Mortgage Payoff Strategies Overview

Paying off a mortgage is often one of the most significant financial achievements for many homeowners.

Mortgage payoff strategies are various methods employed to accelerate mortgage repayment, reduce interest costs, and ultimately achieve financial freedom.

The importance of paying off a mortgage early cannot be overstated, as it can provide increased financial security, flexibility, and peace of mind.

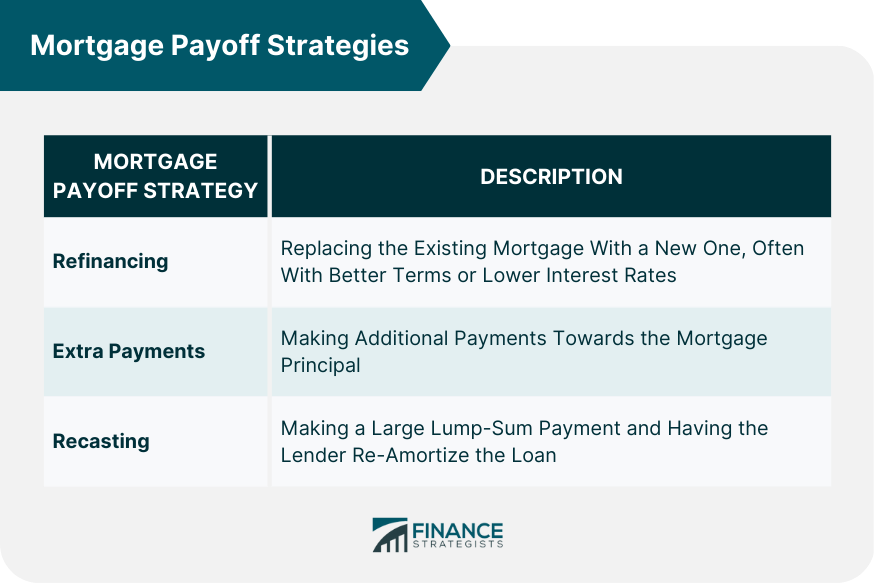

Mortgage Payoff Strategies

Refinancing

Refinancing is a popular mortgage payoff strategy that involves replacing the existing mortgage with a new one, often with more favorable terms or lower interest rates. This strategy can help homeowners save on interest payments and shorten the loan term.

Types of Refinancing

There are two main types of refinancing: rate-and-term refinancing and cash-out refinancing. Rate-and-term refinancing aims to secure a lower interest rate or change the loan term, while cash-out refinancing allows homeowners to access their home equity in the form of cash.

Factors to Consider Before Refinancing

Before refinancing, homeowners should weigh the costs and benefits, including closing costs, the new interest rate, and the time it takes to break even. Additionally, credit scores and current market conditions can impact the success of refinancing.

Extra Payments

Making extra payments towards the mortgage principal is another effective way to pay off a mortgage faster.

Lump-Sum Payments

Homeowners may choose to apply for lump-sum payments from an inheritance, windfalls, or tax refunds toward their mortgage principal. This strategy can significantly reduce the outstanding balance and interest paid over the loan term.

Bi-Weekly Payments

By making bi-weekly payments instead of monthly payments, homeowners can make an extra payment each year, accelerating the mortgage payoff process.

Benefits

Bi-weekly payments can help homeowners save on interest costs and reduce the loan term by several years.

Implementation

To implement bi-weekly payments, homeowners can either work with their lender or set up a separate account to ensure timely payment.

Additional Principal Payments

Homeowners can make additional principal payments either monthly, quarterly, or annually. These payments reduce the principal balance and overall interest paid, accelerating mortgage payoff.

Recasting

Recasting involves making a large lump-sum payment towards the mortgage principal and having the lender re-amortize the loan with the new balance, resulting in lower monthly payments.

Advantages and Disadvantages

Recasting can provide lower monthly payments and increased cash flow, but it does not shorten the loan term or reduce the interest rate.

Eligibility Requirements

Lenders often have specific eligibility requirements for recasting, including minimum payment amounts and restrictions on government-backed loans.

