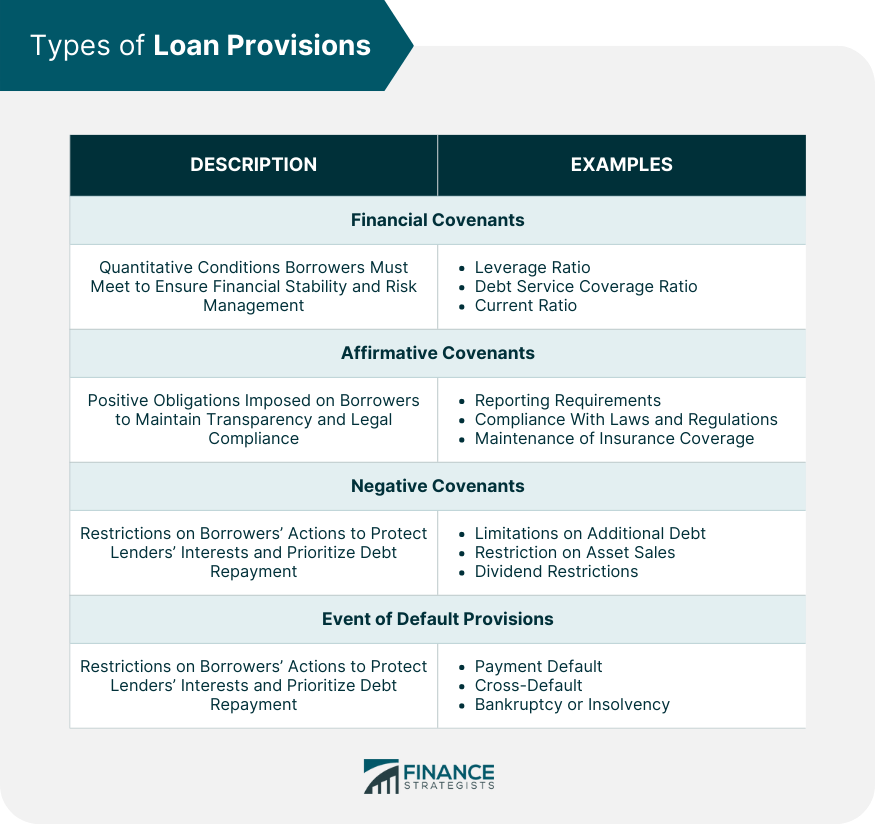

Loan provisions are accounting measures that banks and financial institutions use to account for potential losses from loans that may not be repaid. These provisions are set aside as a reserve against loans that may default or become non-performing. They help banks and financial institutions to account for potential losses and maintain adequate capital reserves to absorb any losses that may arise. Loan provisions are typically established based on the creditworthiness of borrowers, the performance of the loans, and the overall economic conditions. Banks and financial institutions may increase or decrease loan provisions based on changes in these factors over time. Financial covenants are quantitative conditions that borrowers must adhere to during the term of the loan. They help lenders assess and manage the financial risk associated with the loan. Some common financial covenants include: The leverage ratio measures the borrower's debt relative to its equity, ensuring that the borrower maintains a sustainable debt level. The Debt Service coverage ratio assesses the borrower's ability to service its debt by comparing cash flow to debt payments. The current ratio measures the borrower's liquidity, comparing current assets to current liabilities, ensuring that the borrower can meet short-term financial obligations. Affirmative covenants are positive obligations imposed on borrowers. Some common affirmative covenants include: These requirements mandate that the borrower regularly submit financial statements, ensuring transparency and allowing the lender to monitor the borrower's financial health. This covenant requires borrowers to comply with all applicable laws and regulations, ensuring legal and ethical business practices. This covenant ensures that borrowers maintain appropriate insurance coverage to protect against various risks. Negative covenants restrict certain actions by the borrower to protect the lender's interests. Some common negative covenants include: This covenant restricts the borrower from taking on excessive debt, which could jeopardize their ability to repay the loan. This covenant limits the borrower's ability to sell assets, ensuring that the borrower retains enough assets to generate income and repay the loan. This covenant limits the borrower's ability to pay dividends, ensuring that they prioritize debt repayment. Event of default provisions define the circumstances under which the loan can be declared in default, allowing the lender to take legal action. Some common events of default include: This occurs when the borrower fails to make a required payment on the loan. This provision stipulates that a default on one loan triggers a default on other loans with the same lender. This provision declares the loan in default if the borrower files for bankruptcy or becomes insolvent. The loan provision process involves several steps, including assessing the borrower's credit risk, negotiating loan provisions, incorporating provisions into loan agreements, and monitoring and enforcing loan provisions. Lenders evaluate the borrower's creditworthiness, financial position, and ability to repay the loan. This assessment informs the lender's decision regarding the loan terms and provisions. Both parties negotiate the loan provisions, aiming to strike a balance between