SIMPLE IRA (Savings Incentive Match Plan for Employees) and 401(k) plans allow employees to contribute a percentage of their pay to an employer-sponsored retirement investment account. The contributions to both accounts are not subject to IRS income taxes, nor are they subject to capital gains taxes as it grows. The funds grow tax-free until the employee withdraws them during retirement. Suppose you are under the age of 59 1/2. In that case, you must pay an additional 10% tax on the taxable amount you withdraw from these retirement savings unless you qualify for one of the current exceptions to this rule. SIMPLE IRAs necessitate employer contributions. 401(k) plans do not, even though many employers choose to contribute. Employees are always fully vested in SIMPLE IRAs, whereas 401(k) plans may have different vesting rules for employer contributions. The SIMPLE IRA is easier to set up and maintain and is inexpensive, making it ideal for small businesses. A 401(k) plan, though the most popular retirement plan to date, is more challenging to set up and maintain. Deciding between 401(k) and SIMPLE IRA? Click here.

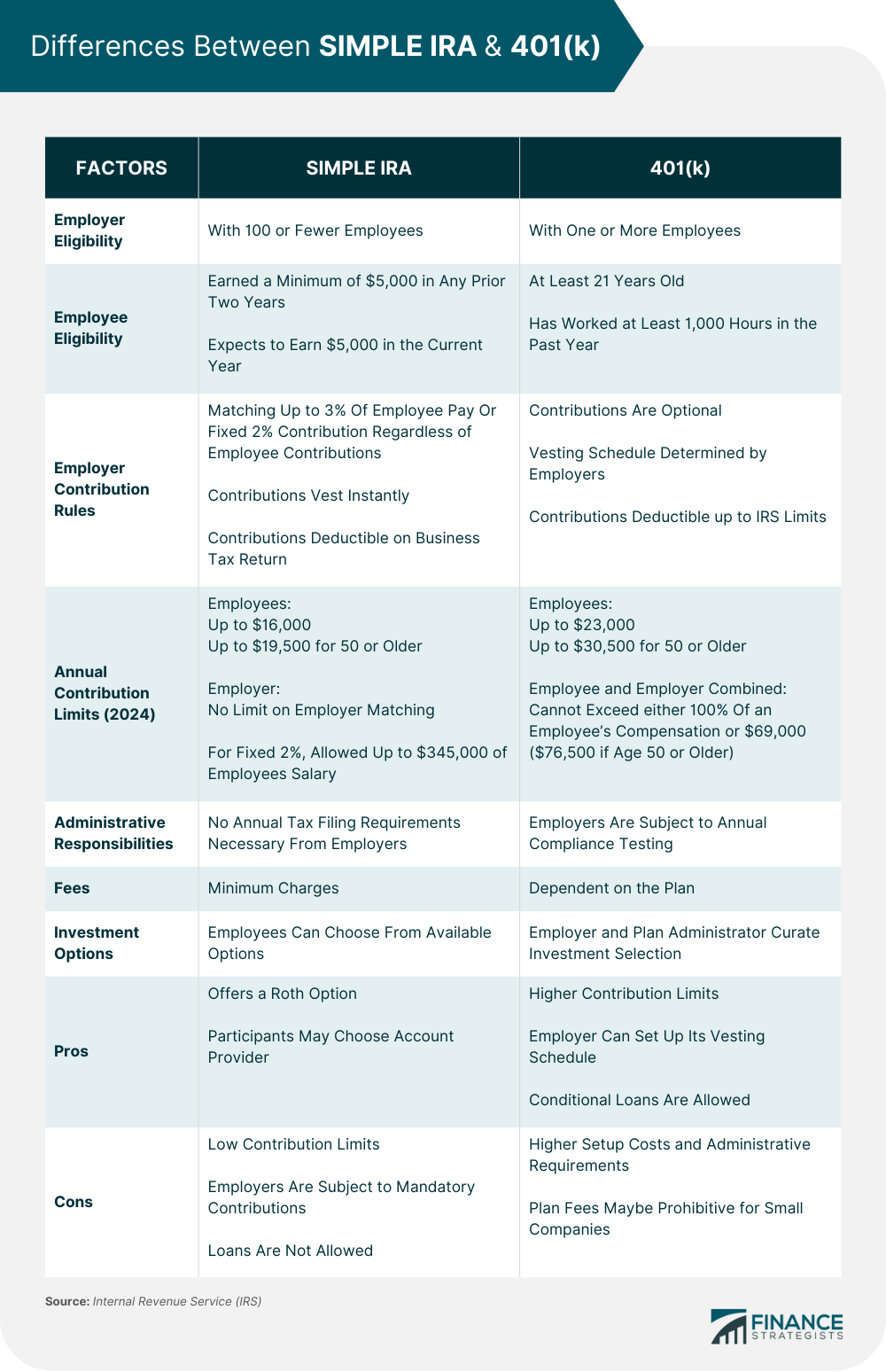

A SIMPLE IRA is a retirement plan provided to employees by a company. These plans are designed specifically for small businesses with 100 or fewer employees. Employees are eligible to participate in the plan if they earned at least $5,000 in the previous two years and expect to earn the same amount in the current year. Contributions to SIMPLE IRAs are not subject to federal income tax withholding. On the other hand, salary reduction contributions are subject to social security, Medicare, and federal unemployment (FUTA) taxes. These taxes do not apply to matching and nonelective contributions made by employers. The funds will grow tax-free until withdrawn at retirement. So, while you will not have to pay taxes on the growth of your investments, you will have to pay income taxes when you withdraw money. SIMPLE IRA plans are subject to the same investment, distribution, and rollover rules as traditional IRAs. A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a portion of their salary into an account before taxes are taken out. Such plans require employees to be at least 21 years old before they can participate. Employees may also be required to serve an equivalent of 1,000 hours in the previous year before being allowed to make elective contributions. Employers typically match employee contributions up to a certain percentage. Employees can choose to allocate their contributions and direct the investments to any assets allowed by the plan, such as stocks, bonds, and mutual funds. Earnings on these investments grow tax-deferred until the money is withdrawn during retirement. 401(k)s and SIMPLE IRAs are similar in their fundamentals. The details are where they differ substantially. Employers with 100 or fewer employees can implement the plan for a SIMPLE IRA. As for a 401(k) plan, all types of businesses, regardless of size, can adopt it. There is no requirement on the number of employees for companies to offer it. A SIMPLE IRA allows non-owners to contribute to the account. It must include any employee who earned at least $5,000 during the two preceding years and is expected to make the same in the current year. In contrast, only employees 21 years or older who have satisfied a one-year service or an equivalent of 1,000 hours are eligible to participate in a 401(k). The SIMPLE IRA offers employers a mandatory contribution, matching up to 3% of employee pay or a fixed 2% contribution regardless of employee contributions. All contributions vest immediately, making it an attractive option for employers seeking solutions to employee retention. For 401(k)s, employer contributions are optional and come with their vesting schedule determined by employers. Furthermore, if an employer makes a contribution on their behalf to the 401(k), they must proportionally contribute for all eligible employees as well. In 2024, a SIMPLE IRA allows employees to contribute up to $16,000 and $19,500 if they are 50 or older. On the employer side, a 2% matching contribution is allowed