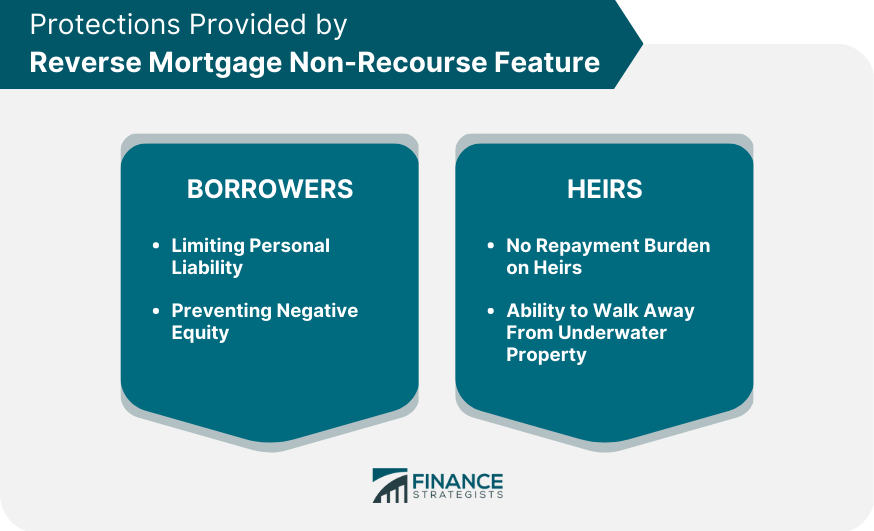

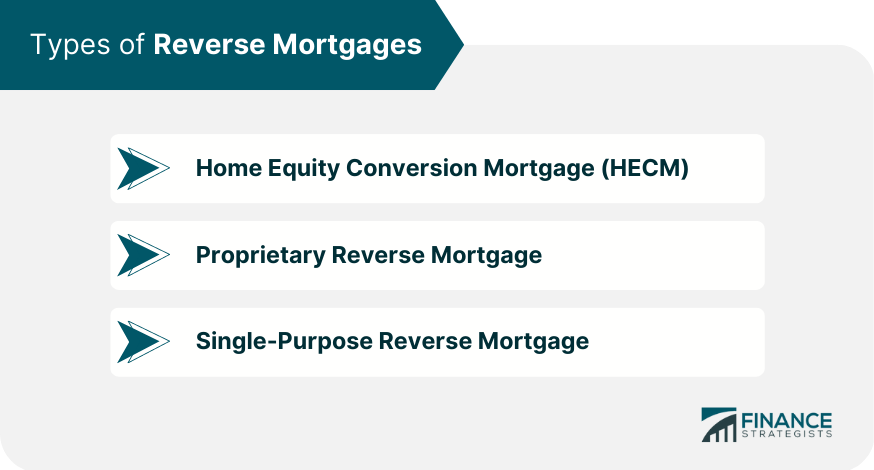

A reverse mortgage non-recourse feature is a provision that protects borrowers and their heirs from owing more than the value of the home when the loan becomes due. This feature is available in all federally-insured reverse mortgages, providing borrowers with a sense of security. The non-recourse feature is a legal provision that limits the borrower's and their heirs' liability for repaying the reverse mortgage loan. In essence, it ensures that the lender can only recover the loan amount from the sale of the home and cannot pursue the borrower's other assets or heirs for repayment. The non-recourse feature provides two main protections to borrowers: Limiting Personal Liability: Borrowers are not personally liable for the loan balance if it exceeds the home's value when the loan becomes due. Preventing Negative Equity: If the home's value declines during the loan term, the non-recourse feature ensures that borrowers do not owe more than the home is worth. The non-recourse feature also offers essential protections to the borrower's heirs: No Repayment Burden on Heirs: Heirs are not personally responsible for repaying the loan balance if it exceeds the home's value. Ability to Walk Away From Underwater Property: If the home is worth less than the loan balance, heirs can choose to let the lender take possession of the property without any financial repercussions. To be eligible for a reverse mortgage, the homeowner must meet the following requirements: Age: The borrower must be at least 62 years old. Homeownership: The borrower must own the home outright or have a low mortgage balance that can be paid off with the reverse mortgage proceeds. Primary Residence: The home must be the borrower's primary residence. There are three main types of reverse mortgages: Home Equity Conversion Mortgage (HECM): This is a federally insured reverse mortgage backed by the U.S. Department of Housing and Urban Development (HUD). Proprietary Reverse Mortgage: This is a private loan offered by financial institutions and not insured by the federal government. Single-Purpose Reverse Mortgage: This type of reverse mortgage is offered by state and local government agencies and non-profit organizations for a specific purpose, such as home repairs or property taxes. Reverse mortgage borrowers can choose from several payment options: Lump Sum: The borrower receives a single, large payment. Tenure Payments: The borrower receives equal monthly payments for as long as they live in the home. Term Payments: The borrower receives equal monthly payments for a specified period. Line of Credit: The borrower can access funds up to a predetermined limit as needed. A reverse mortgage loan becomes due and payable under the following circumstances: Death of the Borrower: The loan becomes due when the borrower dies. Home No Longer Primary Residence: The loan becomes due if the borrower moves out of the home for more than 12 consecutive months. Sale of the Home: The loan becomes due if the borrower sells the home. Heirs have several options for repaying the reverse mortgage loan: Selling the Home: Heirs can sell the home and use the proceeds to repay the loan balance. Refinancing the Mortgage: Heirs can refinance the reverse mortgage into a traditional mortgage to pay off the loan balance and keep the home. Paying the Loan Balance: Heirs can pay off the loan balance with personal funds or other financial resources, allowing them to retain the property. If the home's value is less than the reverse mortgage loan balance when the loan becomes due, the non-recourse feature provides the following protections: Borrower's Estate Not Responsible for Shortfall: The borrower's estate is optional to cover the difference between the loan balance and the home's value. Lender's Recourse Limited to the Home's Value: The lender can only recover the loan amount up to the home's value and cannot pursue the borrower's other assets or heirs for repayment. There are two main differences between non-recourse and recourse loans: Personal Liability: Borrowers and heirs are not personally liable for the loan balance in non-recourse loans, but may be liable in recourse loans. Lender's Ability to Pursue Borrower's Assets: In non-recourse loans, the lender can only recover the loan amount from the sale of the home, while in recourse loans, the lender may be able to pursue the borrower's other assets for repayment. While non-recourse loans provide important protections for borrowers and their heirs, they also have potential drawbacks: Benefits to Borrower and Heirs: Non-recourse loans limit personal liability and protect against negative equity, offering financial security to borrowers and their heirs. Potential for Higher