401(k) fees are the costs that an employer or plan participant incurs to manage and maintain a 401(k) retirement plan. These fees can encompass a range of services, from record-keeping and legal compliance to investment management and employee communication. The fees are either deducted directly from the participant's account or paid by the employer. They play a vital role in the retirement savings landscape, as high fees can significantly erode the retirement savings of employees over the long term. The structure and level of these fees can vary widely between different 401(k) plans. Generally, 401(k) fees are divided into three main categories: administrative fees, investment fees, and individual service fees. These costs can either be charged as a flat rate or as a percentage of the plan's assets, and may be bundled together or charged separately depending on the provider and the plan's specifics. The fees for 401(k) plans vary by size, with plans overseeing more assets with more participants generally charging a lower overall percentage. Generally, between 0.05% and 10% of the total amount of assets goes towards fees. A significant proportion will go to the advisor of the plan. Have questions about 401(k) fees? Click here. 401(k) plan sizes refer to the aggregate assets held within a specific plan. This size often influences the types and amounts of fees incurred. Small-sized plans typically have less than $10 million in assets, medium-sized plans range between $10 million and $100 million, while large-sized plans have assets exceeding $100 million. The size of the plan can affect the fees due to the economies of scale in financial services. Larger plans can often negotiate lower fees because they provide more assets for the plan provider to manage. It's common for smaller plans to have higher average fees as a percentage of plan assets compared to larger plans. Fees for small-sized 401(k) plans, those with less than $10 million in assets, can be proportionally higher than their larger counterparts. This is often due to the fixed costs of administering a 401(k) plan, which represent a higher percentage of smaller plan assets. These fees can range widely based on the specific services included in the plan, but the average total plan cost is typically between 1.5% and 2% of plan assets annually. Medium-sized 401(k) plans, those with assets between $10 million and $100 million, can typically secure lower fee rates due to their larger asset base. The average total plan cost for these plans often falls in the range of 1% to 1.5% of plan assets annually. The fee structure and the specific investment options chosen by the plan significantly influence this variation. Large-sized 401(k) plans, those with assets exceeding $100 million, benefit significantly from economies of scale, which allows them to secure lower fee rates. These plans can often negotiate fees to less than 1% of plan assets annually. It's possible for some large plans to have fees as low as 0.5% of plan assets. The average 401(k) plan returns between 5% and 8% based on market conditions. However, because the returns on a 401(k) plan are based on the success of the investment portfolio, you can see much higher or lower returns depending on the investments and the overall market. The average employer match for a 401(k) plan is 4.7% of the employee's pay. However, there are many different matching systems used; some employers contribute $0.50 for every $1 an employee puts in. Others may use this $0.50 / $1 system only up to 6% of the employees salary. An employer might match 50% of employee contributions up to 6% of the employee's salary. This means that if an employee contributes 6% of their salary to their 401(k), the employer will contribute an additional 3%. The operation of a 401(k) plan involves expenses for administrative services, such as recordkeeping and legal support. Additional services like customer support, educational seminars, and investment advice may also incur costs. These expenses can be covered by investment fees or directly charged to the plan, either proportionally to account balances or as a flat fee per participant. Generally, the more services offered, the higher the fees. The administration fees charged by a 401(k) plan advisor vary widely. Some charge as little as 0.05% of the total assets, where others may charge 7% or more. Generally, the more assets being overseen and the more participants, the smaller the percentage taken as a fee. One effective strategy to minimize 401(k) fees is through a thorough evaluation of the fee structures. Understanding the details of the fee structure can uncover areas for potential savings. Employers can consider whether a bundled service model, where all services are provided by one firm for one fee, or an unbundled model, where different firms provide services and each charges a separate fee, is more cost-effective for their plan. Negotiating with service providers is another powerful strategy to minimize 401(k) fees. Employers can leverage the size of their plan or the potential for future growth to negotiate lower fees with service providers. It's also beneficial to periodically review the market for potential alternatives and use this information in negotiations. Educating employees about the impact of 401(k) fees on their retirement savings is crucial. Empowered with this knowledge, employees can make informed decisions about their investment choices, potentially opting for lower-cost funds where appropriate. Furthermore, a more educated workforce can increase participation rates, allowing the plan to grow and potentially lower fees due to economies of scale. The size of a 401(k) plan, whether small, medium, or large, influences the fees incurred. Small-sized plans tend to have higher fees as a percentage of assets due to fixed costs. Medium-sized plans can secure lower fee rates, while large-sized plans benefit from economies of scale and negotiate the lowest fees. Evaluating fee structures, negotiating with service providers, and educating employees are effective strategies to minimize 401(k) fees. By understanding and actively managing these fees, employers can help employees maximize their retirement savings. It is crucial for individuals to be aware of the impact of fees on their long-term retirement goals and make informed investment decisions to optimize their returns. With careful planning and strategic management, individuals can work towards building a secure financial future.What Are 401(k) Fees?

