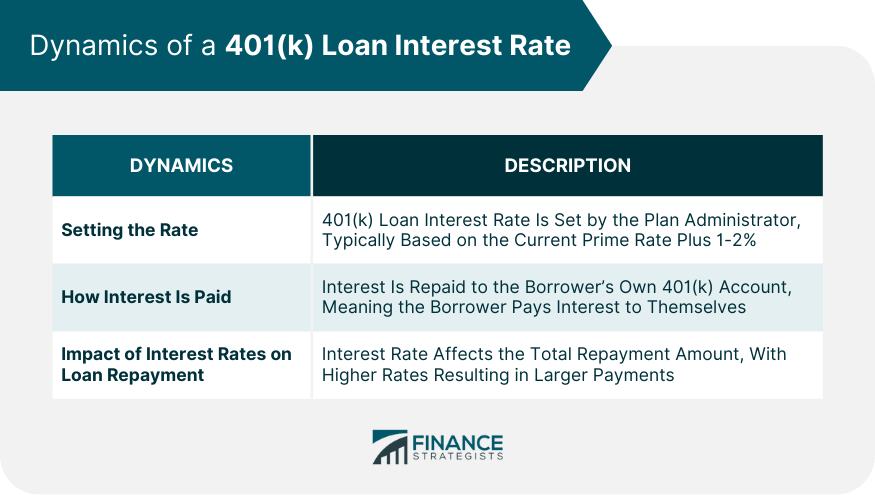

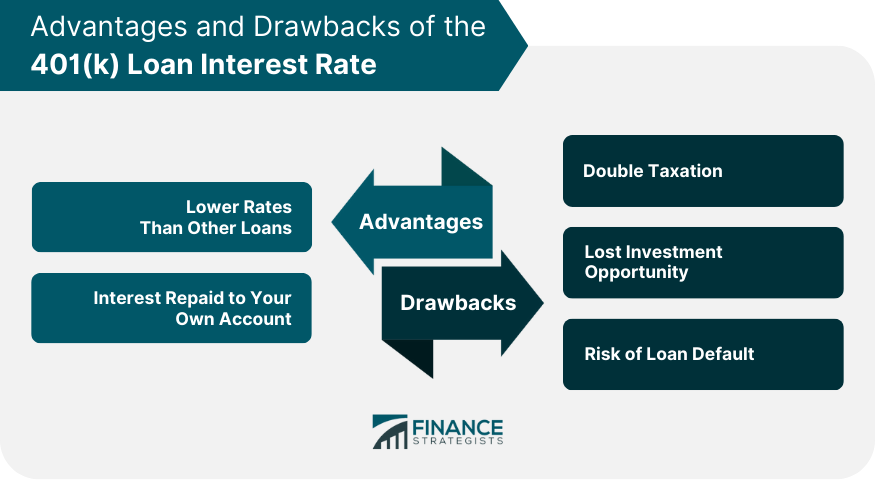

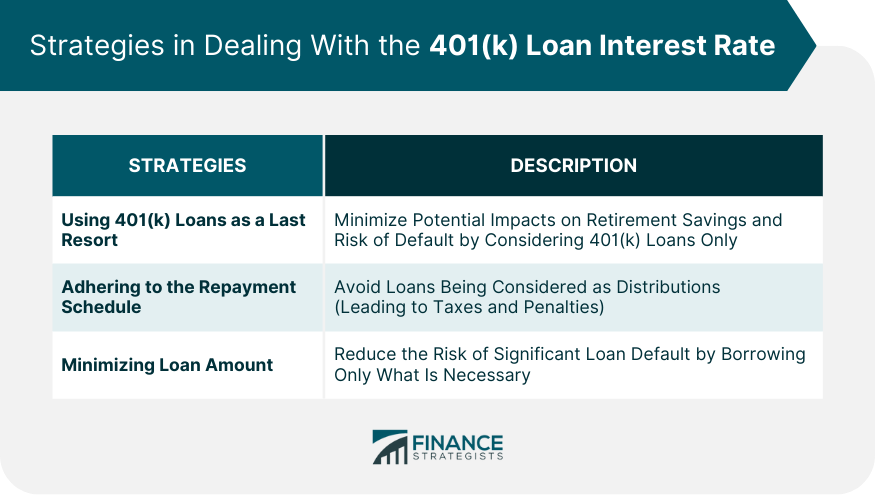

The 401(k) loan interest rate is the rate charged when you borrow money from your 401(k) retirement savings account. The 401(k) loan interest rate is typically determined by the plan administrator, and it's usually a point or two above the prime rate. The purpose of this interest is to compensate for the potential growth that your 401(k) funds could have achieved if they weren't loaned out. The interest paid goes back into your account, allowing you to "pay yourself" interest, which can augment your retirement savings over time. However, the impact of taking out a 401(k) loan can be significant. Borrowers face double taxation, potential lost investment earnings, and the risk of loan default leading to tax penalties. Understanding the 401(k) loan interest rate and its implications is crucial for individuals considering this as an option to address immediate financial needs. The interest rate on a 401(k) loan is typically set by the plan administrator and is usually based on the current prime rate plus an additional 1% or 2%. The interest on a 401(k) loan is repaid to the borrower's own 401(k) account, unlike a typical loan where the interest is paid to the lender. This means the borrower essentially pays interest to themselves. The interest rate of a 401(k) loan affects the total repayment amount. As with any loan, a higher interest rate means higher monthly payments and a larger total repayment amount. 401(k) loan interest rates can be lower than those of other loan options, such as credit cards or personal loans, making them a potentially more affordable borrowing option. Since the interest paid on a 401(k) loan goes back into the borrower's 401(k) account, it can help increase the amount of retirement savings over time. While it might seem beneficial that interest is repaid to your 401(k) account, this payment is made with after-tax dollars. When the time comes to withdraw these funds in retirement, they will be taxed again, resulting in double taxation. Borrowing from a 401(k) means these funds are not invested in the market, potentially missing out on investment gains. Even though the borrower repays the loan with interest, this rate of return may not compare to potential market returns. If a borrower fails to repay a 401(k) loan, the outstanding balance will be considered a distribution, subject to taxes and a potential 10% early withdrawal penalty if the borrower is under 59.5 years old. It's important to consider whether you can afford the loan repayments plus interest, especially as failure to repay can lead to severe tax implications. Before opting for a 401(k) loan, compare the interest rate with other loan options to ensure you're making the most cost-effective choice. Consider how taking out a 401(k) loan and the associated interest rate will impact your overall retirement savings and whether you're willing to risk potential investment gains. To minimize the potential