Loan modification programs are initiatives designed to help borrowers who are struggling to make their mortgage payments. These programs provide an opportunity to restructure the terms of a mortgage loan in order to make it more affordable and manageable for the borrower. The goal of loan modification programs is to prevent foreclosure, keep families in their homes, and stabilize the housing market. To qualify for a loan modification program, borrowers must demonstrate that they are experiencing financial hardship. This may include job loss, reduced income, medical expenses, or other unexpected life events that have impacted their ability to make mortgage payments. Eligibility for loan modification programs may depend on the type of loan the borrower has (e.g., conventional, FHA, VA, or USDA) and how long they have held the mortgage. Some programs require that the borrower be delinquent on their mortgage payments, while others allow for modifications before delinquency occurs. Borrowers' credit history and payment track record may also play a role in determining their eligibility for a loan modification program. Lenders may consider factors such as late payments, missed payments, or other negative credit events when reviewing applications. Loan modification programs generally require that the property be the borrower's primary residence. Investment properties or second homes may not be eligible for these programs. HAMP was a federal program designed to help homeowners who were struggling to make their mortgage payments due to financial hardship. Although the program is no longer accepting new applications, it serves as an example of the type of assistance that may be available. FHA-HAMP is a loan modification program specifically for borrowers with FHA-insured mortgages. The program aims to help homeowners reduce their monthly mortgage payments and avoid foreclosure. The Department of Veterans Affairs offers loan modification programs for eligible veterans with VA-guaranteed mortgages. These programs can provide financial relief to struggling veterans by lowering their mortgage payments or extending their loan terms. The USDA offers loan modification programs for homeowners with USDA-backed mortgages. These programs help borrowers who are experiencing financial hardship by adjusting their mortgage terms to make payments more affordable. Many lenders offer their own loan modification programs, which can vary in terms of eligibility requirements, benefits, and application processes. Examples of lender-specific programs include those offered by Bank of America, Wells Fargo, and JPMorgan Chase. Some states and local governments offer loan modification programs to help homeowners in their communities. Examples include the Hardest Hit Fund (HHF), Keep Your Home California (KYHC), and the New York State Mortgage Assistance Program (NYS-MAP). Before applying for a loan modification program, borrowers need to gather various documents to support their application. These may include: Financial statements Proof of income (e.g., pay stubs, tax returns, or bank statements) Property documents (e.g., mortgage statement, property tax bill, or insurance information) Borrowers should contact their mortgage servicer to discuss their options and determine if they are eligible for a loan modification program. The servicer can provide information on available programs, application requirements, and potential benefits. Once the necessary documentation has been gathered, borrowers can submit their application to their mortgage servicer. It is essential to provide accurate and complete information to improve the chances of approval. If the mortgage servicer approves the application, borrowers may have the opportunity to negotiate the terms of the loan modification. This can include discussing options for lowering monthly payments, reducing interest rates, extending loan terms, or adjusting principal balances. Some loan modification programs require borrowers to complete a trial period during which they must make the modified mortgage payments on time. If the borrower successfully completes the trial period, the loan modification will become permanent. One of the primary benefits of loan modification programs is that they can help borrowers lower their monthly mortgage