on employee compensation up to a maximum of $345,000. With a 401(k), employees can contribute up to $23,000 per year and $30,500 if they are 50 or older. The combined employee and employer contributions on this plan cannot exceed either 100% of an employee’s compensation or $69,000 and $76,500 if age 50 or older. Both the SIMPLE IRA and the 401(k) offer different administrative responsibilities when it comes to personally managing and maintaining retirement plans. With a SIMPLE IRA, there are no annual tax filing requirements necessary from employers; however, employers must annually send details of the plan to employees. On the other hand, employers with a 401(k) are subject to annual compliance testing to ensure that the plan does not unduly favor highly compensated employees. With a SIMPLE IRA, account holders will pay minimal fees. This makes them an attractive choice for those on more limited incomes. On the other hand, a 401(k) comes with more varied fees depending on the plan the employees choose. Individuals have flexibility regarding which investments to select for a SIMPLE IRA through the institution that holds their accounts. On the other hand, a 401(k) is more restrictive in that an employer curates and selects the investment offerings available for its workers. A SIMPLE IRA has a few key benefits, including requiring minimal administrative management, offering a Roth option, and having lower setup and maintenance costs than other plans. Additionally, participants may have the ability to choose their account provider. A 401(k) offers higher contribution limits with an optional employer contribution, plus it provides the flexibility for an employer to set up its vesting schedule. It is also unique in that it may permit loans in certain circumstances. A SIMPLE IRA is a popular choice for small businesses since it has lower setup costs, administrative requirements, and low contribution limits. However, employers are subject to mandatory contributions. Furthermore, loans are not allowed through this type of plan, and an employer cannot maintain any other kind of retirement system in tandem. 401(k)s allow for higher contribution limits but may come with higher setup costs and yearly plan fees that can be restrictive for small business owners. A SIMPLE IRA plan can be an excellent option for smaller businesses with fewer employees. For example, if the business is located in a state that requires employers to provide access to a retirement savings account, offering a SIMPLE IRA plan would meet this requirement. However, the company should consider the extra flexibility and features of a traditional 401(k) as it may better serve its goal of providing good employee benefits. It is also essential for businesses to know what typical retirement packages are offered in the same industry. In such a way, they can remain competitive when recruiting workers and answering employee inquiries about retirement plans. Working with a financial advisor can help you determine which plan best fits your business needs and optimize retirement savings for you and your employees. SIMPLE IRA and 401(k) are retirement plans allowing individuals to save money for the future. A SIMPLE IRA functions similarly to a 401(k), except it is usually available to those employed by small businesses and self-employed individuals. With this plan, employers make contributions directly into their employees' accounts, reducing the amount owed at tax time. The annual employee contribution limit is significantly lower than that of a 401(k). However, employers will typically agree to match employee contributions up to some point. On the other hand, a traditional 401(k) is often associated with larger corporations. It allows employees to contribute much more annually. While there may be no employer-matching contributions, employees can take advantage of loans or receive distributions without penalty when needed. While both offer tax advantages, the benefits received may differ in some cases. When choosing between the two plans, a person should consider their employment status, income level, and retirement goals. SIMPLE IRA vs 401(k): Overview

