Auto-Enrollment Threshold is a percentage of an employee's salary that is automatically deducted from their paycheck and contributed to their retirement savings plan. This contribution rate is set by the employer and is usually between 3% and 6% of an employee's salary. The employer is responsible for choosing the Auto-Enrollment Threshold and selecting the default investment option. Auto-Enrollment Threshold works by automatically enrolling eligible employees in a retirement savings plan. The process starts with the employer selecting the default contribution rate, typically between 3% and 6% of an employee's salary. Once selected, the employer notifies the eligible employees of their enrollment in the retirement savings plan and the contribution rate. Employees who do not want to participate in the plan can opt-out by completing a form or making an online request. Auto-Enrollment Threshold is used by employers who want to increase retirement savings participation rates among their employees. It is particularly useful for employers who have low participation rates in their retirement savings plan. Auto-Enrollment Threshold is most commonly used in the United States, where the Employee Retirement Income Security Act (ERISA) permits employers to automatically enroll employees in a retirement savings plan. The following are some of the factors that determine the Auto-Enrollment Threshold: Employee Salary: The contribution rate is usually a percentage of an employee's salary. A higher salary means a higher contribution rate. Company Match: Employers who offer a company match may set a lower Auto-Enrollment Threshold to encourage employees to contribute more to their retirement savings plan. Age: Older employees may need to save more for retirement and, therefore, may have a higher Auto-Enrollment Threshold. The following are some of the methods used to determine an Auto-Enrollment Threshold: Employers can use industry benchmarks to determine the appropriate Auto-Enrollment Threshold for their retirement savings plan. Industry benchmarks can provide guidance on the typical contribution rates for similar companies and industries. Employers can design their retirement savings plan to encourage employees to contribute more to their retirement savings plan. For example, the employer may offer a company match or increase the Auto-Enrollment Threshold gradually over time. Employers can use employee demographic data to determine an appropriate Auto-Enrollment Threshold. For example, younger employees may save less for retirement, while older employees may need to save more. The following sections provide an overview of the benefits of using the Auto-Enrollment Threshold. Auto-Enrollment Threshold increases retirement savings participation rates among employees. Studies have shown that automatic enrollment increases participation rates to over 80%, compared to around 60% for voluntary enrollment. This increase in participation rates is significant, as it helps employees save more for their future and reduces the risk of financial insecurity in retirement. Auto-Enrollment Threshold is a cost-effective tool for employers. Employers can save on administrative costs associated with enrolling employees manually in a retirement savings plan. Automatic enrollment reduces the administrative burden on employers and increases the efficiency of the enrollment process. Auto-Enrollment Threshold helps employees save more for their future. By automatically enrolling employees in a retirement savings plan, employers encourage employees to save more for their future. This increased savings rate can lead to a higher retirement income and improved financial security. The following sections provide an overview of the disadvantages of using the Auto-Enrollment Threshold. Automatic enrollment may lead to employee dissatisfaction, especially if the default contribution rate is high. Employees may feel like their take-home pay is reduced, leading to frustration and dissatisfaction with the plan. Employers can mitigate this by providing clear communication to employees about the plan and allowing employees to opt-out if they choose. Automatic enrollment reduces employee control over their retirement savings plan. Employees may feel like they have less control over their retirement savings plan if they are automatically enrolled. Employers can mitigate this by providing employees with information about their investment options and offering financial education programs. Automatic enrollment may not be suitable for all employees. Employees with significant financial obligations may not be able to contribute to their retirement savings plan at the default contribution rate. Employers can mitigate this by offering flexibility in the contribution rate and allowing employees to change their contribution rate at any time. Setting an appropriate Auto-Enrollment Threshold is critical for the success of the retirement savings plan. The following sections provide insights into best practices for setting an appropriate Auto-Enrollment Threshold. Employers should set an appropriate contribution rate that is both meaningful and affordable for employees. Employers should consider employee demographics, salary, and plan design when setting the contribution rate. Employers should also communicate the contribution rate clearly to employees and explain the benefits of the retirement savings plan. Employers should communicate clearly with employees about the retirement savings plan. Employers should explain the plan's features, including the contribution rate, investment options, and plan design. Employers should also provide employees with financial education programs to help them make informed decisions about their retirement savings plan. Employers should provide employees with opt-out options if they do not want to participate in the retirement savings plan. Employers should make the opt-out process easy and straightforward for employees. Employers should also communicate the opt-out options clearly to employees and provide them with information about the consequences of opting out of the plan. Auto-Enrollment Threshold is a tool used by employers to automatically enroll eligible employees in a retirement savings plan by setting a default contribution rate usually between 3% and 6% of an employee's salary. However, some disadvantages of Auto-Enrollment Threshold include the possibility of employee dissatisfaction, reduced employee control over their retirement savings plan, and lack of flexibility. Overall, Auto-Enrollment Threshold can be an effective way to get started with retirement planning. Still, it is also important to understand your options and make informed decisions about your retirement savings plan.What Is an Auto-Enrollment Threshold?

