An online line of credit is a type of credit that allows borrowers to access a certain amount of funds as needed, up to a pre-approved limit. It works similar to a credit card, where you can borrow funds as needed, but with lower interest rates and more flexible repayment terms. It is a revolving credit, which means that once you pay off the borrowed amount, the funds become available again for you to use. There are two types of online lines of credit for bad credit: secured and unsecured. A secured line of credit requires collateral such as a home, car, or any valuable asset, while an unsecured line of credit does not require collateral. However, unsecured lines of credit usually come with higher interest rates and lower credit limits compared to secured lines of credit. When you apply for an online line of credit, the lender will evaluate your creditworthiness based on your credit score, income, and other factors. If you meet the lender's requirements, they will offer you a pre-approved credit limit, and you can access the funds as needed. You can withdraw funds through an online account, check, or a credit card that is linked to the line of credit. Once you borrow funds, you will be required to make monthly payments, which include both principal and interest payments. The interest rates for an online line of credit for bad credit are usually higher than those of traditional lines of credit, but they are still lower than those of payday loans or other types of credit for bad credit. While online lines of credit for bad credit are often more accessible than traditional loans, there are still certain eligibility requirements that must be met in order to qualify for this type of financing. Although lenders of online lines of credit for bad credit do not have strict credit score requirements, they will still evaluate your creditworthiness based on your credit score. The minimum credit score required varies depending on the lender, but it is usually between 500 and 600. You will be required to provide proof of income to qualify for an online line of credit for bad credit. The minimum income required varies depending on the lender, but it is usually around $1,000 per month. You must be at least 18 years old to apply for an online line of credit for bad credit. Some lenders may have higher age requirements, so make sure to check with the lender before applying. In addition to the above requirements, lenders may also require you to have a checking account and a valid ID to qualify for an online line of credit for bad credit. Applying for an online line of credit can be a relatively straightforward process, provided that you have a clear understanding of the application requirements and process. The first step to applying for an online line of credit for bad credit is to research and compare different lenders. Look for lenders that specialize in bad credit loans and compare their interest rates, fees, repayment terms, and customer reviews. Once you have identified a lender, you will need to fill out an application. You will be required to provide personal information such as your name, address, income, and social security number. You will also need to provide documentation to support your application, such as proof of income, ID, and bank statements. Once you have submitted your application and documentation, the lender will evaluate your application and notify you of their decision. If you are approved, the funds will be deposited into your account, usually within 24 hours. Despite the challenges of having bad credit, there are a number of benefits associated with obtaining an online line of credit tailored specifically to individuals with poor credit scores. One of the main advantages of an online line of credit for bad credit is its flexibility. Unlike traditional loans, you can access the funds as needed, and you only pay interest on the amount you borrow, not the entire credit limit. This flexibility allows you to manage your cash flow and access funds when you need them. Another advantage is that you can access funds quickly. Once your application is approved, the funds are usually available within 24 hours, which can be a huge advantage in case of emergencies. Although the interest rates for an online line of credit for bad credit are higher than those of traditional loans, they are still lower than those of payday loans or other types of credit for bad credit. This can help you save money on interest charges over the long term. If you use an online line of credit responsibly, it can help you improve your credit score. Making timely payments and keeping your credit utilization low can positively impact your credit score over time. While online lines of credit for bad credit can provide a valuable source of financing, there are also potential risks and drawbacks that must be carefully considered before applying for this type of loan. As already mentioned, the interest rates for online lines of credit for bad credit are higher than for traditional loans, though it may be lower than those of payday loans. Additionally, some lenders may charge high fees, such as application fees, origination fees, or late fees. If you use an online line of credit for bad credit irresponsibly, you may fall into a debt trap, where you accumulate more debt than you can afford to repay. This can lead to financial hardship and negatively impact your credit score. If you fail to make timely payments or default on your online line of credit for bad credit, it can negatively impact your credit score and make it harder to access credit in the future. Using an online line of credit for bad credit can be an effective way to access the financing you need, but it is important to use this type of credit wisely in order to avoid potential financial pitfalls. An online line of credit for bad credit should be used for emergencies or unexpected expenses, not for luxury items or unnecessary expenses. Only borrow what you need and make sure you can afford to pay it back. Before you borrow any funds, create a budget to ensure you can make your monthly payments on time. Stick to your budget to avoid overspending and accumulating more debt. Making timely payments is crucial for improving your credit score and avoiding late fees and penalties. Set up automatic payments or reminders to ensure you don't miss a payment. Keep your credit utilization low by only borrowing what you need and paying it off as soon as possible. A high credit utilization can negatively impact your credit score and make it harder to access credit in the future. An online line of credit for bad credit can be a useful tool for managing your finances and accessing credit when you need it the most. However, it is important to use it responsibly and understand the risks involved. Make sure to research and compare different lenders, stick to a budget, make timely payments, and keep your credit utilization low. By using an online line of credit for bad credit responsibly, you can improve your credit score and achieve financial stability. Moreover, if you are considering applying for an online line of credit for bad credit, it is important to evaluate your financial situation and determine if it is the right option for you. You should only apply for a line of credit if you have a plan to repay it, and you can afford the monthly payments. It is also important to read the terms and conditions carefully and understand the interest rates, fees, and repayment terms. Overall, an online line of credit for bad credit can be a lifeline for people with poor credit scores who need access to funds quickly. It offers more flexibility and lower interest rates compared to other types of credit for bad credit. However, it also comes with risks, such as high fees, potential for debt trap, and negative impact on credit score. Therefore, it is crucial to use it responsibly, make timely payments, and keep your credit utilization low.Understanding Online Line of Credit for Bad Credit

