An unsecured revolving line of credit is a financial arrangement that provides individuals or businesses with access to a predetermined amount of funds. A credit card is the most common example of an unsecured revolving line of credit. Revolving means that once the spent funds have been paid back, they can be spent again; unsecured means that the funds are not secured by collateral. The interest rates on these are generally higher than secured or non revolving loans. For businesses, unsecured lines of credit can be particularly beneficial, providing flexibility and rapid access to funds, helping manage unforeseen costs or take advantage of sudden opportunities. Unsecured revolving lines of credit present a safety net for businesses, covering unexpected expenses or providing cash flow during slower periods. Also, since these credit lines do not require collateral, borrowers' assets remain unencumbered. This makes them an attractive option for start-ups and businesses with fewer assets. The credit line is also revolving, allowing businesses to repay and reuse the funds as often as needed, providing a flexible financial resource. The credit limit is a fundamental feature, representing the maximum amount a borrower can access at any time. The specific limit is often determined based on the borrower's creditworthiness, including factors like credit history, income, and the capacity to repay the loan. It's worth noting that with regular and responsible usage, lenders may be open to increasing this limit. Unlike a traditional loan that provides a lump sum, an unsecured revolving line of credit allows a borrower to draw funds up to the credit limit. This feature contributes to its flexibility, enabling the borrower to access only the required funds, thereby potentially lowering interest costs. It means the credit is not a one-time loan but rather a pool of funds that replenishes as repayments are made. Hence, it's a continuous source of finance that can be tapped into repeatedly, as long as the borrower stays within the credit limit and adheres to the terms and conditions. The revolving nature of this credit line encourages dynamic financial management. It gives borrowers the liberty to strategically utilize funds in sync with their financial needs and repayment capabilities, potentially smoothing out cash flow irregularities. Interest rates and fees on unsecured revolving lines of credit can vary significantly based on the borrower's credit profile and the lending institution's policies. As the line of credit is unsecured, interest rates tend to be higher than those for secured credit lines. The interest is usually charged only on the funds drawn, not the entire credit limit. In addition to interest rates, lenders may also charge annual fees, late payment fees, or transaction fees. Borrowers should therefore thoroughly understand all possible charges associated with their credit line, as these costs can accumulate and significantly affect the cost of borrowing. Repayment terms for an unsecured revolving line of credit generally include a minimum monthly payment, often a percentage of the total outstanding balance. This payment usually includes both principal and interest. However, some lenders may have different repayment structures. The flexibility of repayment is a key feature. Borrowers can choose to repay more than the minimum payment, thereby reducing their outstanding balance and freeing up more of their credit limit. However, late payments or default can result in penalties and a negative impact on the borrower's credit score. Eligibility for an unsecured revolving line of credit largely hinges on the applicant's creditworthiness. Lenders assess this using a combination of factors such as credit score, payment history, income level, and overall financial stability. Businesses may also need to demonstrate steady cash flow and profitability. Some lenders might also consider the length of time a business has been operational. Start-ups and newer businesses may face more stringent eligibility criteria given their lack of a proven track record. These often include financial statements, income tax returns, and bank statements. Businesses may also need to provide business-specific documents such as profit and loss statements, balance sheets, and business tax returns. Documentation requirements can vary depending on the lender's policies and the specific nature of the applicant. Therefore, potential borrowers should consult with their chosen lender to ensure they have all necessary paperwork before starting the application process. The application process for an unsecured revolving line of credit can usually be completed online, although some lenders may also offer offline application methods. The application generally requires the borrower to fill out a form with personal and financial information, alongside any required documentation. The process is typically quick and straightforward, especially if the applicant has prepared all necessary information and documents in advance. Still, some lenders might have more rigorous application processes than others, so borrowers should be prepared for possible variations. Following application submission, the lender evaluates the borrower's creditworthiness. This evaluation involves assessing the applicant's credit score, financial history, income, and any other relevant information provided in the application. Approval times can vary widely depending on the lender and the applicant's specific circumstances. Once approved, the borrower can typically start using the line of credit immediately. The borrower's credit limit and interest rate are communicated at this stage, along with any other specific terms and conditions. An unsecured revolving