Mortgage recasting is a financial strategy used by homeowners to reduce their monthly mortgage payments and the overall interest paid over the life of the loan. By making a lump sum payment towards the principal balance and having the lender recalculate the payment schedule, borrowers can enjoy lower monthly payments without changing the interest rate or loan term. 1. Making a Lump Sum Payment: The homeowner makes a sizable payment towards the principal balance of their mortgage. This payment is typically a one-time, large sum and can come from various sources such as savings, an inheritance, or a bonus from work. Mortgage recasting and refinancing are two different strategies for adjusting the terms of a home loan. Recasting lowers monthly payments by recalculating the loan based on a reduced principal balance. At the same time, refinancing involves taking out a new loan with different terms, such as a lower interest rate or a different loan length. Both options have their advantages and disadvantages, which should be carefully considered by the homeowner. Recasting a mortgage results in lower monthly payments, which can provide relief to homeowners who need to reduce their housing expenses. This can free up cash flow for other financial goals or expenses. By making a lump sum payment towards the principal balance, the overall interest paid over the life of the loan is reduced, potentially saving the homeowner thousands of dollars. With lower monthly payments, homeowners may choose to continue paying their original mortgage payment amount, thereby applying extra funds towards the principal balance and potentially paying off the loan faster. Mortgage recasting allows homeowners to make extra payments towards their loan principal whenever they have the financial means to do so, providing flexibility in managing their mortgage debt. Recasting a mortgage does not change the interest rate or loan length, allowing the homeowner to maintain their current loan terms while benefiting from lower monthly payments. To recast a mortgage, the homeowner must make a significant lump sum payment towards the principal balance. This may not be feasible for some homeowners who lack the necessary funds or who would prefer to allocate their resources elsewhere. Not all mortgage types are eligible for recasting. Some government-backed loans, such as FHA and VA loans, may not allow for recasting. Additionally, individual lenders may have their own restrictions and requirements. Some lenders may charge fees for recasting a mortgage, which can range from a few hundred to several thousand dollars. These fees should be factored into the overall cost of recasting. Mortgage recasting does not result in a lower interest rate, which means that borrowers with high-interest loans may not benefit as much from recasting as they would from refinancing to secure a lower rate. Recasting a mortgage does not affect the borrower's credit score, unlike refinancing, which can have a temporary negative impact due to the new loan application and credit inquiry. Conventional Mortgages: Most conventional mortgages, including those backed by Fannie Mae and Freddie Mac, are eligible for recasting. Government-Backed Mortgages: Some government-backed loans, such as FHA and VA loans, may not be eligible for recasting. Borrowers should contact their lender to confirm eligibility. Loan Must Be Current: Borrowers must be current on their mortgage payments to be eligible for recasting. Minimum Lump Sum Payment: Lenders may require a minimum lump sum payment to recast a mortgage, typically ranging from $5,000 to $10,000 or a specific percentage of the principal balance. Recasting Frequency Limitations: Lenders may also limit the number of times a mortgage can be recast during the life of the loan. Financial Stability: Homeowners should ensure they have a stable financial situation before considering mortgage recasting. Long-Term Goals: Borrowers should evaluate their long-term financial goals and determine if recasting aligns with those objectives. Emergency Savings: Homeowners should have a healthy emergency savings fund before allocating a large sum towards recasting their mortgage. Other High-Interest Debt: If the borrower has other high-interest debts, such as credit card balances, paying off those debts may be more beneficial before recasting the mortgage. Retirement and Investment Accounts: Borrowers should consider their retirement and investment goals and ensure that recasting their mortgage is