What Are 401(k) Plan Sizes?

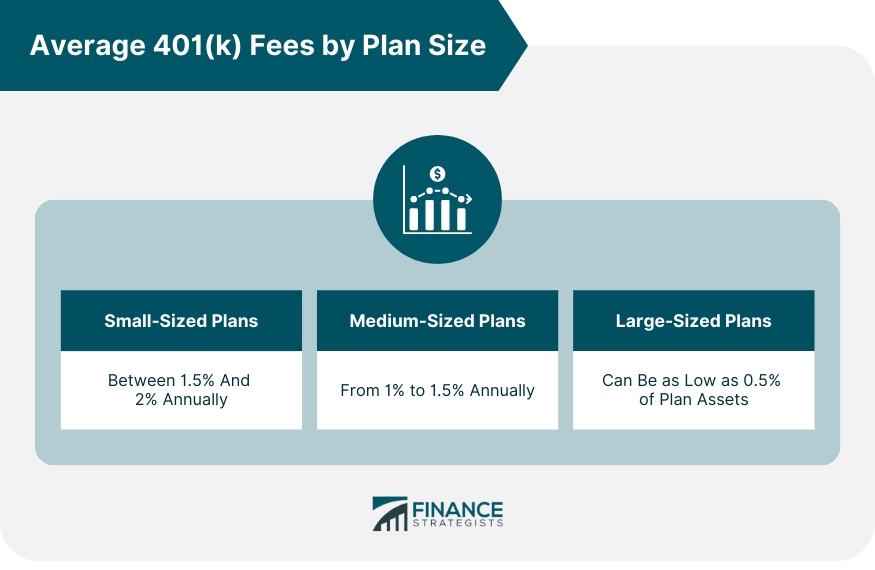

Average 401(k) Fees by Plan Size

Small-Sized Plans

Medium-Sized Plans

Large-Sized Plans

Average Returns on 401(k) Plans

What Is the Average Employer Match to 401(k) Plan?

Average 401(k) Plan Administration Fees

Strategies to Minimize 401(k) Fees

Evaluation of Fee Structures

Negotiation With Service Providers

Employee Education

Conclusion

Average 401(k) Fees by Plan Size FAQs

The average fee for 401(k) plans can vary depending on the size of the plan. Generally, for smaller plans (less than $250,000 in assets), the average fee is around 1% of total assets; for larger plans (over $500,000 in assets), the average fee drops to 0.6%.

A typical 401(k) will include administrative fees such as asset-based fees and advisor/record-keeping fees, as well as investment management expenses that cover actively managed funds or index fund investments.

For smaller plans (less than $250,000 in assets), the average fee is around 1% of total assets; for larger plans (over $500,000 in assets), the average fee drops to 0.6%. The difference in fees reflects economies of scale that can be achieved when operating a larger plan.

Yes, some 401(k) plans may have additional costs such as participant-level fees which are charged per participant, or mutual fund exchange fees and commissions. Other potential fees include setup and termination fees or loan-processing charges.

A 401(k) plan provides potential tax savings, as contributions and earnings on investments can be sheltered from taxes until they are withdrawn. It also helps employers attract and retain quality employees by offering an attractive retirement savings option. Additionally, it enables workers to save for retirement without having to make a large upfront contribution. Finally, many 401(k) plans include employer-matching contributions to incentivize employees to save for retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.