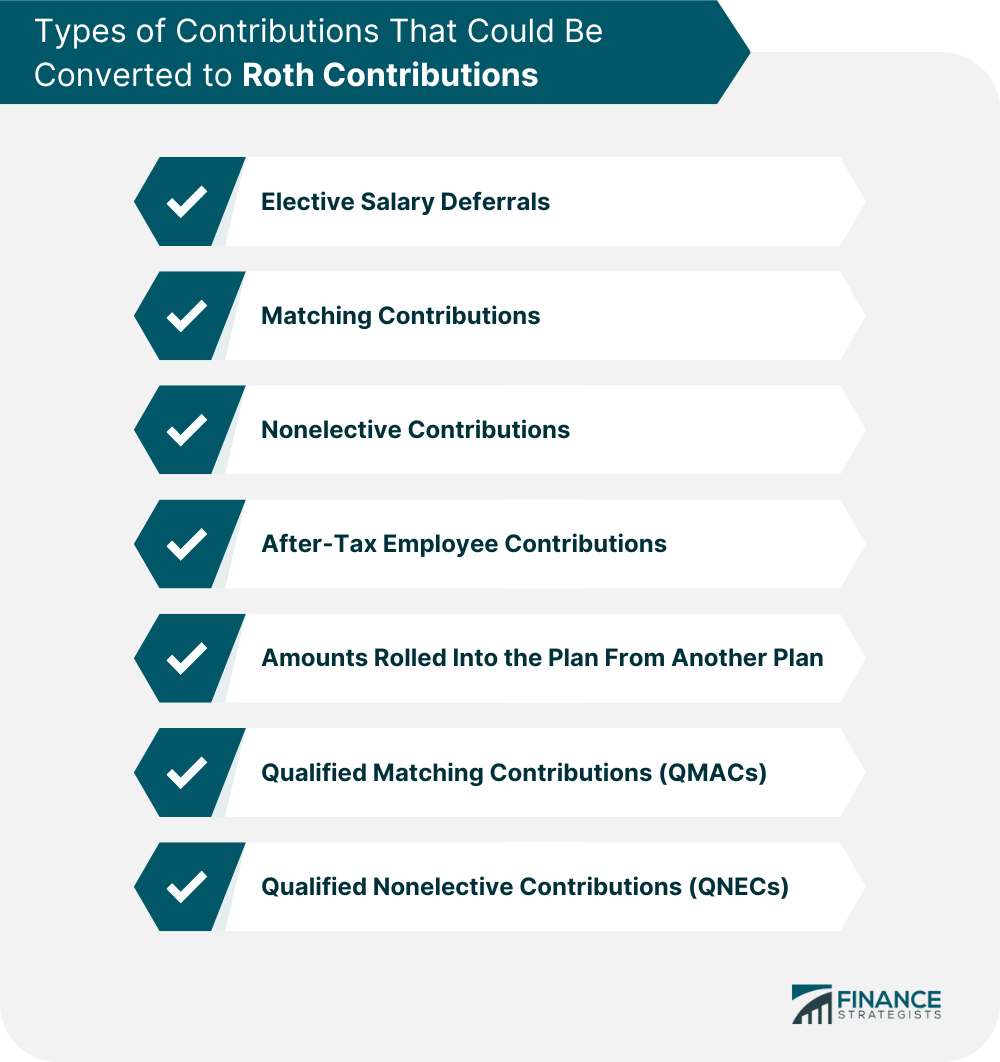

A Roth conversion inside your 401(k) plan is when you convert the traditional, pretax balance of your 401(k) money to tax-free money without taking your money out of the plan. If you do this, you will be required to pay ordinary income tax (taxed at your top marginal tax rate) on the conversion balance. You can pay this amount using a portion of the money in your plan, or you can pay it out of pocket and keep your plan balance unchanged. (Most financial planners strongly recommend the latter option if you can afford it.) The advent of Roth 401(k)s has had a noticeable impact on the savings habits of many employees who have access to these plans. The idea of exchanging tax-deferred money for tax-free money is very appealing to a large segment of workers, especially those who project that their post-retirement income will be at least as high as it is now. Updates to the tax laws in 2013 followed by revised IRS guidelines have made these plans more widely available, and have also opened the door for in-plan Roth conversions. Have questions about 401(k) In-Plan Roth Conversions? Click here. High income earners can use a Roth 401(k) as a tax shelter, and often this is the only way that they can contribute to any type of Roth account, as their income may be too high to allow them to make Roth IRA contributions. But young low income workers in a low tax bracket can also do this while their tax bill is more reasonable and thus start building a pool of tax-free income to enjoy after they stop working. A Roth account of any kind is great for use in estate planning, as it allows the donor to bequeath tax-free money to his or her beneficiary. The IRS website states that "A plan with a designated Roth program can allow rollovers to a designated Roth account from another account in the same plan (an "in-plan Roth rollover" ). Designated Roth accounts can't be set up solely to accept in-plan rollovers - they must also accept elective deferrals from participants." This means that there can be no separation of Roth plans into conversion balances and elective deferrals. These monies must be combined inside a 401(k) or other type of qualified plan. The IRS web page addressing this issue went on to list out the types of contributions that could be converted to Roth contributions, including: The IRS allows each plan administrator to determine which (if not all) of these contributions are convertible. The administrator can also mandate when or how many times per year a Roth conversion can be made. There are also three different parties that may elect to do an in-plan Roth rollover: The 10% early withdrawal penalty is not assessed on a Roth rollover, but tax and penalty may apply if the plan participant takes a distribution from the Roth account before he or she has had a Roth plan or account open for at least five years. Finally, Roth conversions are irreversible and plan sponsors are prohibited from withholding income tax on the conversion balance.Who Can Benefit?

Roth Conversion Rules

401(k) In-Plan Roth Conversion FAQs

401(k) refers to the IRS Tax Code, in particular the section that authorizes and defines this retirement plan.

A Roth conversion inside your 401(k) plan is when you convert the traditional, pretax balance of your 401(k) money to tax-free money without taking your money out of the plan.

With a Roth 401(k), taxes are paid as money is put into the retirement account. With a traditional 401(k), taxes are paid as money is taken out.

Alternatives to 401(k) plans include traditional IRAs, Roth IRAs, pension plans (if your employer offers one), and 403(b) retirement plans for employees of non-profit organizations.

Typically, employees can take advantage of both plans at the same time, which is recommended among financial advisors to maximize retirement savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.