A 401(k) and an Individual Retirement Account (IRA) are both powerful vehicles for retirement savings, offering tax advantages that can significantly amplify growth over time. A 401(k) is an employer-sponsored retirement account where employees can contribute a portion of their pre-tax earnings. Employers often match a percentage of these contributions, making 401(k)s an attractive option. However, they typically have limited investment options. An IRA, on the other hand, is an account individuals can open independently, irrespective of their employment. It offers a broader range of investment options than a 401(k), but lacks the employer-matching benefit. IRA contributions may be tax deductible, depending on the individual's income and participation in an employer-sponsored plan. Both 401(k)s and IRAs come in traditional (tax-deferred) and Roth (tax-free withdrawal) variants. Choosing between the two often involves assessing individual financial circumstances, tax implications, and investment preferences.

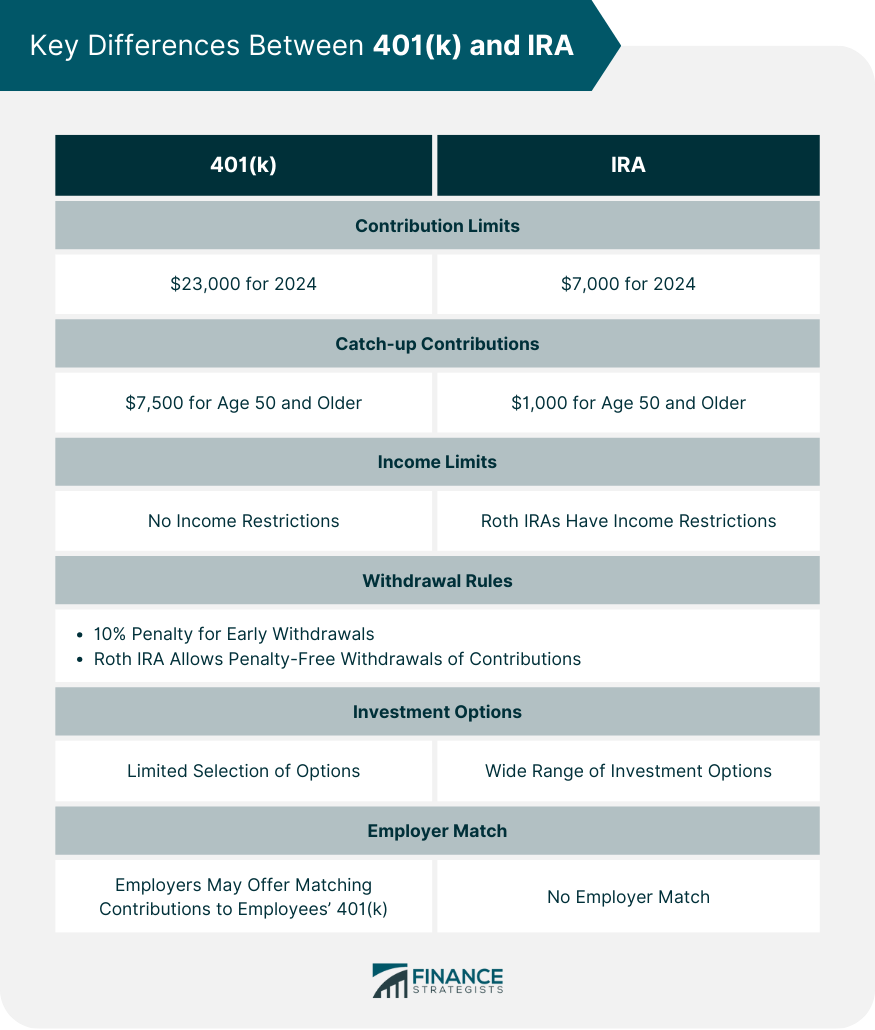

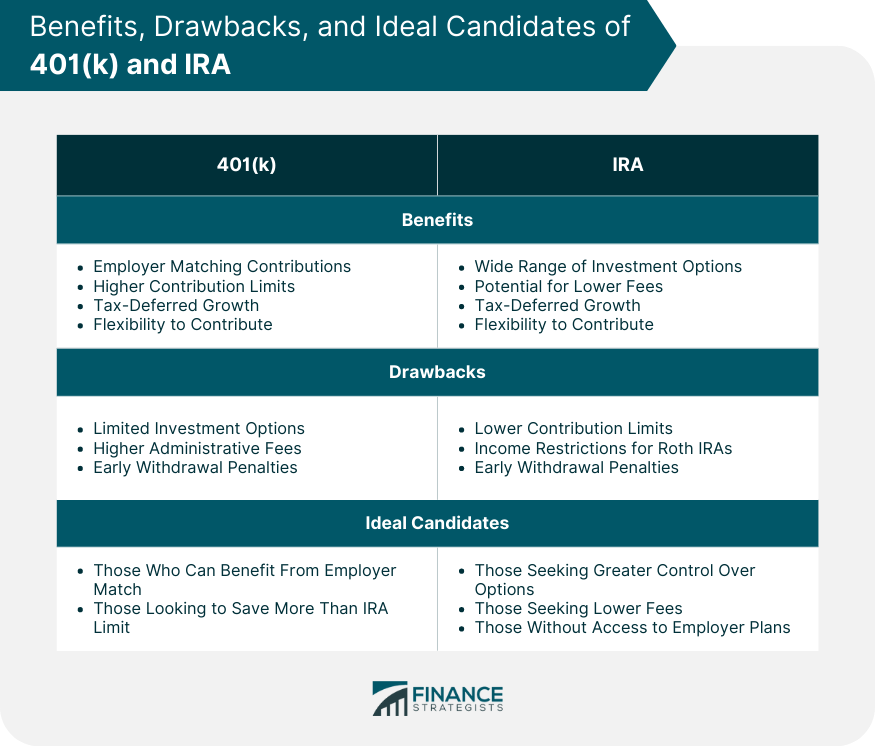

A 401(k) is a retirement savings plan that employers offer to their employees. It gets its name from the section of the IRS code that governs it. The allure of a 401(k) lies in its ability to offer a significant nest egg upon retirement by allowing employees to squirrel away a portion of their pre-tax income into these accounts. The 401(k) comes in two forms. The Traditional 401(k) plan allows employees to make pre-tax contributions. The contributions are deducted from your paycheck before taxes, lowering your overall taxable income. The trade-off comes in retirement when you begin making withdrawals, which are then taxed. The Roth 401(k) is the second form of 401(k) plans. Contributions to a Roth 401(k) are made with post-tax dollars, meaning you pay taxes on your income before you contribute. The upside is that all withdrawals made in retirement from a Roth 401(k) are tax-free, assuming you meet the necessary conditions. An Individual Retirement Account, or IRA, is a type of retirement savings account that individuals set up independently, without employer sponsorship. Like a 401(k), an IRA provides certain tax advantages that promote savings for retirement. A Traditional IRA allows individuals to make pre-tax contributions, which reduces your taxable income for the year in which you contribute. However, similar to a traditional 401(k), withdrawals in retirement are taxed. The Roth IRA follows the same principle as the Roth 401(k). Contributions are made with post-tax dollars, meaning you pay taxes on your income upfront. However, withdrawals in retirement are tax-free as long as you meet the necessary conditions. 401(k) plans and IRAs are both retirement savings accounts that offer tax benefits, but there are some key differences between the two. The IRS sets annual contribution limits for both 401(k)s and IRAs. In 2024, the contribution limit for a 401(k) is $23,000 ($23,500 in 2025), and the contribution limit for an IRA is $7,000 (for both 2024 and 2025). If you're 50 or older, you can make catch-up contributions of $7,500 to your 401(k) and $1,000 to your IRA (for both 2024 and 2025). The contribution limits for IRAs. For both 2024 and 2025, the maximum annual contribution limit for both Traditional and Roth IRAs is set at $7,000 for individuals under the age of 50. For individuals aged 50 or older, an additional catch-up contribution of $1,000 is allowed, bringing the total contribution limit to $8,000 (applicable for both 2024 and 2025). It's important to note that these limits apply to the combined contributions across all IRAs held by an individual. Roth IRAs have income restrictions, meaning that high earners might not be able to contribute. However, there are no such income restrictions for Roth 401(k)s, traditional IRAs, or traditional 401(k)s. Both 401(k)s and IRAs discourage early withdrawals (before age 59 ½ ) by imposing a 10% penalty. However, Roth IRAs provide more flexibility by allowing you to withdraw your contributions (but not earnings) at any time without penalties or taxes. 