How Online Line of Credit Works

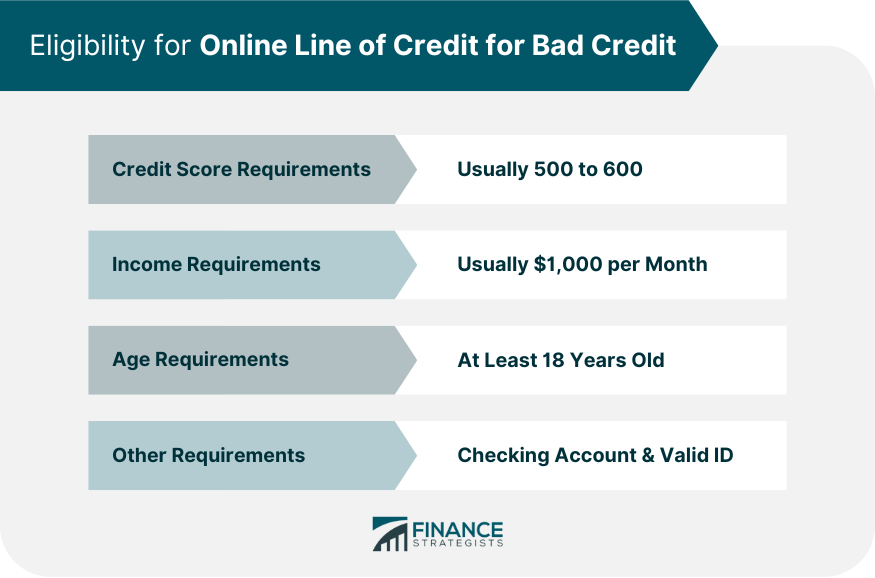

Eligibility for Online Line of Credit for Bad Credit

Credit Score Requirements

Income Requirements

Age Requirements

Other Requirements

How to Apply for Online Line of Credit for Bad Credit

Research and Compare Different Lenders

Fill Out Application

Provide Required Documentation

Approval and Funding Process

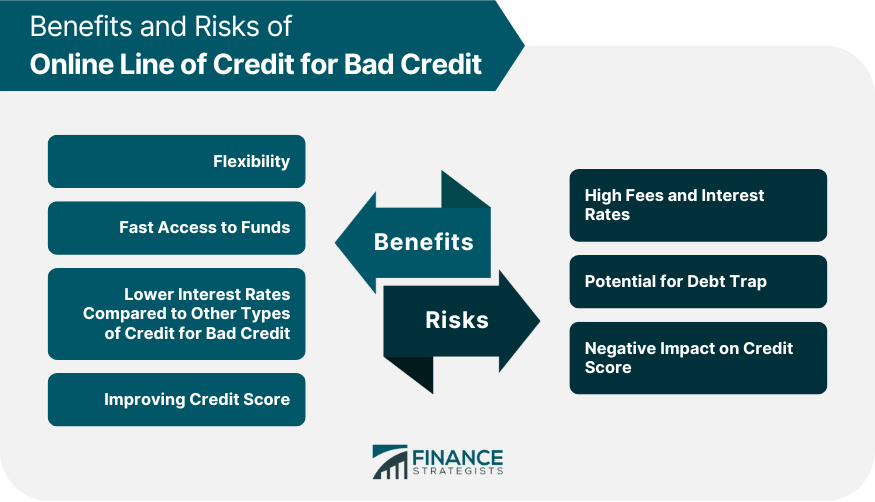

Benefits of Online Line of Credit for Bad Credit

Flexibility

Fast Access to Funds

Lower Interest Rates Compared to Other Types of Credit for Bad Credit

Improves Credit Score

Risks of Online Line of Credit for Bad Credit

High Fees and Interest Rates

Potential for Debt Trap

Negative Impact on Credit Score

Tips for Using Online Line of Credit for Bad Credit

Use Only When Necessary

Stick to Budget

Make Payments on Time

Keep Credit Utilization Low

Conclusion

Online Line of Credit for Bad Credit FAQs

An online line of credit for bad credit is a type of credit that allows individuals with poor credit scores to access funds as needed, up to a pre-approved limit. It works similarly to a credit card, but with more flexible repayment terms and lower interest rates.

The eligibility requirements for an online line of credit for bad credit include having a minimum credit score of 500 to 600, a minimum income of around $1,000 per month, and being at least 18 years old. Some lenders may also require collateral or a valid ID.

To apply for an online line of credit for bad credit, you should research and compare different lenders, fill out an application, and provide documentation such as proof of income and ID. The lender will evaluate your application and notify you of their decision, and if you are approved, the funds will be deposited into your account.

The benefits of an online line of credit for bad credit include flexibility, fast access to funds, lower interest rates compared to other types of credit for bad credit, and the opportunity to improve credit scores.

The risks of an online line of credit for bad credit include high fees and interest rates, potential for debt trap, and negative impact on credit score if you fail to make timely payments or default on the loan. Therefore, it is important to use it responsibly and understand the risks involved before applying.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.