Cashing out a 401(k) after leaving a job involves withdrawing all the funds from your account, which can provide immediate cash. However, doing so has potential drawbacks. If you're under 59.5 years old, you may face a 10% early withdrawal penalty, in addition to income tax on the withdrawn amount. Additionally, cashing out sacrifices the tax-advantaged growth your retirement savings could have enjoyed if left invested. Instead of cashing out, consider alternatives like rolling the funds into an IRA or a new employer's 401(k) plan, which can continue the tax-deferred growth. It's crucial to understand these implications and consult with a financial advisor before making a decision. Cashing out a 401(k) is a way for individuals to access their retirement savings ahead of their retirement. It's an important option to be aware of as it allows for financial flexibility in the face of unexpected life events or expenses. However, it should be considered carefully due to its potential long-term impacts on retirement savings and tax liabilities. Understanding the process of cashing out a 401(k) is crucial for individuals considering this option. The first step in cashing out a 401(k) is to contact the plan administrator. They will guide the individual through the process, which usually involves filling out a distribution request form. Once the form is completed and returned, the administrator will process the request, and the individual will receive a check or direct deposit for the account balance, minus any withholdings for taxes and penalties. When a 401(k) is cashed out, the amount withdrawn is added to the individual's taxable income for that year. This could potentially bump them into a higher tax bracket. Additionally, if the individual is under the age of 59½, a 10% early withdrawal penalty may apply, unless certain exceptions are met. Vesting refers to the amount of time an employee must work for their employer before they fully own their 401(k) contributions. If the employee leaves before they're fully vested, they may forfeit a portion of the employer's matching contributions. Individuals should consider their vesting schedule before deciding to cash out a 401(k). While cashing out a 401(k) is generally not recommended due to potential negative consequences, it does offer certain advantages. The primary advantage is immediate access to cash. This can be particularly beneficial in situations such as unexpected financial emergencies or high-interest debt that needs to be paid off immediately. Once cashed out, the money can be used as the individual sees fit. This could include investing in other vehicles that offer higher returns, starting a business, or meeting immediate financial needs. As previously mentioned, cashing out a 401(k) incurs taxes and potentially a 10% early withdrawal penalty. This means the individual could lose a significant portion of their retirement savings. 401(k) plans offer the benefit of tax-deferred growth, meaning the funds in the account grow without being subject to taxes until they are withdrawn during retirement. By cashing out, individuals forfeit this benefit. Cashing out a 401(k) reduces the amount of money saved for retirement. This can have a considerable impact on an individual's long-term financial security and their ability to maintain their desired lifestyle in retirement. Before deciding to cash out a 401(k), individuals should consider other options. If the new job offers a 401(k) plan, the individual could consider transferring their old 401(k) funds into the new plan. This allows the funds to continue growing tax-deferred. Another option is to roll over the 401(k) into an IRA. IRAs offer similar tax advantages to 401(k)s and might offer more investment options. In some cases, the individual can leave their funds in their old employer's 401(k) plan, where it can continue to grow tax-deferred. However, this option might not be available if the account balance is below a certain threshold. Deciding whether to cash out a 401(k) is a significant financial decision that should be made carefully. The individual needs to weigh their immediate financial needs against their long-term retirement goals. While cashing out can provide immediate funds, it could jeopardize their future financial security. The tax implications of cashing out a 401(k) should also be considered. It may be advantageous to consult with a tax professional to understand the potential tax consequences better. Cashing out a 401(k) can have implications for an individual's overall retirement strategy. It's crucial to consider how this decision fits into their broader financial plans. Consulting with a financial advisor can provide valuable insight into the benefits and drawbacks of cashing out a 401(k), taking into account the individual's unique financial situation and goals. A thorough review of the tax implications associated with cashing out a 401(k) is essential. This includes understanding the potential income tax burden and any early withdrawal penalties. Individuals should reassess their retirement plans and goals before making a decision. If cashing out a 401(k) aligns with their long-term financial objectives, they may need to adjust their retirement plans accordingly. Cashing out a 401(k) after leaving a job can provide instant access to funds, yet it may yield significant drawbacks such as tax implications and potential early withdrawal penalties. The act sacrifices tax-advantaged growth and can negatively impact long-term retirement savings. Before making such a decision, understanding vesting concepts, exploring alternatives like transferring funds to a new 401(k) or an IRA, and consulting with a financial expert are all crucial steps. This decision should be weighed against your immediate needs and future retirement goals, considering your overall financial plans and tax situations. Remember, while accessing cash immediately may be tempting, the long-term implications on your financial security are significant and should be carefully considered.What Is Cashing Out a 401(k) After Leaving a Job?