401(k) plans typically offer a limited selection of investment options, such as mutual funds and annuities. IRAs, on the other hand, offer a wider range of investment options, including individual stocks and bonds. Many employers offer a matching contribution to their employees' 401(k) contributions. This means that your employer will contribute a certain percentage of your salary to your 401(k) for every dollar you contribute. This is a great way to boost your retirement savings. This is one of the biggest benefits of a 401(k) plan. Many employers will match a portion of your contributions up to a certain percentage of your salary. This is essentially "free money" that you can use to grow your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, and you contribute 6% of your salary, you will effectively be saving 12% of your salary for retirement. The contribution limits for 401(k) plans are much higher than those for IRAs. For 2024, the contribution limit for a traditional 401(k) is $23,000 ($23,500 in 2025), and $30,500 ($31,000 for 2025) for ages 50 and above. This means that you can save more money for retirement with a 401(k) plan. The earnings on your 401(k) contributions grow tax-deferred. This means that you do not pay taxes on the investment earnings until you withdraw the money from your account in retirement. This can help your money grow faster over time. You can usually contribute to your 401(k) plan through payroll deduction, which makes it easy to save money on a regular basis. You can also make contributions after tax if you prefer. The investment options offered by 401(k) plans can be limited. This is because the plan is subject to the investment restrictions of the plan's provider. This can make it difficult to find the right investments for your retirement goals. The administrative fees associated with managing a 401(k) plan can be higher than those charged by some IRAs. This is because the plan's provider has to cover the costs of administering the plan, such as providing customer service and recordkeeping. If you withdraw money from your 401(k) plan before you reach age 59½, you may have to pay a 10% early withdrawal penalty. There are some exceptions to this rule, such as if you are taking a withdrawal for qualified expenses, such as medical expenses or the purchase of a first home. Given these characteristics, 401(k) plans are likely most advantageous for individuals who can fully capitalize on employer-matching programs. They also serve well for those who wish to save more than the annual IRA limit. IRAs offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. This gives you the flexibility to choose the investments that are right for your individual needs and risk tolerance. IRAs can be a good way to save money on fees. If you choose a low-cost broker, you can keep your fees low. This means more of your money will be working for you to grow your retirement savings. The earnings on your IRA contributions grow tax-deferred. This means that you do not pay taxes on the investment earnings until you withdraw the money from your account in retirement. This can help your money grow faster over time. You can contribute to your IRA on a regular basis or make lump-sum contributions. You can also contribute to your IRA even if you are not working. The contribution limits for IRAs are lower than those for 401(k) plans. For both 2024 and 2025, the contribution limit for a traditional IRA is $7,000, and the contribution limit for a Roth IRA is $7,000. This means that you can save less money for retirement with an IRA. There are income restrictions for Roth IRAs. If your income is too high, you may not be eligible to contribute to a Roth IRA. If you withdraw money from your IRA before you reach age 59½, you may have to pay a 10% early withdrawal penalty. There are some exceptions to this rule, such as if you are taking a withdrawal for qualified expenses, such as medical expenses or the purchase of a first home. Given their features, IRAs may be most suitable for individuals who want greater control over their investment options, those who are seeking lower fees, or individuals who do not have access to an employer-sponsored retirement plan. Both 401(k)s and IRAs offer distinct advantages and can be utilized strategically depending on an individual's specific circumstances. 401(k)s, particularly those with employer match, can greatly amplify retirement savings and allow for higher contribution limits. On the other hand, IRAs, with their wide range of investment options and potential for lower fees, offer more control and flexibility. When deciding between these two retirement savings vehicles, it's crucial to consider factors such as income, age, tax bracket, contribution limits, and personal investment preferences. Moreover, understanding the tax implications of Traditional and Roth versions of these accounts can significantly impact post-retirement finances. As retirement planning can be complex, engaging with a financial advisor to tailor a strategy that best fits your unique financial circumstances is highly recommended.401(k) vs IRA Overview

