Mortgage preapproval is a process where a lender evaluates a borrower's financial information and credit history to determine how much money they can borrow and at what interest rate. It's a crucial step for potential homebuyers as it gives them an idea of their borrowing capacity and helps them make a more competitive offer when they find the right property. Preapproval typically involves a more thorough evaluation of a borrower's finances than prequalification, which is an initial step that provides an estimate of how much a borrower can afford to borrow. 1. Research Lenders: Explore various lending institutions such as banks, credit unions, and mortgage brokers to compare loan products, interest rates, and terms. Credit Score: Your credit score indicates your creditworthiness and ability to repay the loan. Income: Lenders evaluate your income to ensure you can afford the monthly mortgage payments. Employment History: A stable employment history demonstrates your ability to maintain a consistent income. Debt-To-Income Ratio: This ratio measures your monthly debt payments against your gross monthly income, indicating your ability to manage debts. Assets and Liabilities: Lenders assess your assets and liabilities to determine your net worth and overall financial stability. A mortgage preapproval letter signals to sellers that you are a serious and qualified buyer, which can give you an advantage in competitive housing markets. With a preapproval letter in hand, you can quickly make offers on properties, as sellers will be more likely to accept offers from preapproved buyers. Mortgage preapproval helps you understand how much you can afford, enabling you to search for homes within your budget and avoid disappointment. The preapproval process can reveal areas of improvement in your credit profile, giving you an opportunity to address any issues before applying for a mortgage. A strong preapproval application may qualify you for better interest rates, saving you money over your loan life. Applying for mortgage preapproval typically involves a hard credit inquiry, which can have a minor, temporary negative impact on your credit score. Preapproval letters are typically valid for a limited time (usually 60 to 90 days), which means you must find a property and finalize the mortgage process within that timeframe. Being pre-approved for a high loan amount may tempt some buyers to purchase a more expensive property than they can comfortably afford. Mortgage preapproval does not guarantee final loan approval, as changes in your financial situation or property appraisal can affect the lender's decision. Pay bills on time, reduce outstanding debts, and avoid applying for new credit in the months leading up to your mortgage application to improve your credit score. Lower your debt-to-income ratio by paying down existing debts or increasing your income, which can improve your chances of preapproval. A stable employment history is more appealing to lenders, so try to avoid job changes or gaps in employment before applying for preapproval. Having a larger down payment can improve your chances of preapproval and may result in better loan terms. Ensure your financial documentation is organized, up-to-date, and easily accessible to streamline the preapproval process. Research and compare loan products, interest rates, and terms from multiple lenders to find the best fit for your financial situation. Mortgage preapproval involves a thorough review of your credit and financial history by a lender, resulting in a formal letter stating the loan amount and estimated interest rate for which you qualify. Mortgage prequalification is a more informal process where a lender provides an estimate of the loan amount you may qualify for based on a brief overview of your financial situation, without verifying your credit or financial information. Consider mortgage prequalification when you are in the early stages of the home buying process and want a rough estimate of your borrowing capacity. Opt for mortgage preapproval when you are ready to start making offers on properties and want a more accurate loan eligibility assessment. Pros: Faster and less intrusive process, no impact on credit score Cons: Less accurate assessment of borrowing capacity, not as credible with sellers Pros: More accurate assessment of borrowing capacity, improved credibility with sellers Cons: Longer process, the potential impact on credit score Mortgage preapproval is a crucial aspect of the home-buying process. It provides potential homebuyers with a clear understanding of their borrowing capacity, improves credibility with sellers, and expedites the overall process. Homebuyers can increase their chances of success by carefully following the step-by-step guide to obtaining preapproval, addressing credit issues, and managing debt-to-income ratios. Moreover, understanding the differences between preapproval and prequalification and considering key factors when choosing a mortgage lender can help homebuyers make informed decisions throughout their journey. Ultimately, being well-prepared and knowledgeable about mortgage preapproval can pave the way for a smoother and more successful home-buying experience.What Is Mortgage Preapproval?

