In the realm of personal finance and retirement planning, few topics are as relevant or as essential as the 401(k) plan. Named after a section of the U.S. Internal Revenue Code, a 401(k) is a type of employer-sponsored retirement savings plan. It allows employees to contribute a portion of their pre-tax earnings to their retirement fund. This money is then invested, offering a way to grow the savings over time in a tax-efficient manner. An important aspect of the 401(k) plan is the tax treatment of withdrawals from the plan. Under normal circumstances, 401(k) distributions are subject to income tax. Moreover, early withdrawals (i.e., those made before the age of 59.5) are generally subject to an additional 10% penalty. However, the tax rules can become more complex for nonresident aliens—individuals who are neither U.S. citizens nor residents. The first point of clarification is understanding who qualifies as a nonresident alien. According to the Internal Revenue Service (IRS), a nonresident alien is a foreign individual who does not pass either the Green Card Test or the Substantial Presence Test. In simpler terms, if you're not a U.S. citizen, don't have a U.S. Green Card, and don't spend a significant amount of time in the U.S., you are likely to be classified as a nonresident alien. Typically, a flat 30% federal income tax rate applies to 401(k) distributions made to nonresident aliens. This is considered withholding at source. In other words, when a distribution is made, the plan administrator withholds 30% of the distribution and sends it directly to the IRS. The remaining 70% is paid to the nonresident alien. In some situations, the 30% withholding rate may not apply. For instance, if the distribution is part of a series of substantially equal periodic payments (made at least annually) for your life (or life expectancy), or the joint lives (or joint life expectancies) of you and your designated beneficiary, the 30% withholding doesn't apply. Tax treaties can play a significant role in determining the tax liability of nonresident aliens withdrawing from their 401(k) accounts. The U.S. has tax treaties with several countries, which can affect the withholding rate on 401(k) distributions. Some of these countries include Canada, the United Kingdom, Germany, Australia, and India, among others. It's best to consult the IRS website or a tax professional for the most current list. In many cases, tax treaties can lower or even eliminate the 30% withholding tax. The specific provisions can vary by treaty, and the process of claiming these benefits can be complex. It generally involves the nonresident alien submitting a series of forms to the plan administrator and the IRS, proving their residency in the treaty country and their eligibility for treaty benefits. Understanding the full tax implications of a 401(k) withdrawal is critical for nonresidents. In addition to the withholding tax, there may be other tax consequences to consider. Withdrawals from a 401(k) plan by a nonresident alien is considered U.S. source income and can increase the nonresident's U.S. taxable income for the year of the withdrawal. Withdrawals can come with penalties if not managed correctly. Understanding these and knowing how to avoid them can save a significant amount of money. An early withdrawal penalty is a tax penalty that applies to withdrawals made before age 59.5. This penalty is usually 10% of the amount withdrawn. However, several exceptions can waive this penalty, such as disability, death, or a series of substantially equal periodic payments. Starting at age 72, the IRS mandates that you begin taking Required Minimum Distributions (RMDs) from your 401(k). If you fail to take these distributions, you may face a hefty penalty, which can be up to 50% of the amount not distributed. Finally, withdrawing from a 401(k) can require a nonresident alien to file a U.S. tax return. Nonresident aliens withdrawing from their 401(k) accounts will need to file Form 1040NR, "U.S. Nonresident Alien Income Tax Return." Additionally, Form 8843, "Statement for Exempt Individuals and Individuals With a Medical Condition," may be required