A Defined Benefit Plan Rollover to 401(k) is a process that allows individuals to move funds from a traditional defined benefit pension plan into a 401(k) retirement savings plan. The defined benefit plan, often simply referred to as a pension, offers predetermined, fixed payments in retirement, often based on an employee's years of service and salary. On the other hand, a 401(k) plan allows individuals to contribute a portion of their salary, often with employer matching, to an investment account with potential earnings based on the market's performance. Transitioning funds from a defined benefit plan to a 401(k) can be a complex decision. Still, it's a viable option for many, especially those seeking more control over their retirement investments and a potentially higher growth rate on their savings. A rollover from a defined benefit plan to a 401(k) plan is just like any other type of rollover. When you leave an employer that offers a defined benefit plan, or you work for an employer that terminates its defined benefit plan, then you will be eligible to roll your plan over into an IRA or another employer-sponsored retirement plan such as a 401(k) plan. Have questions about the Defined Benefit Plan Rollovers? Click here.

Some defined benefit plans will allow you to roll your whole plan balance over at once, while others require you to move your plan balance over in segments. The larger the plan you have, the smaller the chance that you'll be able to roll over your entire balance at once. Any amount of your defined benefit plan that is to be used for required minimum distributions cannot be rolled over. Your plan will inform you at the time of separation or termination what your rollover options are. Before initiating a 401(k) rollover, individuals need to understand the eligibility criteria set by both the existing plan and the new plan. This involves verifying whether the receiving 401(k) plan accepts rollovers and whether the individual meets any specific age or service requirements. Additionally, considering any potential vesting schedules and employer contribution policies within the new plan is essential to ensure alignment with retirement goals. The process of a 401(k) rollover necessitates proper documentation and paperwork to ensure a smooth transition. Individuals are typically required to complete forms provided by both the current plan administrator and the new 401(k) plan provider. These forms gather necessary information, such as account details, beneficiary designations, and the rollover amount. Accuracy and completeness are crucial to prevent delays or errors during the transfer. Individuals should be aware of tax consequences associated with rollovers, such as potential tax withholding for direct transfers and the possibility of penalties for missed deadlines. Additionally, understanding the difference between direct rollovers, where funds move directly between accounts, and indirect rollovers, where funds pass through the individual's hands, is essential for managing tax obligations. Careful planning in accordance with tax regulations can help minimize unnecessary financial setbacks during the rollover process. The first step in the rollover process is to determine one's eligibility. Not all pension plans allow for rollovers, and even if they do, there might be specific rules and timelines to follow. It's crucial to review the Summary Plan Description (SPD) or consult with a plan administrator to understand these details. Additionally, federal regulations and IRS guidelines often govern the rollover process, ensuring the preservation of tax advantages. Once eligibility is established, the next step involves initiating the rollover request. This usually requires filling out specific forms provided by the pension plan administrator. It's essential to be precise and accurate when completing these forms to avoid any potential errors or delays. Some plans may require a waiting period or have specific windows during which rollovers can occur. Upon approval of the rollover request, the funds will be transferred from the defined benefit plan to the chosen 401(k). This transfer should ideally be direct, meaning funds move from one institution to another without passing through the individual's hands. Once in the 401(k), individuals have the opportunity to allocate their funds among various investment options, depending on the offerings of the specific plan. One of the primary benefits of rolling over to a 401(k) is gaining increased control over investments. Defined benefit plans typically have fixed payouts, offering little room for individual investment decisions. In contrast, a 401(k) allows participants to select from a range of investment options, enabling them to craft a portfolio that aligns with their personal preferences, risk tolerance, and financial objectives. A 401(k) provides portability and flexibility that traditional pension plans often lack. If an individual changes employers, they can take their 401(k) with them, rolling it into a new employer's plan or into an Individual Retirement Account (IRA). This flexibility ensures continuity in retirement savings efforts, irrespective of career changes or movements across different jobs. While defined benefit plans offer the security of fixed payouts, 401(k) plans, being market-linked, present the potential for higher returns. Depending on the investment choices made and market performance, the growth in a 401(k) can outpace the fixed returns of a traditional pension. 401(k) plans often offer a broader array of investment options compared to traditional pension plans. These options can range from conservative bond funds to aggressive growth stocks. Such diversity allows participants to spread their investments across asset classes, potentially mitigating risk and harnessing growth from different market segments. Before rolling over funds, it's essential to evaluate the value of the pension benefits against potential future payouts. Sometimes, the guaranteed monthly income from a defined benefit plan might outweigh potential returns from a 401(k). Individuals should compare the current lump sum value of the pension with the projected monthly benefits at retirement. Rollovers can have tax implications if not done correctly. Direct rollovers, where funds move directly between plans, are generally tax-free. However, if funds are distributed to the individual first and then contributed to the 401(k), it might lead to tax penalties if the entire process isn't completed within 60 days. Rolling funds into a 401(k) requires active investment management. Individuals need to assess their investment knowledge and risk tolerance. If they're not comfortable making investment decisions, they might benefit from seeking advice from a financial professional. Finally, the decision to roll over should align with one's broader financial planning and retirement goals. It's worth considering factors like expected retirement age, anticipated retirement expenses, other income sources, and long-term financial objectives. If you made after-tax contributions to your defined benefit plan, then you will need to keep track of that money and keep it separate from the rest of your plan that was funded with pretax money so that it doesn't get taxed twice. And, of course, the 401(k) plan that is receiving your defined benefit plan balance must allow for rollovers from other plans (and most of them do). You can also roll your defined benefit plan into a Roth 401(k) if you choose, but you'll have to pay taxes on the rollover amount at the time of distribution. A Defined Benefit Plan Rollover to a 401(k) involves transferring funds from a traditional pension plan to a 401(k) retirement savings account. Defined benefit plans, known as pensions, provide fixed payments based on service and salary, while 401(k) plans allow contributions with market-based earnings potential. This transition offers increased control over investments, portability, potential for higher returns, and diversified investment options. Eligibility for a rollover depends on plan specifics and age criteria. Necessary documentation and forms must be accurately completed to ensure a seamless process. Tax implications, timing, and understanding direct vs. indirect rollovers are critical considerations. Rollover decisions should align with investment knowledge, risk tolerance, and retirement goals. Overall, a well-executed rollover empowers individuals to shape their retirement savings strategy effectivelyWhat Is a Defined Benefit Plan Rollover to 401(k)?