Purpose and Importance

Process of Cashing Out a 401(k) After Leaving a Job

Withdrawal Procedure

Tax Consequences and Penalties

Concept of Vesting

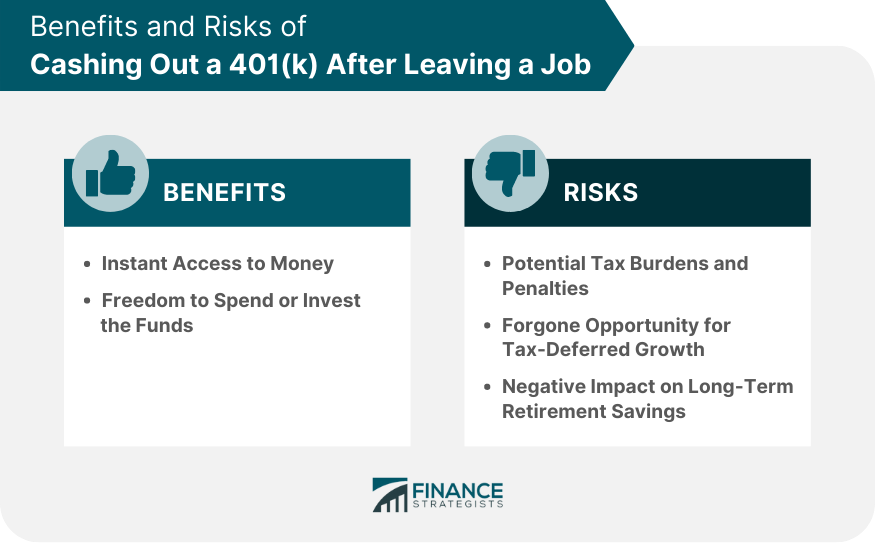

Benefits of Cashing Out a 401(k) After Leaving a Job

Instant Access to Money

Freedom to Spend or Invest the Funds

Risks of Cashing Out a 401(k) After Leaving a Job

Potential Tax Burdens and Penalties

Forgone Opportunity for Tax-Deferred Growth

Negative Impact on Long-Term Retirement Savings

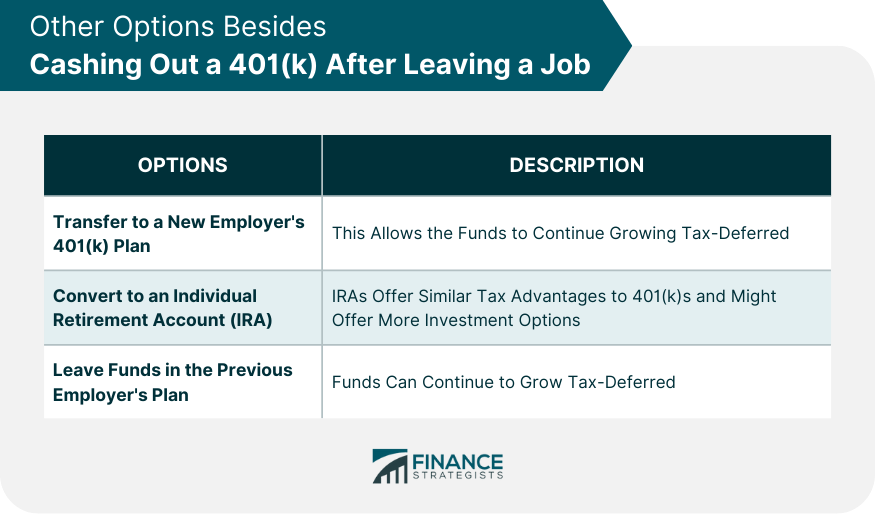

Other Options Besides Cashing Out a 401(k) After Leaving a Job

Transfer to a New Employer's 401(k) Plan

Convert to an Individual Retirement Account (IRA)

