The 401(k) Plan Report is a statement that provides an overview of your retirement account's current status, including your contributions, your employer's contributions, investment performance, and other key details. This report, typically issued quarterly or annually by your plan provider, is a snapshot of your account at a particular point in time. It contains specific information about your personal contributions, any employer-matching contributions, the investments you've chosen, and the performance of those investments. Understanding your 401(k) plan report is crucial for effective retirement planning. It allows you to track your savings, evaluate your investment strategy, and make informed decisions about your retirement goals. By reviewing your report regularly, you can identify areas for improvement, such as increasing your contributions or rebalancing your portfolio. The first section of your report generally includes your personal information. This includes your name, address, social security number, and the period covered by the report. It's essential to verify this information for accuracy. The account summary is an overview of your 401(k) account, including your total account balance at the beginning and end of the period, as well as any changes that occurred during that time. Changes can include contributions, investment gains or losses, withdrawals, loan activity, and fees. This section outlines the total contributions made to your account, both by you and your employer, if they provide matching contributions. It's important to verify that all your contributions have been correctly recorded and that your employer's match is accurate, if applicable. The investment performance section details the performance of each investment option in your 401(k) portfolio. This includes the number of shares, the share price, the total value, and the percentage change over the reporting period. This section allows you to track how your investments are performing over time. Your account summary provides a holistic view of your 401(k). This includes your account balance at the start and end of the period, total contributions, investment returns, and any fees or withdrawals. The summary can give you a quick snapshot of your retirement savings progress. The investment section of your 401(k) plan report provides details on the different investment options in your portfolio. By examining this section, you can see which investments are performing well and which ones may not be meeting your expectations. It's important to note, however, that investment performance should be considered over the long term, and short-term fluctuations are to be expected. The contribution activity section is where you'll see the total contributions made to your account during the reporting period. This includes both your contributions and any employer match. By examining this section, you can see if you're on track with your retirement savings goals. Fees and expenses can significantly impact your retirement savings over the long term. The fee section of your 401(k) report will outline any fees associated with your account, including administrative fees, investment management fees, and individual service fees. It's crucial to understand these fees, as they can eat into your retirement savings. If you're not on track with your retirement savings goals, one of the most effective changes you can make is to increase your contributions. Your 401(k) plan report can help you assess whether you're saving enough to meet your retirement goals. If your investments aren't performing as expected, or if your financial goals or risk tolerance have changed, it might be time to reassess your portfolio. Your 401(k) plan report can help you identify which investments are underperforming and may need to be rebalanced. It's important to regularly verify the beneficiary information on your 401(k) plan report. If there have been changes in your life, such as marriage, divorce, or the birth of a child, you may need to update your beneficiary information. Your 401(k) plan report can help you plan for future contributions. If you're not on track to meet your retirement goals, you may need to consider increasing your contributions. Your plan report can provide the information you need to make an informed decision. One of the most common mistakes people make with their 401(k) plan report is simply not reviewing it. Regularly reviewing your report can help you stay on track with your retirement goals and catch any potential errors or discrepancies. Performance metrics can be misleading if not understood correctly. It's important to remember that short-term performance is less significant than long-term trends when it comes to retirement savings. Fees can significantly eat into your retirement savings. It's important to understand all the fees associated with your 401(k) plan and to consider these costs when assessing your overall retirement savings strategy. Beneficiary information should be updated to reflect life changes. Failing to keep this information updated could result in your retirement savings not being distributed according to your wishes. A 401(k) plan report, which offers a detailed snapshot of your retirement savings account, is an invaluable tool for informed financial planning. It furnishes details on contributions, investment performance, applicable fees, and beneficiary information, providing crucial insights to help shape your retirement strategy. Beyond avoiding common missteps such as ignoring the report, misunderstanding performance metrics, or forgetting to update beneficiary details, one should actively use this report to align with retirement goals. It serves as a guide for modifying contribution rates, reevaluating your portfolio, and strategizing future contributions. Incorporating regular review and management of your 401(k) Plan Report into your financial practices ensures that your retirement savings progress aligns with your expectations. For a more structured and personalized approach to securing your retirement, take action today by seeking retirement planning services that are customized to your unique needs.What Is a 401(k) Plan Report?

