401(k) plans for businesses are retirement savings plans that allow employees to contribute a portion of their salary on a pre-tax basis. A 401(k) plan is a retirement savings plan sponsored by employers, which allows employees to save and invest a portion of their paycheck before taxes are deducted. Employers may also provide matching or profit-sharing contributions. These plans offer tax advantages and help employees save for retirement while offering businesses potential tax benefits and employee retention. Offering a 401(k) plan not only serves as a key employee benefit but also provides businesses with tax advantages. In a 401(k) plan, employees can contribute a percentage of their pre-tax salary toward their retirement savings. The specific amount is often subject to annual limits set by the Internal Revenue Service (IRS). For 2024, the maximum employee contribution limit is $23,000 for those under 50. Employees aged 50 or over are allowed an additional "catch-up" contribution of $7,500, which aims to assist those nearing retirement in bolstering their retirement savings. In addition to employee contributions, employers can also contribute to the 401(k) plan. These contributions can take several forms, including matching contributions, non-elective contributions, or profit-sharing contributions. Employer matching contributions involve the employer matching a portion of the employee's own contribution to the plan. Non-elective contributions are those made by the employer regardless of the employee's own contribution. Profit-sharing contributions are discretionary contributions that the employer can make from its profits. The amount and type of employer contributions can vary depending on the organization's financial situation and goals. 401(k) plans provide significant tax advantages. Employee contributions are made on a pre-tax basis, which reduces the employee's current taxable income. Any investment gains on these contributions grow tax-deferred until withdrawal. Employer contributions are tax-deductible for the business, and the earnings on these contributions also grow tax-deferred. Additionally, some small businesses may be eligible for tax credits to offset the costs of setting up and administering a 401(k) plan. A traditional 401(k) plan offers the highest level of flexibility for employers. It allows employers to choose whether to make contributions on behalf of all participants, match employees' deferrals, or do both. These plans require annual testing to ensure that the benefits do not disproportionately favor highly compensated employees. In a traditional 401(k) plan, the employer has the flexibility to decide each year whether to make contributions on an employee's behalf and how much those contributions will be. However, these discretionary contributions must meet certain nondiscrimination requirements. A safe harbor 401(k) plan is similar to a traditional 401(k) plan, but it exempts employers from most annual tests that a traditional 401(k) must undergo. To qualify for these exemptions, the employer must make contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The Safe Harbor 401(k) provides an excellent choice for employers who want to maximize contributions while avoiding annual compliance testing. Simple 401(k) plans are retirement plans for small businesses - those with 100 or fewer employees. Like safe harbor 401(k) plans, they're exempt from annual nondiscrimination testing but have lower contribution limits. Under the Simple 401(k), the employer is required to make either a matching contribution, up to 3% of an employee's compensation, or a non-elective contribution of 2% of an employee's compensation. Employees can also make salary deferral contributions to the Simple 401(k) plan. They can make salary deferral contributions to the Simple 401(k) plan up to the annual contribution limit, which is $16,000 for 2024, with catch-up contribution of $3,500. For employees to participate in a 401(k) plan, they must meet certain eligibility requirements, which are typically defined in the plan document. These requirements may include reaching a certain age (usually 21) and completing a specific period of service. However, employers can choose less restrictive eligibility requirements. Once employees satisfy the plan's eligibility requirements, they can choose to opt into the plan and determine how much they want to contribute from their paycheck. The IRS sets minimum coverage requirements to ensure that a 401(k) plan benefits a broad group of employees and not just highly compensated employees or key employees. These minimum coverage tests are designed to prevent discrimination in favor of highly compensated or key employees. Under these requirements, either a specific percentage of non-highly compensated employees must be covered, or the plan must meet an average benefits test. Automatic enrollment is a feature that can be included in a 401(k) plan to increase employee participation. Under this feature, an employee is automatically enrolled in the employer's plan unless they explicitly choose to opt-out. The employer sets a default contribution rate at which a percentage of the employee's wages is deducted and invested in the plan's default investment. Automatic enrollment can be an effective tool for boosting retirement savings and improving plan participation rates among employees. Plan sponsors, typically the employer, have a variety of responsibilities in managing a 401(k) plan. These include creating the plan document, arranging a trust for the plan's assets, keeping detailed records, providing participants with information about the plan, and filing annual returns with the IRS. Managing a 401(k) plan also requires certain administrative tasks, such as enrolling participants, handling contributions and distributions, and testing the plan annually for compliance. Plan sponsors often partner with third-party administrators