sufficient for their progress in those areas. Confirm Recasting Eligibility: Homeowners should review their mortgage terms and conditions to confirm that their loan is eligible for recasting. Understand Fees and Costs Involved: Borrowers should be aware of any fees or costs associated with recasting their mortgage and factor them into their decision. Refinancing: Homeowners should weigh the pros and cons of refinancing versus recasting to determine which option is more beneficial for their specific situation. Extra Principal Payments Without Recasting: Making extra payments towards the principal balance without recasting the mortgage is another option for borrowers looking to reduce their overall interest payments and potentially pay off their loan sooner. Investing the Lump Sum Elsewhere: Homeowners should consider if investing the lump sum in other financial instruments, such as stocks or bonds, might yield a higher return than recasting their mortgage. Inquire About Recasting Options and Fees: Homeowners should contact their lender to discuss recasting options and any associated fees. Confirm Eligibility: The lender will review the borrower's mortgage and determine if they are eligible for recasting. Determine the Payment Amount: Homeowners should decide on the amount they wish to contribute towards the principal balance. Source of Funds: Borrowers should ensure they have the necessary funds available for the lump sum payment. After confirming eligibility and preparing the lump sum payment, the borrower submits the recasting request and payment to their lender. Once the lender has recalculated the loan, they will provide the borrower with a new payment schedule that reflects the lower monthly payments. Homeowners should adjust their budget accordingly to accommodate the new mortgage payment amount. In addition to mortgage recasting, homeowners have other options for managing their mortgage debt and improving their financial situation. Exploring these alternatives is essential to determine which strategy best aligns with the homeowner's goals and circumstances. Refinancing involves taking out a new loan with different terms, often to secure a lower interest rate or adjust the loan length. Refinancing can result in lower monthly payments, reduced interest paid over the loan's life, or a faster loan payoff, depending on the new loan terms. Homeowners can make extra payments towards the principal balance without recasting or refinancing their mortgage. This strategy can reduce the overall interest paid and shorten the loan term, as the additional payments directly reduce the principal balance, causing less interest to accrue over time. A loan modification involves negotiating with the lender to change the original mortgage terms, such as the interest rate, monthly payment, or loan length. This option may be suitable for homeowners experiencing financial hardship or those unable to qualify for refinancing. Switching to a biweekly mortgage payment plan involves making half of the monthly payment every two weeks, resulting in 26 half-payments or 13 full payments per year instead of the standard 12. This extra payment is applied directly to the principal balance, reducing the overall interest paid and potentially shortening the loan term. By considering the various alternatives to mortgage recasting, homeowners can make informed decisions that best meet their financial needs and goals. In conclusion, mortgage recasting is a viable financial strategy for homeowners looking to reduce their monthly mortgage payments and overall interest paid over the life of the loan. The process involves making a lump sum payment towards the principal balance of the mortgage and having the lender recalculate the payment schedule. Mortgage recasting offers several benefits, including lower monthly payments, reduced interest paid over the life of the loan, potential for faster loan payoff, flexibility to apply extra payments when desired, and no change to loan terms. However, there are also some limitations and drawbacks, such as the lump sum payment requirement, lender fees, and the fact that it does not reduce the interest rate. Homeowners should carefully consider their financial situation and long-term goals before deciding to recast their mortgage and explore other alternatives, such as refinancing, extra principal payments, loan modification, and biweekly mortgage payments, to determine which strategy best aligns with their needs and circumstances.What Is Mortgage Recasting?

