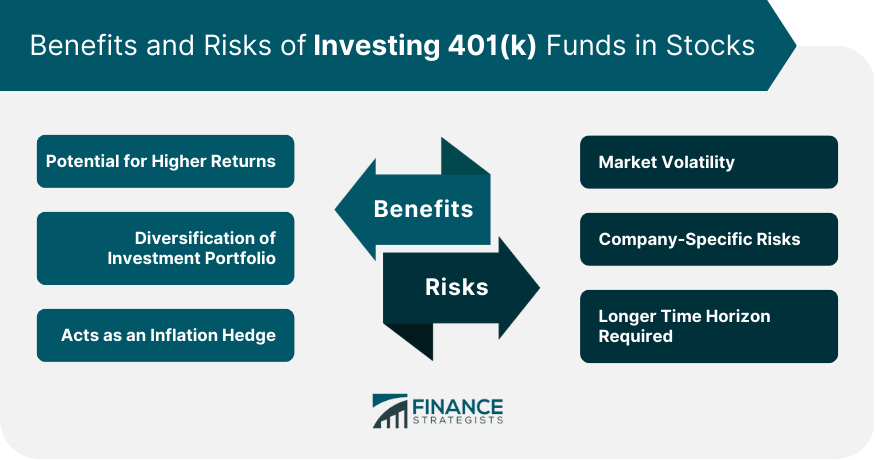

Yes, individuals can invest their 401(k) retirement savings in stocks. Most 401(k) plans offer various investment options, including stock funds. These funds may invest in individual stocks or a portfolio of stocks. One of the advantages of investing 401(k) funds in stocks is the potential for higher returns. The stock market historically has offered higher returns than other investment options, such as bonds and cash. Additionally, investing in stocks can provide diversification to an individual's portfolio, which can help reduce the overall risk of the portfolio. However, it is important to note that investing in stocks carries risks. The stock market is volatile, and there is a possibility of losing money. A 401(k) plan is a type of defined contribution retirement plan where an employer sets up an account for each employee and makes contributions to the account on the employee's behalf. Employees may also choose to make contributions to the account, with the contributions deducted from their pre-tax income. The contributions are then invested in various investment options, such as mutual funds, bonds, and stocks. One of the key features of 401(k) plans is the contribution limits. The IRS sets these limits annually, and they are subject to change. For the year 2024, the maximum contribution limit for 401(k) plans is $23,000 for individuals under 50 years old ($23,500 for 2025) and $30,500 ($31,000 for 2025) for individuals 50 years and older. Additionally, 401(k) plans have distribution rules, which dictate when individuals can withdraw funds from their accounts without incurring penalties. Generally, individuals cannot withdraw funds from their 401(k) accounts before they reach 59 ½ years old unless they meet specific criteria, such as disability or financial hardship. Investing 401(k) funds in stocks can be an essential way for individuals to achieve their long-term retirement savings goals. Additionally, diversifying a person's financial portfolio by purchasing stocks through a 401(k) plan can help lower total portfolio risk. It is crucial to be aware that stock investing involves risks such as market volatility and company-specific risks. However, when investing with a long-term investment horizon and a diversified portfolio strategy, investing in stocks can provide an effective way to build wealth over time. With contributions made on a pre-tax basis and taxes deferred until withdrawals are made, investing 401(k) funds in stocks can also offer tax advantages. There are potential benefits and risks of investing 401(k) funds in stocks. The anticipated benefits of investing 401(k) in stocks are higher returns, diversification, and an inflation hedge. The stock market has historically provided higher returns than other investment options. Investing in stocks can help individuals grow their retirement savings faster than other investment options. Investing in stocks can provide diversification to an individual's portfolio. A diversified portfolio can help reduce the overall risk of the portfolio by spreading investments across different asset classes and sectors. A hedge against inflation is an investment that aims to safeguard the investor from a decline in the purchasing power of money. Stocks can act as an inflation hedge, as the value of stocks tends to rise as inflation increases. Among the risks in investing 401(k) in stocks are market volatility, company-specific risks and a longer time horizon. The stock market is known for its volatility, which means that stock prices can fluctuate rapidly and significantly. This volatility can result in losses for individuals who have invested their retirement savings in stocks. Investing in individual stocks can be risky, as the performance of a single company can affect the value of an individual's investment significantly. Investing in stocks requires a longer time horizon as compared to other investment options. The stock market is volatile in the short term, but over the long term, it has provided higher returns. Investing 401(k) funds in stocks can have tax implications that individuals should be aware of. One of the benefits of investing in a 401(k) plan is that contributions are made on a pre-tax basis. The contributions and earnings in the 401(k) plan are not taxed until the individual withdraws the funds from the plan. When an individual withdraws funds from their 401(k) plan, the amount withdrawn is subject to income tax. Additionally, if an individual withdraws funds from their 401(k) plan before they reach 59 ½ years old, they may be subject to a 10% early withdrawal penalty. When an individual invests their 401(k) funds in stocks, they can buy and sell stocks within their 401(k) plan without incurring any taxes. The taxes are deferred until the individual withdraws funds from their 401(k) plan. Investing in individual stocks may be subject to capital gains taxes when the stocks are sold. However, these taxes are also deferred until the individual withdraws funds from their 401(k) plan. Investing 401(k) funds in stocks can be an effective way for individuals to grow their retirement savings, provided they do so wisely and with careful consideration of their investment objectives, risk tolerance, and time horizon. Can I Invest My 401(k) in Stocks?

