A 401(k) and a mutual fund are distinct financial entities. A 401(k) is a type of employer-sponsored retirement savings plan. It allows employees to contribute a portion of their pre-tax salaries to a tax-advantaged account, potentially matched by employers. The funds are invested, usually in a variety of assets, which may include mutual funds, for long-term growth. On the other hand, a mutual fund is an investment vehicle pooling money from many investors to buy a diversified portfolio of stocks, bonds, or other assets. 401(k)s are savings plans with tax advantages, while mutual funds are investment instruments. You can invest in mutual funds within your 401(k), blending the benefits of both – the tax advantages of a 401(k) and the diversified exposure of a mutual fund. A 401(k) plan is a company-sponsored retirement account that employees can contribute to directly through paycheck withdrawals. The primary purpose is to help employees save for retirement by providing a platform where they can invest their pre-tax earnings. For 2024, the contribution limit for a 401(k) plan is $23,000 for those below 50 years old and $30,500 for those 50 and older. Eligibility for a 401(k) is typically based on an employee's age and length of service, which varies from one company to another. Many employers offer a match to the contributions their employees make to a 401(k). For instance, an employer might match 50% of the employee's contributions up to 6% of their salary. This employer match effectively increases the employee's income and accelerates retirement savings growth. A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities. Mutual funds give small or individual investors access to professionally managed, diversified portfolios, which would be difficult to create with a small amount of capital. These funds invest primarily in stocks, representing shares of ownership in publicly-traded companies. The goal of these funds is to achieve capital appreciation, meaning they want the stocks they invest in to increase in value. Equity funds can further be categorized based on the size of the companies they invest in (small-cap, mid-cap, or large-cap), whether they focus on growth or value investing, or whether they target certain sectors (like technology or healthcare). These funds tend to offer high return potential but also come with a higher level of risk compared to other types of mutual funds. Bond funds are mutual funds that invest in bonds or other types of debt securities. Bonds are essentially IOUs where the issuer (like a government or corporation) borrows money from investors and promises to repay it with interest over a certain period. Bond funds aim to generate income for investors, which can make them a good choice for more conservative investors looking for regular income and less volatility. However, bond funds are still subject to interest rate risk, credit risk, and inflation risk. Index funds are a type of mutual fund or exchange-traded fund (ETF) with a portfolio designed to match or track the components of a financial market index, such as the S&P 500. The goal of an index fund is not to outperform the market but rather to mirror its performance. This type of investment strategy is known as passive investing. Index funds often come with lower fees compared to actively-managed funds because they don't require as much research or active decision-making. They're a popular choice for investors looking for a low-cost, diversified investment. Mutual funds pool money from many investors to purchase a wide variety of securities. This diversification can reduce the risk associated with investing in single stocks or bonds and can help smooth out returns over time. When you invest in a mutual fund, your money is managed by professional portfolio managers who make investment decisions based on thorough research and analysis. This can be especially beneficial for investors who lack the time or expertise to manage their own portfolios. Mutual funds can typically be bought or sold on any day when the markets are open, providing investors with high liquidity. This makes it easier for investors to manage their investments and adjust their portfolios as needed. Mutual funds charge management fees, which can eat into your returns over time. These fees are charged regardless of the fund's performance, so you'll pay them even if the fund loses money. Some mutual funds also charge sales commissions or "loads". While mutual funds are professionally managed, this doesn't guarantee they'll outperform the market. In fact, many actively-managed funds fail to beat their benchmark indexes after fees are taken into account. Profits from mutual funds are subject to capital gains tax when the fund sells a security that has gone up in value. Even if you haven't sold any shares of the fund, you could still owe taxes. Additionally, some mutual fund transactions can trigger a taxable event, potentially creating a tax liability for investors. When you invest in a mutual fund, you're entrusting your money to the fund's managers. This means you don't have control over which specific securities the fund invests in. If the fund's investment strategy doesn't align with your values or goals, this could be a drawback. Like any investment, mutual funds are subject to market risk. The value of the securities within a fund can go up or down based on market conditions, potentially resulting in a loss of your investment. Fees and expenses associated with mutual funds can significantly impact returns. These fees may include management fees, 12b-1 fees, and sales loads. It's essential to understand these costs before investing in mutual funds. 401(k) plans often have a limited range of investment options, typically a selection of mutual funds chosen by the plan provider. Despite these limitations, these options usually offer a balanced array of asset classes and risk levels. In contrast, investing directly in mutual funds offers a vast universe of options. Investors can choose funds based on factors such as asset type, investment strategy, risk level, and geographic focus. 401(k) plans have annual contribution limits, which can restrict the amount an employee can save for retirement through these plans. On the other hand, employer matching contributions, a feature usually not found in mutual funds, can significantly boost the potential returns on 401(k) investments. 401(k) contributions are made pre-tax, meaning they reduce your taxable income for the year. This can provide immediate tax savings. Mutual fund returns are subject to capital gains tax. However, if these funds are held in a tax-advantaged account like an IRA, taxation can be deferred or potentially reduced. 401(k) plans have strict withdrawal rules. Early withdrawals before the age of 59 ½ are subject to penalties, except in certain circumstances. Mutual funds generally allow for redemption at any time, but certain funds may have short-term trading penalties. Additionally, capital gains from selling fund shares can trigger a tax liability. Your investment goals and time horizon will largely dictate whether a 401(k) plan, mutual funds, or a combination of both is right for you. For instance, younger investors might prefer a mix, taking advantage of the tax benefits of 401(k)s and the wider array of options in mutual funds. Your risk tolerance and preferences for diversification will also influence your decision. Those with lower risk tolerance may favor the diversification and professional management of mutual funds, while higher-risk individuals may want to select specific funds within a 401(k). If your employer offers a 401(k) match, contributing enough to capture the full match is typically a good decision. Beyond that, you might consider mutual funds for additional investment opportunities. Utilizing both 401(k) plans and mutual funds for retirement savings can create a balanced, diversified approach that maximizes potential gains while mitigating risk. Firstly, maximizing your 401(k) contributions to take full advantage of any employer matches and tax benefits is a prudent financial strategy. Not only are you effectively receiving free money, but you're also saving on taxes both now and in the future. In addition to maximizing your 401(k), including mutual funds in your portfolio allows for further diversification and the opportunity for potentially higher returns. Mutual funds can also be used within 401(k) plans, offering an easy way to diversify your retirement account. Both 401(k) plans and mutual funds offer distinct advantages and can play a crucial role in achieving a well-rounded retirement strategy. A 401(k) provides tax benefits and an opportunity for an employer match, boosting retirement savings. On the other hand, mutual funds offer diversification and access to professional management. While a 401(k) may have limited investment choices, it's important to remember that mutual funds can be included within these plans, merging the benefits of both. By comprehending the features, pros, cons, and tax implications of these financial tools, individuals can make informed decisions that align with their investment goals, risk tolerance, and retirement plans. To navigate this complex landscape effectively, consider seeking the guidance of a retirement planning professional. Their expertise can be invaluable in shaping a tailored retirement strategy that aligns with your unique financial situation and goals.401(k) vs Mutual Funds Overview

