A 401(k) plan, named after the tax code that defines it, is a retirement savings plan sponsored by employers. It allows workers to save and invest part of their paychecks before taxes are taken out. Taxes are only paid once the money is withdrawn from the account. The primary benefit of a 401(k) is immediate tax savings. The money invested in a 401(k) is tax-deferred, which means you pay taxes only when you withdraw it, typically in retirement when your tax bracket may be lower. This allows the contributions to grow tax-free over time. Additionally, many employers offer matching contributions to a 401(k), effectively providing free money to those who participate in the plan. This match can significantly increase the value of retirement savings and provide a compelling incentive for employee participation. In the restaurant industry, the workforce is often characterized by high turnover rates, a large percentage of part-time or seasonal workers, and a broad range of ages and financial literacy levels. As such, a one-size-fits-all approach to 401(k) plans may not work well. Restaurants can adapt 401(k) plans to better suit their unique workforce in several ways. For instance, they can choose a plan with a short eligibility period, allowing workers to start contributing sooner. They can also provide educational resources to help employees of all backgrounds and life stages understand the benefits of participating. More importantly, restaurants can consider offering a Roth 401(k) option. Unlike traditional 401(k)s, Roth 401(k)s are funded with after-tax dollars, but withdrawals in retirement are tax-free. This might be appealing to younger, lower-wage workers who are currently in a lower tax bracket. Before setting up a 401(k) plan, restaurants must consider their unique circumstances and the needs of their employees. Restaurants, especially those in the fast-food sector, are known for high employee turnover. While a 401(k) plan can help with retention, it also means that the restaurant will need to manage many small accounts and deal with frequent enrollments and withdrawals. Many restaurant workers are part-time or seasonal, which can complicate 401(k) participation. However, the IRS requires that any employee who worked at least 1,000 hours in a previous year be allowed to participate in the 401(k) plan. Restaurant workers are a diverse group with varying levels of income, financial literacy, and retirement savings needs. Restaurants should ensure their 401(k) plan and accompanying education efforts cater to this diversity. This provider should be familiar with the challenges and needs of the restaurant industry. They should offer plans that are flexible enough to accommodate the high turnover, part-time and seasonal workers, and diverse demographics of restaurant employees. When designing the 401(k) plan, the restaurant should consider offering features that make the plan attractive to its employees. This might include a generous matching contribution, a Roth 401(k) option, immediate vesting of employer contributions, and a wide range of investment options. Once the plan is set up, the restaurant will need to enroll its eligible employees. This includes not just providing them with enrollment materials but also educating them on the benefits of participating and how to manage their account. Offering a 401(k) plan comes with a host of legal obligations. Restaurants will need to ensure they comply with all relevant laws and regulations, including the Employee Retirement Income Security Act (ERISA), IRS rules, and Department of Labor regulations. They will also need to conduct nondiscrimination testing to ensure the plan does not favor highly compensated employees. These compliance requirements can be complex and time-consuming. Therefore, restaurants should work closely with their 401(k) plan provider and possibly a third-party administrator to ensure they meet all their obligations. It's also worth noting that the restaurant industry is subject to certain laws and regulations that can impact their 401(k) plan. For instance, tips are considered part of an employee's wages for retirement plan purposes, so restaurants will need to take this into account when calculating 401(k) contributions. One