A Multi-Family Line of Credit (MFLOC) is a specialized financing tool designed for property investors who oversee multi-family units like apartments, duplexes, or larger housing complexes. Unlike traditional loans, where a lump sum is disbursed upfront, MFLOC provides borrowers the flexibility to draw funds as needed, up to a pre-established credit limit. The main objective of MFLOC is to offer property managers and investors easy access to funds without the need for repeated loan applications. This comes in handy for ongoing expenses or unplanned repairs. Given the dynamic nature of multi-family properties where expenses can arise unpredictably, having an MFLOC is a strategic move, ensuring that funds are readily available when required. Qualifying for an MFLOC typically involves an assessment of both the borrower’s creditworthiness and the value or potential value of the multi-family property. Lenders look at credit scores, property income, occupancy rates, and other relevant financial metrics. A property appraisal might also be part of the process to determine the property's value and how much credit a lender is willing to extend. Once the line of credit is established, borrowers can draw from it, much like using a credit card. There’s no obligation to use the entire amount, and interest is only charged on the funds used. Repayment terms vary, but they often include both interest-only payment options or principal plus interest, depending on the lender's terms and the borrower's needs. Interest rates for MFLOCs can be fixed or variable. Variable rates are typically pegged to an index, such as the prime rate, and can fluctuate over time. Apart from interest, borrowers might also encounter other fees, including origination fees, maintenance fees, or annual charges, depending on the lender's terms. While MFLOC offers flexibility, there might be some restrictions on its use. For instance, some lenders may stipulate that the funds be used only for property-related expenses. It’s essential to understand these restrictions upfront to avoid any complications later. The primary advantage of an MFLOC is the flexibility it offers. Borrowers have the liberty to draw funds when required, making it a suitable tool for addressing both expected and unexpected property-related costs. Given that the credit line is backed by a tangible asset (the multi-family property), lenders might be willing to extend a more considerable credit line compared to unsecured credit lines or loans, especially if the property boasts a solid income stream and high occupancy rates. Once the initial MFLOC is approved, accessing funds is generally swift and requires no additional approval, unlike traditional loans that require a new application for each borrowing need. Some MFLOCs offer interest-only payment options, especially in the initial stages. This can be a boon for property managers as it provides more leeway in managing cash flow, particularly if the property has variable income. Variable interest rates can be a double-edged sword. While they might start lower than fixed rates, they can increase over time, impacting the borrowing costs and making budgeting a challenge. The convenience of drawing funds can sometimes lead to overborrowing. Property managers need to be disciplined and strategic to ensure they don't accrue more debt than necessary. Some MFLOCs come with annual maintenance fees or charges, adding to the overall cost of borrowing. It's essential to be aware of these and factor them into the decision-making process. In most cases, the multi-family property itself serves as collateral for the line of credit. If the borrower fails to repay, there's a risk of losing the property to the lender. Traditional loans usually have fixed monthly repayments, while MFLOCs might offer more flexible repayment options, including interest-only payments or variable repayments based on the amount drawn. MFLOCs offer on-demand access to funds up to the credit limit, eliminating the need for multiple loan applications. Traditional loans, on the other hand, provide a lump sum upfront and require a new application for additional funds. While both MFLOCs and traditional loans necessitate an initial application and approval process, once an MFLOC is established, additional fund access is usually more streamlined and faster. Both financing tools may require collateral, but the specifics can vary. An MFLOC typically uses the multi-family property as collateral, whereas traditional loans might have diverse collateral requirements or even be unsecured in some cases. Regularly reviewing and tracking the MFLOC usage is essential. This ensures that the credit line is used judiciously and helps in effective financial planning. Timely repayments not only keep interest costs in check but also enhance the borrower’s credibility, potentially making it easier to negotiate favorable terms in the future. Lenders might update terms or offer promotional rates. Regularly reviewing the MFLOC terms ensures that the borrower remains aware of any changes and can capitalize on beneficial opportunities. A well-maintained property with high occupancy rates and consistent income is more likely to command a higher credit line and better terms. Regular maintenance, timely rent collection, and proactive tenant management are crucial. A robust application, complete with comprehensive financial records, high occupancy rates, and a good credit score, can improve the chances of MFLOC approval and secure favorable terms. Each lender may have its unique criteria. By understanding these requirements upfront, applicants can tailor their applications to align better with the lender's expectations. A well-organized and comprehensive documentation package can expedite the approval process. This includes financial statements, property appraisals, tenant lease agreements, and any other relevant records. Negotiation can play a pivotal role in securing favorable MFLOC terms. By showcasing the property's financial strength and one's creditworthiness, borrowers might be in a position to negotiate lower interest rates or waive certain fees. The Multi-Family Line of Credit (MFLOC) stands out as an indispensable financial instrument specifically designed for those who manage or invest in multi-housing units. Its standout feature is its adaptability, ensuring that funds are within arm's reach for both regular and unexpected expenses associated with property management. While its pluses, such as flexible repayment structures and the potential for more substantial loan quantities, make it attractive, it's also important to navigate it with a clear understanding of its challenges, like unpredictable interest rates and the risk of excessive borrowing. In contrast to the more rigid structure of traditional loans, MFLOCs offer fluidity, a trait that shines especially in the ever-evolving financial arena, marked by digital shifts and the rise of online lenders. Thus, an MFLOC, when harnessed with discernment and strategic foresight, has the potential to be a steadfast financial ally, providing stability and support for property investors in an unpredictable market.What Is Multi-Family Line of Credit?

