, especially when compared to some traditional medical loans. A borrower’s creditworthiness significantly influences this. For those maintaining a robust credit history, MLOCs can become a cost-effective way to manage medical expenses. In contrast, some fixed-rate medical loans might not provide such financial flexibility or benefits. While MLOCs offer various benefits, they come with potential pitfalls. Interest and debt can accumulate rapidly if consumers are not diligent about repayments. Relying heavily on the line and making only minimal payments can lead to significant long-term financial obligations. Being proactive in repayments and understanding the terms can prevent this situation. Medical lines of credit, when mismanaged, can adversely affect credit scores. Timely repayments are critical. Missed or late payments are usually flagged to credit agencies, resulting in potential score reductions. Moreover, consistently using a large chunk of the available credit, even if repaying diligently, can also affect the credit score. Balancing the usage and maintaining a low credit utilization ratio can positively impact credit health. With easy access to funds, there's a temptation to borrow more than necessary. Over-reliance on an MLOC, even for non-critical treatments, can lead to financial challenges in the future. It's imperative to differentiate between essential medical needs and discretionary treatments. Exercising prudence and being judicious about borrowing can ensure the MLOC remains a beneficial tool rather than a financial burden. Personal loans often come with fixed interest rates. This means that the borrower will pay a consistent amount over the loan's life. In some instances, these rates can be lower than those on credit cards or MLOCs, especially for borrowers with stellar credit histories. However, since these rates are fixed, they might not adjust to changing market conditions, potentially making them less favorable over time. The terms of personal loans can vary but typically range from a year to several years. One of the primary benefits of this fixed term is the predictability it provides. Borrowers know precisely when the loan will be paid off, assuming they stick to the repayment schedule. On the downside, there's less flexibility. Once a loan is taken out, increasing the borrowing amount typically requires a new loan application, whereas MLOCs allow for continuous borrowing up to the set limit. Credit cards are versatile financial tools suitable for a myriad of expenses, including medical. However, their general-purpose nature doesn't necessarily make them the best choice for healthcare-related costs. While they provide instant access to funds, they lack the specialized features and benefits that MLOCs might offer, such as deferred interest promotions or direct tie-ups with healthcare providers. Credit cards often come with higher interest rates compared to MLOCs or personal loans. While introductory offers might promise low or zero interest for an initial period, these rates can skyrocket after this period ends. It's crucial for consumers to be aware of these rate hikes and how they can affect the total repayment amount. On the brighter side, credit cards often come with rewards programs. For consumers who can promptly pay off their balances, using a credit card for medical expenses might earn them points, cash back, or other rewards. However, these benefits can quickly be overshadowed by high interest if the balance isn't cleared in full each month. Many healthcare providers offer direct payment plans, especially for significant procedures or treatments. These plans often allow patients to repay their bills in installments, sometimes without any interest. This can be particularly helpful for those who might struggle with getting credit approval. Having a direct arrangement also fosters a closer relationship between the patient and provider, potentially leading to more personalized care and understanding. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are examples of pre-planned medical saving strategies. These accounts allow individuals to set aside money, pre-tax, for medical expenses. This not only helps in budgeting for healthcare costs but also offers tax advantages. HSAs, in particular, are paired with high deductible health plans (HDHPs) and allow for contributions to be rolled over year after year. This means that funds not used in one year can be saved for future medical expenses. On the other hand, FSAs usually require the funds to be used within the plan year, with some exceptions allowing for a carryover of a limited amount. Both these saving strategies emphasize the importance of planning ahead for medical costs. They encourage individuals to be proactive about their healthcare finances and can be especially beneficial in complementing other financing options like MLOCs, personal loans, or credit cards. Medical lines of credit (MLOCs) serve as a specialized financial solution designed explicitly for healthcare expenses, offering flexibility and prompt access to funds. Acting as a bridge to address unexpected medical costs, MLOCs emphasize immediate healthcare over financial constraints. While they function similarly to credit cards, their unique design caters specifically to medical needs. Borrowers enjoy significant benefits such as financial preparedness for emergencies and potential competitive interest rates. However, awareness of the potential pitfalls, including interest accumulation and credit score implications, is essential. When juxtaposed with alternatives like personal loans and credit cards, MLOCs display distinct advantages, but also underline the value of health savings and payment plans. This myriad of options ensures individuals can make informed decisions tailored to their unique healthcare and financial situations.What Are Medical Lines of Credit?