401(k) vs IRA

Definition of a 401(k)

Definition of an IRA

Key Differences Between 401(k) and IRA

Contribution Limits

Income Limits for Contributions

Withdrawal Rules and Penalties

Investment Options

Employer Match

In-Depth Analysis of 401(k)

Benefits of a 401(k)

Employer Matching Contributions

Higher Contribution Limits

Tax-Deferred Growth

Flexibility to Contribute

Drawbacks of a 401(k)

Limited Investment Options

Higher Administrative Fees

Early Withdrawal Penalties

Ideal Candidates for a 401(k)

In-Depth Analysis of IRA

Benefits of an IRA

Wide Range of Investment Options

Potential for Lower Fees

Tax-Deferred Growth

Flexibility to Contribute

Drawbacks of an IRA

Lower Contribution Limits

Income Restrictions for Roth Iras

Early Withdrawal Penalties

Ideal Candidates for an IRA

Bottom Line

401(k) vs IRA FAQs

A 401(k) is a retirement plan provided by employers, while an IRA (Individual Retirement Account) is set up by individuals. Both offer tax advantages but differ in terms of contribution limits, income restrictions, and investment options.

Ideal candidates for a 401(k) are those who can fully utilize employer-matching programs and those who wish to save more than the annual IRA limit.

An IRA offers a wide range of investment options and potentially lower fees compared to a 401(k). However, the contribution limit is lower, and Roth IRAs have income restrictions.

Yes, you can have both a 401(k) and an IRA. Many people take advantage of their employer's 401(k) match and then invest additional savings in an IRA for greater investment flexibility.

It's beneficial to start saving as early as possible, no matter the retirement account. The earlier you start, the more time your investments have to grow due to compounding.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.