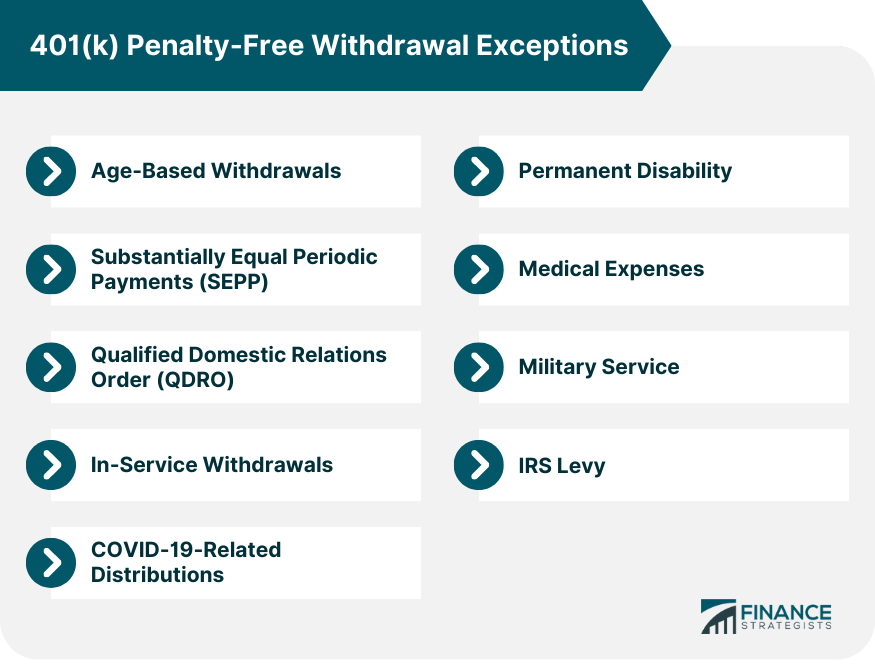

401(k) penalty-free withdrawal exceptions are provisions outlined by the IRS that permit individuals to make early withdrawals from their 401(k) accounts without incurring the usual 10% penalty. These exceptions are designed to provide financial relief in specific situations. Some of these situations include reaching the age of 59½, permanent disability, Substantially Equal Periodic Payments (SEPP), and certain medical expenses. Qualified Domestic Relations Orders (QDRO), military service, in-service withdrawals, IRS levies, and COVID-19-related distributions are included, as well. While these exceptions allow early access to retirement funds without the additional penalty, it's important to understand their specific criteria, requirements, tax implications, and potential impact on retirement savings, as discussed in the preceding article. Consequently, considering professional advice before making such decisions is highly recommended to ensure the best possible outcome for one's financial future. Upon reaching the age of 59½, individuals can begin to make withdrawals from their 401(k) accounts without incurring any penalties. This is a standard rule set by the Internal Revenue Service (IRS) that applies to all 401(k) accounts. It marks the point at which savers are considered to be of retirement age and, therefore, no longer subject to early withdrawal penalties. These age-based withdrawals offer flexibility for those approaching retirement. While they might not yet be ready to fully retire, they can start drawing on their 401(k) savings for supplemental income, large purchases, or even a phased approach to retirement. However, it's essential to bear in mind that while there are no penalties, these withdrawals are still subject to income tax. In the event of an unfortunate circumstance where an individual becomes permanently disabled, they are allowed to access their 401(k) funds without any penalties. This is an essential provision, providing financial assistance when it may be most needed. The IRS recognizes the hardship such circumstances can cause and allows individuals to tap into their retirement savings early without incurring the typical 10% early withdrawal penalty. This withdrawal option offers a financial lifeline, providing access to funds that can be used to pay for medical care or to supplement lost income. However, it's important to understand that this exception applies to permanent disabilities. The IRS requires proof of permanent disability, usually in the form of a physician's statement, to qualify for this exception. The IRS also offers an exception to the early withdrawal penalty known as SEPP. This method allows individuals to take early withdrawals from their 401(k) based on their life expectancy or the joint life expectancies of the individual and their beneficiary. The key factor is that these payments must be made at least annually, and they must be substantially equal. This strategy can provide a steady stream of income before reaching the age of 59½. However, it's essential to note that once SEPP withdrawals begin, they must continue for at least five years or until the individual reaches age 59½, whichever is longer. This can be a complex strategy, and it's advised to consult a financial professional before proceeding with SEPPs. When faced with significant medical expenses, individuals may find relief in the fact that they can withdraw money from their 401(k) without penalty. To qualify for this exception, the unreimbursed medical expenses must exceed 7.5% of the individual's adjusted gross income. This can include expenses for diagnosis, cure, mitigation, treatment, or prevention of disease and the amounts paid for treatments affecting any part or function of the body. Although this provision can be helpful during times of medical crisis, it's crucial to understand the implications. These withdrawals are still taxable as income. Furthermore, this exception only applies in the specific tax year that the medical expenses were incurred. In situations involving court-ordered financial agreements, like a divorce or child support, individuals might have to give a portion of their 401(k) to a former spouse or dependent. Under such circumstances, known as QDRO, the typical early withdrawal penalty does not apply. This allows the 401(k) account holder to comply with the legal obligation without incurring additional financial penalties. However, it's important to note that the recipient of the 401(k) funds, not the account holder, is typically responsible for any income taxes owed on the withdrawal. If the recipient is under 59½, they also won't be subject to the early withdrawal penalty. The IRS provides additional withdrawal exceptions for members of the military. Specifically, reservists called to active duty for more than 179 days are allowed to take an early withdrawal from their 401(k) without penalty. This provision is intended to help military members and their families manage