Fiduciary responsibility is an ethical obligation to act in a client's or beneficiary's best interests. In the context of 401(k) plan administration, this includes acting honestly, prudently, and loyally when selecting investments, administering assets, and other responsibilities. The Department of Labor (DOL) and the Internal Revenue Service (IRS) outline essential fiduciary responsibilities for 401(k) plan administrators. This includes: Acting solely in the best interest of participants and beneficiaries Having a written plan to guide operations Setting up a trust to hold plan assets Maintaining records and documents Fulfilling duties with care and diligence Adhering to plan terms Diversifying investments The fiduciary must act solely in the interest of their beneficiaries without any consideration for personal gain. Have questions about 401(k) Plans? Click here. 401(k) plan administrators act as fiduciaries, meaning they must make the best decisions for participants and beneficiaries of the plan. Responsibilities include: The plan administrator must ensure that the investments chosen for the 401(k) plan are suitable for those investing in it. This includes researching and comparing funds to ensure that they meet performance and risk expectations and selecting funds that offer appropriate diversification. Fiduciary responsibilities related to planning investments can be fulfilled by selecting “prudent” investments that enable participants to diversify their accounts. A “prudent investment” meets its investment objective at a fair cost. This becomes simpler when using index funds, as they are designed to track a market benchmark and offer similar returns and low fees across all the major providers (e.g., Vanguard, Blackrock, Schwab, and Fidelity). Employers can also create or model their fund lineup after the Federal government’s Thrift Savings Plan (TSP) for similar results. They can also outsource these duties to an ERISA 3(38) financial advisor. Moreover, meeting the diversification requirements of ERISA section 404(c) will ensure that participants have access to a broad range of financial markets. For example, this can be done with a three-fund lineup (equity, fixed-income, and capital preservation funds). The plan administrator is responsible for ensuring that the 401(k) plan complies with all applicable laws and regulations, including those set forth by the DOL, IRS, and ERISA. Being a responsible 401(k) plan administrator involves a variety of fiduciary duties that can seem daunting. These include: Ensuring that the governing plan document complies with applicable law Operating the plan in accordance with its plan document, including letting employees participate based on age and service eligibility requirements, allocating contributions to participant accounts based on the compensation definition used by the plan, and paying out participant distributions Administering participant loan programs (if applicable) Splitting participant accounts per Qualified Domestic Relations Order (QDRO) requirements Meeting ERISA participant disclosure and government reporting requirements Completing any necessary plan testing and correcting any test failures promptly Maintaining records according to ERISA document retention rules Fortunately, qualified 401(k) providers can help employers fulfill most of these responsibilities. Employers should use a checklist to ensure that tasks have been completed correctly. The plan administrator must keep expenses associated with investments low and reasonable. Expenses should be disclosed to participants in a transparent manner so that they can understand how their money is being used. Employers have an important fiduciary responsibility to pay only "reasonable" fees from their 401(k) plan assets. This is because overly high fees can drastically reduce a participant's account balance over time, despite the lack of a clear definition of what constitutes "reasonable" per ERISA guidelines. The DOL suggests establishing an “objective process” for fee evaluation. This should include reviewing fees in relation to the services provided and investments offered. Benchmarking 401(k) fees against competing providers or industry averages is recommended. It involves calculating the all-in fee (service provider fees + investment expenses), comparing it with other providers, and doing so every three years. The plan administrator must deposit employee contributions into the 401(k) plan promptly and ensure that the funds are invested according to the plan documents. Employers must adhere to a fiduciary responsibility regarding 401(k) plan assets. Employee contributions (including any participant loan repayments) must be deposited in the 401(k) plan as soon as possible to meet this responsibility. This should be done no later than the 15th business day of the month following the withholding. Small employers (100 or less employees) can adhere to this rule automatically by making deposits no later than the 7th business day after the date of withholding. The plan administrator must maintain an adequate fidelity bond to protect participants' investments in case of misappropriation or misuse of funds by any fiduciary. An ERISA fidelity bond must cover employers with discretionary authority over their 401(k) plan assets. This allows participants to be safeguarded against dishonest acts on behalf of the employer. The coverage