A 401(k) withdrawal refers to the process of extracting funds from a 401(k) retirement savings plan, an employer-sponsored program in the United States. This plan allows workers to invest a portion of their pre-tax salary for retirement. When funds are withdrawn, they are typically subject to income taxes. However, an exception applies to qualified distributions from Roth 401(k) accounts, where withdrawals can be tax-free due to post-tax contributions. Understanding the rules that regulate 401(k) withdrawals is crucial for efficient retirement planning. These rules, established by the Internal Revenue Service (IRS), aim to encourage long-term savings and ensure the funds are primarily used during retirement. By fully grasping these guidelines, individuals can avoid unnecessary tax penalties and effectively manage their retirement funds.

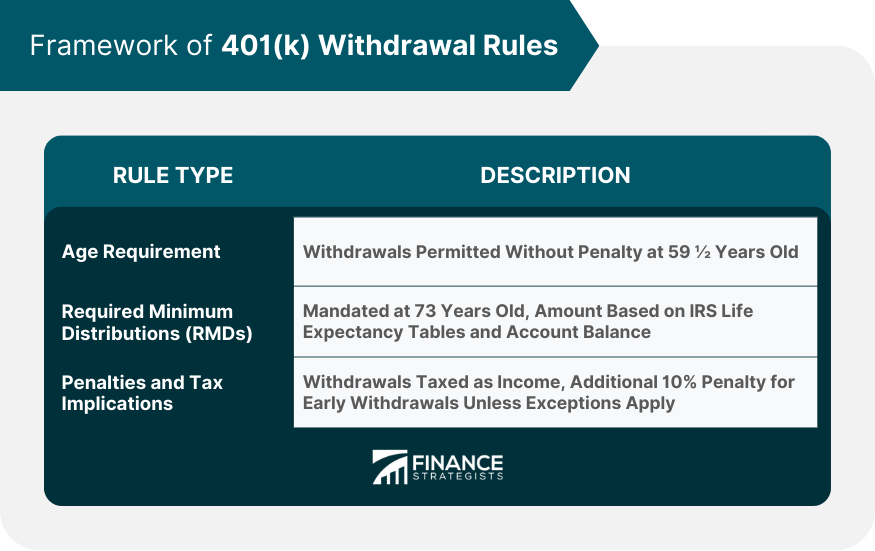

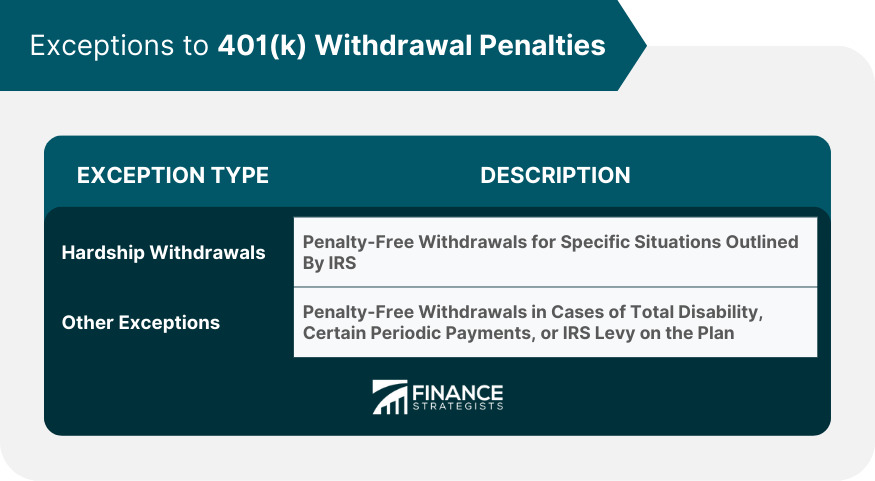

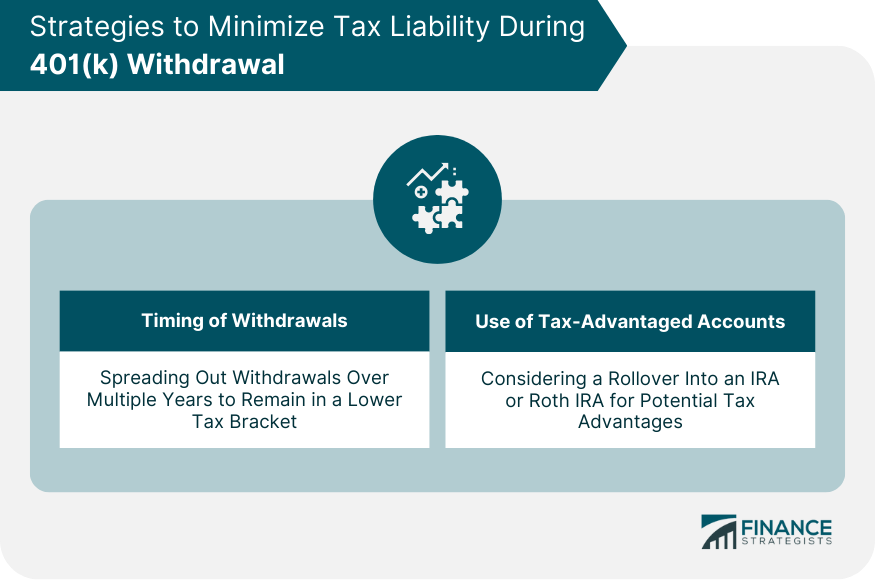

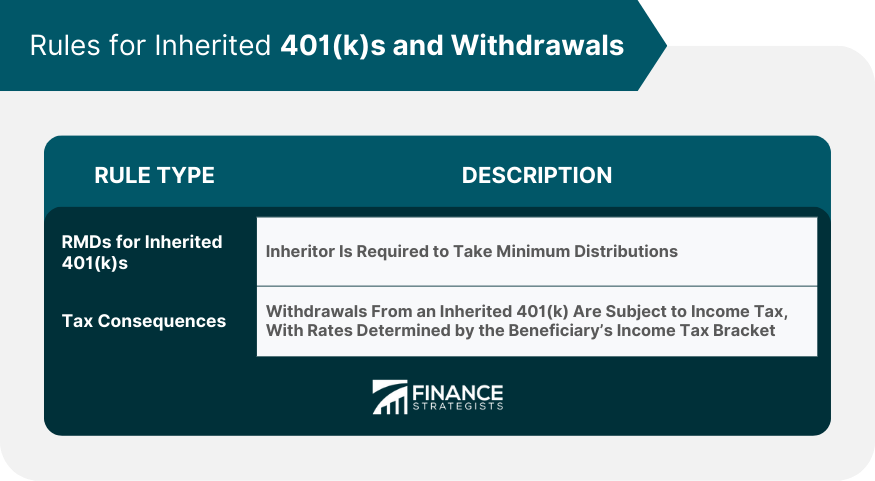

The withdrawal rules that apply to 401(k) plans are largely defined within the Internal Revenue Code. The IRS is the body that administers these rules, aiming to strike a balance between promoting retirement savings and providing limited access to these funds when required. Generally, individuals are allowed to make withdrawals from their 401(k) accounts once they turn 59 ½ years old. Any withdrawals made before this age are considered "early withdrawals" and are typically subject to a 10% penalty. This penalty is in addition to regular income taxes that apply to the withdrawal amount. When a 401(k) account holder reaches the age of 73, they must start taking required minimum distributions (RMDs) from their account. The exact amount of these distributions is based on IRS life expectancy tables and the individual's account balance. This rule is designed to ensure that retirement funds are actually used during the retirement years and not merely accumulated. As a rule, 401(k) withdrawals are taxed as income. The amount of tax an individual will owe depends on their income tax bracket for the year in which the withdrawal occurs. If someone makes an early withdrawal from their 401(k), they're typically subject to a 10% penalty unless they meet specific exceptions. The IRS provides some relief by allowing penalty-free withdrawals in cases of "hardship." The IRS has specified certain situations