of the most significant benefits of a 401(k) plan for restaurant employees is the potential for financial stability in retirement. Even modest contributions can grow substantially over time thanks to the power of compound interest. This can provide a critical source of income in retirement, reducing reliance on Social Security. Contributions to a traditional 401(k) plan are made pre-tax, reducing the employee's current taxable income. Also, the money grows tax-free until it is withdrawn in retirement. In the case of Roth 401(k) contributions, while they are made with after-tax dollars, both the contributions and the earnings can be withdrawn tax-free in retirement, offering a significant tax advantage. Offering a 401(k) plan can also boost employee morale and job satisfaction. Employees are likely to feel more valued and secure knowing that their employer cares about their long-term financial well-being. This can lead to increased job satisfaction and commitment to the company. Just as employees get tax benefits from 401(k) plans, so do employers. Contributions that the restaurant makes to the plan, such as matching contributions or profit-sharing, are tax-deductible for the business. Moreover, any expenses related to managing the plan, such as administrative costs or consulting fees, can be deducted as a business expense. Offering a 401(k) plan can enhance a restaurant's appeal as a workplace. It shows prospective employees that the business is invested in their long-term financial well-being, which can help attract high-quality talent. In an industry known for high turnover, this can be a significant advantage. A 401(k) plan can also increase employee loyalty. Employees who feel valued and secure in their financial future are likely to stay with the company longer, reducing turnover costs. Additionally, employees who are not worried about their financial future may be more productive and focused at work. One of the biggest challenges of providing a 401(k) plan in the restaurant industry is the cost. Restaurants often operate on thin margins, and the costs associated with setting up and administering a 401(k) plan can be significant. However, these costs must be weighed against the benefits of attracting and retaining quality employees and the tax benefits the plan can provide. Restaurants often operate outside of the standard 9-5 workday, and many employees work part-time or irregular hours. This can make administering a 401(k) plan more complicated. Ensuring that all employees have an equal opportunity to participate and receive communications about the plan can require extra effort. Given the diverse nature of the restaurant workforce, ensuring all employees understand the value of the 401(k) plan and how to participate can be a challenge. Restaurants may need to offer education and communication in multiple languages and formats and take extra steps to engage younger workers or those with less financial literacy. As mentioned earlier, offering a 401(k) plan comes with a host of legal obligations. In addition to the general regulations that all industries must comply with, restaurants must also take into account industry-specific laws and regulations. This can add a layer of complexity to the plan administration. A 401(k) plan is a retirement savings program that restaurants can provide as a part of their employee benefits package. Through the right plan design, consideration of unique workforce attributes, and diligent compliance with regulations, restaurants can successfully implement a 401(k) plan that caters to the needs of their employees. Offering a 401(k) plan provides several benefits in the restaurant industry. Employees gain a valuable tool for building financial stability and enjoying tax advantages, which can increase job satisfaction. Meanwhile, employers enjoy tax benefits, enhanced workplace appeal, and increased employee loyalty. Despite the challenges, such as cost concerns and the need for ongoing administration and regulatory compliance, the value of 401(k) plans is evident. Restaurants need to select the right plan provider, design the plan considering their unique workforce, and invest in employee education to ensure the success of the plan.Overview of 401(k) Plans