How Mortgage Recasting Works

The Recasting Process

2. Contacting the Lender: The borrower contacts their mortgage lender to request a recast. The lender will then review the request and determine if the borrower is eligible for recasting.

3. Recalculating of the Loan: If approved, the lender will recalculate the loan based on the new principal balance, using the same interest rate and remaining loan term.

4. Providing of the New Payment Schedule: The lender provides the borrower with a new payment schedule reflecting the lower monthly payments.Mortgage Recasting vs Refinancing

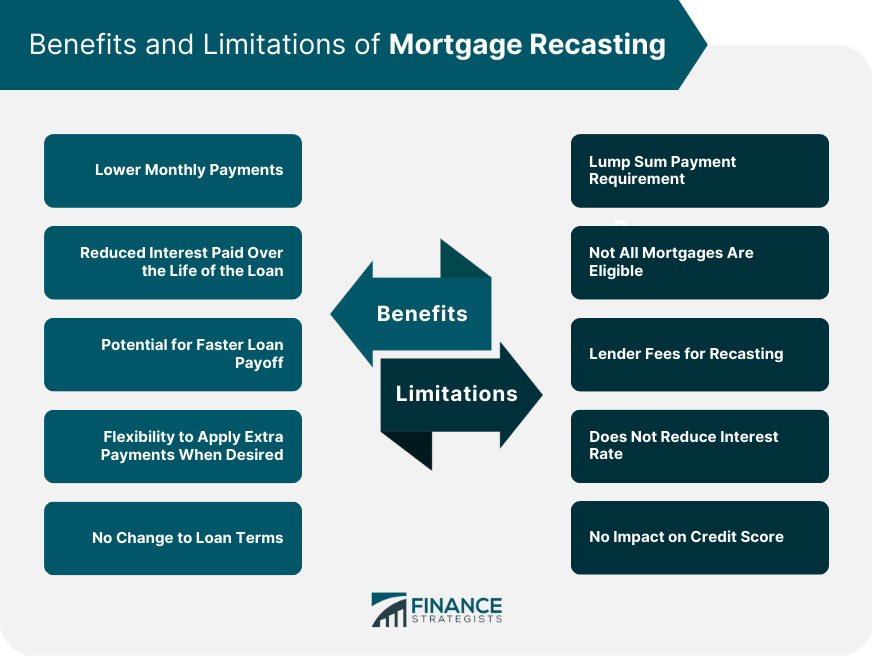

Benefits of Mortgage Recasting

Lower Monthly Payments

Reduced Interest Paid Over the Life of the Loan

Potential for Faster Loan Payoff

Flexibility to Apply Extra Payments When Desired

No Change to Loan Terms (Interest Rate, Loan Length)

Limitations and Drawbacks of Mortgage Recasting

Lump Sum Payment Requirement

Not All Mortgages Are Eligible

Lender Fees for Recasting

Does Not Reduce Interest Rate

No Impact on Credit Score

Eligibility for Mortgage Recasting

Mortgage Types That Can Be Recast

Lender Requirements and Restrictions

Borrower Considerations

Steps to Take Before Recasting a Mortgage

Analyze Personal Financial Situation

Review Mortgage Terms and Conditions

Compare Mortgage Recasting to Other Financial Strategies

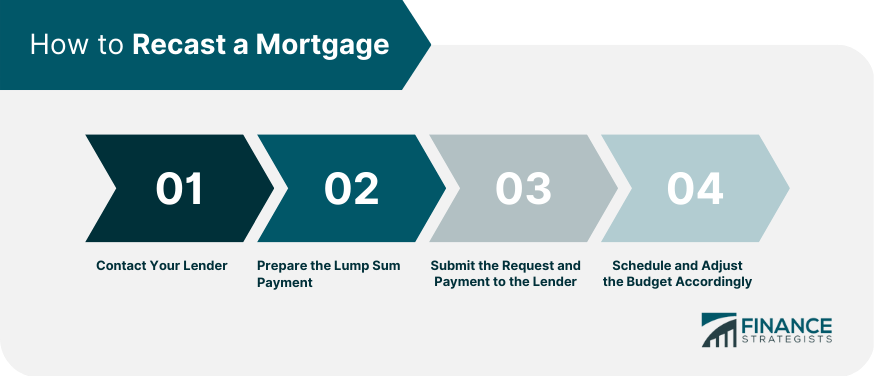

How to Recast a Mortgage

Contact Your Lender

Prepare the Lump Sum Payment

Submit the Request and Payment to the Lender

Schedule and Adjust the Budget Accordingly

Alternatives to Mortgage Recasting

Mortgage Refinancing

Extra Principal Payments

Loan Modification

Biweekly Mortgage Payments

Conclusion

Mortgage Recasting FAQs

Mortgage recasting is when a borrower pays a lump sum towards their mortgage, which is then applied to the principal balance, lowering their monthly payments for the remainder of the loan term.

Mortgage recasting does not involve taking out a new loan, unlike refinancing. Instead, it involves making a lump sum payment towards the principal balance of an existing loan.

Mortgage recasting can lower a borrower's monthly mortgage payments without the need to refinance, allowing them to pay off their mortgage faster or have more disposable income.

One drawback of mortgage recasting is that it typically requires a large lump sum payment, which may only be feasible for some. Additionally, there may be better options for those looking to lower their interest rate or change their loan terms.

To recast a mortgage, a borrower must contact their mortgage servicer and request a recast. The servicer will then determine if the borrower is eligible and provide instructions on how to proceed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.