impact on retirement savings and avoid the risk of double taxation and default, use 401(k) loans as a last resort after exploring other loan or financial assistance options. Ensure you're able to adhere to the repayment schedule to avoid the loan being considered a distribution, subject to tax and penalties. To reduce the risk of a large loan default and lessen the potential impact on retirement savings, borrow only what is necessary. Understanding the 401(k) loan interest rate is vital for potential borrowers. Set by your plan administrator, this rate is often lower than other loan options, making it an appealing choice for immediate financial needs. However, it carries significant implications such as double taxation, missed investment opportunities, and loan default risks. Borrowers pay interest back into their accounts, aiding retirement savings, yet diverting funds from investments may diminish potential market gains. Adhering to the repayment schedule is essential to avoid heavy penalties. It's crucial to assess affordability, compare loan options, and consider the impact on retirement savings before committing to a 401(k) loan. As a strategy, use these loans as a last resort, adhere to the repayment schedule, and borrow only what's necessary. By understanding the full picture, individuals can make informed decisions about utilizing 401(k) loans.401(k) Loan Interest Rate Overview

Dynamics of a 401(k) Loan Interest Rate

Setting the Rate

How Interest Is Paid

Loan Repayment and the Impact of Interest Rates

Advantages of the 401(k) Loan Interest Rate

Lower Rates Than Other Loans

Interest Repaid to Your Own Account

Risks of the 401(k) Loan Interest Rate

Double Taxation

Lost Investment Opportunity

Risk of Loan Default

Considerations for the 401(k) Loan Interest Rate

Assess Affordability

Compare Loan Options

Impact on Retirement Savings

Strategies in Dealing With the 401(k) Loan Interest Rate

Using 401(k) Loans as a Last Resort

Adhere to the Repayment Schedule

Minimize Loan Amount

Conclusion

401(k) Loan Interest Rate FAQs

A 401(k) loan interest rate is the interest charged when you borrow money from your 401(k) retirement savings account. It's typically a point or two above the prime rate.

The 401(k) loan interest rate is typically determined by the plan administrator, and it's usually a point or two above the prime rate.

The interest paid on a 401(k) loan goes back into your own 401(k) account. Essentially, you pay interest to yourself, which can increase your retirement savings over time.

Drawbacks of a 401(k) loan interest rate include double taxation, potential lost investment opportunity, and risk of loan default, which could lead to tax and penalty implications.

401(k) loan interest rates can be lower than those of other loan options, such as credit cards or personal loans, making them a potentially more affordable borrowing option. However, you should weigh this against potential drawbacks before deciding to take a 401(k) loan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.