Individuals can choose to invest a portion of their 401(k) funds in these stock funds, depending on their investment objectives, risk tolerance, and time horizon.Understanding 401(k) Plan Rules and Regulations

Importance of Investing 401(k) Funds in Stocks

The potential for higher returns on investments in the stock market can help individuals grow their retirement savings at a faster rate than other investment options, such as bonds or cash.Benefits and Risks of Investing 401(k) Funds in Stocks

Benefits

Higher Returns

Diversification

Inflation Hedge

Risks

Market Volatility

Company-Specific Risks

If the company experiences financial difficulties or fails, the value of the individual's investment can decrease significantly.Time Horizon

Individuals who have a shorter time horizon may not be able to withstand the volatility of the stock market and should consider other investment options.

Tax Implications of Investing 401(k) Funds in Stocks

This means that individuals can deduct the contributions they make to their 401(k) plans from their taxable income. The Bottom Line

While investing in stocks carries risks, such as market volatility and company-specific risks, the potential benefits, such as higher returns and diversification, make it a worthwhile consideration for individuals.

As retirement planning can be complex and overwhelming, it may be helpful to seek the services of a retirement planning professional to help guide you in making informed investment decisions.

By taking action now and planning for retirement, you can ensure financial security and peace of mind during your retirement years.

Can I Invest My 401(k) In Stocks? FAQs

It is generally recommended that individuals diversify their investment portfolio by investing in multiple asset classes, including stocks, bonds, and cash. While it is possible to invest all of your 401(k) funds in stocks, it may not be the best strategy for your investment objectives, risk tolerance, and time horizon.

While most 401(k) plans offer various investment options, including stock funds, there may be restrictions on the amount of 401(k) funds that can be invested in stocks. Additionally, some plans may limit the types of stocks that can be invested in, such as limiting investments to only domestic stocks.

Yes, investing in stocks carries risks, such as market volatility and company-specific risks. The value of stocks can fluctuate rapidly and significantly, which can result in losses for individuals who have invested their retirement savings in stocks.

When individuals invest their 401(k) funds in stocks, they can buy and sell stocks within their 401(k) plan without incurring any taxes. The taxes are deferred until the individual withdraws funds from their 401(k) plan. If the individual invests in individual stocks, they may be subject to capital gains taxes when they sell the stocks.

Yes, most 401(k) plans allow individuals to change their investment strategy, including their allocation of funds to different investment options. However, individuals should be aware of any fees or restrictions associated with making changes to their investment strategy in their 401(k) plan. It is recommended that individuals consult with a financial advisor before making any significant changes to their investment strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.