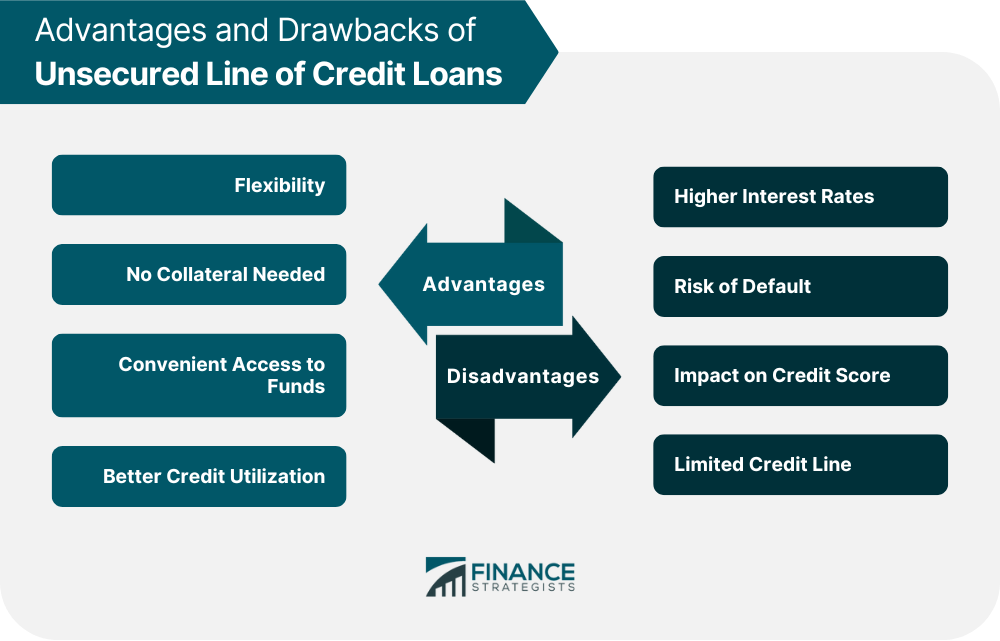

Unsecured Line of Credit Loans are a type of credit that allows borrowers to access funds up to a certain limit without having to put up collateral. These loans are an excellent option for those who need access to funds but do not want to risk their assets. Unlike traditional loans, borrowers can withdraw funds as needed and pay interest only on the amount borrowed. There are two types of line of credit loans: secured and unsecured. Secured Lines of Credit: Require borrowers to put up collateral, such as a house, car, or other valuable assets. In contrast, unsecured lines of credit do not require collateral, but borrowers may have to pay higher interest rates. Unsecured Line of Credit: This is ideal for borrowers who do not have collateral or do not want to put up their assets as collateral. They are also ideal for those who need access to funds for a short period, such as small business owners, freelancers, or individuals with irregular income streams. Flexibility: Borrowers can access funds as needed and pay interest only on the amount borrowed. No Collateral Needed: Unsecured lines of credit do not require borrowers to put up collateral, making them an ideal option for those who do not want to risk their assets. Convenient Access to Funds: Borrowers can access funds quickly and easily without having to go through a lengthy application process. Better Credit Utilization: Using an unsecured line of credit can improve your credit utilization ratio, which is an important factor in determining your credit score. An unsecured line of credit loan has several disadvantages. These include higher interest rates, risk of default, impact on credit score, and a limited credit line. Higher Interest Rates: Unsecured lines of credit typically have higher interest rates than secured lines of credit or traditional loans. Risk of Default: Since there is no collateral, lenders have a higher risk of default, which can lead to higher interest rates and fees. Impact on Credit Score: Late payments or defaulting on an unsecured line of credit can negatively impact your credit score. Limited Credit Line: Unsecured lines of credit typically have lower credit limits than secured lines of credit or traditional loans. Before applying for an unsecured line of credit loan, borrowers must meet certain eligibility criteria, which may vary depending on the lender. Some common eligibility criteria include: Credit Score: Most lenders require a minimum credit score of 650 to qualify for an unsecured line of credit loan. However, some lenders may require a higher credit score. Income: Lenders may require borrowers to have a certain level of income to qualify for an unsecured line of credit loan. Employment History: Lenders may also require borrowers to have a stable employment history to ensure that they can repay the loan. Debt-To-Income Ratio: Lenders may also consider the borrower's debt-to-income ratio, which is the amount of debt the borrower has compared to their income. Other Criteria: Some lenders may have additional eligibility criteria, such as a minimum age requirement or residency status. The application process for an unsecured line of credit loan varies depending on the lender. However, some common steps are the following: Research and Compare Lenders: Before applying for an unsecured line of credit loan, borrowers should research and compare lenders to find the best option for their needs. Gather Required Documentation: Borrowers will need to provide documentation such as proof of eligibility, proof of income, employment history, and credit score. Fill Out the Application: Borrowers can usually fill out the application online or in person. They will need to provide personal and financial information, including