An auto-enrollment threshold is an important feature of employer-sponsored retirement savings plans. It encourages employees to save for retirement by automatically enrolling them in the plan and deducting a percentage of their salary for contributions.

Employees can opt-out of auto-enrollment or adjust their contribution rate at any time. However, by default, they will be enrolled and begin to accumulate savings in their account, which can help set them on the path toward a financially secure retirement.How Does an Auto-Enrollment Threshold Work?

Who Uses an Auto-Enrollment Threshold?

Factors That Determine an Auto-Enrollment Threshold

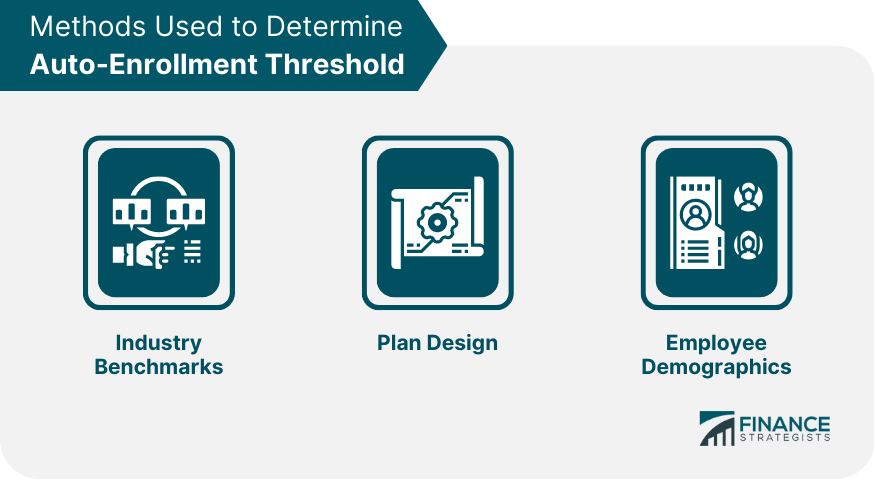

Methods Used to Determine an Auto-Enrollment Threshold

Industry Benchmarks

Plan Design

Employee Demographics

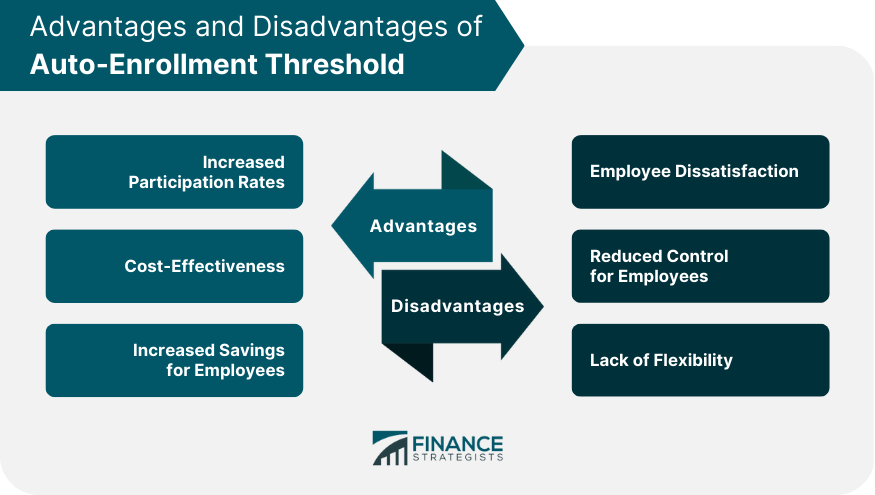

Pros of Auto-Enrollment Threshold

Increased Participation Rates

Cost-Effectiveness

Increased Savings for Employees

Cons of Auto-Enrollment Threshold

Employee Dissatisfaction

Reduced Control for Employees

Lack of Flexibility

Best Practices for Setting Auto-Enrollment Threshold

Setting Appropriate Contribution Rates

Communicating Clearly With Employees

Providing Opt-Out Options

The Bottom Line

Auto-enrollment helps increase retirement savings participation rates among employees, reduces administrative costs, and encourages employees to save more for their future, which can lead to higher retirement income and improved financial security.

To set an appropriate Auto-Enrollment Threshold, employers should consider employee demographics, salary, plan design, communicate clearly with employees, and provide opt-out options.

Auto-Enrollment Threshold FAQs

Auto-Enrollment Threshold is a percentage of an employee's salary that is automatically deducted from their paycheck and contributed to their retirement savings plan unless they opt-out.

Auto-Enrollment Threshold offers several advantages, including increased participation rates, cost-effectiveness, and increased savings for employees.

Employers can set an appropriate Auto-Enrollment Threshold by considering factors such as employee demographics, salary, and plan design. They can also use industry benchmarks and communicate clearly with employees about the plan.

Auto-Enrollment Threshold may lead to employee dissatisfaction, reduced control for employees, and lack of flexibility in some cases.

Best practices for setting Auto-Enrollment Threshold include setting appropriate contribution rates, communicating clearly with employees, and providing opt-out options for employees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.