How 401(k) Plans Can Be Adapted to Fit the Specific Needs of Restaurant Workers

Implementing 401(k) Plans in a Restaurant Setting

Key Considerations Unique to Restaurants

High Employee Turnover Rates

Part-Time and Seasonal Workers

Diverse Employee Demographics

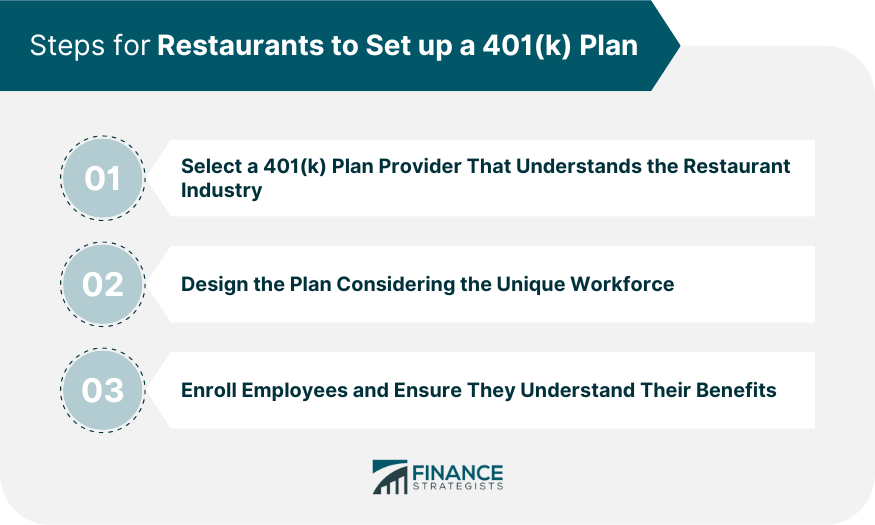

Steps for Restaurants to Set up a 401(k) Plan

Select a 401(k) Plan Provider That Understands the Restaurant Industry

Design the Plan Considering the Unique Workforce

Enroll Employees and Ensure They Understand Their Benefits

Regulatory Compliance Specific to the Restaurant Industry

Impact of 401(k) Plans on Restaurant Employees and Employers

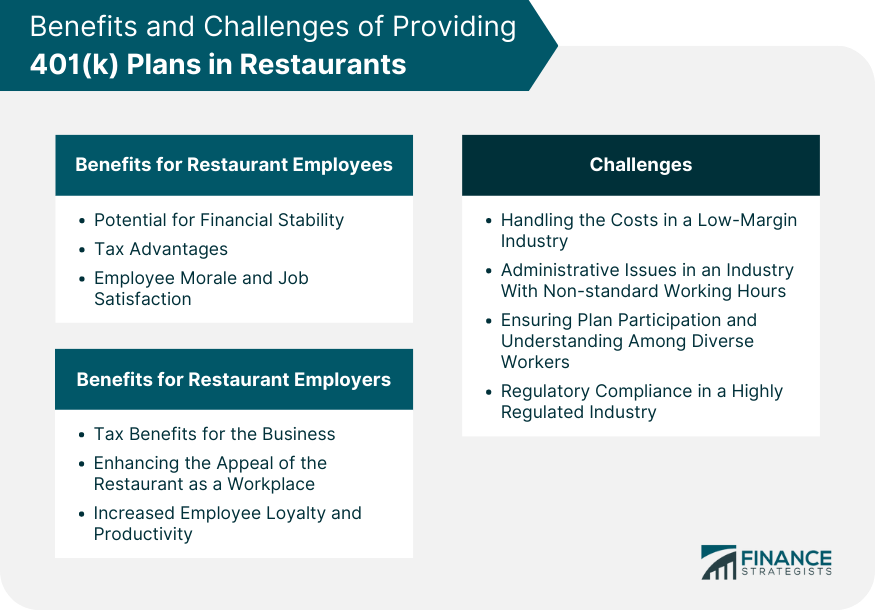

Benefits for Restaurant Employees

Potential for Financial Stability

Tax Advantages

Employee Morale and Job Satisfaction

Benefits for Restaurant Employers

Tax Benefits for the Business

Enhancing the Appeal of the Restaurant as a Workplace

Increased Employee Loyalty and Productivity

Challenges of Providing 401(k) Plans in Restaurants

Handling the Costs in a Low-Margin Industry

Administrative Issues in an Industry With Non-standard Working Hours

Ensuring Plan Participation and Understanding Among Diverse Workers

Regulatory Compliance in a Highly Regulated Industry

The Bottom Line

401(k) Plans for Restaurants FAQs

Restaurant employees benefit from potential financial stability in retirement, immediate tax advantages, and increased job satisfaction through the provision of a 401(k) plan.

Offering a 401(k) plan enhances the appeal of the restaurant as a workplace, provides tax benefits for the business, and boosts employee loyalty and productivity.

Restaurants may face challenges such as handling the costs in a low-margin industry, dealing with administrative issues due to non-standard working hours, ensuring plan participation and understanding among diverse workers, and meeting regulatory compliance.

Restaurants can adapt 401(k) plans to their workforce's needs by choosing a plan with a short eligibility period, offering a Roth 401(k) option, and providing educational resources on the benefits of participating in the plan.

Regulatory compliance adds a layer of complexity to 401(k) plan administration in restaurants, as they must adhere to general regulations that all industries must comply with, as well as industry-specific laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.