Interest Rates or Fees: Lenders may charge higher interest rates or fees for non-recourse loans to compensate for the additional risk associated with limited recovery options. Reverse mortgages are subject to federal regulations, including oversight from the following agencies: U.S. Department of Housing and Urban Development: HUD insures HECM loans and sets the rules and requirements for HECM lenders. Consumer Financial Protection Bureau (CFPB): The CFPB enforces consumer protection laws and provides information to help borrowers make informed decisions about reverse mortgages. State laws and regulations can also impact reverse mortgage requirements and protections, including those related to the non-recourse feature. Borrowers should research their state's regulations to understand how they may affect their reverse mortgage. HUD requires borrowers to undergo reverse mortgage counseling from a HUD-approved counselor before obtaining a HECM loan. The counseling session helps borrowers understand the non-recourse feature and other aspects of reverse mortgages, ensuring they make informed decisions. A reverse mortgage non-recourse feature is a legal provision that limits the borrower's and their heirs' liability for repaying the reverse mortgage loan. This feature ensures that the lender can only recover the loan amount from the sale of the home and cannot pursue the borrower's other assets or heirs for repayment. It provides two main protections to borrowers, limiting personal liability and preventing negative equity. For heirs, the non-recourse feature offers essential protections such as no repayment burden and the ability to walk away from an underwater property. There are three main types of reverse mortgages: Home Equity Conversion Mortgage (HECM), Proprietary Reverse Mortgage, and Single-Purpose Reverse Mortgage. Borrowers can choose from several payment options, including a lump sum, tenure payments, term payments, and a line of credit. Repayment triggers for a reverse mortgage loan include death of the borrower, the home no longer being the primary residence, and the sale of the home. Heirs have several options for repaying the loan, including selling the home, refinancing the mortgage, and paying the loan balance. The non-recourse feature also provides protections such as borrower's estate not responsible for shortfall and lender's recourse limited to the home's value. While non-recourse loans provide important protections, they also have potential drawbacks such as the potential for higher interest rates or fees. Federal regulations for reverse mortgages include oversight from the U.S. Department of Housing and Urban Development (HUD) and the Consumer Financial Protection Bureau (CFPB). State laws and regulations can also impact reverse mortgage requirements and protections, including those related to the non-recourse feature. HUD requires borrowers to undergo reverse mortgage counseling from a HUD-approved counselor before obtaining a HECM loan, ensuring they make informed decisions about the non-recourse feature and other aspects of reverse mortgages.What Is a Reverse Mortgage Non-Recourse Feature?

Reverse Mortgage Non-Recourse Feature Explained

Definition and Benefits

How It Protects Borrowers

How It Protects Heirs

Reverse Mortgage Basics

Eligibility Requirements

Types of Reverse Mortgages

Payment Options

Loan Repayment and Non-Recourse

Repayment Triggers

Repayment Options for Heirs

Loan Forgiveness Under Non-Recourse

Non-Recourse vs. Recourse Loans

Key Differences

Pros and Cons of Non-Recourse Loans

Legal and Regulatory Framework

Federal Regulations for Reverse Mortgages

State Laws and Regulations

Role of Counseling in Understanding Non-Recourse Features

Conclusion

Reverse Mortgage Non-Recourse Feature FAQs

A reverse mortgage non-recourse feature is a provision that protects borrowers and their heirs from owing more than the value of the home when the loan becomes due.

The reverse mortgage non-recourse feature ensures that the borrower and their heirs will not be held personally responsible for any deficiency if the loan balance exceeds the value of the home when the loan is due.

The reverse mortgage non-recourse feature provides borrowers with a sense of security, knowing that they will not owe more than the value of their home, even if the loan balance exceeds that value.

Yes, all federally-insured reverse mortgages, also known as Home Equity Conversion Mortgages (HECMs), have a non-recourse feature that protects borrowers and their heirs.

Yes, a borrower can still lose their home with a reverse mortgage non-recourse feature if they fail to comply with loan terms, such as paying property taxes and insurance or maintaining the home's condition.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.