Private money lending is the practice of providing loans to individuals or businesses by private entities or individuals rather than traditional financial institutions like banks or credit unions. These lenders typically offer short-term financing options for various purposes, such as real estate investments, business capital, or personal needs. Private money lending plays a crucial role in the financial market by providing alternative financing options for borrowers who may not meet the stringent requirements of traditional lenders. This type of lending caters to unique needs and circumstances, making it an essential component of a diverse and robust financial ecosystem. Below are the different types of private money lenders. Individuals can act as private money lenders, offering loans to friends, family members, or business associates. This form of lending often involves less formal agreements and may be based on personal relationships and trust. Private money lending companies are specialized firms that provide loans to borrowers. These companies typically have more resources and established processes for underwriting, managing, and servicing loans compared to individual lenders. Hard money lenders are a subset of private money lenders primarily focusing on real estate-backed loans. They usually offer short-term financing options based on the property's value rather than the borrower's creditworthiness. Real estate investors often turn to private money lenders for financing their projects. These lenders provide the necessary funds for property acquisitions, renovations, and other real estate-related activities. After examining the advantages and disadvantages of private money lending, borrowers may wonder how to effectively navigate the private money lending process to secure the best possible financing terms. Borrowers may consider the following: To find reputable private money lenders, borrowers should conduct thorough research, seek recommendations from trusted sources, and consult industry professionals. Online platforms and forums can also be useful resources for identifying reliable lenders. Before entering a private money lending agreement, borrowers must carefully review the terms and conditions. This includes understanding the interest rates, fees, repayment schedule, and any potential penalties for early repayment or default. Borrowers may have the opportunity to negotiate certain aspects of the loan agreement, such as the interest rate, loan term, or fees. Effective negotiation can result in more favorable terms for the borrower. It is essential for borrowers to perform due diligence before entering into a private money lending agreement. This includes verifying the lender's reputation, reviewing the loan terms, and consulting with legal and financial professionals to ensure compliance with applicable regulations. Private money lending can be a profitable investment strategy that offers various benefits to investors. However, investors must evaluate private lending opportunities, manage risks, and build a diversified portfolio to ensure long-term success. Investing in private money lending can offer several benefits, including higher returns, diversification, and the potential for passive income. By providing loans to borrowers, investors can generate a steady stream of interest payments while mitigating risk through collateral, such as real estate. When evaluating private money lending investment opportunities, investors should consider factors such as the borrower's creditworthiness, the collateral's value, and the loan terms. A thorough analysis of these factors can help investors make informed decisions and minimize risk. To manage risk in private money lending investments, investors should diversify their portfolios, conduct thorough due diligence on potential borrowers, and establish a solid loan servicing and monitoring process. In addition, investors may consider working with experienced professionals to ensure proper risk management practices are in place. A diversified private money lending portfolio can help investors mitigate risk and achieve more stable returns. This can be achieved by lending to multiple borrowers across different sectors, geographic locations, and loan terms. Private money lending is subject to various federal and state laws, and compliance with these laws is crucial for lenders and borrowers to avoid legal issues. Private money lending is subject to various federal and state laws, including the Truth in Lending Act, the Real Estate Settlement Procedures Act, and state-specific usury laws. Compliance with these laws is critical for both lenders and borrowers to avoid legal issues. Depending on the jurisdiction, private money lenders may be required to obtain a license or register with state or federal agencies. It is important for lenders to understand and adhere to these requirements to operate legally. Private money lenders may be subject to reporting and disclosure requirements, which can include providing borrowers with specific loan-related information and submitting periodic reports to regulatory