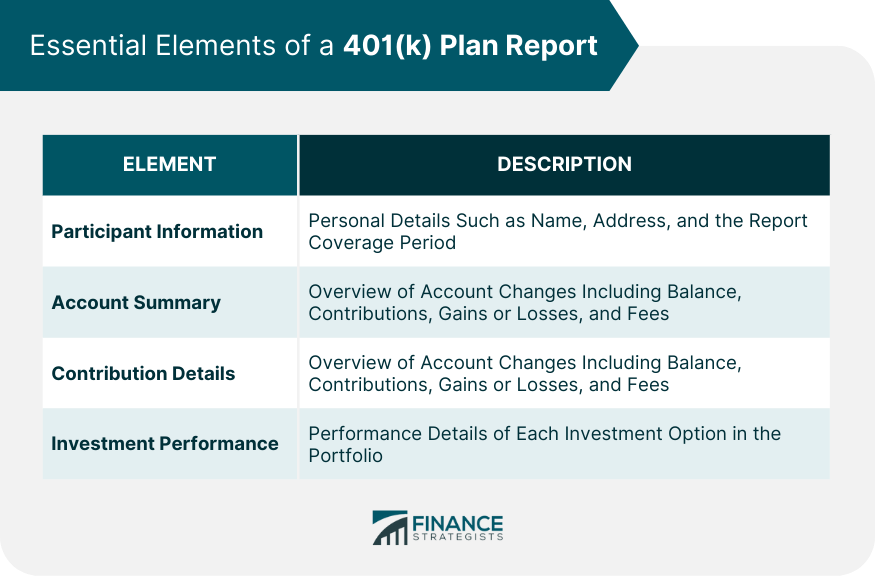

Essential Elements of a 401(k) Plan Report

Participant Information

Account Summary

Contribution Details

Investment Performance

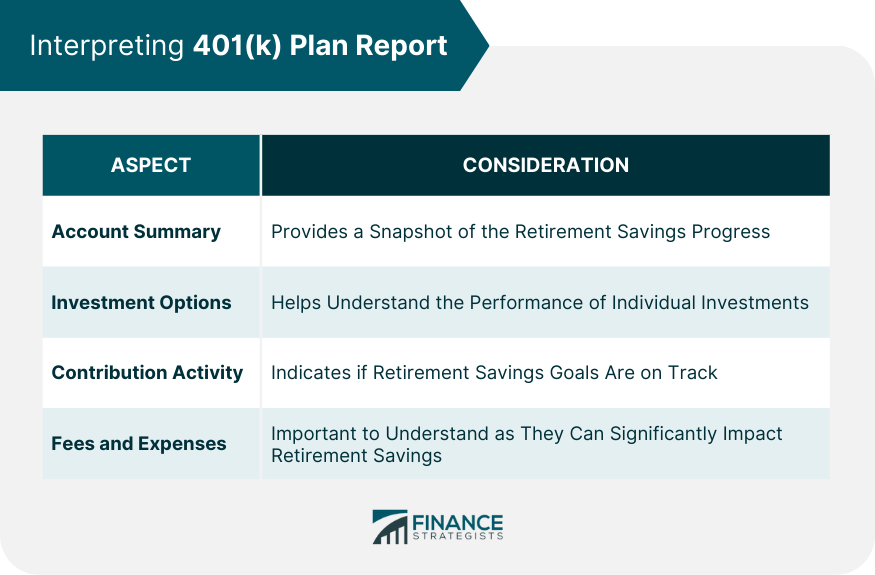

Interpreting Your 401(k) Plan Report

Reading the Account Summary

Understanding Investment Options

Evaluating Contribution Activity

Discerning Fees and Expenses

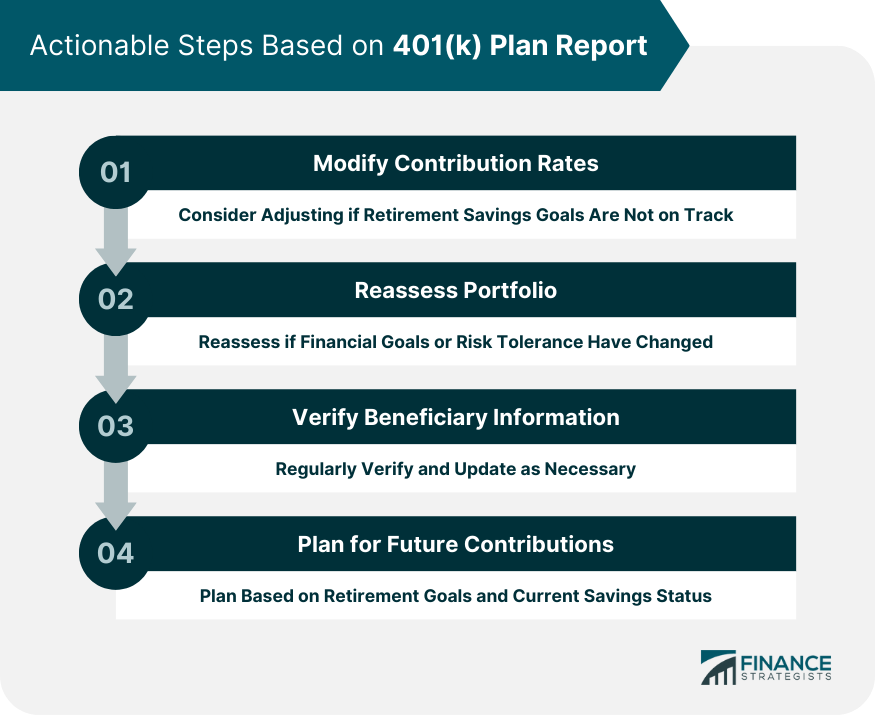

Actionable Steps Based on 401(k) Plan Report

Modify Contribution Rates

Reassess Portfolio

Verify Beneficiary Information

Plan for Future Contributions

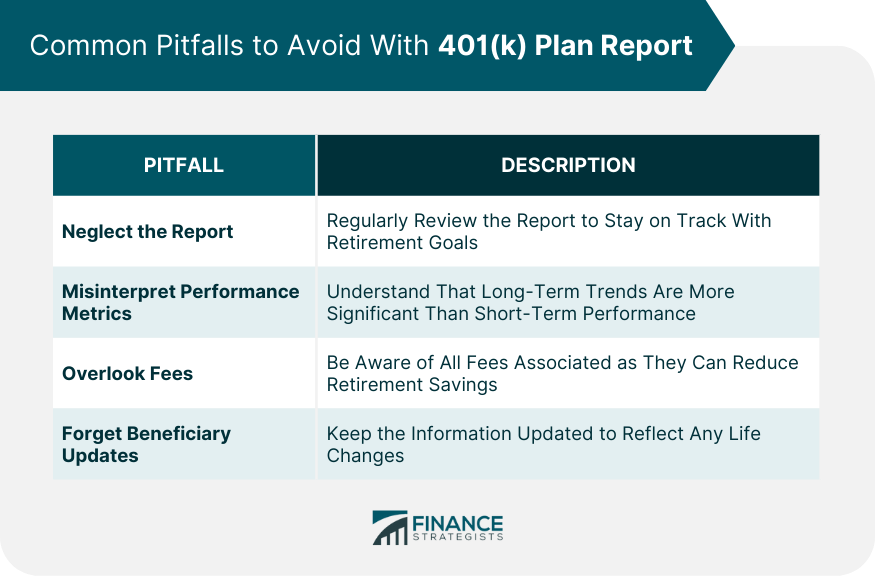

Common Pitfalls to Avoid With 401(k) Plan Report

Neglecting the Report

Misinterpreting Performance Metrics

Overlooking Fees

Forgetting Beneficiary Updates

Final Thoughts

401(k) Plan Report FAQs

A 401(k) plan report is a document that outlines the current status of your retirement savings, including personal contributions, employer contributions, and investment performance.

The account summary provides a snapshot of your 401(k) account, detailing your balance at the beginning and end of the period, total contributions, investment returns, and any fees or withdrawals.

Assessing the investment performance helps you track the performance of your portfolio and make informed decisions about rebalancing if necessary.

You can adjust your contribution rates, reassess your investment portfolio, verify your beneficiary information, and plan for future contributions based on the insights from your 401(k) plan report.

Common mistakes include neglecting the report, misinterpreting performance metrics, overlooking fees, and forgetting to update beneficiary information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.