Leave the Funds in the Previous Employer's Plan

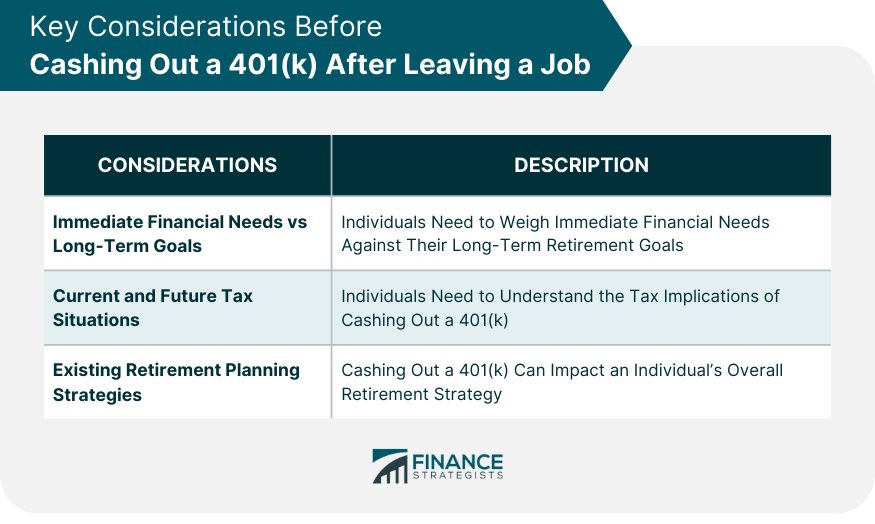

Key Considerations Before Cashing Out a 401(k) After Leaving a Job

Immediate Financial Needs and Long-Term Goals

Current and Future Tax Situations

Existing Retirement Planning Strategies

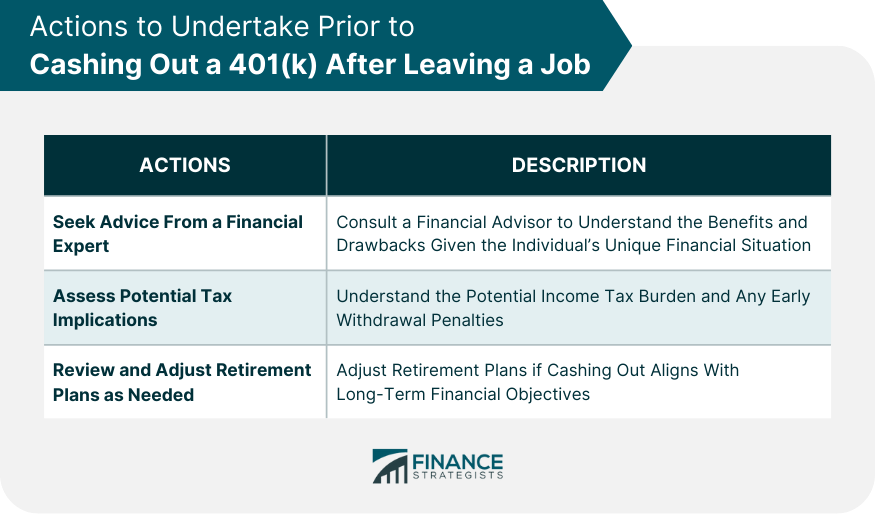

Actions to Undertake Prior to Cashing Out a 401(k) After Leaving a Job

Seek Advice From a Financial Expert

Assess Potential Tax Implications

Review and Adjust Retirement Plans as Needed

Conclusion

Cashing Out a 401(k) After Leaving a Job FAQs

Cashing out a 401(k) after leaving a job refers to the process of withdrawing the funds accumulated in your 401(k) account when you leave your employer. This gives you immediate access to your money, but it also incurs immediate tax liability and possible early withdrawal penalties.

When you cash out a 401(k), the amount withdrawn is treated as taxable income for that year. This could potentially put you in a higher tax bracket. If you are under the age of 59½, you may also face a 10% early withdrawal penalty, unless you meet certain exceptions.

Instead of cashing out, you can consider transferring your 401(k) funds to a new employer's plan, rolling it over into an Individual Retirement Account (IRA), or leaving it in your previous employer's plan if the balance is above a certain threshold.

People might consider cashing out a 401(k) for immediate financial needs, such as paying off high-interest debt, covering emergency expenses, or investing in other opportunities. However, it's crucial to weigh these immediate needs against the long-term impact on retirement savings and potential tax liabilities.

Before cashing out, it's advisable to seek advice from a financial expert to understand the potential benefits and drawbacks. You should also assess potential tax implications and review and adjust your retirement plans as necessary.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.