agencies. Compliance with these requirements is essential for maintaining good standing with regulators. In the event of disputes related to private money lending transactions, borrowers and lenders may seek legal recourse through negotiation, mediation, arbitration, or litigation. It is essential for both parties to be familiar with their rights and obligations under the loan agreement and applicable laws to effectively resolve any disputes that may arise. Private money lending offers some advantages. These include: One of the main benefits of private money lending is its speed and flexibility. Since private lenders are not bound by the same regulations as traditional financial institutions, they can often make faster decisions and offer more customized loan terms. Private money lending can be suitable for borrowers with unique circumstances, such as low credit scores, unconventional income sources, or recent financial difficulties. These lenders may be more willing to consider a borrower's overall financial situation rather than relying solely on traditional credit metrics. Private money lending can serve as an alternative financing option for those who do not qualify for traditional loans. This allows borrowers to access the funds they need without going through a lengthy and often frustrating process with conventional lenders. Real estate investors frequently rely on private money lending to finance their projects, as these loans offer quick access to funds and more flexibility in terms of loan terms and repayment schedules. While private money lending can offer advantages, it also comes with some potential disadvantages and risks that borrowers should be aware of before pursuing this type of financing. Private money lenders typically charge higher interest rates compared to traditional financial institutions. This is due to the increased risk associated with lending to borrowers who may not meet conventional credit requirements. Private money loans often have shorter loan terms, ranging from a few months to a few years. This may result in higher monthly payments and increased pressure on the borrower to repay the loan quickly. Some private money lenders may engage in predatory practices, such as charging excessive fees or using aggressive collection tactics. Borrowers should exercise caution and thoroughly research potential lenders before entering into any loan agreement. Private money lending is subject to federal and state regulations. Noncompliance with these regulations can result in legal consequences for lenders and borrowers. It is essential for all parties involved to be aware of the applicable laws and regulations governing their transactions. The private money lending industry is constantly evolving, and several trends are shaping its future, including the following: Advancements in technology, such as online platforms, mobile applications, and artificial intelligence, are transforming the private money lending industry. These innovations enable more efficient loan processing, underwriting, and servicing, making it easier for borrowers and lenders to connect and transact. Crowdfunding platforms has emerged as a popular method for raising capital, and private money lending has become an integral part of this trend. These platforms allow individual investors to pool their resources and lend money to borrowers, democratizing access to financing and investment opportunities. Economic conditions like interest rates, inflation, and market volatility can significantly impact the private money lending industry. Lenders and borrowers must closely monitor these factors to make informed decisions and adjust their strategies accordingly. As the private money lending industry continues to evolve, regulatory changes may be introduced to address emerging concerns and risks. Lenders and borrowers should stay informed about potential changes in the regulatory landscape and be prepared to adapt their practices as needed. Private money lending is vital to the financial market, offering alternative financing options to borrowers who may not qualify for traditional loans. This type of lending is particularly popular among real estate investors who require quick access to funds for their projects. Key advantages of private money lending include speed, flexibility, and accessibility, while potential risks involve higher interest rates, shorter loan terms, and predatory practices. When considering private money lending, it is crucial for borrowers to perform due diligence, understand loan terms, and negotiate agreements to secure the most favorable conditions. In addition, staying informed about the regulatory landscape and potential future trends in the industry can help borrowers and lenders navigate this dynamic market effectively. To ensure you make informed decisions and find the best financing options for your needs, consider seeking the services of a professional mortgage broker. Mortgage brokers can provide expert guidance, connect you with reputable private money lenders, and help you navigate the complexities of the lending process. What Is Private Money Lending?