or record keepers to help manage these tasks. Under the Employee Retirement Income Security Act (ERISA), those responsible for managing 401(k) plans have fiduciary responsibilities. This means they must act solely in the interest of the plan participants and their beneficiaries. Fiduciaries must carry out their duties prudently, follow the plan documents, diversify plan investments, and ensure the plan's expenses are reasonable. Fiduciary responsibilities carry legal liabilities, and failing to meet these standards can result in penalties or legal action. Plan sponsors also have the responsibility of communicating and educating employees about the 401(k) plan. This includes providing plan participants with detailed information about their rights and the features of the plan. Education can cover a range of topics, from the basics of saving and investing to the specifics of the plan's investment options. Effective communication and education can encourage participation and help employees make informed decisions about their retirement savings. Mutual funds are a common investment option in 401(k) plans. These funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer diversification and professional management but can vary widely in terms of risk, return, and fees. Index funds are a type of mutual fund designed to track a specific market index, such as the S&P 500. These funds offer broad market exposure and typically have lower fees than actively managed funds. Index funds can be a good choice for plan participants seeking a low-cost, passive investment strategy. However, like all investments, they carry some degree of risk, including the risk of market declines. Target-date funds are increasingly popular as a 401(k) plan investment. These funds adjust their asset mix over time, becoming more conservative as the target retirement date approaches. For example, a target-date fund designed for those retiring in 2040 will initially hold a higher percentage of stocks, gradually shifting towards bonds and other fixed-income securities as the target date nears. This automatic adjustment can be helpful for participants who prefer a "set it and forget it" approach to their retirement savings. Vesting refers to the ownership rights an employee acquires over their employer's contributions to their 401(k) account. Under a vesting schedule, these rights accrue over time based on the employee's years of service. For example, under a six-year graded vesting schedule, an employee would earn a 20% vested interest in their employer's contributions for each year of service, becoming fully vested after six years. Upon reaching retirement age, plan participants can start taking distributions from their 401(k) plan. The distributions are generally subject to federal (and possibly state) taxes. The plan may offer several distribution options, such as lump-sum payments, annuity payments, or rollovers into an IRA or another employer's plan. In certain circumstances, plan participants may be able to take a loan or hardship withdrawal from their 401(k) plan. Hardship withdrawals are permitted for immediate and heavy financial needs, but they are subject to taxes and possible early withdrawal penalties. Loans allow plan participants to borrow from their account balance and repay the loan with interest to their own account. However, if a participant fails to repay the loan on time, it could become a taxable distribution. This includes notifying plan participants, distributing all assets, filing a final plan tax return, and possibly filing a termination notice with the Department of Labor. All plan participants become 100% vested in their account balances when the plan terminates. Following plan termination, participants can roll over their account balance into an IRA or another employer's plan to avoid immediate taxation. When employees leave a company, they typically have several options for their 401(k) account. They can leave the money in the former employer's plan, roll over the assets into a new employer's plan or an IRA, or cash out the account. While cashing out may provide immediate funds, it may also result in significant taxes and penalties. In most cases, rolling over the 401(k) balance into another tax-advantaged plan is the best option to maintain the tax benefits and continue to save for retirement. Once a plan participant reaches the age of 73, they generally must start taking required minimum distributions (RMDs) from their 401(k) plan each year. The amount of the RMD is based on IRS life expectancy tables and the participant's account balance. Failing to take the RMD can result in a hefty penalty of 50% of the amount that should have been withdrawn. Therefore, understanding and planning for RMDs is crucial as participants approach and enter retirement. 401(k) plans for businesses are valuable retirement savings options that offer benefits to both employees and employers. These plans allow employees to contribute a portion of their salary on a pre-tax basis, helping them save for retirement. Employers can also make contributions, such as matching or profit-sharing contributions, which can aid in attracting and retaining employees. The tax advantages of 401(k) plans allow ontributions and earnings growing tax-deferred until withdrawal. Businesses may also be eligible for tax credits related to these plans. There are different plan options available, including traditional, safe harbor, and Simple 401(k) plans. Employers have responsibilities as plan sponsors, including managing administrative tasks, fulfilling fiduciary duties, and providing employee education and communication. Investment options within 401(k) plans typically include mutual funds, index funds, and target-date funds. Vesting schedules determine the ownership rights of employees over employer contributions, and distribution options are available upon retirement. What are 401(k) Plans for Businesses?

