401(k) loan rules govern how an individual can borrow from their 401(k) retirement savings account. Established by the IRS and the specifics of individual plan agreements, these rules allow participants to borrow a maximum of either $50,000 or 50% of their vested account balance, whichever is less. Loans must typically be repaid within five years through at least quarterly payroll deductions, but a longer repayment period may apply if the loan is used to buy a primary residence. If the loan isn't repaid on schedule, it is considered a distribution, subjecting the borrower to taxes and potential penalties. These rules aim to provide a safety net for individuals in financial hardship while protecting their retirement savings from premature depletion. The eligibility to take out a 401(k) loan depends on the specific terms of the participant's plan. Not all 401(k) plans allow loans and those that do often have specific guidelines around eligibility. Generally, to be eligible, you must be a vested participant in the plan, and the loan must be for a permissible purpose. The maximum amount that a participant can borrow from their 401(k) plan is generally 50% of their vested account balance or $50,000, whichever is less. However, if the vested account balance is less than $10,000, the participant can borrow up to $10,000. A 401(k) loan must typically be repaid within five years. The payments are made through payroll deductions, and the payments must be made at least quarterly. However, if the loan is used to buy a primary residence, the repayment period can be extended. The interest rate on a 401(k) loan is usually prime rate plus 1%. The interest paid on the loan goes back into the borrower's 401(k) account. If a borrower fails to repay the 401(k) loan as per the terms, the unpaid balance is considered a distribution and is subject to taxes and penalties. This can significantly impact the borrower's retirement savings and future financial stability. 401(k) loans are typically easier to access than traditional loans. There's no application process, and you don't have to prove financial hardship or meet any income requirements. Unlike traditional loans, 401(k) loans do not require a credit check. This can be beneficial for those with a poor credit history or those who want to avoid a hard inquiry on their credit report. The interest you pay on a 401(k) loan goes back into your 401(k) account, essentially allowing you to pay interest to yourself. The funds from a 401(k) loan can be used for almost any purpose, providing flexibility for the borrower. Taking a loan from your 401(k) plan could potentially reduce your retirement savings. This is especially true if you're unable to make contributions while you're repaying the loan or if the investments you sold to take the loan would have yielded high returns. If you fail to repay the loan as per the terms, the outstanding balance could be considered a taxable distribution. Furthermore, the money used to repay the loan is taxed twice – once when you earn it and again when you withdraw it at retirement. If you leave or lose your job, the outstanding balance of the loan is usually due within a short period of time. If you can't repay it, it'll be treated as a taxable distribution. If you default on the loan or can't repay it when you leave your job, not only will you face taxes, but you might also face an early withdrawal penalty if you're under the age of 59½. Understand your financial needs and consider all available alternatives. A 401(k) loan should typically be your last resort for obtaining funds. Consider the impact of the loan on your retirement savings. Will you be able to continue making contributions? Will the loan significantly reduce your savings? Understand the tax and legal implications of taking a 401(k) loan. Consult a tax advisor or financial planner to help you navigate these complexities. Assess your job security. If you're unsure about your job's stability, a 401(k) loan could be risky. 401(k) loan rules have evolved over the years, providing more flexibility for borrowers but also increasing the potential risks. In the past, many 401(k) plans didn't allow loans, or they had very strict rules. However, as more employees needed access to funds, many plans began to allow loans. Recent amendments to 401(k) loan rules have increased the maximum loan amount for some borrowers and extended the repayment period for loans used to purchase a home. These changes have made 401(k) loans more attractive for some borrowers, but they also increase the potential risk of retirement savings depletion. 401(k) loan rules, although providing a convenient and accessible financial resource, should be approached with caution due to potential drawbacks to retirement savings. Guided by the IRS and specific plan terms, they permit borrowing a maximum of 50% of the vested account balance or $50,000, typically repayable in five years. While they provide benefits such as no credit checks and self-interest payment, they also hold risks like reduced retirement savings, possible tax implications, repayment risks, and penalties for default. The flexibility in loan usage and recent amendments enhancing loan amounts and extending repayment periods can make them attractive. However, before opting for a 401(k) loan, one must evaluate financial needs, impact on retirement savings, tax and legal implications, and job security to protect their financial future. Therefore, a 401(k) loan should typically be considered as a last resort.What Are 401(k) Loan Rules?

