A 401(k) rollover is moving assets from one account to another. A 401(k) rollover may be necessary when you leave your employer, retire, or are unable to continue making contributions toward your 401(k) plan. If you leave your job, the amount of money in your 401(k) accounts will need to be rolled over into either another retirement plan or an IRA since it cannot remain in the former employer's 401(k). Have questions about 401(k) Rollovers? Click here. Rolling over a 401(k) means transferring all or part of these plans into an IRA or another employer-sponsored plan such as a qualified pension, profit-sharing, simplified employee pension (SEP), or 401(k) plan. You can either have the money sent directly to the new plan or IRA, or you can take possession of the funds and do the rollover yourself. However, if you choose to do the rollover yourself, you must complete it within 60 days of receiving the distribution. There are two ways to rollover a 401k: a direct rollover and a 60-day rollover. A direct rollover is when the money goes straight from your old account to your new account without ever touching your hands. This is usually done by your former employer sending the money directly to your new 401(k) plan or IRA account. The advantage of this method is that there are no tax consequences since the money never hits your wallet. You'll still have to pay taxes on the funds once you withdraw, but you will not incur a penalty from the IRS since you did not actually receive a distribution from your old 401(k) account. A 60-day rollover is when you take possession of the funds and then redeposit it into an IRA or new employer plan within sixty days. The benefit of taking possession of the assets yourself is that this gives you enough time to find out whether or not a direct rollover is allowed. For instance, if your new employer's plan does not accept incoming rollovers, there would be no reason for them to complete a direct rollover, so instead, they may send the funds to you and you would have to do a 60-day rollover. The downside of this option is that if the funds are not deposited back into an IRA or new employer plan within 60 days, the money will be treated as a taxable distribution and you will likely have to pay a 10% penalty for withdrawing funds before retirement. Here are the steps in completing a 401(k) rollover: This process can be a little daunting because there are so many different types of IRA accounts to choose from. The most common are Roth and traditional IRAs. It is an advantage to transfer your old 401k into another retirement plan of the same nature as a traditional IRA or Roth IRA or another Roth 401(k). This will help you avoid paying taxes on the distribution when you eventually withdraw the money. You have a few different options here, but it is important to do your research to make sure you are getting the best deal. Most people choose online brokerages because they offer low-cost trading and a wide variety of investment options. You may also opt for a full-service broker, but this will likely come at a higher cost. Finally, some people choose to set up their IRA account with their current bank. Once you have chosen the type of IRA account and where to open it, you can start the process of rolling over your 401(k). This is usually done by filling out a form provided by the new account provider and sending it back along with a copy of your old 401(k) statement. It is in this stage where you decide whether to do a direct rollover or a 60-day rollover. You now have a few options to choose from when deciding how and where you will invest the money deposited into your new IRA account. You can take advantage of low-cost index funds, Robo advisors, or traditional stockbrokers depending on which path you wish to take as far as finances go. When doing a 401(k) rollover there are many different taxes that come into play regarding both withdrawals and contributions moving forward. First off, it is important to remember that all distributions taken prior to age 59 1/2 will result in a 10% penalty unless an exception applies. In addition, it is important to remember that doing a 401(k) rollover will not change the taxation of your contributions as they are subject to normal income tax rates. It is only your contribution limits that will be affected moving forward after making a 401(k) rollover. Doing the rollover via direct rollover will have the least amount of tax implications as the money technically never leave the account. If you do a 60-day rollover, on the other hand, you will be taxed on the withdrawal and then have another 60 days to put the money back into an IRA or employer plan. Now that you understand all of the different tax implications of doing a 401(k) rollover, it is important to weigh out the pros and cons to see if this is the right decision for you. The biggest pro of doing a 401(k) rollover is that it allows you to keep your money in a retirement account, which can help defer taxes and allow the funds to grow tax-free until you withdraw them. Another advantage of making a 401(k) rollover is the accession of more investment freedom along with higher contribution limits. When you roll over your 401(k), as long as the new account is also a traditional IRAs or Roth IRA, there are no income limitations on who can contribute to it. You will now be able to make contributions from any type of employment income and earn any amount of money you want without penalty. The biggest con of doing a 401(k) rollover is that it leaves you with fewer investment options than staying put in the old account. This may not seem like a big deal now, but if you end up changing jobs multiple times throughout your career then this could end up being more costly for you financially. Before making the decision to do a 401(k) rollover, it is important to consult with a financial advisor to weigh out all of the different consequences both short and long term. This is a big decision that should not be taken lightly and should only be done if it is the best option for your specific situation. How Does a 401(k) Rollover Work?