payments. This can make it easier for homeowners to manage their finances and avoid falling behind on their mortgages. Loan modification programs may offer borrowers the opportunity to reduce their interest rates. Lower interest rates can result in significant savings over the life of the loan. Some loan modification programs may allow borrowers to extend their loan repayment terms. This can help reduce monthly payments by spreading the remaining loan balance over a longer period. In some cases, loan modification programs may include principal forbearance or reduction, which can help homeowners reduce their overall mortgage balance and make payments more manageable. Loan modification programs can help homeowners avoid foreclosure by providing more affordable mortgage terms. By preventing foreclosure, borrowers can maintain ownership of their homes and protect their credit scores from the negative effects of foreclosure. While a loan modification can help borrowers avoid foreclosure, it may still have a negative impact on their credit score. The extent of the impact depends on the specific modification terms and how the lender reports the modification to credit bureaus. Extending the loan repayment term through a loan modification program can result in lower monthly payments, but it may also mean that borrowers pay more in interest over the life of the loan. Unfortunately, loan modification programs can be a target for scams and fraud. Borrowers should be cautious when seeking assistance and always verify the legitimacy of any program or service before providing personal or financial information. Refinancing involves taking out a new mortgage to replace the existing one, potentially with more favorable terms, such as a lower interest rate or a longer repayment term. This can help borrowers reduce their monthly mortgage payments and save money over time. Forbearance is a temporary suspension or reduction of mortgage payments granted by the lender to help borrowers experiencing financial hardship. While forbearance does not permanently modify the loan terms, it can provide short-term relief until the borrower's financial situation improves. A short sale occurs when a borrower sells their property for less than the outstanding mortgage balance, with the lender's permission. This can help borrowers avoid foreclosure, but it may result in a negative impact on their credit score. A deed-in-lieu of foreclosure is an arrangement in which the borrower voluntarily transfers the property's title to the lender in exchange for the cancellation of the outstanding mortgage debt. This option can help borrowers avoid foreclosure but may also negatively affect their credit scores. Bankruptcy is a legal process that can help borrowers restructure or eliminate their debts, including mortgage debt. While bankruptcy can have severe long-term consequences for a borrower's credit, it may be an option for those who are unable to qualify for other forms of assistance. Loan modification programs are designed to help borrowers who are struggling to make their mortgage payments due to financial hardship. These programs provide an opportunity to restructure the terms of a mortgage loan to make it more affordable and manageable for the borrower, with the goal of preventing foreclosure and stabilizing the housing market. Eligibility for loan modification programs may depend on factors such as financial hardship criteria, loan type and age requirements, credit and payment history, and property eligibility. There are various types of loan modification programs, including federal programs, lender-specific programs, and state and local programs. The application process typically involves gathering required documentation, contacting the mortgage servicer, submitting the application, negotiating loan modification terms, and completing a trial period. While loan modification programs can have benefits such as lower monthly payments, reduced interest rates, extended loan terms, and avoidance of foreclosure, there are also potential drawbacks, such as an impact on credit scores and longer loan repayment terms. Alternatives to loan modification programs include refinancing, forbearance, short sale, deed-in-lieu of foreclosure, and bankruptcy.Definition of Loan Modification Programs