line of credit offers significant flexibility, a feature particularly beneficial for managing short-term cash flow needs or unexpected costs. Borrowers can draw funds as required, up to their credit limit, rather than receiving a lump sum as with a traditional loan. The revolving nature also allows for funds to become available again once repayments are made, ensuring a continuous source of funds. This ability to adapt to changing financial needs sets unsecured revolving lines of credit apart from other financial tools. Another key advantage is the immediate availability of funds once the credit line is established. This speed and convenience can prove invaluable for addressing unexpected expenses or taking advantage of sudden opportunities. Whether it's to bridge a cash flow gap, invest in a growth opportunity, or cover an unforeseen expense, the instant access to funds can be a game-changer for many businesses. Businesses often face periods of mismatched income and expenses, which can create cash flow challenges. A line of credit provides a financial cushion for such instances, helping businesses maintain operations despite short-term cash flow hiccups. This tool can also be used strategically to fund growth initiatives or take advantage of supplier discounts, contributing positively to a business's financial planning and overall performance. Lastly, responsibly using an unsecured revolving line of credit can help build a business's credit history. Regular repayments indicate creditworthiness and can improve a business's credit score over time. A strong credit score can open doors to larger loans and more favorable interest rates in the future, making this a long-term benefit of using an unsecured revolving line of credit. Despite the many advantages, there are also drawbacks to using an unsecured revolving line of credit. As these credit lines are unsecured, lenders typically charge higher interest rates to compensate for the greater risk. These higher interest rates can make an unsecured line of credit more expensive compared to other forms of financing, particularly if the borrower carries a large balance over an extended period. The ease of access to funds, coupled with the revolving nature of the credit, could potentially lead to overborrowing. Without careful management, borrowers might find themselves continually maxing out their credit limit, resulting in a cycle of debt that can be difficult to escape. This potential for overborrowing underscores the need for careful financial planning and responsible borrowing practices when using an unsecured revolving line of credit. While responsible use of a line of credit can enhance a borrower's credit score, the opposite is also true. Late payments or defaults can negatively impact the borrower's credit rating, making future borrowing more difficult and potentially more expensive. Further, the utilization rate, which is the ratio of the outstanding balance to the total credit limit, is a significant factor in credit score calculations. High utilization can lower a credit score, even if payments are made on time. While unsecured revolving lines of credit do not require collateral, some lenders may require a personal guarantee. This means that in the case of default, the lender can pursue the borrower's personal assets to recover the debt. This requirement can add a level of risk for the borrower, as personal assets, including homes or personal savings, could potentially be at stake if the business cannot repay the debt. Proper budgeting and planning are crucial when using an unsecured revolving line of credit. This includes understanding the cost of borrowing, assessing the ability to repay, and planning for how the funds will be used. A well-thought-out budget can also help avoid overborrowing, ensuring the line of credit is used responsibly and strategically. Regular forecasting and reviewing financial plans can help businesses stay on track and make the most of their line of credit. This involves only borrowing what is needed and can reasonably be repaid. Keeping the credit utilization rate low, ideally below 30%, can also positively impact credit scores. It's also crucial to make payments on time, as late payments can result in penalties and damage to the credit score. Setting up automatic payments or reminders can help ensure punctuality and consistency in repayments. Regular monitoring of the credit line is vital to ensure it continues to serve its intended purpose. This includes regularly reviewing the balance, the available credit, the repayment history, and any fees or charges. Borrowers should also review their financial situation periodically to ensure the line of credit still suits their needs. If circumstances change significantly, it may be worth discussing with the lender whether adjustments to the credit limit or terms are necessary. An unsecured revolving line of credit is a flexible financial tool that allows individuals and businesses to access funds on an ongoing basis. It provides a pre-approved credit limit that can be borrowed, repaid, and borrowed again without the need for collateral. It offers substantial flexibility, immediate access to funds, enhanced cash flow management, and the potential to build business credit. However, it comes with higher interest rates, the potential for overborrowing, potential impacts on credit scores, and possible personal guarantees. To effectively use this financial tool, proper budgeting and planning, responsible borrowing practices, and regular monitoring are essential. With careful management, an unsecured revolving line of credit can be a powerful tool for businesses, supporting their growth and financial stability.What Is an Unsecured Revolving Line of Credit?