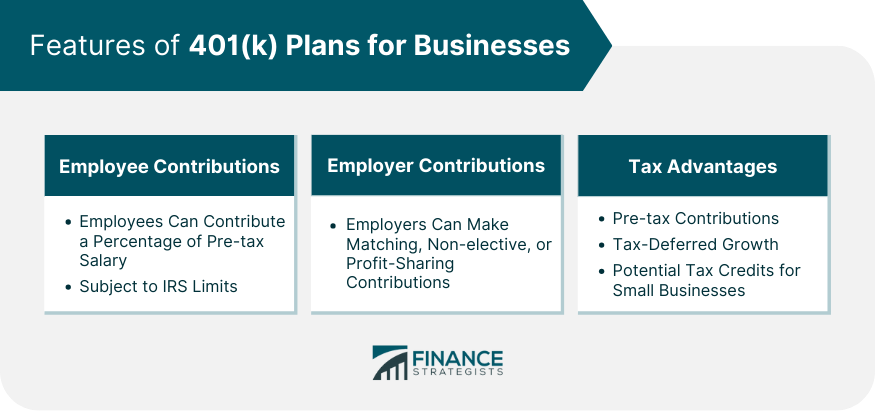

Features of 401(k) Plans for Businesses

Employee Contributions

Employer Contributions

Tax Advantages

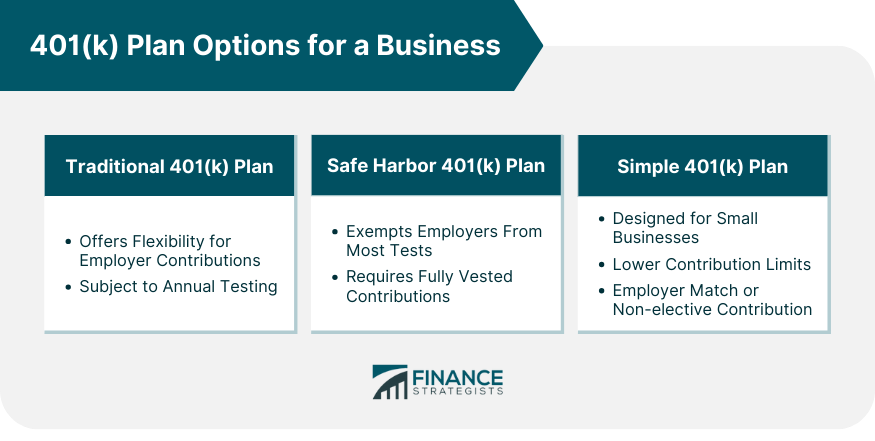

401(k) Plan Options for a Business

Traditional 401(k) Plan

Safe Harbor 401(k) Plan

Simple 401(k) Plan

401(k) Plan for Business Requirements

Employee Eligibility

Minimum Participation

Automatic Enrollment

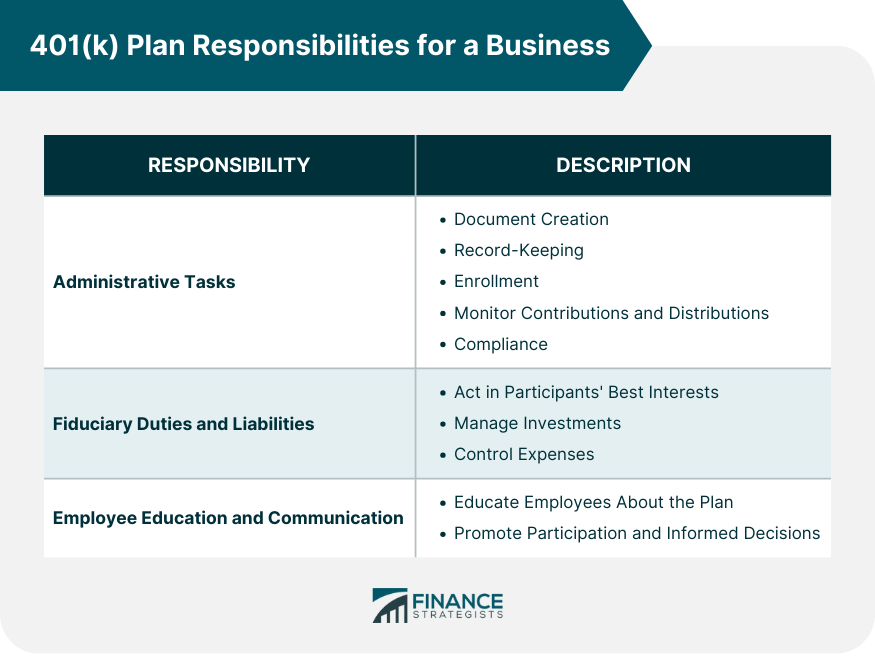

401(k) Plan for a Business Responsibilities

Administrative Tasks

Fiduciary Duties and Liabilities

Employee Education and Communication

Types of 401(k) Plan for a Business Investment Options

Mutual Funds

Index Funds

Target-Date Funds

Employee Benefits and Vesting

Employee Vesting Schedules

Retirement Benefits and Distribution Options

Hardship Withdrawals and Loans

401(k) Plan for a Business Plan Termination and Rollovers

Process

Rollover Options

Required Minimum Distributions

Conclusion

401(k) Plans For Businesses FAQs

A 401(k) plan is a tax-advantaged retirement savings plan sponsored by an employer. It allows employees to save and invest a portion of their pre-tax salary. Employers can also contribute to employees' accounts.

Contributions to a 401(k) plan are made pre-tax, reducing the employee's taxable income. Both employee and employer contributions grow tax-deferred until withdrawal. Additionally, employer contributions are tax-deductible for the business.

Employers are responsible for creating the plan, arranging a trust for the plan's assets, providing plan information to employees, and filing annual returns with the IRS. They also have fiduciary responsibilities to act in the best interest of the plan participants.

Common investment options include mutual funds, index funds, and target-date funds. These options provide a range of risk and return profiles to meet different investor needs and preferences.

When employees leave a company, they can choose to leave the money in the former employer's plan, roll over the assets into a new employer's plan or an IRA, or cash out the account. However, cashing out can lead to taxes and penalties, so a rollover is often the best option. If the employer terminates the plan, all participants become fully vested and must roll over their assets to avoid immediate taxation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.