401(k) Rollover Requirements

Eligibility and Qualification Criteria

Documentation and Forms

Tax Considerations and Timing

Defined Benefit Plan Rollover Process

Determine Eligibility and Regulations

Initiate the Rollover Request

Manage Funds Transfer and Investment Allocation

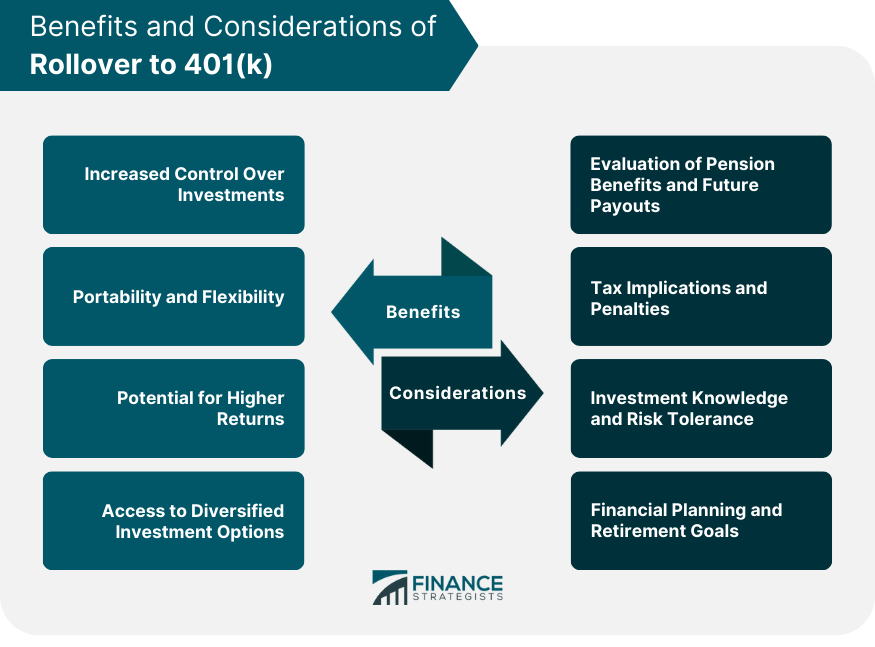

Benefits of Rollover to 401(k)

Increased Control Over Investments

Portability and Flexibility

Potential for Higher Returns

Access to Diversified Investment Options

Considerations Before Rollover

Evaluation of Pension Benefits and Future Payouts

Tax Implications and Penalties

Investment Knowledge and Risk Tolerance

Financial Planning and Retirement Goals

401(k) Rollover TaxesConclusion

Defined Benefit Plan Rollover to 401(k) FAQs

A Defined Benefit Plan Rollover to 401(k) is when an individual moves the funds held in their defined benefit plan into a 401(k) retirement account. This may be done for tax planning purposes, access to more investment options or other reasons.

Rolling over from a defined benefit plan to a 401(k) should be considered when you want access to more customizable investment options and if you are looking for additional flexibility with your retirement savings. It can also offer greater control and transparency of your investments, as well as potentially more favorable tax implications.

The process for transferring funds from your defined benefit plan to a 401(k) will depend on the specific details of each individual case, however in most cases you can rollover eligible funds directly from one account to another without being subject to paying any taxes.

Rolling over a defined benefit plan into a 401(k) may expose an individual to increased investment risk and fees, which could reduce their overall return on investments. Additionally, if the transfer is not done correctly it may be subject to penalties or taxes, which could significantly reduce the amount of money that can be saved for retirement.

It is always worth seeking out qualified financial advice in order to understand the full implications of any decisions being made with regards to your retirement savings. This will ensure that you are able to make informed decisions and access all available options in order to maximize your returns while minimizing risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.