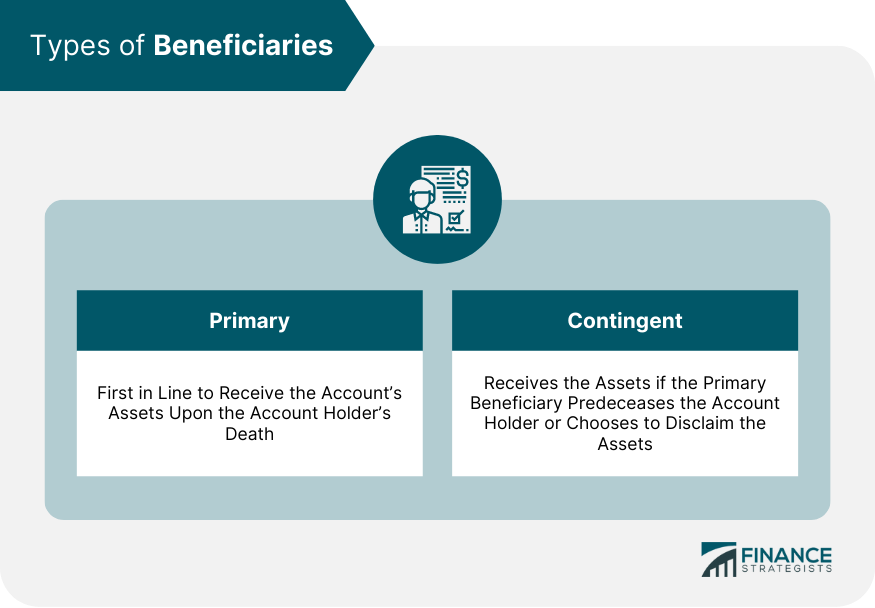

401(k) beneficiary rules refer to the regulations governing the distribution of a 401(k) account holder's assets upon their death. When establishing a 401(k) account, holders designate primary and contingent beneficiaries to receive their accumulated assets. If the holder is married, the spouse is typically the automatic beneficiary unless they provide written consent for another person to be named. Beneficiaries can be individuals, trusts, charities, or estates. Distribution to non-spouse beneficiaries is subject to specific tax implications, which were notably impacted by the SECURE Act of 2019. The act requires most non-spouse beneficiaries to distribute the inherited assets within ten years. Understanding these rules is essential for financial planning and ensuring the holder's assets are allocated according to their wishes. When setting up a 401(k) plan, account holders are typically required to name a beneficiary. This person will receive the assets in the account after the holder's death. If the account holder is married, their spouse is usually the automatic beneficiary under federal law unless the spouse provides written consent for another person to be named the beneficiary. Life events such as marriage, divorce, the birth of a child, or death can lead to changes in beneficiary designations. It's essential to review and update these designations regularly to ensure they align with the account holder's current wishes and circumstances. If the spouse is the named beneficiary, they generally have several options. They can roll over the assets into their own IRA or 401(k), take distributions over time, or even disclaim the inheritance. Non-spouse beneficiaries also have a few options. They can take a lump-sum distribution, which may result in a hefty tax bill, or they may choose to transfer the assets to an inherited IRA and take the required minimum distributions over their life expectancy. If no beneficiary is named, the assets typically go to the account holder's estate, which can lead to complications, additional taxes, and potentially probate. There are two main types of beneficiaries: primary and contingent. The primary beneficiary is the first in line to receive the account's assets upon the account holder's death. If the primary beneficiary predeceases the account holder or chooses to disclaim the assets, these then pass on to the contingent beneficiary. Understanding 401(k) beneficiary rules provide account holders with clarity about how their retirement assets will be distributed after their death. This knowledge can help prevent disputes among family members and ensure the account holder's wishes are respected. Spouses who inherit 401(k) accounts can roll over the assets into their own retirement account. This allows the assets to continue growing tax-deferred, potentially resulting in a more significant inheritance. 401(k) beneficiary rules provides flexibility. Account holders can designate anyone as a beneficiary, allowing them to distribute their assets according to their personal wishes and family circumstances. Beneficiaries must start taking required minimum distributions (RMDs) from the inherited account by a certain date. The size and timing of these distributions can be complex to calculate, particularly for non-spouse beneficiaries. Non-spouse beneficiaries are subject to specific tax rules that can lead to significant tax liabilities. Understanding these rules and planning accordingly is essential to avoid a potential tax burden. If an account holder's wishes aren't clearly defined, it can lead to disputes among heirs. For example, if the primary beneficiary predeceases the account holder and there are no contingent beneficiaries named, the account holder's children might argue over who should receive the assets. Non-spouse beneficiaries don't have the same level of flexibility as spouse beneficiaries. For example, they can't roll the assets into their own 401(k) or IRA and may be subject to different RMD rules. The SECURE Act did not significantly change the rules for spouse beneficiaries. Spouses can still roll over inherited 401(k) assets into their own retirement accounts or an inherited IRA. For non-spouse beneficiaries, the SECURE Act introduced a notable change. Most non-spouse beneficiaries are now required to fully distribute the inherited account within ten years of the account holder's death, rather than over their own life expectancy. The SECURE Act also impacted trusts named as beneficiaries of 401(k) accounts. Depending on the type of trust, the new ten-year payout rule may apply, potentially resulting in significant tax implications. To ensure the correct individuals inherit the 401(k) assets, account holders should regularly review and update their beneficiary designations, especially after significant life events. Financial and legal advisors can help account holders navigate the complexities of 401(k) beneficiary rules. They can provide guidance on tax implications, the impact of life events on beneficiary designations, and the effects of legislative changes like the SECURE Act. Account holders should communicate their wishes to their designated beneficiaries. This communication can prevent surprises and potential disputes after the account holder's death. Understanding the tax implications of inheriting a 401(k) is crucial for beneficiaries. They should be aware of potential tax liabilities and strategies to minimize them. 401(k) beneficiary rules are vital guidelines dictating the allocation of a 401(k) account holder's assets upon their death. With spouses usually being the automatic beneficiary and non-spouses subject to specific distribution rules, understanding these provisions is crucial for financial planning. The SECURE Act of 2019 significantly affected non-spouse and trust beneficiaries, making awareness of its implications vital. Regular review and updates of beneficiary designations, consultation with financial and legal advisors, and communication with beneficiaries can ensure a smooth transition of assets. The rules offer flexibility in designating beneficiaries, opportunities for tax-deferred growth, and clarity in asset allocation. However, they come with complexities like required minimum distributions, the potential for disputes, and limited options for non-spouse beneficiaries. Thus, mastering these rules can help navigate potential challenges and maximize the benefits of 401(k) plans.What Are 401(k) Beneficiary Rules?