requirements are usually set at either 10% of the plan assets or $500,000, whichever is lesser, and bonds can be obtained from sureties or reinsurers listed on the Department of Treasury's Listing of Approved Sureties. The plan administrator is responsible for selecting third-party service providers (such as record keepers and trustees), monitoring their performance, and ensuring that they comply with all applicable regulations. When it comes to 401(k) plans, employers have a responsibility to select service providers with reasonable fees. As these plans can be complex and services vary in quality and cost, an objective process should be established to assess the fees according to services offered and investments. Employers should also benchmark these fees against other providers every three years. Additionally, employers must monitor their selected provider’s performance, ensuring that they are fulfilling their responsibilities competently and on time for reasonable fees; therefore, choosing transparent service providers is highly encouraged. The DOL is authorized to take civil or criminal actions against fiduciaries who violate their basic fiduciary obligations. This also gives participants and other plan fiduciaries the right to take legal action by instituting a lawsuit and imposing liability for any breach of fiduciary duties. ERISA makes all fiduciaries responsible for losses that are caused due to failing in their duty. ERISA may require them to restore those losses or pay expenses in case of correcting wrong decisions. A fiduciary may be accountable not only for their actions, but those of other plan fiduciaries if they do not put restrictions upon the scope of their role in the plan. Finally, they can be liable for co-fiduciary discrepancies if no corrective steps have been taken once they become aware of such an event. As with any responsibility, there is an associated potential for liability. As a 401(k) plan administrator, limiting liability and protecting against legal and financial consequences is important. Hiring outside experts, such as investment advisors or plan consultants, can greatly mitigate liability. Investment advisors can ensure the plan’s investments are prudent and in line with ERISA regulations, while plan consultants can provide expert advice and guidance when establishing or managing the plan. Additionally, providing participants with clear information about their investment options and account balances helps them make more informed decisions, thus limiting the administrator's responsibility for any losses caused by the participants’ investments. Finally, documenting the decision-making process for all fiduciary activities shows that reasonable care was taken in the process, which may help limit potential liability. Choosing and monitoring the right 401(k) plan service provider is a crucial responsibility for administrators. Here are some tips and guidance on selecting and monitoring such a provider: All fees should also be disclosed before signing a contract. It is important to review the services provided by the service provider, assess the cost of those services for both employers and participants, and be sure that any fees charged are reasonable in relation to the services rendered. Administrators should ensure that the service provider has experience working with qualified retirement plans, is well-versed in ERISA regulations, and offers services that align with the plan’s objectives. Ask questions about their background, check references if necessary, and verify credentials with independent agencies. Carefully read all agreements and contracts to understand the provider's responsibilities and any other details regarding services rendered or fees charged. Be sure to read all these agreements carefully and understand their terms before signing them, as this will help limit liability down the road. Stay abreast of market conditions to effectively evaluate how well your service provider performs for your plan participants by comparing performance benchmarks against industry standards. Regular reviews can help identify any areas of concern before they become more significant problems. Gathering feedback from plan participants can be a great way to audit a service provider and identify ways to improve the user experience. Pay attention to participant comments or complaints about providers, as these can provide helpful information about a company's level of service or potential areas for improvement. 401(k) plan administrators have a fiduciary responsibility to ensure that the plans are managed with the interests of participants and beneficiaries in mind. This means that they must adhere to basic principles such as diversifying investments, providing adequate disclosure of plan documents, accurate recordkeeping, and following the applicable laws and regulations. Additionally, they must periodically review their investments to ensure that they continue to serve the long-term goals of their participants. While these responsibilities may be daunting, employers should remember that their financial security rides on their chosen administrator's ability to fulfill them. To help guarantee compliance, many employers utilize third-party services like attorneys or financial advisors as additional oversight to ensure plan approval and monitor best practices for continued success.What Is Fiduciary Responsibility?