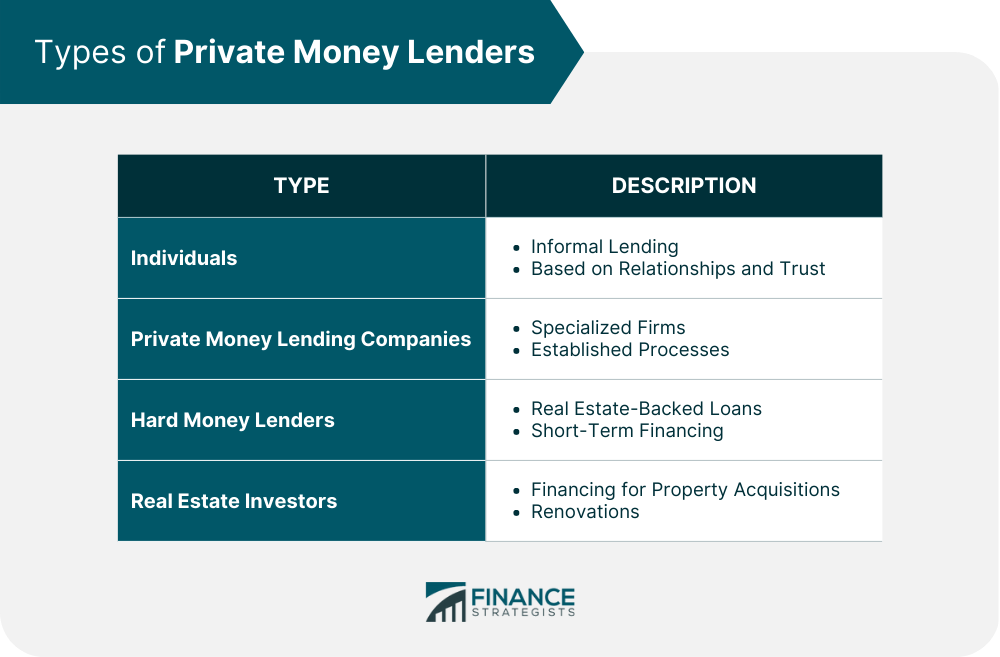

Types of Private Money Lenders

Individuals as Private Money Lenders

Private Money Lending Companies

Hard Money Lenders in Private Money Lending

Real Estate Investors and Private Money Lending

Navigating the Private Money Lending Process

Finding Reputable Private Money Lenders

Understanding Private Money Lending Terms and Conditions

Negotiating Private Money Lending Agreements

Private Money Lending Due Diligence for Borrowers

Private Money Lending as an Investment Strategy

Benefits of Investing in Private Money Lending

Evaluating Private Money Lending Opportunities

Managing Risk in Private Money Lending Investments

Building a Diversified Private Money Lending Portfolio

Regulation and Compliance in Private Money Lending

Federal and State Laws Governing Private Money Lending

Licensing and Registration for Private Money Lenders

Reporting and Disclosure Requirements in Private Money Lending

Legal Recourse for Private Money Lending Disputes

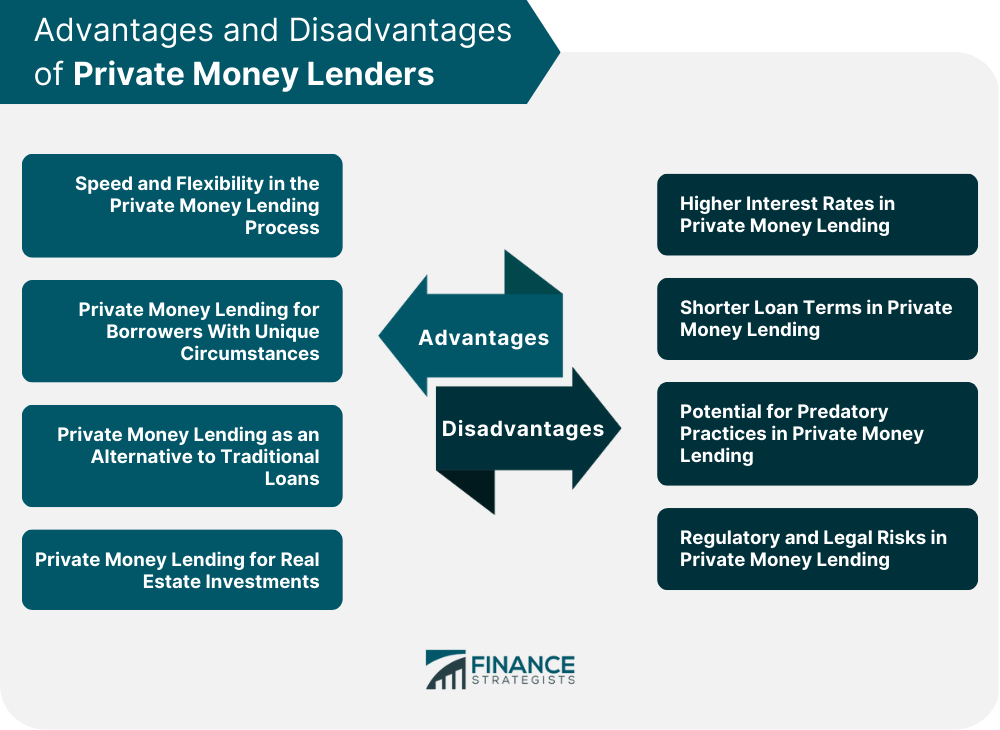

Advantages of Private Money Lending

Speed and Flexibility in the Private Money Lending Process

Private Money Lending for Borrowers With Unique Circumstances

Private Money Lending as an Alternative to Traditional Loans

Private Money Lending for Real Estate Investments

Disadvantages and Risks of Private Money Lending

Higher Interest Rates in Private Money Lending

Shorter Loan Terms in Private Money Lending

Potential for Predatory Practices in Private Money Lending

Regulatory and Legal Risks in Private Money Lending

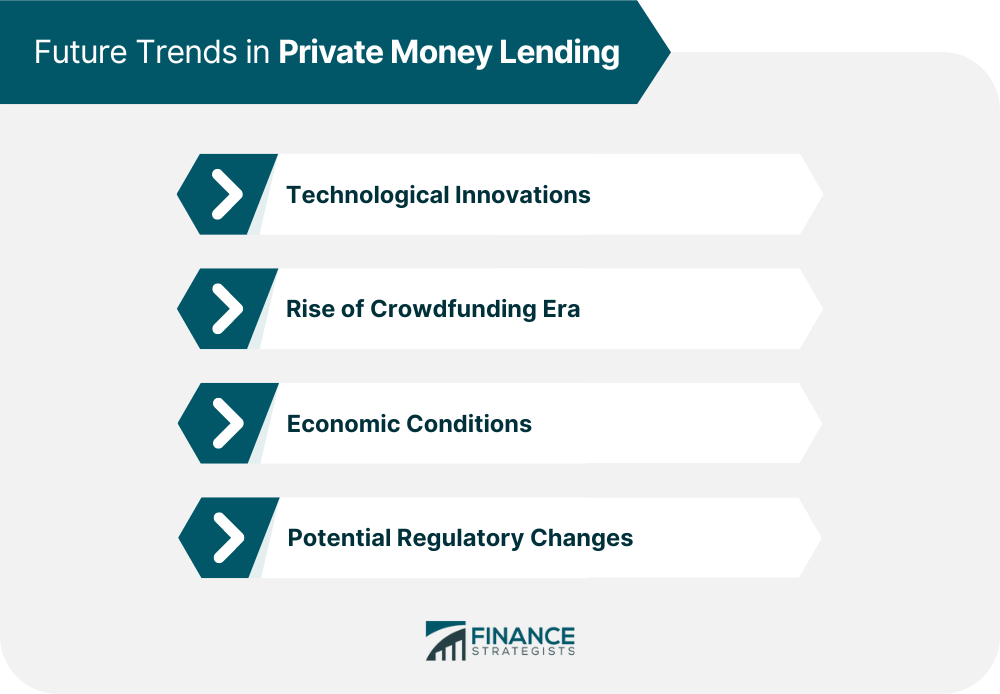

Future Trends in Private Money Lending

Technological Innovations

Rise of Crowdfunding Era

Economic Conditions

Potential Regulatory Changes

Final Thoughts

Private Money Lending FAQs