the financial challenges that can come with active duty service. Though this is a beneficial provision, it's essential to understand the broader financial implications. These withdrawals, while not subject to the early withdrawal penalty, are still considered taxable income. As such, military members should consider all their options before opting for an early 401(k) withdrawal. Certain 401(k) plans offer a provision known as in-service withdrawals. These plans allow active employees who are over the age of 59½ to withdraw money from their 401(k) without incurring the early withdrawal penalty. This provision essentially enables older employees to access their retirement savings while they are still working and contributing to their 401(k). While in-service withdrawals can provide additional financial flexibility, they also come with implications. Withdrawals can reduce the potential future growth of retirement savings and are subject to regular income tax. Therefore, employees considering this option should carefully evaluate their financial needs and retirement goals. In certain situations, the IRS can levy or legally seize a person's property to satisfy a tax debt. If this occurs and the IRS levies your 401(k) account, the early withdrawal penalty will not apply. This is a specific situation in which the IRS permits early access to 401(k) funds without the typical 10% penalty. However, an IRS levy on a 401(k) account is usually a measure of last resort, occurring after the IRS has assessed the tax and sent notices of demand for payment. It's essential to engage with tax professionals when dealing with potential tax debts to avoid such drastic measures. In response to the financial difficulties caused by the COVID-19 pandemic, the government enacted the CARES Act, which temporarily waived the early withdrawal penalty for COVID-19-related distributions made in 2020 and 2021. This relief measure provided an essential lifeline for those impacted by the pandemic, allowing access to retirement savings to cover immediate financial needs. However, while the CARES Act waived the 10% early withdrawal penalty, the withdrawn funds were still subject to income tax. To reduce the tax burden, the act allowed taxpayers to spread the income tax owed over three years. Despite the expiration of the CARES Act provisions, this example demonstrates how extraordinary circumstances can lead to temporary changes in the 401(k) withdrawal rules. Each exception to the 10% early withdrawal penalty has specific criteria and conditions that must be met. For instance, for medical expense exceptions, the expenses must exceed 7.5% of your adjusted gross income, and for the SEPP exception, the payments must be made at least annually and continue for five years or until the account holder reaches age 59½, whichever is longer. The IRS requires proof or documentation to verify that your withdrawal qualifies for an exception. This could be a physician's statement for disability exceptions, a court order for QDRO exceptions, or receipts and bills for medical expense exceptions. While the 10% penalty is waived for these exceptions, the withdrawn amounts are still subject to regular income taxes. Also, a larger withdrawal can potentially push you into a higher tax bracket, increasing your overall tax burden. Penalty-free withdrawals can provide immediate financial relief, but they also reduce the amount of money you'll have for retirement. Moreover, you lose the potential growth that the withdrawn amount could have earned if it had stayed in the account. Before making an early withdrawal, consider your overall financial situation and long-term retirement goals. Explore other options like loans or hardship distributions if your plan offers them. Given the complexities involved in early 401(k) withdrawals, it might be beneficial to seek advice from a financial advisor or tax professional. They can provide guidance tailored to your specific circumstances and help you understand the potential impacts of your decisions. A 401(k) is a vital asset within the realm of personal finance and retirement planning, providing individuals with a powerful tool to accumulate wealth over time. It offers multiple advantages, including growth potential, employer matching contributions, and tax deferral benefits, making it a crucial part of a comprehensive retirement strategy. However, understanding its limitations, such as penalties for early withdrawals, required minimum distributions, and limited investment choices, is equally important. Diversification within the 401(k) and regular monitoring of this asset can help mitigate risks and optimize returns. While it demands strategic management, a 401(k) continues to be an indispensable asset for long-term financial security and a comfortable retirement, safeguarded by robust legal protections. Ensuring one is informed and active in managing their 401(k) is key to maximizing its benefits as an asset.Overview of Penalty-Free Withdrawals From a 401(k) Account