What Are 401(k) Plans?

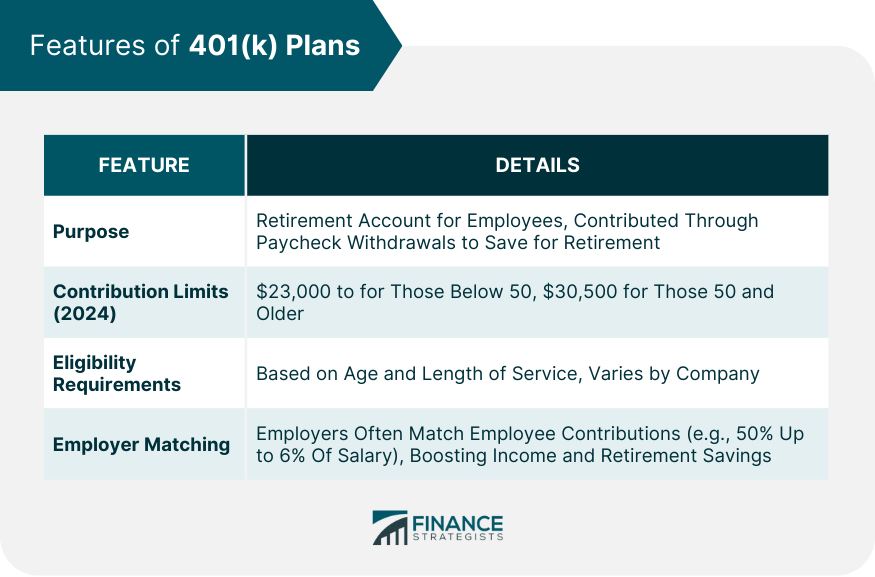

Definition and Purpose of 401(k) Plans

Contribution Limits and Eligibility Requirements

Employer Matching Contributions

What Are Mutual Funds?