the borrower's needs and the lender's risk tolerance. Once the provisions are agreed upon, they are incorporated into the loan agreement, making them legally binding. Lenders continuously monitor the borrower's compliance with the loan provisions and enforce them as necessary to protect their interests. Loan provisions have various advantages and potential drawbacks for both borrowers and lenders. Access to Credit: Loan provisions enable borrowers to access credit, which can be used to finance business operations or personal expenses. Flexible Terms and Conditions: Loan provisions can be negotiated to provide borrowers with flexible terms and conditions that suit their specific needs and financial situations. Improved Financial Discipline: Loan provisions encourage borrowers to maintain healthy financial practices, ensuring long-term sustainability and growth. Risk Management: Loan provisions help lenders manage the risk associated with lending, protecting their investments and minimizing losses. Control over Borrower's Financial Activities: Loan provisions enable lenders to monitor and control borrowers' financial activities, ensuring that borrowers prioritize repaying their debts. Legal Protection in Case of Default: In the event of default, loan provisions provide lenders with legal grounds to pursue repayment or seize collateral. Restrictive Covenants May Limit Borrower's Growth: Some loan provisions, particularly negative covenants, may constrain borrowers' business activities, potentially limiting their growth. High Monitoring and Enforcement Costs for Lenders: Lenders may incur significant costs to monitor and enforce loan provisions, which can be a burden for smaller financial institutions or when borrowers are consistently non-compliant. Loan provisions are subject to a variety of regulations and industry standards, ensuring responsible lending practices and borrower protection. Regulations in the banking and financial sector govern the lending process, stipulating minimum standards for loan provisions and other lending practices. International Financial Reporting Standards (IFRS) dictate how financial institutions should account for loan provisions and other financial instruments, promoting transparency and comparability. Loan market associations, such as the Loan Syndications and Trading Association (LSTA) and the Loan Market Association (LMA), provide best practice guidelines for loan provisions, ensuring consistency and fairness in the lending process. Loan provisions play a crucial role in fostering responsible lending and borrowing practices by governing the relationship between borrowers and lenders. They come in various types, such as financial covenants, affirmative covenants, negative covenants, and event of default provisions, each serving different purposes in risk management, transparency, and legal protection. Both borrowers and lenders can benefit from loan provisions, enjoying advantages such as access to credit, flexible terms, and improved financial discipline, while being mindful of potential drawbacks like limiting growth and incurring monitoring costs. As the lending environment continues to evolve, it is vital for stakeholders to stay informed about the changes that influence loan provisions and their impact on responsible lending and borrowing practices.Definition of Loan Provisions