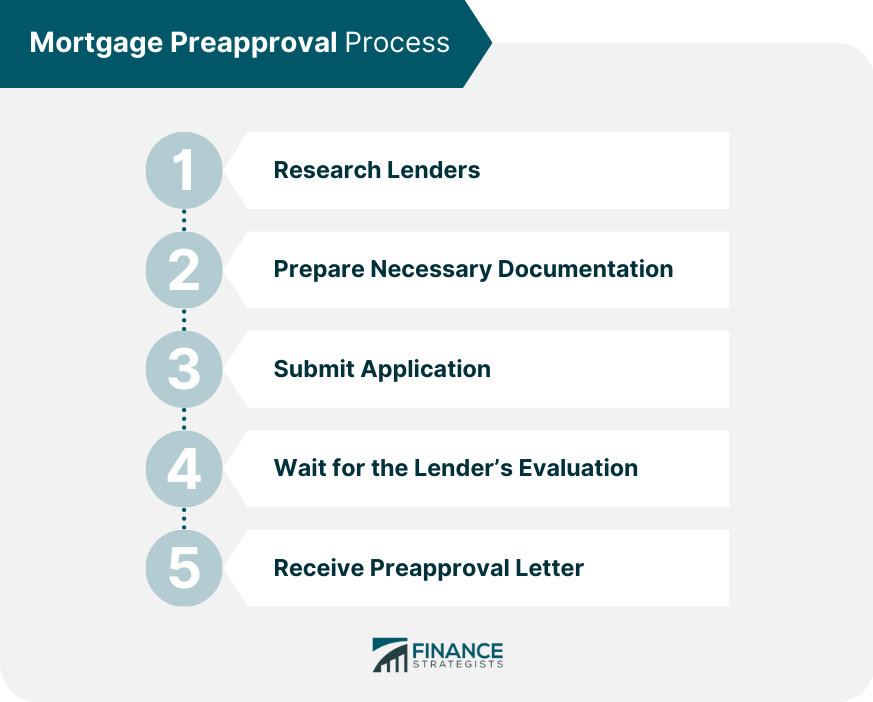

Mortgage Preapproval Process

Step-by-Step Guide

2. Prepare Necessary Documentation: Gather essential documents such as pay stubs, W-2 forms, tax returns, bank statements, and a list of assets and liabilities.

3. Submit Application: Fill out the mortgage preapproval application and submit it to your chosen lender along with the required documentation.

4. Wait for the Lender’s Evaluation: The lender will assess your credit history, income, employment, and overall financial situation.

5. Receive Preapproval Letter: If your application is successful, the lender will issue a preapproval letter outlining the maximum loan amount and estimated interest rate.

Factors Considered by Lenders During Preapproval

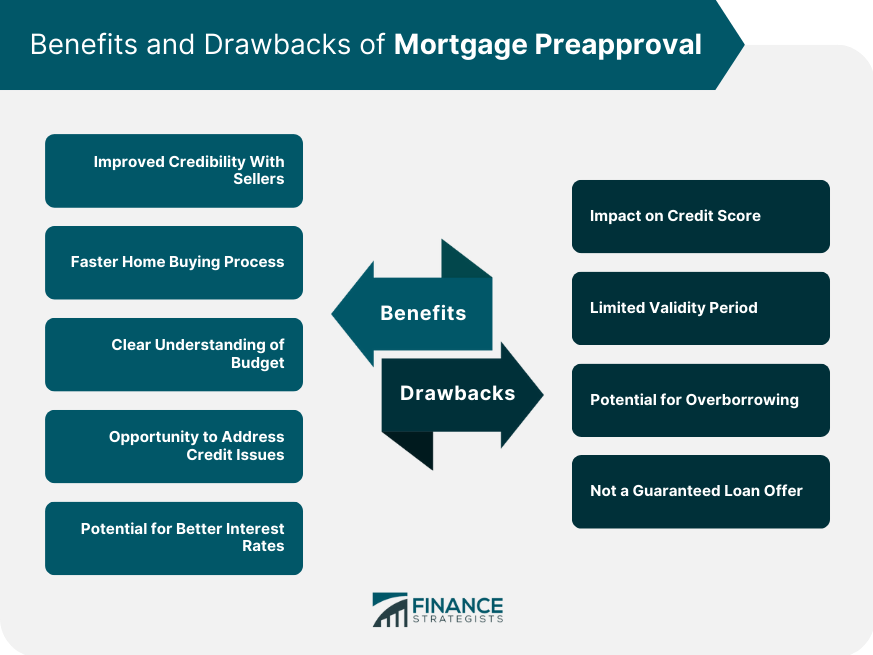

Benefits of Mortgage Preapproval

Improved Credibility With Sellers

Faster Home Buying Process

Clear Understanding of Budget

Opportunity to Address Credit Issues

Potential for Better Interest Rates

Potential Drawbacks of Mortgage Preapproval

Impact on Credit Score

Limited Validity Period

Potential for Overborrowing

Not a Guaranteed Loan Offer

Tips for Successful Mortgage Preapproval

Improve Credit Score

Manage Debt-To-Income Ratio

Maintain Stable Employment

Save for a Down Payment

Organize Documentation Efficiently

Compare Multiple Lenders

Mortgage Preapproval vs. Prequalification

Definitions and Differences

When to Consider Each Option

Pros and Cons of Each Option

Conclusion

Mortgage Preapproval FAQs

A mortgage preapproval is a process where a lender evaluates a borrower's financial information and credit history to determine how much money they can borrow and at what interest rate.

Prequalification is an initial step that gives you an estimate of how much you can afford to borrow. Preapproval involves a more thorough evaluation of your finances, and it gives you a more accurate idea of how much you can borrow and at what interest rate.

Getting pre-approved for a mortgage gives you an edge in a competitive housing market. It shows sellers that you're a serious buyer and can help you move quickly when you find the right property.

You'll need to provide information about your income, employment history, credit score, debt-to-income ratio, and other financial information. The lender may also ask for documentation, such as pay stubs, tax returns, and bank statements.

The length of a mortgage preapproval varies by lender, but it typically lasts between 60 and 90 days. After that time, you may need to go through the preapproval process again if you have yet to find a property.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.