Definition and Purpose of Mutual Funds

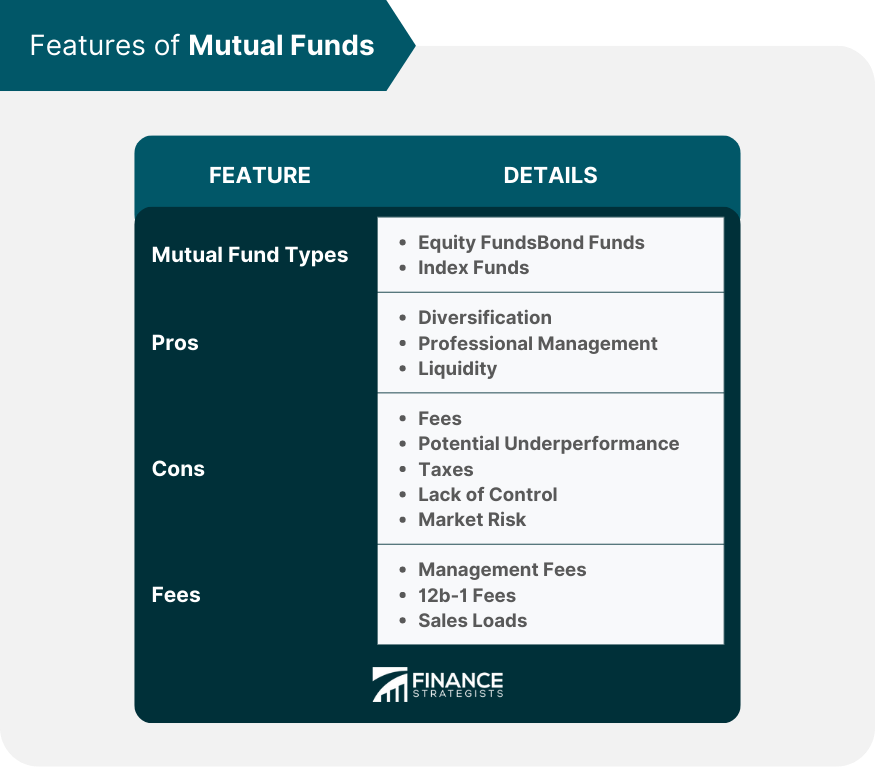

Types of Mutual Funds

Equity Funds

Bond Funds

Index Funds

Pros of Investing in Mutual Funds

Diversification

Professional Management

Liquidity

Cons of Investing in Mutual Funds

Fees

Potential Underperformance

Taxes

Lack of Control

Market Risk

Understanding Fees and Expenses

Comparing 401(k) Plans and Mutual Funds

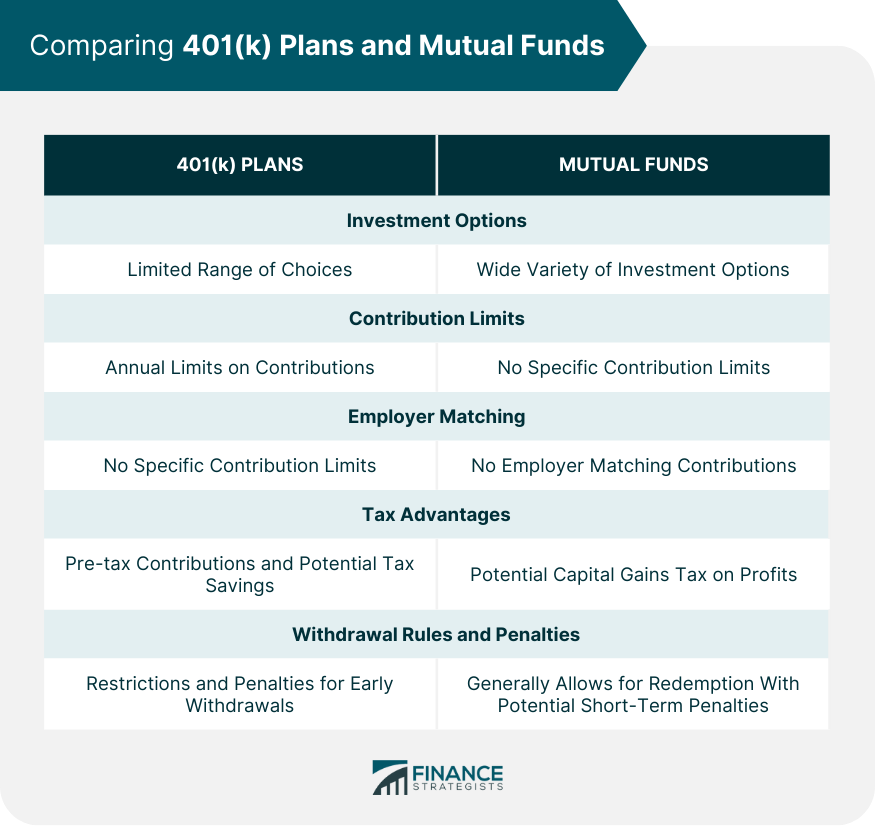

Investment Options and Flexibility

Contribution Limits and Employer Matching

Tax Advantages and Considerations

Withdrawal Rules and Penalties

Factors to Consider When Choosing Between 401(k) and Mutual Funds

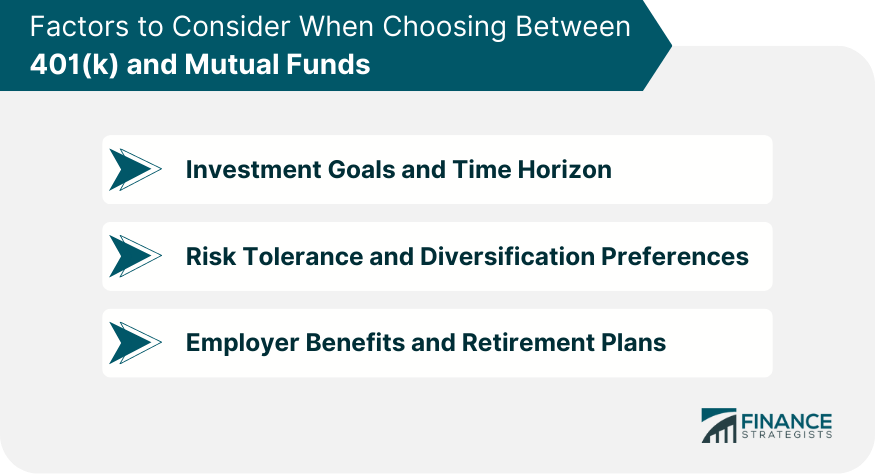

Investment Goals and Time Horizon

Risk Tolerance and Diversification Preferences

Employer Benefits and Retirement Plans

Combining 401(k) Plans and Mutual Funds for a Balanced Retirement Strategy

Maximizing 401(k)

Incorporating Mutual Funds

Bottom Line

401(k) vs Mutual Funds FAQs

A 401(k) plan is a company-sponsored retirement account that allows employees to save for retirement through pre-tax contributions.

Mutual funds provide diversification, professional management, and access to a wide range of investment options for potential growth.

Employer matching contributions are additional funds provided by employers to match a portion of an employee's contributions to their 401(k) account.

Mutual funds can be categorized into equity funds (investing in stocks), bond funds (investing in debt securities), and index funds (tracking specific market indexes).

Yes, combining both options can be beneficial. Maximize your 401(k) contributions to take advantage of employer matches and use mutual funds for additional diversification and potentially higher returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.