An S Corp, is a special type of corporation designed and recognized by the Internal Revenue Service (IRS). It gets its name from Subchapter S of the Internal Revenue Code, which describes its tax status. S Corps avoid the double taxation issue that plagues traditional corporations by allowing profits to be passed through directly to the owners' personal income without any corporate tax rates imposed. Have questions about an S Corp 401(k) Plan? Click here. The IRS recognized that an S Corporation can sponsor a solo 401(k), also called an individual 401(k). The caveat is that there must be no full-time common law employees and you and any other owner must have at least 2% of the outstanding company stock. Despite its unique tax status, an S Corp is eligible to sponsor a 401(k) plan for its employees, just like any other corporation. This confluence of S Corp tax benefits and 401(k) retirement savings can provide a symbiotic relationship, allowing for both enhanced retirement savings for employees and potential tax advantages for the business. This document outlines the workings of the 401(k) plan, including information on contributions, eligibility, and distributions. Once the plan document is drafted, it needs to be formally adopted by the S Corp. The act of adoption involves an agreement by the S Corp to provide the benefits outlined in the plan document. Guidelines around eligibility and participation form the cornerstone of any 401(k) plan. For an S Corp's 401(k) plan, these rules must be clearly defined. Commonly, employees must be at least 21 years old and have completed one year of service with the S Corp. However, more lenient criteria can also be established. Once employees meet the eligibility requirements, they must be allowed to participate in the 401(k) plan. The IRS sets the contribution limits for 401(k) plans annually, and this limit applies to S Corp plans as well. A vesting schedule, on the other hand, defines when employees acquire non-forfeitable rights to employer contributions in their 401(k) accounts. This schedule can either be immediate or span several years, based on the S Corp's policies. This requirement ensures that the 401(k) benefits do not favor highly compensated employees or key personnel over other employees. If the 401(k) plan fails this test, the S Corp must take corrective action to ensure compliance. S Corps are required to provide plan participants with certain information and reports about the 401(k) plan, such as Summary Plan Descriptions (SPD) and annual reports. They also must file an annual return/report regarding the plan's financial condition and operations with the IRS. An attractive benefit package can often be the deciding factor for a potential hire. Offering a 401(k) plan can help an S Corp attract top talent and retain its existing employees by providing them with a substantial means to save for their future. A symbiotic benefit emerges from offering a 401(k) plan, providing tax advantages for both the corporation and its employees. For employees, 401(k) contributions are made pre-tax, reducing their taxable income for the year. For the S Corp, employer contributions to the plan are tax-deductible, reducing its taxable income as well. While the benefits are plentiful, there are some potential drawbacks for an S Corp offering a 401(k) plan. Among them is the burden of administrative responsibilities and costs. The corporation must handle recordkeeping, nondiscrimination testing, and IRS reporting - tasks that often require time, knowledge, and resources. Depending on the design of the plan, the S Corp may match employee contributions or provide profit-sharing contributions. While these contributions are tax-deductible, they could also potentially strain the corporation's cash flow, particularly for smaller S Corps. The structure should align with the corporation's goals and the needs of its employees. Aspects to consider include contribution matching, vesting schedules, and the potential inclusion of profit-sharing or Roth 401(k) options. When setting up the 401(k) plan, the S Corp must carefully consider eligibility requirements and participation rules. These decisions can affect employee morale and the plan's overall success. A more inclusive approach may increase participation rates, fostering a culture of savings and financial wellness within the corporation. The final crucial aspect of setting up a 401(k) plan for an S Corp involves understanding and complying with fiduciary responsibilities. Under the Employee Retirement Income Security Act (ERISA), the S Corp must act in the best interest of the plan participants. This responsibility includes ensuring the plan's fees are reasonable, selecting appropriate investment options, and ensuring the plan remains in compliance with ERISA and other regulations. Yes, an S Corp can contribute to the 401(k) plan. These contributions can be structured as matching, where the S Corp matches a portion of the employee's contributions, or non-elective, where the S Corp contributes regardless of the employee's contributions. The introduction of a 401(k) plan can indeed have a positive impact on the S Corp's taxes. Employer contributions to the plan are tax-deductible, reducing the corporation's taxable income. Furthermore, the plan can offer tax-deferred growth on investments, bolstering the financial health of the corporation. While the 401(k) plan is a wonderful perk, there are indeed limitations for highly compensated employees. These limitations are a result of non-discrimination testing, which ensures that the plan does not favor highly compensated employees over non-highly compensated employees. If the test fails, corrective actions may limit contributions by highly compensated employees. Should the S Corp terminate, the future of the 401(k) plan rests on several factors, including the specifics outlined in the plan document. Options may include rolling the plan assets into another qualified plan or dispersing the assets directly to the plan participants. An S Corp can have a 401(k) plan. This fusion of the S Corp's unique tax status and a 401(k) retirement plan can offer a multitude of benefits, such as attracting and retaining employees and providing tax advantages. In order to sponsor a 401(k) plan, an S Corp must navigate through several requirements. These requirements span from creating a plan document to adhering to contribution limits, conducting non-discrimination testing, and fulfilling reporting and disclosure responsibilities. While offering a 401(k) plan can provide significant benefits like attracting top talent and providing tax advantages, potential drawbacks like administrative responsibilities and possible cash flow impacts must also be considered.What Is an S Corporation?