How 401(k) Beneficiary Rules Work

Situations for Changes in Beneficiary Designations

Distribution Rules for Spouse Beneficiaries

Distribution Rules for Non-spouse Beneficiaries

Beneficiary Designation Without a Named Beneficiary

Types of Beneficiaries

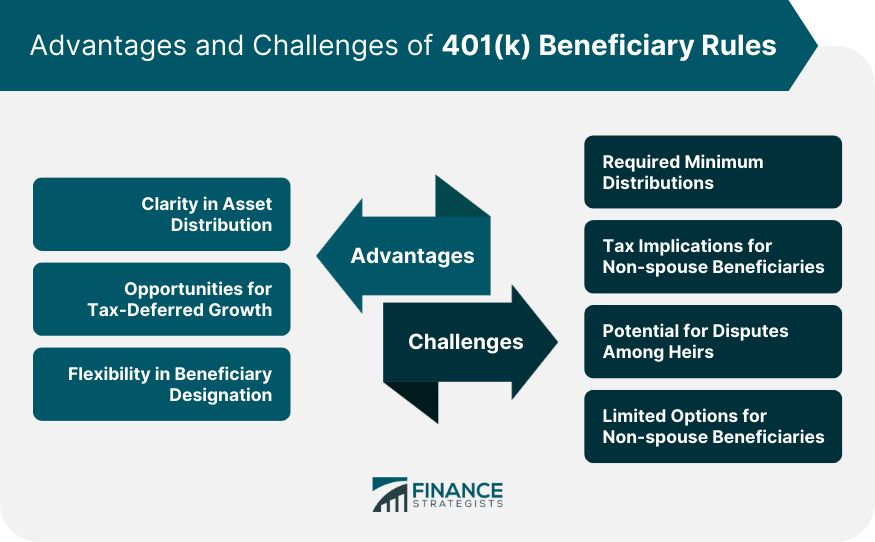

Advantages of 401(k) Beneficiary Rules

Clarity in the Designation of Retirement Assets

Opportunities for Tax-Deferred Growth

Flexibility in Beneficiary Designation

Challenges With 401(k) Beneficiary Rules

Complexities of Required Minimum Distributions

Tax Implications for Non-spouse Beneficiaries

Potential for Disputes Among Heirs

Limited Options for Non-spouse Beneficiaries

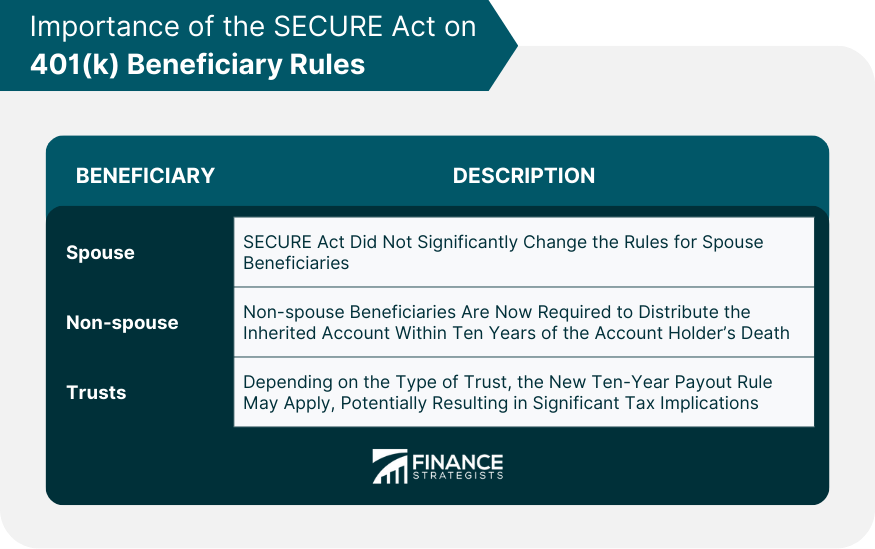

Importance of the SECURE Act on 401(k) Beneficiary Rules

Impact on Spouse Beneficiaries

Changes for Non-spouse Beneficiaries

Influence on Trust as a 401(k) Beneficiary

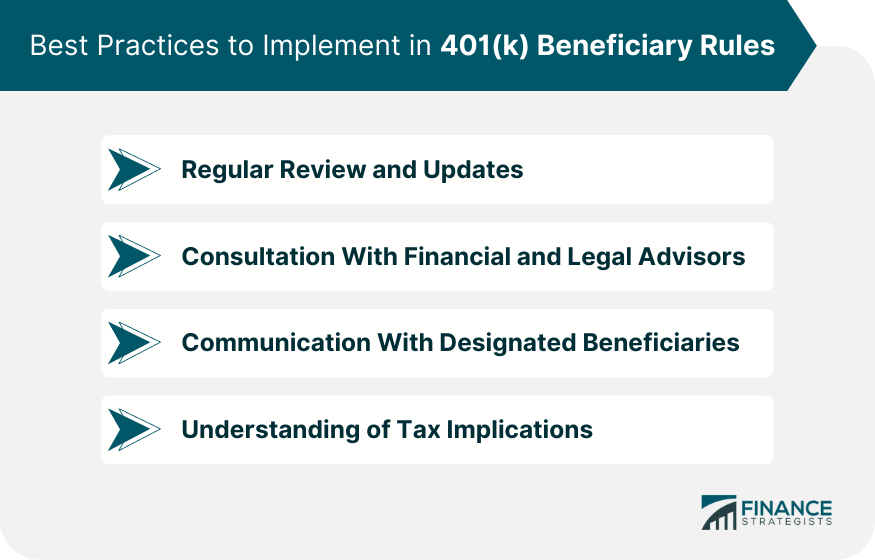

Best Practices to Implement in 401(k) Beneficiary Rules

Regular Review and Updates of Beneficiary Designations

Seek Assistance From Financial and Legal Advisors

Communication With Designated Beneficiaries

Comprehension of Tax Implications

Conclusion

401(k) Beneficiary Rules FAQs

401(k) beneficiary rules dictate who inherits your 401(k) assets upon your death. Generally, if you're married, your spouse is the default beneficiary. If you wish to name someone else, your spouse must provide written consent. You can also name a non-spouse beneficiary, like a child, friend, or trust. Upon your death, beneficiaries must take the required minimum distributions based on specific IRS rules, and these distributions are subject to tax.

You can change your beneficiaries at any time by submitting a new beneficiary designation form to your 401(k) plan administrator. It's recommended to review your beneficiary designations regularly and particularly after significant life events like marriage, divorce, or the birth of a child.

Non-spouse beneficiaries, such as children or friends, have different rules for distributions. The SECURE Act of 2019 requires most non-spouse beneficiaries to withdraw all funds from the inherited 401(k) within ten years. This rule can have significant tax implications, as the distributions are considered taxable income.

Yes, a trust can be named as a beneficiary of a 401(k). However, the SECURE Act has changed the distribution rules for trusts, which can have complex tax implications. Consultation with a financial or legal advisor is recommended when considering a trust as a beneficiary.

If no beneficiary is named, the 401(k) assets typically default to your estate. This can lead to complications, as the funds may need to go through probate, and the distribution could be subject to both estate and income taxes. It's advisable to always name a beneficiary to avoid these issues.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.