in some cases. The U.S. tax year runs from January 1 to December 31. Typically, tax returns must be filed by April 15 of the following year. However, if the nonresident alien did not receive wages subject to U.S. income tax withholding, the deadline extends to June 15. Making a withdrawal from your 401(k) as a nonresident alien isn't a decision that should be taken lightly. There are several factors that you should consider before deciding to make a withdrawal. First, it's crucial to weigh the cost and benefit of withdrawing your money early. As mentioned earlier, early withdrawals may attract a 10% penalty in addition to income tax. Consequently, your retirement savings could take a significant hit if you decide to withdraw your money before you turn 59.5 years old. On the other hand, leaving your money in the 401(k) allows it to continue growing tax-free until you decide to take distributions. If you anticipate your income in retirement to be lower than your current income, it might be more beneficial to leave your money in the account until retirement. In such a case, you might end up paying less tax on your distributions in retirement than you would if you withdrew the money now. If you need money now, there are a few alternatives to withdrawing your funds early that won't trigger the 10% early withdrawal penalty. Some 401(k) plans allow you to take a loan against your account. You can borrow up to $50,000 or half of your vested account balance, whichever is less. The loan is tax-free, and you repay it, with interest, through payroll deductions. Another option is to roll over your 401(k) into an Individual Retirement Account (IRA). This could give you more control over your investments and might offer more withdrawal flexibility compared to a 401(k). Note that, similar to a 401(k), early withdrawals from an IRA before age 59.5 are generally subject to income tax and the 10% early withdrawal penalty. Navigating the complexities of 401(k) withdrawals for nonresidents can be daunting. However, with expert guidance, you can make informed decisions that best serve your financial situation and future goals. It's always advisable to seek the advice of a financial advisor or tax professional when dealing with significant financial decisions such as a 401(k) withdrawal. This is especially true for nonresidents, given the added complexities of tax treaties and U.S. tax laws. A tax professional can help you understand the tax implications of a withdrawal, assess your options, and guide you through the necessary steps. Minimizing your tax liability is key when making a 401(k) withdrawal. Some best practices include: Think about when you plan to make a withdrawal. If you expect your income to be lower in a particular year, it might be a good time to make a withdrawal to take advantage of lower tax rates. If you're a resident of a country that has a tax treaty with the U.S., you might be able to reduce or even eliminate U.S. tax on your 401(k) withdrawal. Make sure you understand the provisions of the treaty and take the necessary steps to claim these benefits. If possible, try to avoid making withdrawals before age 59.5 to avoid the 10% early withdrawal penalty. If you need to access your money, consider alternatives such as a 401(k) loan or a rollover to an IRA. The tax implications of 401(k) withdrawal for nonresidents can be intricate. It is essential to understand that a flat 30% withholding rate generally applies, with potential adjustments based on tax treaties between the U.S. and the nonresident's country of residence. Beyond taxes, nonresidents should be cognizant of the penalties for early withdrawals and the necessity of filing a U.S. tax return under certain circumstances. Given the complexities involved, it's highly recommended to consider the cost-benefit analysis and explore alternatives to early withdrawal, such as 401(k) loans or rollovers to an IRA. Given the potential financial implications, seeking professional help for personalized advice is a prudent move. Your retirement is a significant phase of life, and planning it correctly is paramount.Overview of 401(k) Plan and Withdrawal Tax