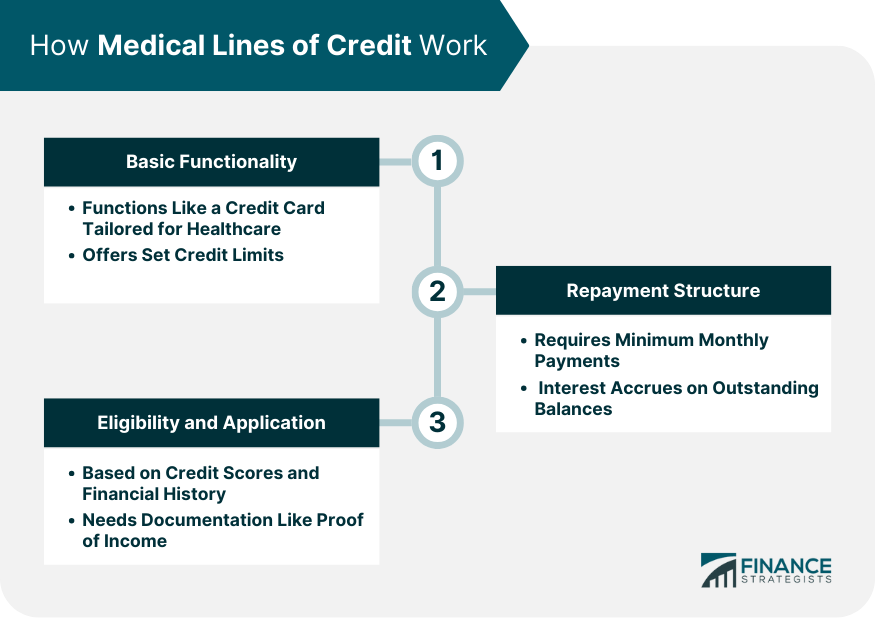

How Medical Lines of Credit Work

Basic Functionality

Repayment Structure

Eligibility and Application

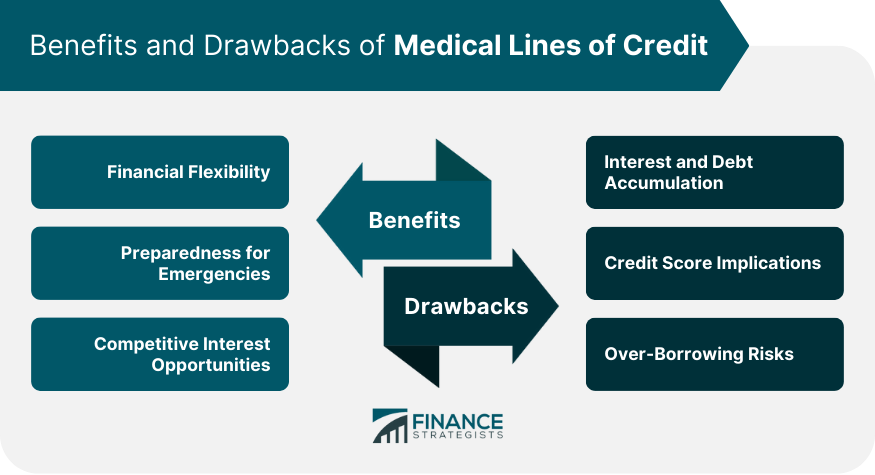

Benefits of Medical Lines of Credit

Financial Flexibility

Preparedness for Emergencies

Competitive Interest Opportunities

Drawbacks of Medical Lines of Credit

Interest and Debt Accumulation

Credit Score Implications

Over-Borrowing Risks

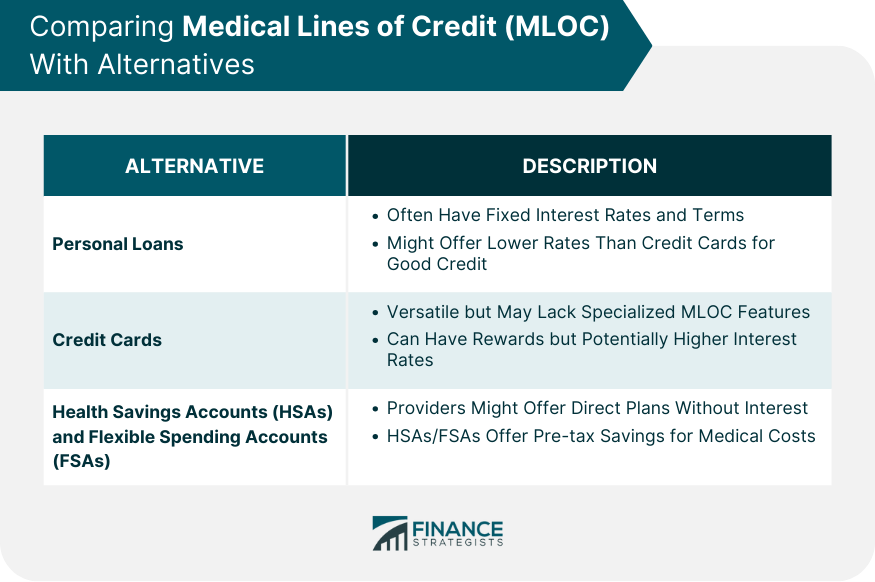

Comparing Medical Lines of Credit with Alternatives

Personal Loans

Interest Rates, Terms, and Benefits

Credit Cards

Suitability for Medical Expenses

Interest Rates and Reward Considerations

Health Savings and Payment Plans

Direct Arrangements With Health Providers

Benefits of Pre-planned Medical Saving Strategies

Conclusion

Medical Lines of Credit FAQs

Medical Line of Credit (MLOC) is a specialized financial product designed exclusively for covering healthcare-related expenses, functioning similarly to a credit card but solely for medical needs.

While both offer a form of revolving credit, Medical Lines of Credit are tailored specifically for medical expenses, often coming with specialized features and benefits suited to healthcare financing.

Yes, Medical Lines of Credit can offer competitive interest rates, especially for those with good credit histories, sometimes even more favorable than general-purpose credit cards.

Absolutely. Just like any credit product, the management of a Medical Line of Credit can affect your credit score. Timely repayments enhance credit health, while missed payments can negatively impact it.

While MLOCs provide financial flexibility, they come with potential pitfalls, such as interest accumulation and the risk of over-borrowing, making it essential for users to manage them diligently.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.