Factors of 401(k) Loan Rules

Eligible Criteria

Maximum Loan Amount

Repayment Terms and Period

Interest Rates

Loan Defaults and Consequences

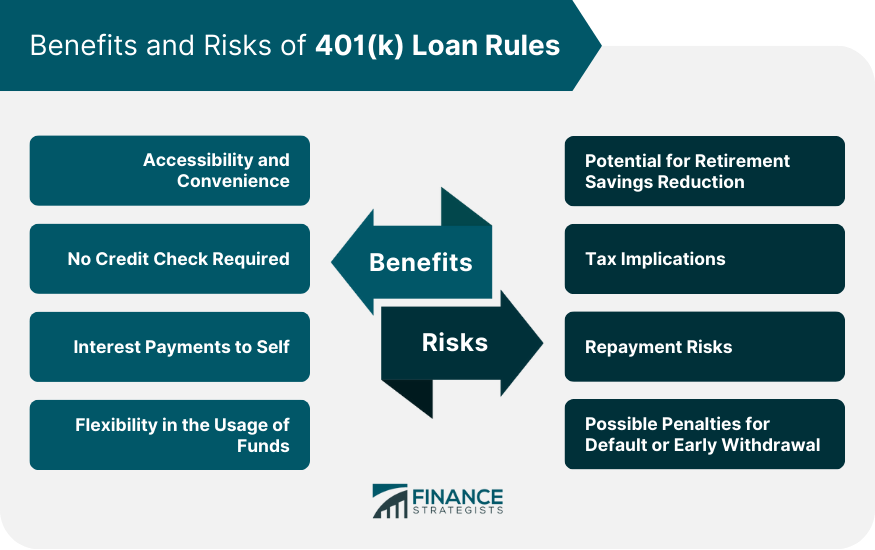

Benefits of 401(k) Loan Rules

Accessibility and Convenience

No Credit Check Required

Interest Payments to Self

Flexibility in the Usage of Funds

Risks of 401(k) Loan Rules

Potential for Retirement Savings Reduction

Tax Implications

Repayment Risks

Possible Penalties for Default or Early Withdrawal

Key Considerations Before Taking a 401(k) Loan

Evaluating Financial Needs and Alternatives

Impact on Retirement Savings and Future Contributions

Tax and Legal Implications

Job Security and Loan Repayment

Changes in 401(k) Loan Rules Over the Years

Past Rules and Policies

Recent Amendments and Their Implications

Conclusion

401(k) Loan Rules FAQs

The maximum you can borrow under 401(k) loan rules is generally either $50,000 or 50% of your vested account balance, whichever is less. If your vested account balance is less than $10,000, you may be able to borrow up to $10,000.

If you follow the 401(k) loan rules and repay the loan on time, there typically aren't any immediate tax implications. However, the money you use to repay the loan, which comes from after-tax income, will be taxed again when you withdraw it during retirement.

If you default on a 401(k) loan, the outstanding balance is generally treated as a taxable distribution. You'll be liable for income taxes on that amount, and if you're under the age of 59½, you might also have to pay a 10% early withdrawal penalty.

Yes, you can generally use a 401(k) loan for any purpose. This flexibility is one of the benefits of 401(k) loans. However, it's important to remember that the primary purpose of your 401(k) is to save for retirement.

No, 401(k) loan rules do not require a credit check. This can make 401(k) loans a more accessible option for people with poor credit. However, it's essential to consider the potential impact on your retirement savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.