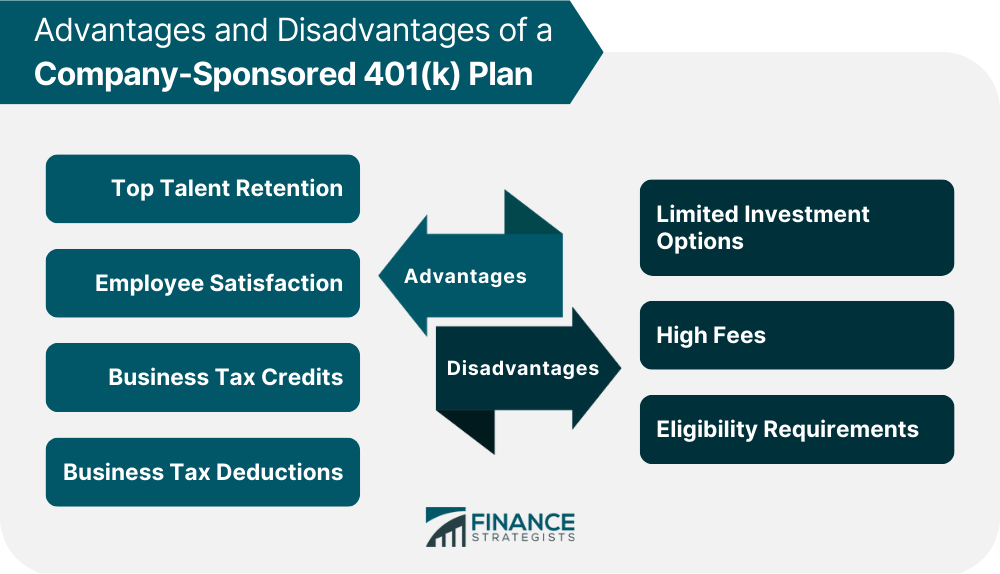

A company-sponsored 401(k) plan is a retirement savings account offered to employees by their employer. It allows workers to save and invest money for retirement while receiving certain tax benefits. The money in the account grows tax-deferred, meaning it is only taxed when the funds are withdrawn after retirement. The 401(k) plan was designed to help workers accumulate substantial funds by the time they retire and reduce the tax burden of saving for retirement. These plans usually offer a wide variety of investment options and provide protection from creditors in most cases. Furthermore, they often include loan provisions and other features such as Roth contributions and catch-up contributions, which are available to older individuals with higher income levels. Have questions about 401(k) Plans? Click here. In a company-sponsored 401(k) plan, employers typically match a portion of the contributions that their employees make, making it a powerful investment instrument for individuals looking to save for retirement. In order to participate in a company-sponsored 401(k) program, participants must make regular contributions through payroll deductions, and these contributions are automatically invested based on the individual’s plan selections. The amount of money that an employee can contribute varies depending on their salary level, but it's possible for them to defer without having to pay taxes on that income or have it count against income limits for Social Security benefits. The employer usually matches these contributions in some form which incentivizes the employee to set aside more funds. This contribution matching may range from a flat amount or a percentage of the employee’s salary based on length of service or salary level. Furthermore, employers may offer additional benefits such as automatic enrollment programs and hardship withdrawals under certain qualifying conditions. Once the funds have been deposited into the account, they can be invested in several different options such as stocks, bonds, and mutual funds according to each individual’s preferences and financial goals. It's essential to set up an allocation strategy when managing investments within the 401(k). By diversifying and spreading risk across multiple asset classes, savers can help protect their investments against market fluctuations while optimizing their returns over time. Advantages of a company-sponsored 401(k) include top talent retention, high employee satisfaction, business tax credits, and business tax deductions. Offering a 401(k) can be an excellent way to attract and retain top talent in a competitive market. When employees have access to such a powerful investment instrument, they’ll likely stay longer at the company with the assurance of financial security once they retire. Having access to a company 401(k) also helps raise employee satisfaction levels since they know they’re investing in their own future while getting money saved on taxes through payroll deductions. This often leads to improved morale and performance within the workplace which will benefit your bottom line in the long run. Companies can take advantage of certain tax credits when launching a 401(k) plan for their employees — such as tax credits for administrative expenses related to setting up or maintaining the program or credits for automatic enrollment features if included in the setup. Businesses may also be eligible for various tax deductions when offering this type of benefit as well — including deductions from wages used to fund matching contributions as well as any deduction from profits related to starting or administering the plan itself. There are also drawbacks to keep in mind, which include limited investment options, high fees, and eligibility requirements. Depending on the plan provider, participants may have limited investment options — meaning they won’t be able to choose their own stocks or diversify their portfolio as much as they would with a traditional IRA or another type of investment account. While most 401(k) plans are generally cheaper than other types of retirement accounts, fees associated with them can still add up over time and eat into your overall return on investment. These fees include administrative fees such as maintenance fees, recordkeeping fees, transaction costs (for buying/selling investments), and