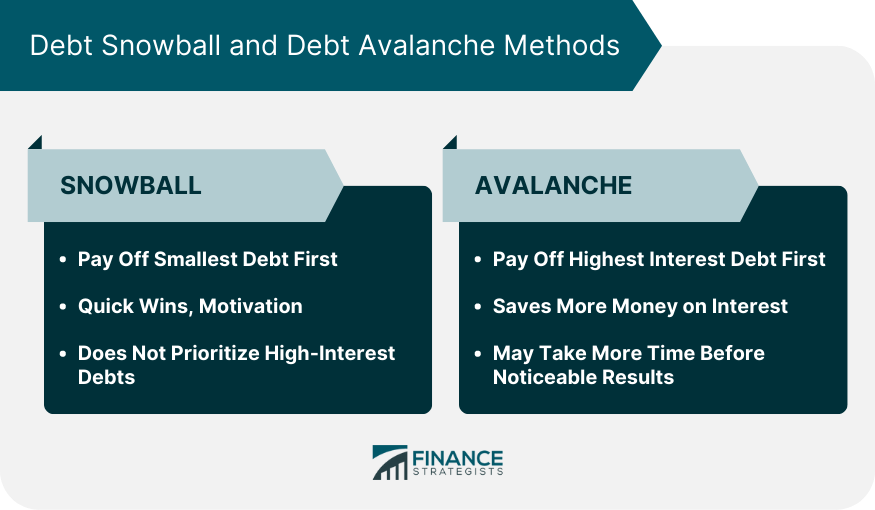

Debt Snowball and Debt Avalanche Methods

Debt Snowball Method

The debt snowball method focuses on paying off debts with the smallest balances first while making minimum payments on all other debts.

Benefits and Drawbacks

This method can provide quick wins and motivate individuals to continue their debt payoff journey. However, it may not be the most cost-effective strategy, as it does not prioritize high-interest debts.

Debt Avalanche Method

The debt avalanche method involves paying off debts with the highest interest rates first while making minimum payments on all other debts.

Benefits and Drawbacks

This method saves more money on interest payments but may require more time before achieving noticeable results.

Choosing Between Debt Snowball and Debt Avalanche

Individuals should consider their financial goals, motivation levels, and debt balances when selecting between these methods.

Evaluating Your Financial Situation

Assessing Income, Expenses, and Savings

Understanding one's financial situation is crucial when choosing a mortgage payoff strategy. Homeowners should evaluate their income, expenses, and savings to determine the most suitable approach.

Considering Mortgage Rates and Terms

Homeowners should consider their mortgage interest rates and remaining loan terms when selecting a payoff strategy. For instance, a low-interest rate may justify investing extra funds elsewhere, while a high-interest rate may warrant prioritizing mortgage payoff.

Balancing Other Financial Goals

Before focusing on mortgage payoff, homeowners should consider other financial goals and obligations.

Emergency Fund

Maintaining an emergency fund is essential for financial stability. Homeowners should ensure they have sufficient savings to cover unexpected expenses before aggressively paying off their mortgage.

Retirement Savings

Contributing to retirement savings is crucial for long-term financial security. Homeowners should evaluate their retirement goals and ensure they are on track before allocating additional funds towards mortgage payoff.

College Tuition

For parents, saving for their children's college tuition may be a priority. Balancing mortgage payoff with college savings requires careful planning and consideration of various factors, such as tuition costs, financial aid, and investment returns.

Investments

Homeowners should consider the potential returns on investment opportunities before directing additional funds towards mortgage payoff. In some cases, investing in the stock market or other investment vehicles may yield higher returns than paying off a low-interest mortgage.