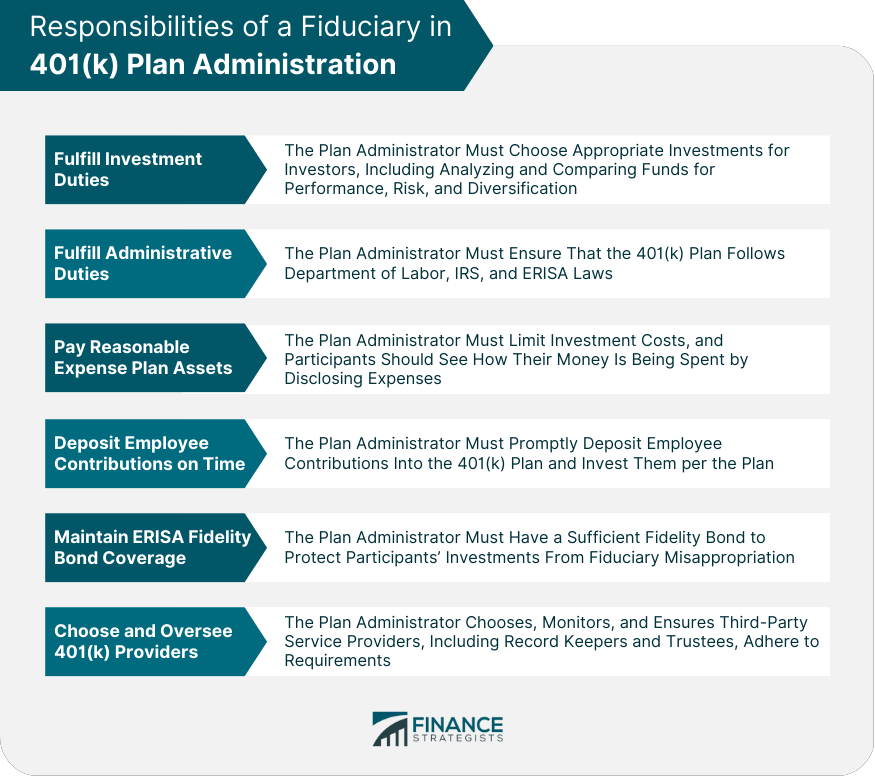

Responsibilities of a Fiduciary in 401(k) Plan Administration

Fulfill Investment Duties

Fulfill Administrative Duties

Pay Reasonable Expense Plan Assets

Deposit Employee Contributions on Time

Maintain ERISA Fidelity Bond Coverage

Choose and Oversee 401(k) Providers

Consequences of Failing to Meet Fiduciary Responsibilities

How to Limit Liability as a 401(k) Plan Administrator

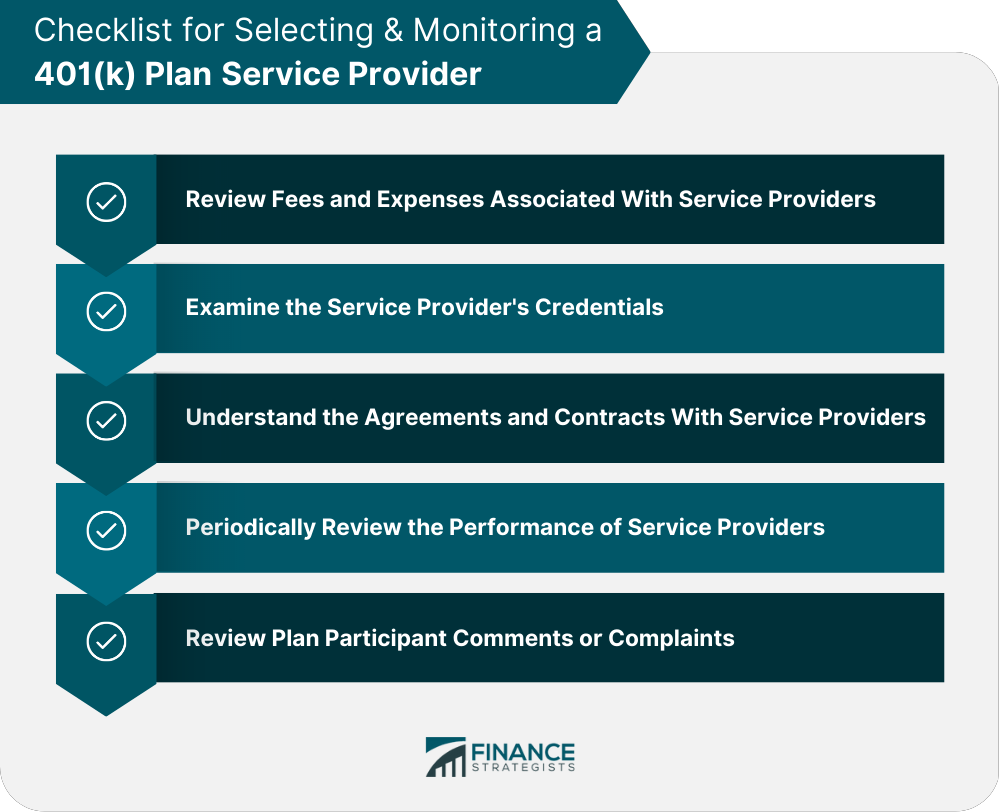

Tips for Selecting & Monitoring a 401(k) Plan Service Provider

Review Fees and Expenses Associated With Service Providers

Examine the Service Provider's Credentials

Understand the Agreements and Contracts With Service Providers

Periodically Review the Performance of Service Providers

Review Plan Participant Comments or Complaints

Final Thoughts

A Guide to 401(k) Plan Administrator Fiduciary Responsibilities FAQs

Fiduciary duties exist to guarantee that those managing other individuals' finances are serving the best interests of their beneficiaries rather than pursuing their selfish gain. Fiduciary responsibility is an important part of 401(k) plan administration as it helps to ensure that the plan's investments are well-managed and that employees' funds are protected.

If 401(k) plan administrator fails to perform their fiduciary duties, they may be held liable for any losses incurred by the plan. In addition, the Department of Labor may impose fines or require corrective action to protect beneficiaries.

Yes, a 401(k) plan administrator can be held personally liable for losses incurred by the plan if they breach their fiduciary duties. In such cases, beneficiaries may be able to seek legal recourse to recover any lost assets.

401(k) plan administrators should regularly review their plan's investments and expenses to ensure that they fulfill their fiduciary responsibilities. The frequency of these reviews can vary depending on the complexity of the plan, but at least annual reviews are typically recommended as best practice.

A 401(k) Plan Administrator must be aware of any potential conflicts of interest when making decisions with respect to the plan. This includes avoiding self-dealing and ensuring that any fees charged by third-party service providers are reasonable and disclosed to participants in a transparent manner. Additionally, fiduciaries should avoid taking risks that could lead to losses or liabilities for the plan. By understanding these responsibilities and avoiding potential conflicts of interest, 401(k) plan administrators can ensure that they act in their beneficiaries' best interests and fulfill their fiduciary duties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.