What Is a SIMPLE IRA?

What Is a 401(k)?

Differences Between SIMPLE IRA & 401(k)

Employer Eligibility

Employee Eligibility

Employer Contribution Rules

Contribution Limits

Administrative Responsibilities

Fees

Investment Options

Pros

Cons

SIMPLE IRA vs 401k: Which Is Better?

The Bottom Line

SIMPLE IRA vs 401(k) FAQs

A SIMPLE IRA has a few drawbacks to consider. Contributions are limited to $16,000 yearly (or $19,500 if you are 50 or older) in 2024, and employers must make mandatory contributions that can be costly for small businesses with tight budgets. Additionally, employees cannot take out loans against their SIMPLE IRAs.

The primary benefit of a SIMPLE IRA is its low administrative costs compared to other employer-sponsored retirement plans such as 401(k)s. It is also easier for business owners to set up than other types of plans, and there are no filing fees.

This depends on the size of your business and your budget. While a 401(k) may offer more significant contribution limits, higher contribution matching options, and loan features, it also has significantly higher administrative costs and filing requirements, making it more suitable for larger businesses. For smaller firms, a SIMPLE IRA may be the better option due to its low costs and ease of setup.

Yes - many companies that offer 401(k) plans are now offering the option to change to a SIMPLE IRA. However, checking with the Internal Revenue Service (IRS) for any tax or penalty implications before switching is essential.

How a company holds your 401(k) depends entirely on how much you have in the account. Your employer can choose to keep the funds for as long as you want if you have more than $5000 in the account; however, they can also opt to cash out and send your account balance in a lump sum should it be below $5000. After 60 days, these funds will be automatically rolled over into a new retirement account or cashed out. If this is not done within that time frame and you do not roll over your 401(k), the company may no longer manage it for you and transfer those funds to the IRS to cover any taxes due from your distribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.