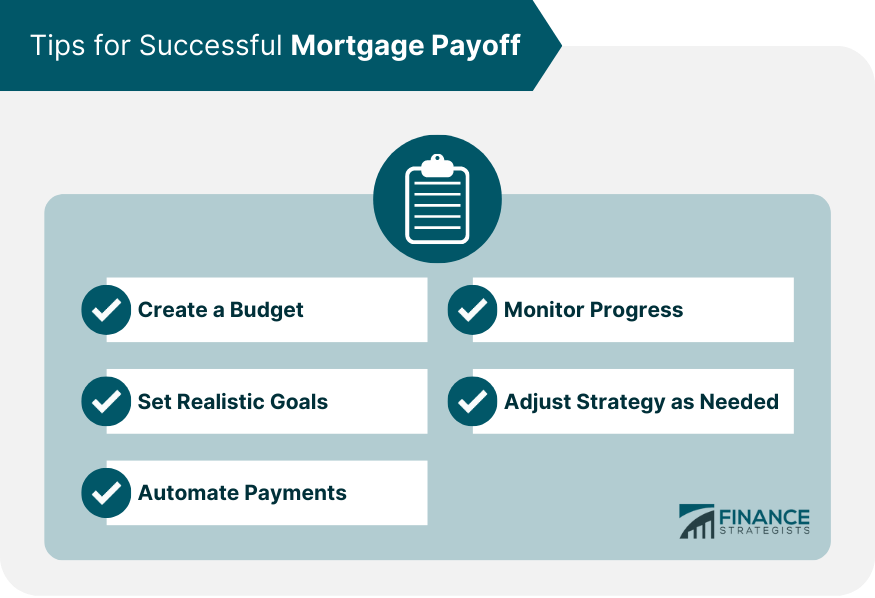

Tips for Successful Mortgage Payoff

Creating a Budget

A well-crafted budget can help homeowners track their income, expenses, and progress toward mortgage payoff. Regularly reviewing and adjusting the budget is crucial for financial success.

Setting Realistic Goals

Homeowners should set realistic goals for mortgage payoff, taking into account their current financial situation and other financial priorities.

Automating Payments

Automating extra mortgage payments can help homeowners stay on track and ensure consistent progress towards their mortgage payoff goal.

Monitoring Progress

Regularly reviewing the mortgage balance and overall progress can help homeowners stay motivated and make adjustments as needed.

Adjusting Strategy as Needed

Homeowners should be prepared to adjust their mortgage payoff strategy based on changes in their financial situation, interest rates, or other factors.

Potential Risks and Drawbacks

Opportunity Cost

Paying off a mortgage early may come with an opportunity cost, as homeowners could potentially earn higher returns by investing in other opportunities, such as stocks or real estate.

Tax Implications

Mortgage interest is tax-deductible in some countries, and paying off a mortgage early may reduce this benefit. Homeowners should consult a tax professional to understand the implications of their mortgage payoff strategy.

Reduced Liquidity

Directing significant funds toward mortgage payoff can reduce an individual's liquid assets, making it harder to cover unexpected expenses or take advantage of investment opportunities.

Early Payoff Penalties

Some mortgage lenders impose penalties for early mortgage payoff, which can offset the benefits of paying off a mortgage ahead of schedule. Homeowners should review their mortgage terms and consult their lenders before adopting an aggressive payoff strategy.

Bottom Line

Understanding various mortgage payoff strategies and their implications is crucial for homeowners seeking to reduce their loan term and achieve financial freedom.

Key strategies include refinancing, extra payments, and recasting, while debt snowball and debt avalanche methods can also play a role in paying off mortgages along with other debts.

It is essential to evaluate one's financial situation, considering factors such as mortgage rates, financial goals, and potential risks and drawbacks before selecting a strategy.

By creating a budget, setting realistic goals, automating payments, monitoring progress, and adjusting strategies as needed, homeowners can effectively work towards mortgage freedom and enjoy the benefits of early mortgage payoff.

Mortgage Payoff Strategies FAQs

Some of the most common mortgage payoff strategies include refinancing, making extra payments (such as lump-sum payments, bi-weekly payments, or additional principal payments), and recasting. Each of these strategies has its own benefits and drawbacks, so it's essential for homeowners to carefully consider their personal financial situation before choosing a strategy.

The debt snowball and debt avalanche methods are primarily used for paying off multiple debts, including mortgages. These methods can be incorporated into mortgage payoff strategies to help homeowners prioritize their debts and systematically pay them off. The debt snowball method focuses on paying off smaller debts first, while the debt avalanche method targets debts with the highest interest rates.

To evaluate the best mortgage payoff strategies for your financial situation, start by assessing your income, expenses, and savings. Consider your mortgage interest rate, remaining loan term, and other financial goals like emergency funds, retirement savings, college tuition, and investment opportunities. Additionally, consult a financial advisor to help you make informed decisions based on your unique circumstances.

Yes, there are potential risks and drawbacks to using mortgage payoff strategies to pay off your loan early. These may include opportunity costs, tax implications, reduced liquidity, and early payoff penalties. It's crucial to weigh these factors against the benefits of early mortgage payoff before deciding on a strategy.

To stay on track with your chosen mortgage payoff strategies, create a budget, set realistic goals, automate extra payments, monitor your progress, and adjust your strategy as needed. Keeping a close eye on your financial situation and making necessary adjustments will help ensure you achieve mortgage freedom and reap the benefits of an early mortgage payoff.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.