Can an S Corp Have a 401(k) Plan?

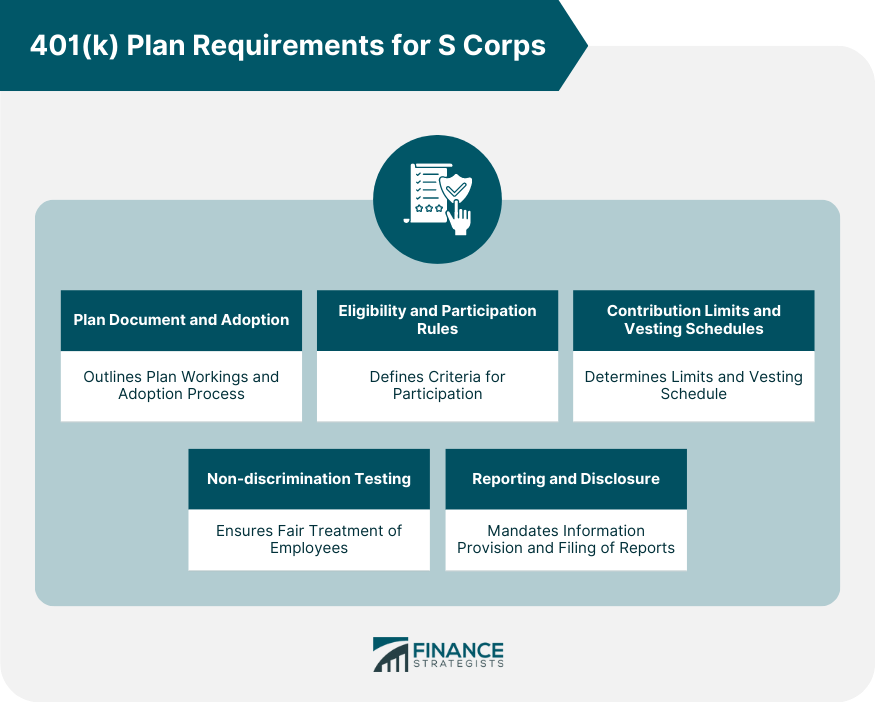

401(k) Plan Requirements for S Corps

Plan Document and Adoption

Eligibility and Participation Rules

Contribution Limits and Vesting Schedules

Non-Discrimination Testing

Reporting and Disclosure Requirements

Benefits of Offering a 401(k) Plan as an S Corp

Attracting and Retaining Employees

Tax Advantages for the Corporation and Employees

Drawbacks of Offering a 401(k) Plan as an S Corp

Administrative Responsibilities and Costs

Potential Impact on Cash Flow

Setting Up a 401(k) Plan for an S Corp

Plan Design and Structure

Considerations for Employee Eligibility and Participation

Fiduciary Responsibilities and ERISA Compliance

Common Questions and Concerns

Can the S Corp Contribute to the 401(k) Plan?

How Does a 401(k) Plan Impact the S Corp's Taxes?

Are There Any Limitations for Highly Compensated Employees?

What Happens to the 401(k) Plan if the S Corp Terminates?

Conclusion

Can an S Corp Have a 401(k) Plan? FAQs

Yes, an S corporation can offer its employees a 401(k) plan in order to provide long-term savings and financial security for employees.

The process for setting up a 401(k) plan for an S corporation includes establishing the plan according to IRS guidelines, selecting investments that are appropriate for the type of business, and ensuring all required documents are filed with the IRS.

Yes, an S corporation may need to take into consideration additional filing requirements such as Form 5500-SF in order to comply with IRS regulations for their 401(k) plan.

Offering a 401(k) plan can provide certain tax advantages for S corporations, including deductions from taxable income and potential credits for startup costs associated with setting up the plan.

Yes, according to IRS rules, the maximum amount an employee can contribute to a 401(k) plan in 2021 is $19,500. Employees who are age 50 or older can make additional catch-up contributions of up to $6,500.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.