A 401(k) blackout period is a temporary interval where participants in a retirement plan are barred from making certain changes to their accounts. This can include altering investment distributions, initiating loans, or making withdrawals. The blackout period, typically lasting from a few days to a few weeks, is necessary for plan administrators to carry out significant tasks, such as switching service providers, implementing plan enhancements, or transitioning to a new recordkeeping system. They provide the necessary time for plan administrators to conduct essential administrative tasks that would otherwise be challenging or impossible to execute while maintaining normal plan operations. Blackout periods have a certain operational logic tied to specific requirements set out by the Department of Labor. Understanding these mechanics can help participants navigate this period with less anxiety and greater confidence. Blackout periods are typically initiated when a plan undergoes changes that require interruption of regular operations. Examples include changing service providers or migrating to a new recordkeeping platform. The duration of a blackout period varies depending on the complexity of the administrative task but typically lasts between a few days to a few weeks. The timing of the blackout is designed to cause as little disruption as possible, with advance notice given to all plan participants. Before a blackout period, plan administrators must provide at least 30 days' advance notice to participants. This notice helps participants prepare for the blackout and gives them time to make necessary changes to their accounts before their account access is temporarily restricted. Blackout periods are typically tied to significant changes in the operation or administration of a 401(k) plan. These factors may include: When a plan undergoes a major overhaul, a blackout period is often necessary. During this time, the administrator adjusts the fund line-up or restructures the plan design. When there's a change in service providers, such as moving to a new recordkeeper or custodian, a blackout period allows for the secure and accurate transition of data and assets. Administrative changes, such as updating recordkeeping systems or migrating to a new platform, often require a blackout period. During this time, administrators can ensure data accuracy and system functionality before reopening the plan to participant transactions. 401(k) blackout periods are not unregulated periods of administrative discretion. Instead, they are governed by specific legal guidelines designed to protect plan participants. The Employee Retirement Income Security Act (ERISA) contains provisions that directly address blackout periods. These include requirements for advance notice and rules for fiduciary conduct during the blackout. The Department of Labor has issued guidelines outlining what information must be included in blackout notices, such as the reasons for the blackout, its expected duration, and the rights of plan participants. Plan fiduciaries have a continued duty to act in the best interest of participants during a blackout period. This duty includes ensuring the blackout is as short as possible and that all actions taken are for the benefit of the participants. Despite the temporary inconvenience they may cause, blackout periods have several advantages: A blackout period allows plan administrators to transition smoothly to a new service provider or platform, reducing the risk of errors that could occur if such a transition was attempted while maintaining regular plan operations. By temporarily suspending account activity, administrators can devote their full attention to administrative tasks. This focus can lead to enhanced efficiency and accuracy. Blackout periods often accompany plan improvements. The temporary suspension of account activity allows for the successful introduction of new investment options or system features. However, blackout periods also have some drawbacks: During a blackout period, participants are temporarily unable to access their accounts to make loans, withdrawals, or changes to their investment allocations. This restriction can be inconvenient, especially in case of an unexpected financial need. Blackout periods prevent participants from making investment changes, which means they can't respond to market conditions during this time. This inability could be a disadvantage in a volatile market. Explaining blackout periods to participants can be challenging. Participants may not understand the purpose of the blackout or why they can't access their accounts. This lack of understanding can lead to frustration and dissatisfaction. With preparation and communication, plan sponsors and participants can manage blackout periods effectively. Before a blackout period, participants should carefully review their accounts and consider any necessary changes. For example, they might want to adjust their investment allocation or take a loan before their account access is temporarily restricted. Participants should also consider how the inability to change investments during the blackout period might affect their risk exposure. They may want to consult with a financial advisor to ensure they are comfortable with their risk level, given the inability to make changes during the blackout. During the blackout, participants should stay informed by reading any communications from the plan sponsor or administrator and reaching out with any questions. They should also review their accounts as soon as the blackout is lifted to confirm that everything is in order. A 401(k) blackout period, a necessary but temporary restriction, plays a vital role in maintaining the operational integrity of a 401(k) plan. Occurring during substantial plan transitions, it allows administrators to execute vital tasks with enhanced precision. Despite potential inconveniences such as temporary asset inaccessibility and exposure to market volatility, blackout periods often lead to plan enhancements and improved administrative efficiency. Regulated by ERISA and guided by the Department of Labor, these periods uphold participants' interests. Both sponsors and participants can effectively manage the process through adequate preparation, informed risk mitigation, and proactive communication. Understanding its purpose, mechanics, legal implications, advantages, and challenges empowers participants to navigate this period confidently. It ensures a seamless transition towards an upgraded 401(k) plan, ultimately benefiting the participant.What Is a 401(k) Blackout Period?