that allow individuals to withdraw from their retirement accounts without penalty, including expenses such as medical expenses, education costs, eviction or foreclosure prevention, funeral expenses, and home repair costs. There are also other exceptions where the usual 10% early withdrawal penalty doesn't apply. These include instances like distributions to beneficiaries after the death of the account holder, distributions due to total and permanent disability, distributions as part of a series of substantially equal periodic payments (SEPPs), and distributions due to an IRS levy on the plan. The timing of withdrawals can significantly affect the amount of tax you owe. If feasible, spreading out withdrawals over multiple years may be advantageous in order to remain in a lower tax bracket. One option to consider when planning withdrawals is rolling over your 401(k) into an Individual Retirement Account (IRA) or a Roth IRA. Traditional IRA distributions work similarly to 401(k) distributions, being taxed as income. However, Roth IRA offers tax-free withdrawals during retirement since the contributions are made post-tax. A 401(k) can be rolled over into a Roth IRA. This move allows future earnings to grow tax-free. While the rollover amount is considered taxable income in the year of conversion, the future withdrawals during retirement will be tax-free, provided certain conditions are met. The conversion amount from a 401(k) to a Roth IRA is treated as taxable income in the year of the rollover. However, in the long run, this could potentially be beneficial since Roth IRA withdrawals are tax-free in retirement. This strategy might be worth considering, especially for those who expect to be in a higher tax bracket in retirement. In the case of inherited 401(k)s, the inheritor is usually required to take minimum distributions. The exact rules can be somewhat complex, depending on several factors, like whether the original account holder had already started taking RMDs and the relationship of the beneficiary to the deceased. The withdrawals from an inherited 401(k) are subject to income taxes, with the rate being determined by the beneficiary's income tax bracket. Lump-sum distributions are an option but could potentially push the beneficiary into a higher tax bracket. A 401(k) withdrawal refers to the process of taking out funds from a retirement savings account, usually during retirement. The