withdrawal fees if applicable. It’s vital to know exactly how much you will be charged for each service when signing up for a 401(k). Employees must meet certain eligibility requirements in order to contribute to a company’s 401(k). Generally speaking, these requirements involve things like age (participants must be at least 21 years old), hours worked per week (must work at least 1,000 hours per year), and length of service (must have worked at least one year at the same job). Employees who don't meet these criteria won't be able to contribute unless they're eligible through another plan first, like an individual retirement account (IRA). When you're transitioning to a new job, it's essential to have a plan for your company-sponsored 401(k) account so that you can make the most out of its many benefits. If you don’t want to leave your money with the same provider, transferring it into an IRA is one option. This will allow you to keep saving and investing on your own terms while still taking advantage of tax-deferred growth potential. Rolling over your funds into another qualified retirement account such as a 401(k) or IRA with a new employer is also possible if they allow it. It’s essential to note that this will require closing out the original plan entirely and paying any related fees associated with that process first. Cashing out the funds completely may be an option, but it should be avoided unless absolutely necessary. Doing so means giving up those tax benefits and incurring an early withdrawal penalty if applicable. Furthermore, the withdrawn funds become taxable income for that year, making this a less desirable choice. A company-sponsored 401(k) plan provides an excellent opportunity to save for retirement. Taking advantage of employer contributions, tax benefits, and investment options can be a powerful tool in creating financial security for the future. Keep in mind that there are also downsides to consider, like having limited investment options and high fees, as well as the stringency of eligibility requirements. You’ll also need to think about your options if you decide to leave your job. It's important to research all of your particular company's plans to make sure you understand the fees associated and find the best fit for your needs.What Is a Company-Sponsored 401(k) Plan?

How a Company-Sponsored 401(k) Plan Works

Advantages of a Company-Sponsored 401(k) PlanTop Talent Retention

Employee Satisfaction

Business Tax Credits

Business Tax Deductions

Disadvantages of a Company-Sponsored 401(k) Plan

Limited Investment Options

High Fees

Eligibility Requirements

What to Do With Your Company-Sponsored 401(k) Plan When You Leave Your Job

Transfer Options

Rollover Options

Cash Out Option

Conclusion

Company-Sponsored 401(k) Plan FAQs

A company-sponsored 401(k) plan is an employer-sponsored retirement savings account that allows employees to invest pre-tax money for retirement. Employers often contribute matching funds to these accounts as an incentive for their employees to save.

The main advantages of having a company-sponsored 401(k) plan include the ability to save pre-tax money, employer contributions, tax-deferred growth potential, and in some cases, access to lower fees than traditional investments.

In order to be eligible to participate in a company’s 401(k) plan, you must typically meet certain criteria such as being over 18 years of age and being employed with the company for at least one year. There may also be other criteria based on the individual employer’s guidelines.

Like any investment, there are associated risks with investing in a company-sponsored 401(k). These include having limited investment options, high fees, and possible early withdrawal penalties if funds are withdrawn prior to reaching retirement age. It's crucial to consider all of these factors before deciding which investments are right for you.

When leaving your job, you can either transfer your funds into an individual retirement account (IRA), roll over your funds into another qualified retirement account such as a 401(k) or IRA with your new employer, or cash out the funds entirely. It's vital to understand all of the implications associated with each option before making any decisions, so it is wise to discuss any questions or concerns you have with a financial advisor first.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.