Private money lending is the practice of providing loans to individuals or businesses by private entities or individuals rather than traditional financial institutions like banks or credit unions. These loans typically offer short-term financing options and can be more accessible to borrowers with unique circumstances or who do not qualify for traditional loans.

Private money lending differs from traditional lending in several ways, including the source of funds, approval speed, loan terms flexibility, and borrower qualifications. Private money lenders are not subject to the same regulations as traditional financial institutions, which allows them to offer more customized loan terms and make faster decisions. They may also be more willing to lend to borrowers with unconventional income sources or low credit scores.

Some advantages of private money lending for borrowers include faster approval times, more flexible loan terms, and the ability to obtain financing even with unique circumstances or lower credit scores. This type of lending can be particularly useful for real estate investors who require quick access to funds for property acquisitions or renovations.

Some risks and disadvantages of private money lending include higher interest rates, shorter loan terms, the potential for predatory practices, and regulatory risks. Borrowers should carefully evaluate the terms and conditions of any private money loan and thoroughly research potential lenders before entering into an agreement.

To find reputable private money lenders, borrowers should conduct thorough research, seek recommendations from trusted sources, and consult industry professionals. Online platforms, forums, and local real estate investment groups can also be useful resources for identifying reliable lenders. It is essential to perform due diligence and verify the lender's reputation, licensing, and compliance with applicable regulations before entering into any loan agreement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.