Types of Loan Provisions

Financial Covenants

Leverage Ratio

Debt Service Coverage Ratio

Current Ratio

Affirmative Covenants

Reporting Requirements

Compliance with Laws and Regulations

Maintenance of Insurance Coverage

Negative Covenants

Limitations on Additional Debt

Restrictions on Asset Sales

Dividend Payment Restrictions

Event of Default Provisions

Payment Default

Cross-Default

Bankruptcy or Insolvency

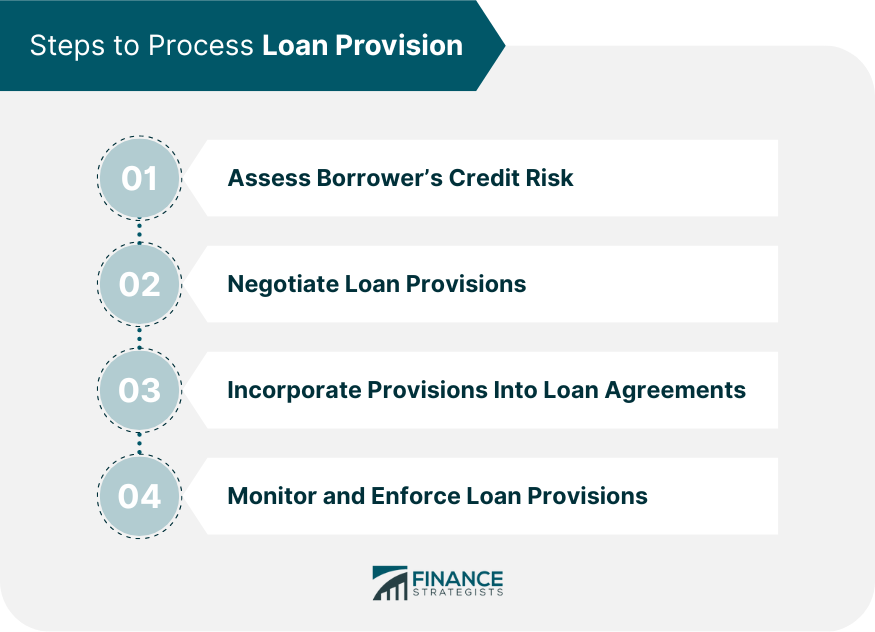

Loan Provision Process

Assessing Borrower's Credit Risk

Negotiating Loan Provisions

Incorporating Provisions into Loan Agreements

Monitoring and Enforcing Loan Provisions

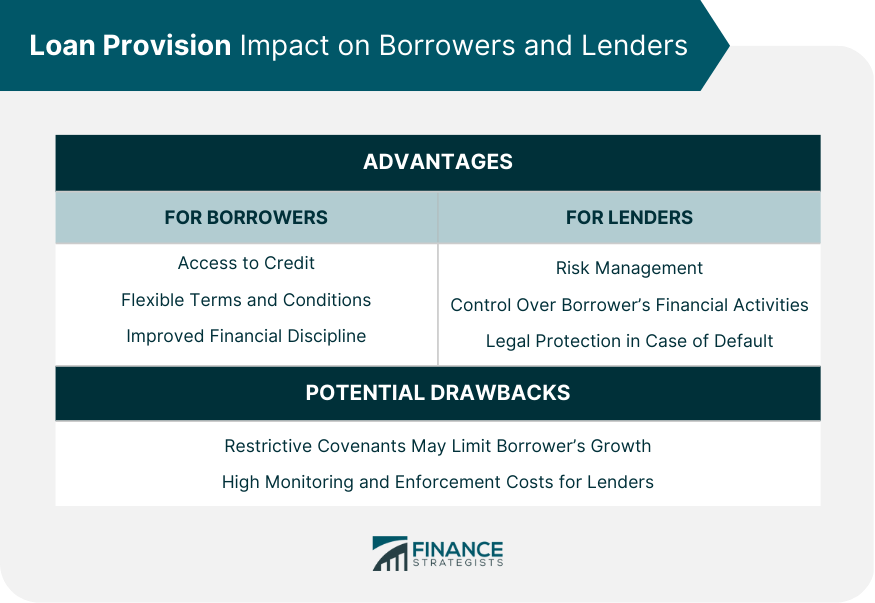

Loan Provision Impact on Borrowers and Lenders

Advantages for Borrowers

Advantages for Lenders

Potential Drawbacks

Regulatory Framework and Industry Standards

Banking and Financial Sector Regulations

International Financial Reporting Standards

Loan Market Associations and Best Practices

Final Thoughts

Loan Provisions FAQs

Loan provisions are specific terms and conditions included in a loan agreement that govern the relationship between borrowers and lenders. They are important because they help lenders manage risk, protect their investments, and ensure borrowers maintain healthy financial practices, ultimately promoting responsible lending and borrowing.

There are several types of loan provisions, including financial covenants, affirmative covenants, negative covenants, and event of default provisions. These provisions serve various purposes, such as managing risk, ensuring transparency, and establishing legal protection. They can provide advantages to both borrowers and lenders, such as access to credit, flexible terms, and improved financial discipline, but may also have potential drawbacks like limiting borrowers' growth and incurring high monitoring and enforcement costs for lenders.

Regulatory frameworks and industry standards, such as banking and financial sector regulations, International Financial Reporting Standards (IFRS), and guidelines from loan market associations, help ensure responsible lending practices, borrower protection, and transparency in loan provisions. These standards and regulations promote consistency and fairness in the lending process.

The loan provision process involves assessing the borrower's credit risk, negotiating loan provisions, incorporating them into a loan agreement, and monitoring and enforcing them throughout the loan term. Lenders evaluate the borrower's creditworthiness and ability to repay the loan, negotiate provisions, make them legally binding, and ensure compliance throughout the loan term.

Loan provisions promote responsible lending and borrowing practices by helping lenders assess and manage financial risk, ensuring borrowers maintain transparency and adhere to legal and ethical business practices, and providing legal protection in case of default. This creates a more stable and sustainable lending environment, benefiting both borrowers and lenders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.