their name, address, Social Security Number, and income. Wait for Approval: After submitting the application, borrowers will need to wait for approval. Lenders may conduct a credit check and review the borrower's financial history before making a decision. Before applying for an unsecured line of credit loan, borrowers should consider several factors, including: Unsecured lines of credit often have higher rates and fees than secured lines of credit or traditional loans. Borrowers should compare rates and fees from different lenders to find the best option for their needs. Borrowers should also consider the repayment terms of the loan, including the length of the repayment period and the minimum monthly payments. Late payments or defaulting on an unsecured line of credit can negatively impact the borrower's credit score. Borrowers should ensure that they can make timely payments before applying for a loan. Borrowers should also consider the potential risks of borrowing money, including the risk of default, bankruptcy, or foreclosure. Borrowers should also consider alternatives to unsecured lines of credit loans, such as secured lines of credit, personal loans, or credit cards. An unsecured line of credit loan is an excellent option for borrowers who need access to funds but do not want to risk their assets. However, before applying, borrowers should consider the advantages and disadvantages of unsecured lines of credit and the eligibility criteria and application process. Borrowers should also compare rates and fees from different lenders and consider the potential risks and alternatives to unsecured lines of credit loans. By taking these factors into account, borrowers can make an informed decision and find the best option for their needs.What Is an Unsecured Line of Credit Loan?

Advantages of Unsecured Line of Credit Loans

There are several advantages of unsecured line of credit loans that borrowers should consider before applying.Disadvantages of Unsecured Line of Credit Loans

Eligibility Criteria for Unsecured Line of Credit Loans

How to Apply for Unsecured Line of Credit Loans

Factors to Consider Before Applying for Unsecured Line of Credit Loans

Interest Rates and Fees

Repayment Terms

Credit Score Impact

Potential Risks

Alternatives to Unsecured Line of Credit Loans

The Bottom Line

Unsecured Line of Credit Loans FAQs

An unsecured line of credit loan is a type of credit that allows borrowers to access funds up to a certain limit without having to put up collateral. Borrowers can withdraw funds as needed and pay interest only on the amount borrowed.

A secured line of credit loan requires borrowers to put up collateral, such as a house, car, or other valuable assets, while an unsecured line of credit loan does not require collateral. However, unsecured lines of credit may have higher interest rates than secured lines of credit.

Eligibility criteria for an unsecured line of credit loan may vary depending on the lender, but common requirements include a minimum credit score, income, employment history, debt-to-income ratio, and other factors such as age and residency status.

Disadvantages of an unsecured line of credit loan include higher interest rates, a higher risk of default due to the absence of collateral, the potential negative impact on the credit score in case of late payments or default, and a limited credit line.

Before applying for an unsecured line of credit loan, you should consider factors such as interest rates and fees, repayment terms, credit score impact, potential risks, and alternatives to unsecured lines of credit loans. It is important to compare rates and fees from different lenders and assess your financial situation to make an informed decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.