rules governing these withdrawals, established by the IRS, are crucial for efficient retirement planning, balancing long-term savings with necessary withdrawals. These guidelines help individuals avoid additional tax penalties and effectively manage their retirement funds. Navigating through these rules, from the age requirement for penalty-free withdrawals to understanding the implications of early withdrawals and potential exceptions, is crucial. Moreover, adopting strategies like timing withdrawals and utilizing tax-advantaged accounts can minimize tax liabilities. With the possibility of 401(k) rollovers and conversion to Roth IRAs, individuals can further optimize their retirement planning. Lastly, understanding the rules and tax implications for inherited 401(k)s helps ensure the continuation of smart financial planning. Seek professional retirement planning services to navigate the complex world of 401(k) withdrawals and secure a comfortable retirement.What Is 401(k) Withdrawal?

Framework of 401(k) Withdrawal Rules

Overview and Legal Basis

Age Requirement and Early Withdrawals

Required Minimum Distributions (RMDs)

Penalties and Tax Implications

Exceptions to 401(k) Withdrawal Penalties

Hardship Withdrawals

Other Exceptions

Strategies to Minimize Tax Liability During 401(k) Withdrawal

Timing of Withdrawals

Utilizing Tax-Advantaged Accounts

401(k) Rollovers and Conversion to Roth IRAs

Process and Benefits

Tax Implications

Rules for Inherited 401(k)s and Withdrawals

Understanding the RMDs for Inherited 401(k)s

Tax Consequences

Bottom Line

401(k) Withdrawal Rules FAQs

A 401(k) withdrawal involves taking out funds from your 401(k) retirement savings account. Withdrawn amounts are typically subject to income tax.

Early withdrawals, usually made before the age of 59.5, are typically subject to a 10% penalty on top of regular income taxes.

RMDs start when an account holder reaches 73 years old. The exact amount depends on the IRS life expectancy tables and the individual's account balance.

Some exceptions include cases of "hardship" as defined by the IRS, disability, certain equal periodic payments, or due to an IRS levy on the plan.

Strategies include timing your withdrawals wisely, using tax-advantaged accounts like IRAs, and considering a rollover into a Roth IRA for potential tax-free withdrawals in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.