Direct Rollover

60-Day Rollover

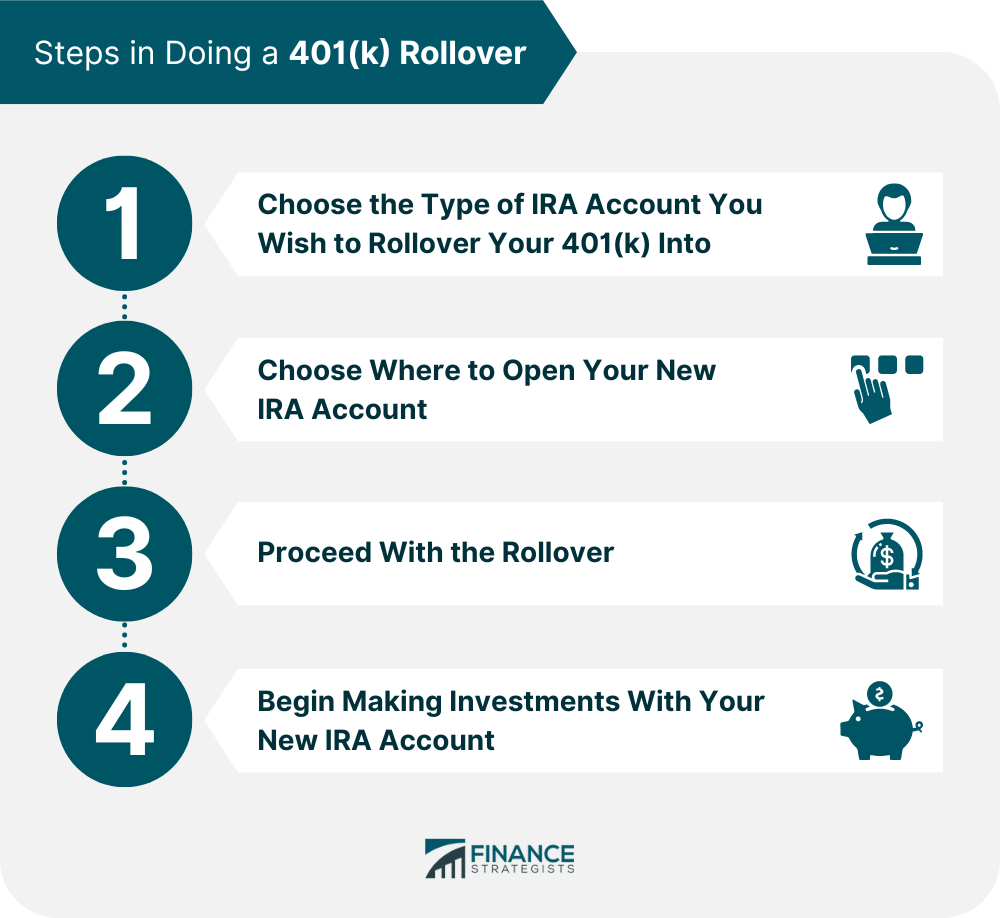

Steps in Doing a 401(k) Rollover

1. Choose the type of IRA account you wish to rollover your 401(k) into.

2. Choose where to open your new IRA account.

3. Proceed with the rollover.

4. Begin making investments with your new IRA account.

Tax Implications of Making a 401(k) Rollover

Pros and Cons of Making a 401(k) Rollover

Final Thoughts

401(k) Rollover FAQs

Some people might be tempted to simply cash out their 401(k) when they leave their jobs to avoid any penalties. However, this is a big financial mistake as it is better to keep your money in a tax-advantaged account. Once you have left your employer-sponsored plan, most providers will allow you to continue making contributions into the same account with some limitations. You can therefore choose to rollover your 401(k) to an IRA, as this will give you more investment freedom and have less tax implications.

There are no additional taxes associated with rolling over your 401(k) to an IRA. You will only need to pay taxes if you choose to withdraw the money before reaching retirement age.

The entire process of doing a 401k rollover should only take a few days. However, you will have 60 days to put the money back into an IRA or employer-sponsored plan if you do a 60-day rollover.

Yes, you can do a 401(k) rollover even if you are still employed. However, make sure that you are aware of any restrictions that might be placed on contributions from your current employer.

Yes, you can continue making contributions to your old 401(k) after doing a rollover but there may be some limitations on how much you can contribute.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.