401(k) plans provide a tax-advantaged way for employees to save for their retirement. Employers can also match a portion of the contributions made by employees, thereby enhancing the retirement savings potential of these plans. Individuals who are self-employed or who operate their own businesses also have the opportunity to contribute to these plans. Partner refers to individuals who have an ownership interest in a business and are actively involved in its management and operations. A partner can usually still contribute to a 401(k) plan, however the tax treatment of the contributions is different. For example, the partnership's matching contribution is considered a guaranteed payment, and is treated like self-employment income rather than a salary, which leads to different taxes. Partners are not considered employees in the traditional sense, but for the purposes of contributing to a 401(k) plan, they are often treated as such. According to the Internal Revenue Service (IRS), partners can make elective deferrals to a 401(k) plan out of their earned income, which includes their share of the partnership's profits. However, just as with employees, partners must meet certain eligibility criteria to contribute to a 401(k) plan. These criteria vary depending on factors such as the individual's age, length of service, and the specific eligibility rules set by the employer or plan. Notably, the partner's role in and relationship to the business entity they are a part of also plays a significant part in determining their ability to contribute to a 401(k) plan. The first step in determining eligibility to contribute to a 401(k) plan involves employment status. Partners must have earned income from the partnership and should be active participants in the business. This income serves as the basis for their contributions. For most 401(k) plans, participants must be at least 21 years of age to make contributions. However, certain plans may allow younger individuals to participate, subject to the plan's specific rules and the employer's discretion. Many 401(k) plans also require individuals to have completed a certain period of service with the employer before they are eligible to participate. This requirement varies from plan to plan, but a common standard is one year of service. Each employer or plan sponsor may establish its own additional eligibility criteria. These might include stipulations about the minimum hours worked, specific employment categories eligible for the plan, or the vesting schedule for employer contributions. Different types of business entities can impact the nature of a partner's contribution to a 401(k) plan. These include partnerships, limited liability companies (LLCs), S corporations, and C corporations. In general partnerships, partners are active participants in the business, meaning they are eligible to contribute to a 401(k) plan based on their earned income. The same often applies to partners in limited partnerships, although limited partners (those who are not involved in daily management) may face different considerations. Members of an Limited Liability Companies (LLCs) are considered self-employed, and they can contribute to a 401(k) plan. The nature of their contributions and the associated tax implications can depend on how the LLC is structured and how it chooses to be taxed. Shareholders who are also employees in an S Corporation can contribute to a 401(k) plan based on their W-2 wages. However, passive shareholders – those not involved in the business operations – may not be eligible to contribute. In a C Corporation, shareholders can contribute to a 401(k) plan if they are also employees receiving W-2 wages from the corporation. However, the corporation's profits are subject to double taxation – first at the corporate level and again when distributed as dividends – which can impact the overall tax benefits of the 401(k) plan. Contributing to a 401(k) plan provides significant tax advantages. Contributions made to a traditional 401(k) plan are pre-tax, meaning they reduce the contributor's taxable income for the year. The funds then grow tax-deferred until withdrawal, typically during retirement when the individual may be in a lower tax bracket. Partners can potentially benefit from employer matching contributions if their business offers this feature in its 401(k) plan. Under this arrangement, the business matches the partner's contributions up to a certain percentage, effectively providing free money towards their retirement savings. 401(k) plans offer the opportunity for substantial growth in retirement savings, thanks to the power of compound interest. Over time, the interest earned on both the initial contributions and the reinvested interest can lead to significant accumulation of retirement funds. The IRS sets annual limits on how much individuals can contribute to their 401(k) plans. These limits apply to partners as well, and they include both the partner's individual contributions and any employer matching contributions. Certain 401(k) plans may have additional restrictions or requirements beyond the standard IRS rules. For example, some plans may limit the types of investments that can be made, or they may have specific rules about when and how funds can be withdrawn. There may also be other legal and regulatory restrictions on partner contributions to a 401(k) plan, particularly in relation to anti-discrimination rules. These rules are designed to ensure that benefits under the plan do not disproportionately favor highly compensated employees or owners, including partners. Partners can contribute to a 401(k) plan, subject to certain eligibility criteria. The ability to participate in a 401(k) plan may vary depending on the type of business entity in which the partner is involved. Different considerations apply to partners in various business structures, such as general partnerships, limited partnerships, LLCs, S Corporations, and C Corporations. It is important for partners to understand the specific rules and requirements related to their entity type. Contributing to a 401(k) plan as a partner offers several benefits and advantages. These include tax advantages, potential employer matching contributions, and the opportunity for retirement savings to grow over time. Participating in a 401(k) plan allows partners to secure their financial future and take advantage of the long-term investment potential provided by these retirement savings vehicles.Overview of 401(k) Plans

