What Is a 457(b) Plan?

Congress created the 457(b) plan in 1982 to allow employees of state and local governments, as well as tax-exempt organizations, to set aside money for retirement on a pre-tax basis.

Since then, employees of for-profit companies have been able to participate if their employer allows it.

Deciding between a 457(b) and a 401(k) Plan? Click here.

How Does It Work?

Employers can contribute to 457 plans in one of two ways: matching contributions or nonelective contributions, which is often referred to as a "top-hat" contribution.

Matching Contributions

While it is common for employers to match employee contributions dollar-for-dollar, there are no legal requirements that state they must do so.

Employer contributions are treated like your contributions for tax purposes, meaning they are not taxed unless the money is withdrawn before you reach 59½ years old.

There's also an annual limit to how much an employer can contribute to these plans each year.

For 2025, the limit is $23,500 per year.

If you are over 50 years old, there is an additional catch-up contribution available to you. This allows you to make up to an additional $7,500 in contributions each year.

This money grows tax-deferred until you make withdrawals.

Meaning, you won't have to pay any taxes on the money until you withdraw it from your account.

Nonelective Contributions

These contributions are also known as "top-hat" contributions because they generally come from employers that haven't elected to contribute matching money.

Here, 457(b) plans can be funded by top-hat employer contributions, but it's not required under the law.

If your employer decides to make this type of contribution, it's up to their discretion how much they contribute.

Top-hat contributions are only taxed when you withdraw the money from your account, so there is no limit on how much an employer can contribute.

Benefits of 457(b) Plan

457(b) plans offer tax-deferred growth, meaning that you won't pay taxes on your investment earnings until you withdraw the money from your account.

Many workers like this because it allows them to use their pre-tax dollars to grow their savings without paying taxes on those dollars each year.

Another benefit is that there are no required minimum distributions, or RMDs. This allows the money in your account to continue growing tax-deferred throughout your retirement years.

What Is a 401(k) Plan?

401(k) plans have been offered by employers since the mid-1980s, and have become the most commonly used retirement plan in the United States.

The plan is available to employees of any company, even if their employer doesn't offer a pension plan or other type of retirement plan.

Employees are permitted to contribute up to $23,500 for 2025 ($31,000 if over 50 years old), which is a pre-tax deduction from their income.

The investments in these plans are typically handled by a third-party firm that establishes the plan on behalf of your employer.

How Does It Work?

These plans allow employees to choose which investments they want in their account.

Typically, an employer offers a handful of investment options that are then reflected in your account.

It's up to you to decide how much money to contribute and how that money gets invested.

Money grows tax-deferred, meaning you'll only have to pay taxes on your 401k when you make withdrawals after retirement.

Benefits of 401(k) Plan

Since the investment options are typically managed by a third-party company, they usually have lower costs than most investments you could purchase on your own.

This reduces the fees you pay each year, which can help your money grow faster.

401k plans also offer additional benefits through matching contributions.

This is where an employer will match every dollar that you contribute to your account. If an employer offers a 3% matching contribution, that means they will match up to 3% of your contributions.

This is free money from the company and can really help you grow your nest egg faster over time.

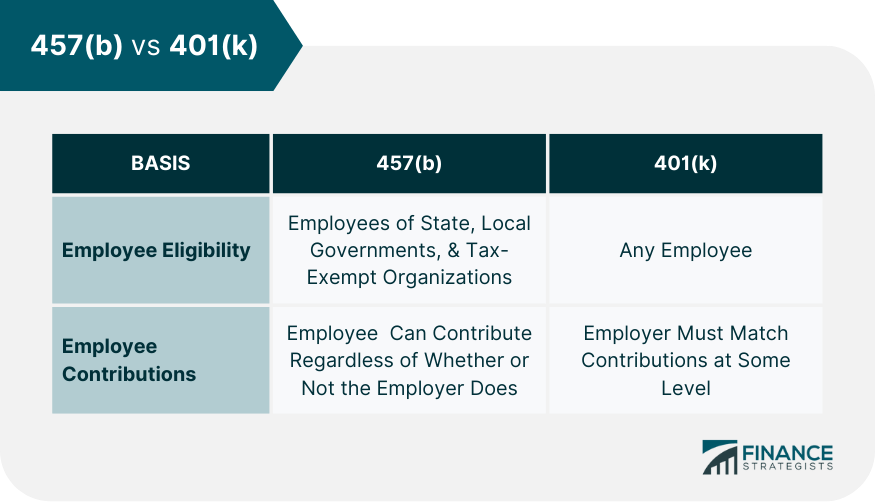

Key Differences Between 457(b) and 401(k)

There are key differences between the two plans and it's important to understand what those differences mean for your retirement results.

The most significant factors include:

Employee Eligibility

457(b) plans are limited to employees of state and local governments, as well as tax-exempt organizations.

401(k) plans, on the other hand, can be offered by any employer.

Employee Contributions

You can contribute to a 457(b) plan regardless of whether or not your employer does.

The only stipulation is that the total contribution cannot exceed the lesser of $23,500 or 100% of taxable compensation for 2025 ($31,000 if over 50 years old).

With 401k plans, the employer must match contributions at some level. If they don't, employees are limited to pre-tax contributions of $23,500 for 2025 ($31,000 if over 50 years old).

Catch-Up Contributions

The catch-up contribution rules allow employees over 50 to contribute an additional $7,500 a year into their 457 plans, on top of the max contributions outlined above.

401(k)s also offer this benefit.

Taxation of Contributions and Withdrawals

Both plans require you to start withdrawing money from your account once you turn 59.5 years old, but 457(b)s have slightly stricter rules when it comes to taxation.

This is because all contributions are made with pre-tax dollars, meaning that they get taxed when you withdraw the money during retirement.

With 401(k) plans, you can avoid taxation on contributions and earnings by rolling over your account to an IRA upon retirement.

The Bottom Line

Both types of plans offer significant benefits when it comes to retirement savings, but each plan also has its own pros and cons.

The differences between the two plans make it clear that one might be better suited for your needs than the other.

If you work for a state or local government, or a tax-exempt organization, 457(b) plans might be the better option.

Otherwise, 401(k) plans offer more flexibility and could end up being the better choice for your retirement savings.

457(b) vs 401(k) FAQs

A 457(b) plan is a type of tax-advantaged retirement savings account. It's similar to a 401(k) plan, but it's only available to employees of state and local governments and tax-exempt organizations. Employees can invest pre-tax money in the account and all contributions are tax deductible.

A 401(k) plan is a type of retirement savings account that's only available to employees who have the option offered by their employer. Employees can contribute pre-tax money into the account and all contributions are tax deductible since they're made with pre-tax dollars.

457 plans have some big benefits over other retirement savings accounts. The biggest benefit is that you can contribute up to $23,500 per year ($31,000 if over 50 years old) in 2025 regardless of whether or not your employer offers matching contributions.

401(k) plans might offer fewer benefits than 457 plans. The biggest benefit is that the employer must match the contributions of employees at some level, making these plans a little more of an incentive than 457 plans.

The right retirement savings plan for you depends on where you work, your income level and several other factors. It's recommended that you talk with a financial expert to see which plan can provide the greatest benefits for your unique situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.