401(k) Penalty-Free Withdrawal Exceptions

Age-Based Withdrawals

Permanent Disability

Substantially Equal Periodic Payments (SEPP)

Medical Expenses

Qualified Domestic Relations Order (QDRO)

Military Service

In-Service Withdrawals

IRS Levy

COVID-19-Related Distributions

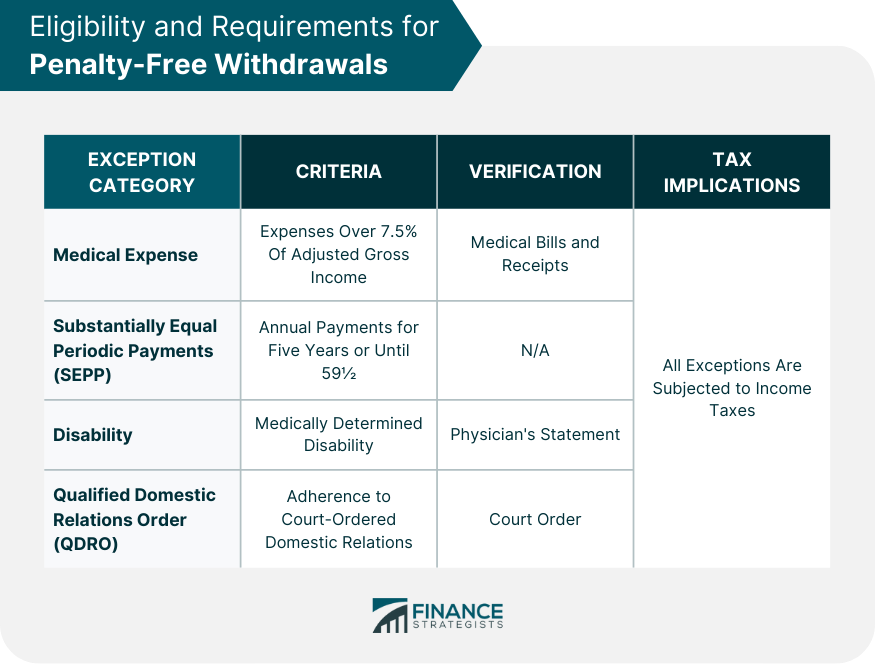

Eligibility and Requirements for Penalty-Free Withdrawals

Specific Criteria and Conditions for Each Exception

Documentation and Verification Process

Tax Implications of Penalty-Free Withdrawals

Considerations of 401(k) Penalty-Free Withdrawal Exceptions

Potential Impact on Retirement Savings

Financial Plan and Decision-Making Tips

Seek Professional Advice

Conclusion

401(k) Penalty-Free Withdrawal Exceptions FAQs

Generally, you can start making penalty-free withdrawals from your 401(k) account when you reach the age of 59½. However, there are certain exceptions that allow you to withdraw funds before this age without penalties.

The SEPP exception allows you to take regular withdrawals over your life expectancy or the joint life expectancies of you and your beneficiary without paying the 10% early withdrawal penalty. However, these payments must be made at least annually and continue for five years or until you reach the age of 59½, whichever is longer.

Yes, you can withdraw money from your 401(k) without penalty if you have unreimbursed medical expenses that exceed 7.5% of your adjusted gross income. However, these withdrawals are still subject to regular income tax.

If you are ordered by a court to give a portion of your 401(k) to a former spouse or dependent through a QDRO, the early withdrawal penalty does not apply.

While the 10% penalty is waived for certain exceptions, the withdrawn amounts are still subject to regular income taxes. Furthermore, a larger withdrawal could potentially push you into a higher tax bracket.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.