401(k) Withdrawal Tax for Nonresidents

Definition of Nonresident Alien for 401(k) Withdrawal Tax Purpose

How 401(k) Withdrawal Tax Applies to Nonresidents

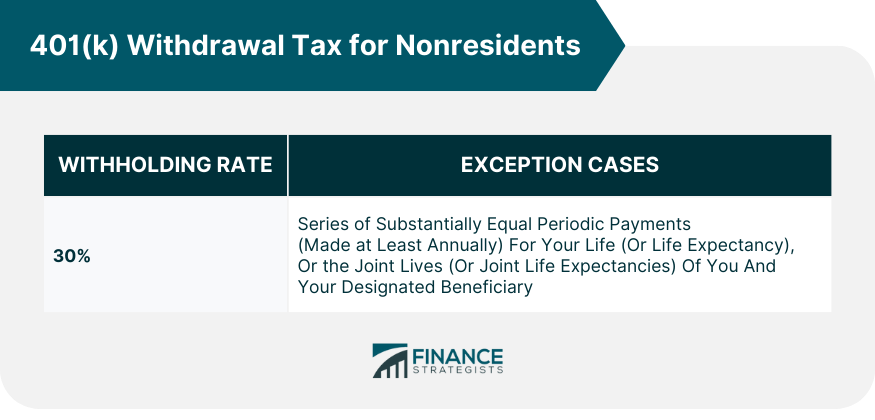

Withholding Rate

Exception Cases

Tax Treaty Impact on 401(k) Withdrawal for Nonresidents

List of Countries With Tax Treaties

How Tax Treaties Affect the Withdrawal Tax

Tax Implications of 401(k) Withdrawal for Nonresidents

Impact on Taxable Income

Potential Penalties and Their Avoidance

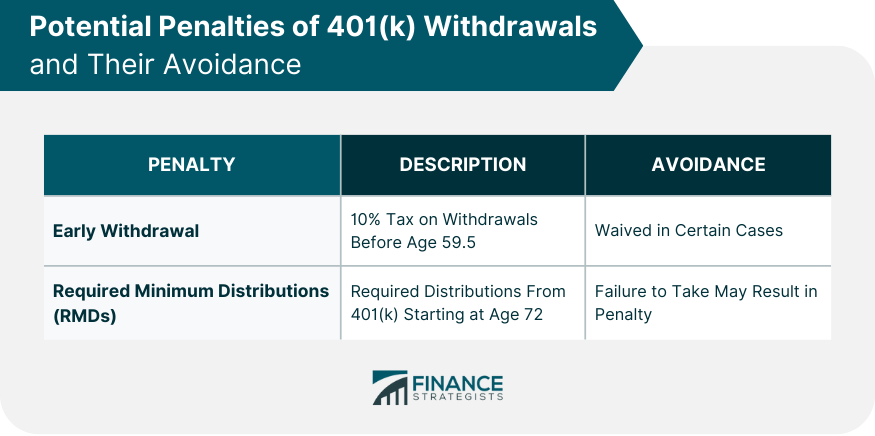

Early Withdrawal Penalty

Required Minimum Distributions (RMDs)

Filing US Tax Return as a Nonresident

Necessary Forms

Key Deadlines

Considerations Before Making a 401(k) Withdrawal as a Nonresident

Weighing the Cost and Benefit

Alternatives to Withdrawing Funds Early

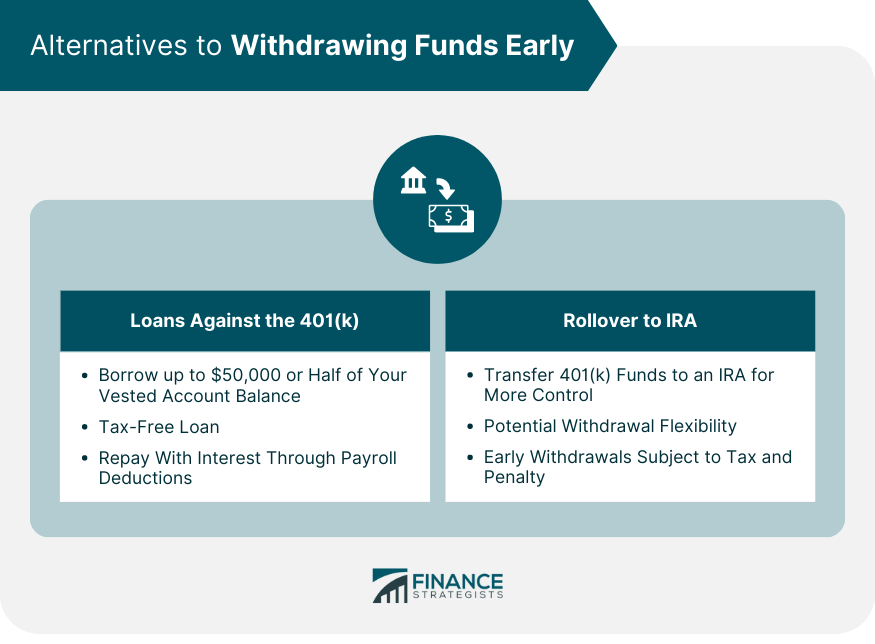

Loans Against the 401(k)

Rollover to IRA

Expert Tips and Advice on 401(k) Withdrawal for Nonresidents

When to Seek Professional Help

Best Practices to Minimize Tax Liability When Making a 401(k) Withdrawal

Consider the Timing

Use Tax Treaties

Avoid Early Withdrawal Penalties

The Bottom Line

401(k) Withdrawal Tax for Nonresidents FAQs

The tax rate for 401(k) withdrawals for nonresidents is generally a flat 30% withholding rate. However, tax treaties between the U.S. and the nonresident's home country can potentially alter this rate.

Yes, nonresidents can avoid the 10% early withdrawal penalty on a 401(k) if they meet certain criteria, such as reaching age 59.5, experiencing disability, or setting up a series of substantially equal periodic payments.

Yes, nonresidents must file a U.S. tax return if they make a withdrawal from a 401(k). They will generally use Form 1040NR, "U.S. Nonresident Alien Income Tax Return."

Alternatives to early withdrawal from a 401(k) for nonresidents include taking a loan against the 401(k) or rolling over the 401(k) to an Individual Retirement Account (IRA).

It's always advisable for nonresidents to seek professional help when making significant financial decisions, such as a 401(k) withdrawal, given the complexities of tax treaties and U.S. tax laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.