Can a Partner Contribute to a 401(k) Plan?

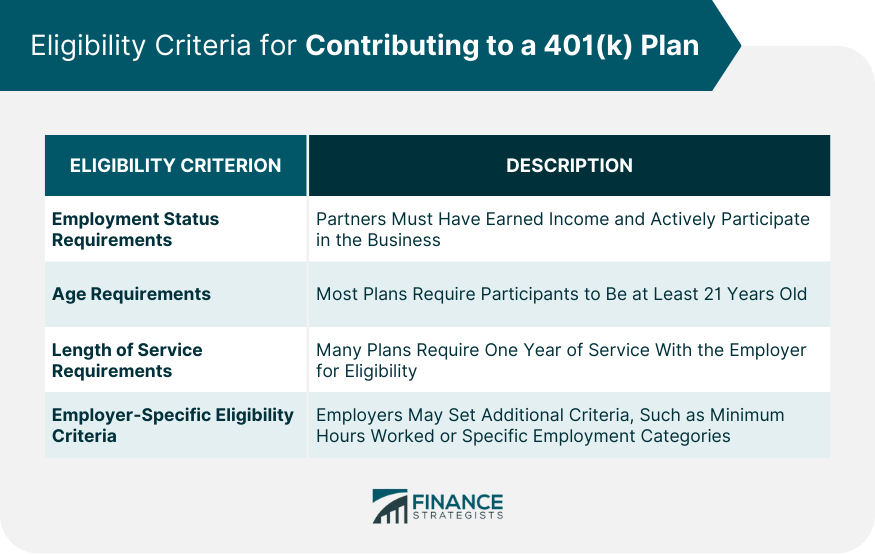

Eligibility Criteria for Contributing to a 401(k) Plan

Employment Status Requirements

Age Requirements

Length of Service Requirements

Employer-Specific Eligibility Criteria

Considerations for Partners in Different Types of Business Entities

Partnerships

Limited Liability Companies (LLCs)

S Corporations

C Corporations

Benefits and Advantages of Partner Contributions to a 401(k) Plan

Tax Advantages

Employer Matching Contributions

Retirement Savings Growth

Limitations on Partner Contributions to a 401(k) Plan

Contribution Limits

Plan-Specific Restrictions

Other Legal and Regulatory Restrictions

Conclusion

Can a Partner Contribute to a 401(k) Plan? FAQs

A 401(k) plan is a retirement plan offered by an employer designed to help employees save for retirement.

A partner can usually still contribute to a 401(k) plan, however the tax treatment of the contributions is different. For example, matching contributions is treated like self-employment income rather than a salary.

Yes, as long as the individual is a working spouse or domestic partner of the primary account holder, they can make contributions to their own 401(k) plan or any other employer-sponsored retirement savings account.

No, it does not matter what your partner’s income is; only the primary account holder’s salary will be taken into consideration when determining contribution limits and eligibility for tax benefits.

Yes, there is an annual maximum that your partner can contribute to your joint 401(k). In 2021, this amount is capped at $14,500 or 100% of their income (whichever is less).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.