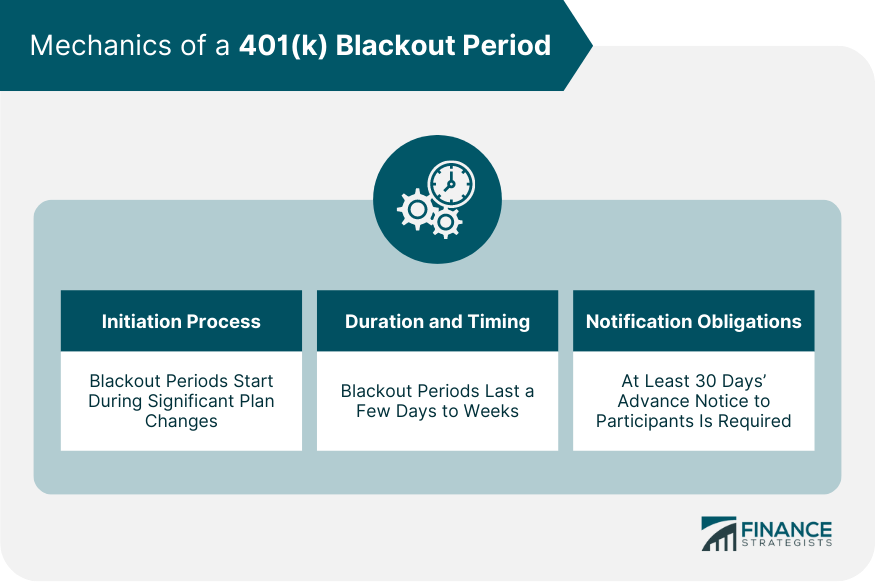

Mechanics of a 401(k) Blackout Period

Initiation Process

Duration and Timing

Notification Obligations and Participant Requirements

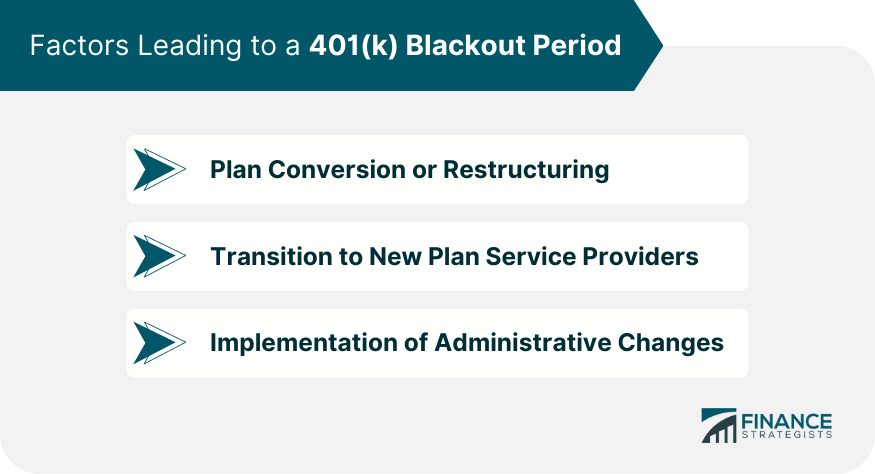

Factors Leading to a 401(k) Blackout Period

Plan Conversion or Restructuring

Transition to New Plan Service Providers

Implementation of Administrative Changes

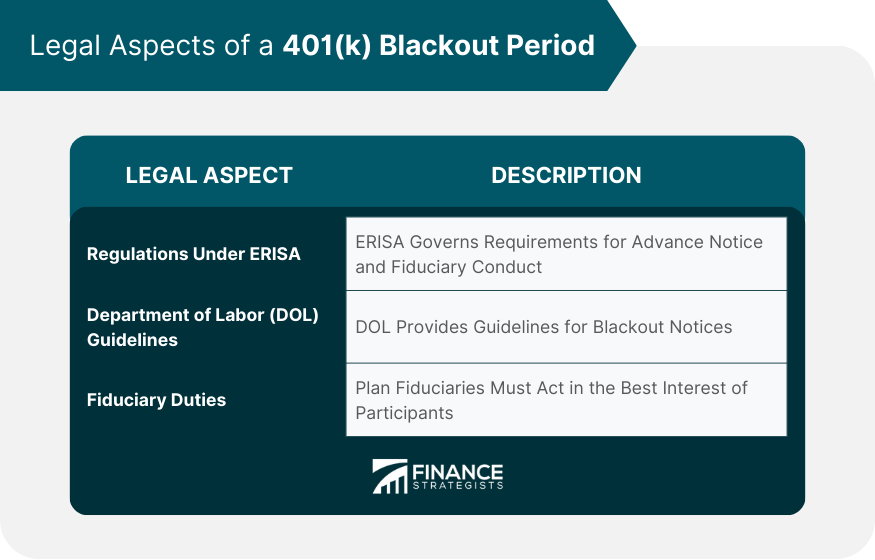

Legal Aspects of a 401(k) Blackout Period

Regulations Under Employee Retirement Income Security Act (ERISA)

Department of Labor Guidelines

Fiduciary Duties During a Blackout Period

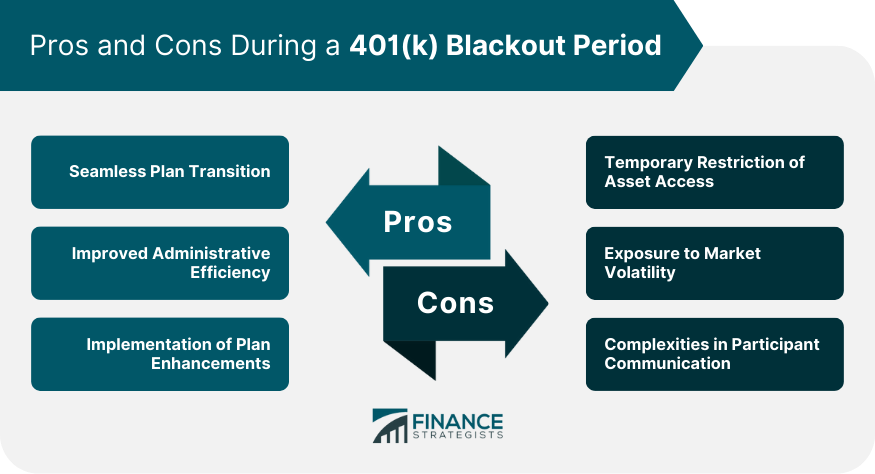

Pros of a 401(k) Blackout Period

Seamless Plan Transition

Improved Administrative Efficiency

Implementation of Plan Enhancements

Cons During a 401(k) Blackout Period

Temporary Restriction of Asset Access

Exposure to Market Volatility

Complexities in Participant Communication

Effective Management of a 401(k) Blackout Period

Adequate Preparation for a Blackout Period

Risk Mitigation Strategies

Optimize Actions During the Blackout Period

Conclusion

401(k) Blackout Period FAQs

A 401(k) blackout period is a temporary period during which plan participants cannot make certain changes to their retirement accounts, such as modifying investment allocations, taking loans, or initiating distributions. These periods are typically necessary when plan administrators need to perform significant administrative tasks.

The duration of a 401(k) blackout period can vary, but it usually lasts between a few days to a few weeks. The length depends on the nature of the administrative task being performed.

A 401(k) blackout period can be triggered by several factors, such as a major plan conversion or restructuring, a transition to new plan service providers, or the implementation of significant administrative changes.

The Employee Retirement Income Security Act (ERISA) and Department of Labor guidelines provide the legal framework for a 401(k) blackout period. They stipulate requirements such as advance notice to participants and fiduciary duties during the blackout period.

Prior to a blackout period, it's important to review your account and make any necessary changes. During the blackout period, stay informed by reading communications from your plan sponsor or administrator. Once the blackout period is over, review your account to ensure everything is in order.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.