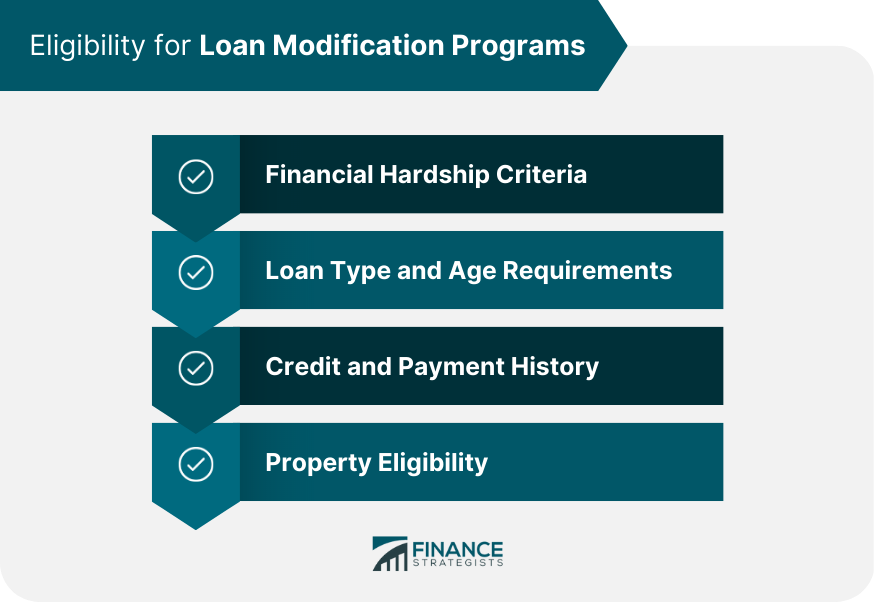

Eligibility for Loan Modification Programs

Financial Hardship Criteria

Loan Type and Age Requirements

Credit and Payment History

Property Eligibility

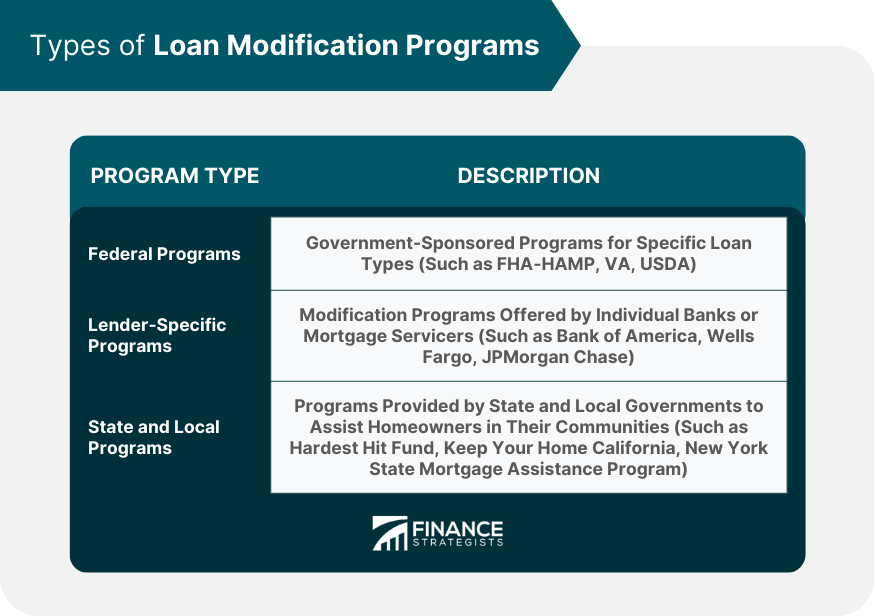

Types of Loan Modification Programs

Federal Programs

Home Affordable Modification Program (HAMP)

FHA Home Affordable Modification Program (FHA-HAMP)