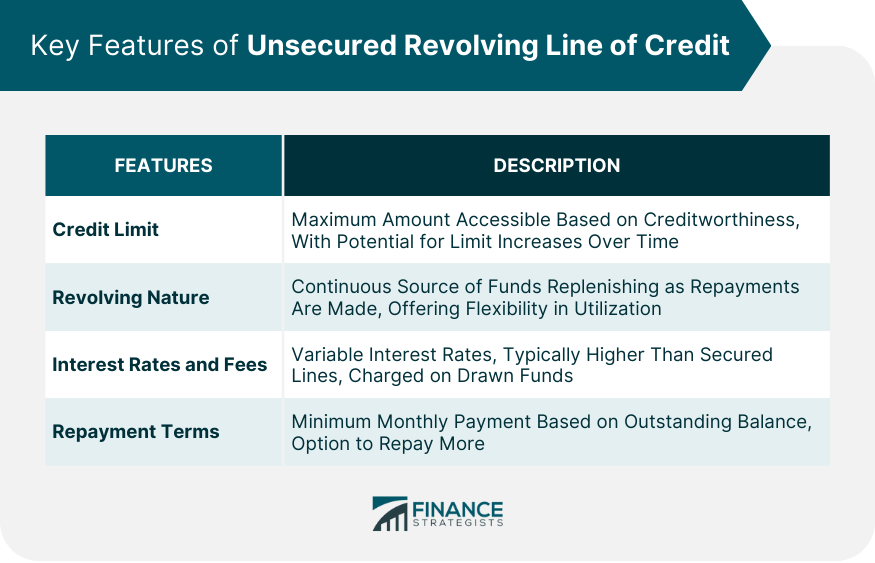

Key Features of an Unsecured Revolving Line of Credit

Credit Limit

Revolving Nature

Interest Rates and Fees

Repayment Terms

Eligibility and Application Process for an Unsecured Revolving Line of Credit

Eligibility Criteria

Required Documentation

Application Submission

Credit Evaluation and Approval

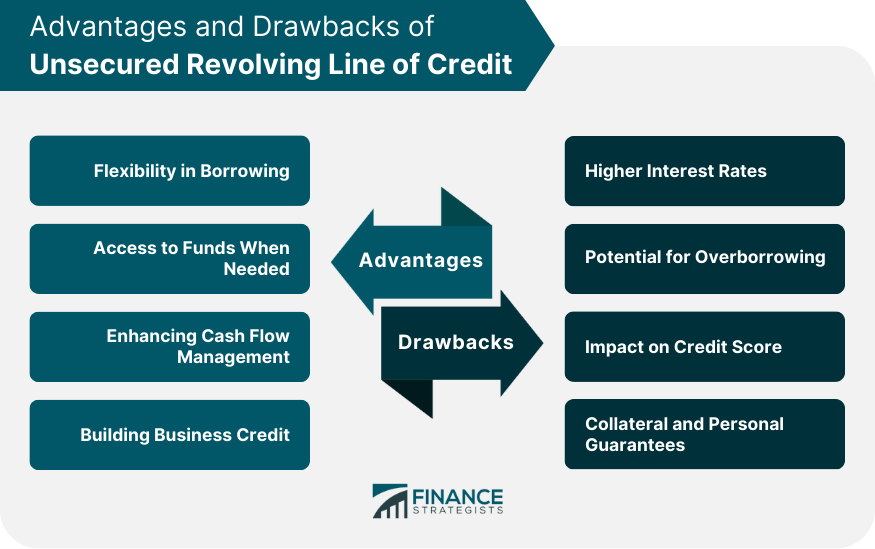

Advantages of an Unsecured Revolving Line of Credit

Flexibility in Borrowing

Access to Funds When Needed

Enhancing Cash Flow Management

Building Business Credit

Drawbacks of an Unsecured Revolving Line of Credit

Higher Interest Rates

Potential for Overborrowing

Impact on Credit Score

Collateral and Personal Guarantees

Tips for Effective Use of an Unsecured Revolving Line of Credit

Budgeting and Planning

Responsible Borrowing Practices

Regular Monitoring and Review

Conclusion

Unsecured Revolving Line of Credit FAQs

A line of credit is money lent to an individual or business. If a line of credit is revolving, then the line of credit will replenish as the borrower pays back money borrowed.

The acronym LOC stands for Line of Credit.

A revolving line of credit is one which replenishes when the loan is paid off. An example of this is a credit card. A non-revolving line of credit closes once the loan is paid off, such as a student loan.

A loan is typically a lump sum whereas a line of credit is typically revolving which allows for the borrower to draw, repay, and again draw as needed.

An Unsecured Revolving Line of Credit can provide borrowers with access to funds quickly, easily, and at a lower cost than other types of loans. It also offers the flexibility to borrow only when necessary and pay back quickly without incurring hefty penalty fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.