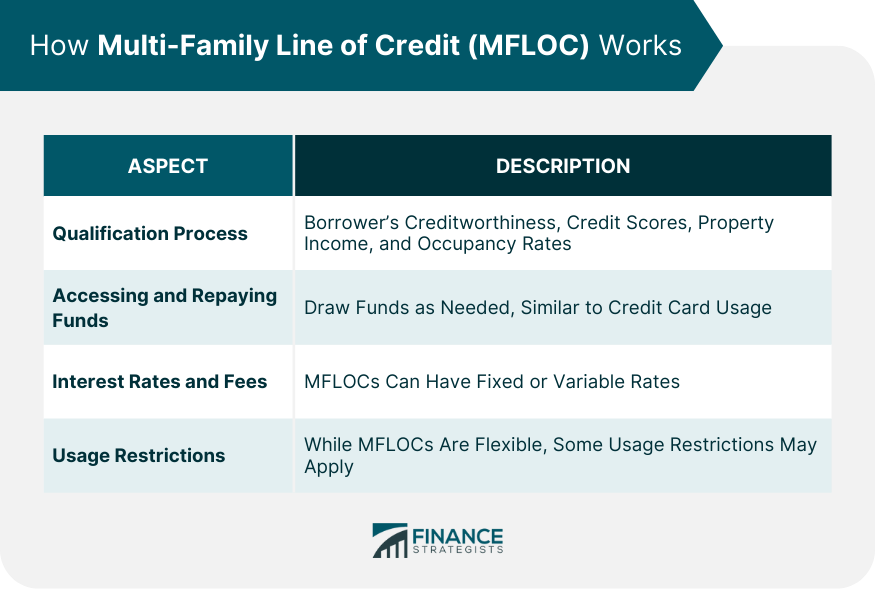

How Multi-Family Line of Credit Works

Qualification Process

Accessing and Repaying Funds

Interest Rates and Fees

Usage Restrictions

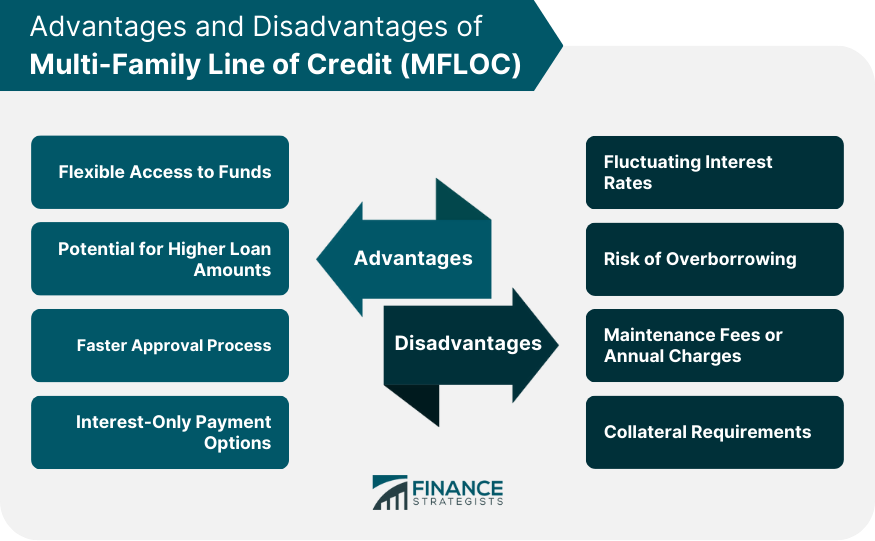

Pros of Multi-Family Line of Credit

Flexible Access to Funds

Potential for Higher Loan Amounts

Faster Approval Process Compared to Traditional Loans

Potential for Interest-Only Payments

Cons of Multi-Family Line of Credit

Fluctuating Interest Rates

Potential for Overborrowing

Maintenance Fees or Annual Charges

Collateral Requirements

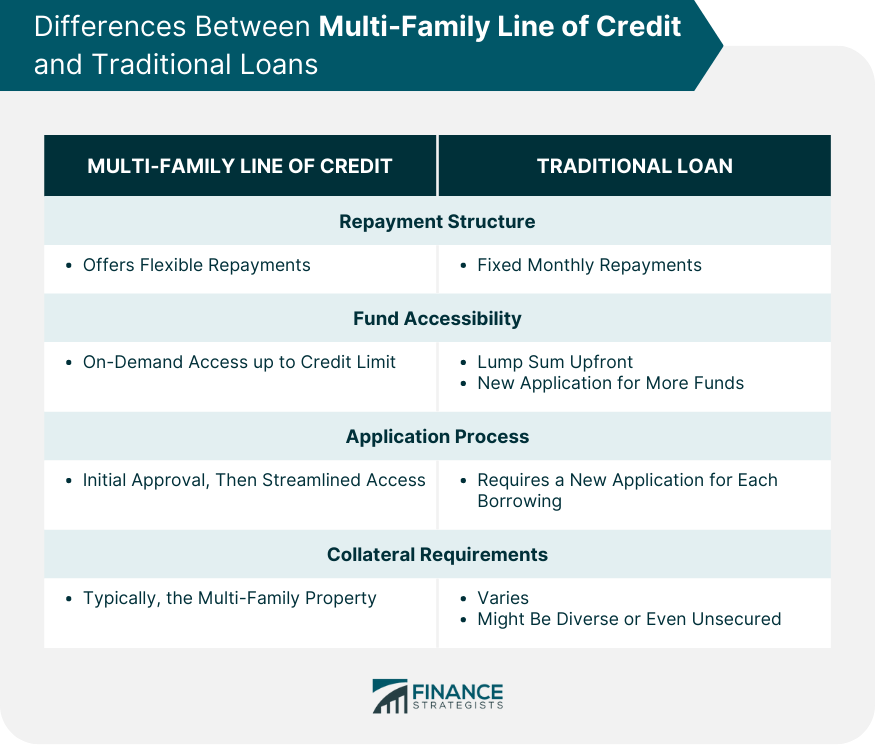

Key Differences Between Multi-Family Line of Credit and Traditional Loans

Repayment Structure

Flexibility and Accessibility

Application and Approval Process

Collateral and Security Requirements

Best Practices in Managing a Multi-Family Line of Credit

Monitoring Borrowing Activity

Ensuring Timely Repayments

Reviewing Terms and Conditions Periodically

Maintaining Strong Financial Health of the Multi-Family Property

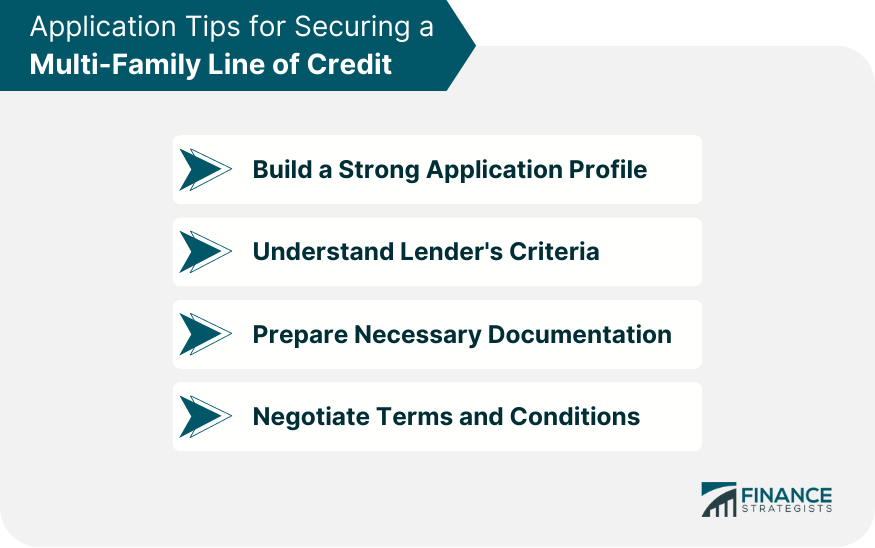

Application Tips for Securing a Multi-Family Line of Credit

Building a Strong Application Profile

Understanding Lender's Criteria

Preparing Necessary Documentation

Negotiating Terms and Conditions

Conclusion

Multi-Family Line of Credit FAQs

Multi-Family Line of Credit (MFLOC) is a financial tool designed specifically for investors in multi-family housing units. Unlike traditional loans, MFLOC allows investors to draw funds as needed, up to a certain limit, making it flexible for addressing both routine and unexpected expenses.

The application for a Multi-Family Line of Credit typically evaluates the applicant's creditworthiness and the value of the multi-family property. Once approved, MFLOC allows for easy, repeated access to funds without reapplying, unlike traditional loans which require a new application for additional funds.

Yes, some lenders may have stipulations on how the funds from a Multi-Family Line of Credit can be used, often requiring them to be utilized for property-related expenses. It's essential to clarify these conditions with the lender beforehand.

Interest rates for a Multi-Family Line of Credit can be either fixed or variable. Variable rates often fluctuate based on an index, like the prime rate. The specifics vary by lender and can be influenced by factors like creditworthiness and the property's value.

The primary benefit of a Multi-Family Line of Credit is its flexibility. Investors can draw funds as needed, making it suitable for varied expenses without the rigidity of fixed loan repayments or the need for multiple loan applications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.