VA Loan Modification Programs

USDA Loan Modification Programs

Lender-Specific Programs

State and Local Programs

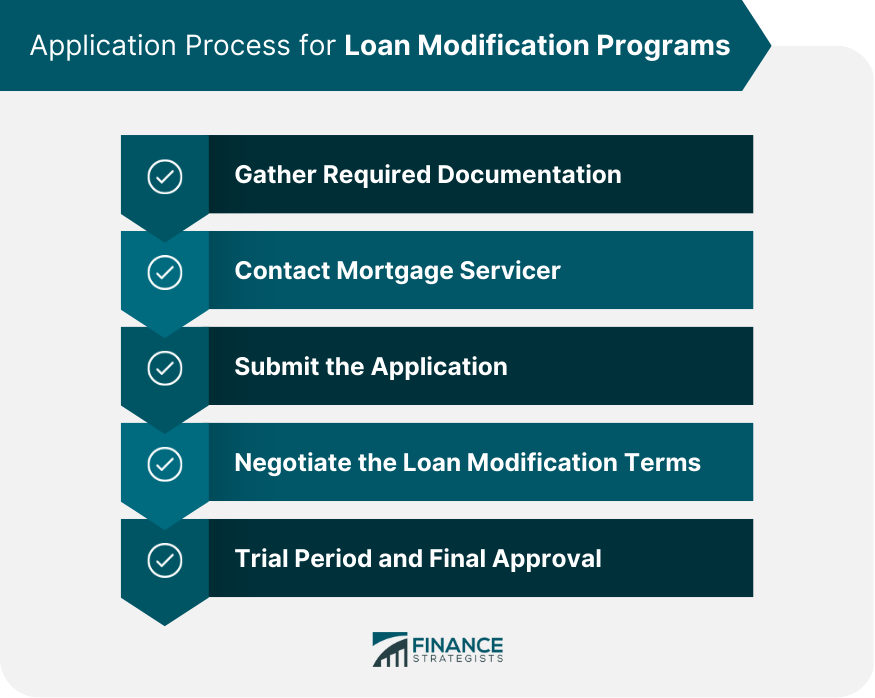

Application Process for Loan Modification Programs

Gathering Required Documentation

Contacting Your Mortgage Servicer

Submitting the Application

Negotiating the Loan Modification Terms

Trial Period and Final Approval

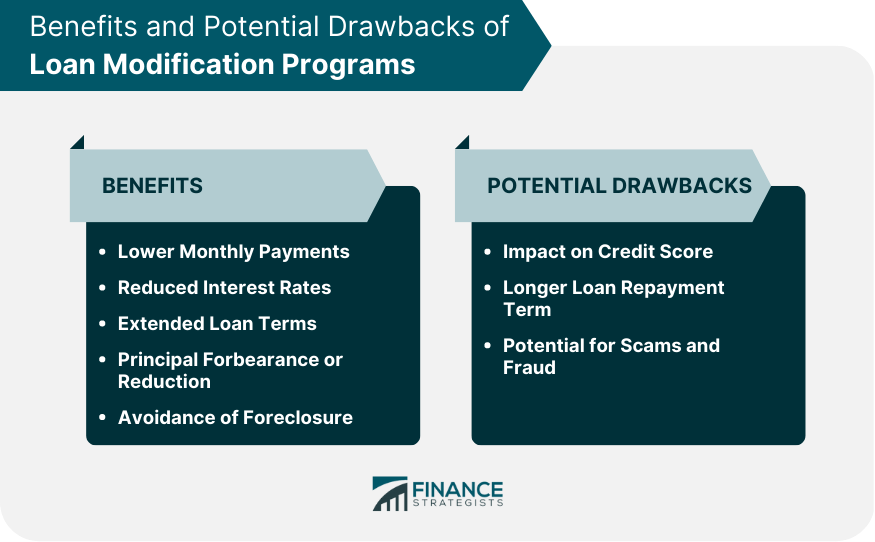

Benefits of Loan Modification Programs

Lower Monthly Payments

Reduced Interest Rates

Extended Loan Terms

Principal Forbearance or Reduction

Avoidance of Foreclosure

Potential Drawbacks of Loan Modification Programs

Impact on Credit Score

Longer Loan Repayment Term

Potential for Scams and Fraud

Alternatives to Loan Modification Programs

Refinancing

Forbearance

Short Sale

Deed-in-Lieu of Foreclosure

Bankruptcy

The Bottom Line

Loan Modification Programs FAQs

Loan modification programs can help borrowers lower their monthly mortgage payments, reduce interest rates, extend loan terms, achieve principal forbearance or reduction, and ultimately avoid foreclosure.

Eligibility for loan modification programs depends on various factors, including financial hardship, loan type and age, credit and payment history, and property eligibility. Contact your mortgage servicer to discuss your specific situation and determine your eligibility.

Federal loan modification programs are offered by the federal government and apply to specific types of loans, such as FHA, VA, or USDA mortgages. Lender-specific programs are provided by individual banks or mortgage servicers and may vary in terms of eligibility and benefits. State and local programs are offered by state and local governments and aim to assist homeowners in their communities.

While loan modification programs can help avoid foreclosure, they may still have a negative impact on your credit score, depending on the specific terms of the modification and how the lender reports it to credit bureaus. It is essential to consider this potential drawback before proceeding with a loan modification.

Yes, there are several alternatives to loan modification programs, such as refinancing, forbearance, short sale, deed-in-lieu of foreclosure, and bankruptcy. Homeowners should carefully evaluate each option and seek professional advice to determine the most suitable course of action based on their unique circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.