Overview of How Cryptocurrency Fits Into a 401(k) Portfolio

Cryptocurrency, a digital or virtual currency that uses cryptography for security, has emerged as a potential asset class that can be incorporated into a 401(k) portfolio.

The inclusion of cryptocurrency in a 401(k) depends on your plan's specific rules and regulations.

While cryptocurrencies like Bitcoin and Ethereum offer the possibility of high returns due to their rapidly changing values, they're also known for their extreme volatility.

This makes them a higher-risk asset class compared to traditional ones like stocks and bonds. Consequently, they should only constitute a portion of a diversified portfolio based on your risk tolerance.

Regular portfolio review and rebalancing become even more critical when including such a volatile asset.

So, although cryptocurrencies can enhance portfolio diversification and potentially offer significant gains, they should be approached with a clear understanding of the risks involved.

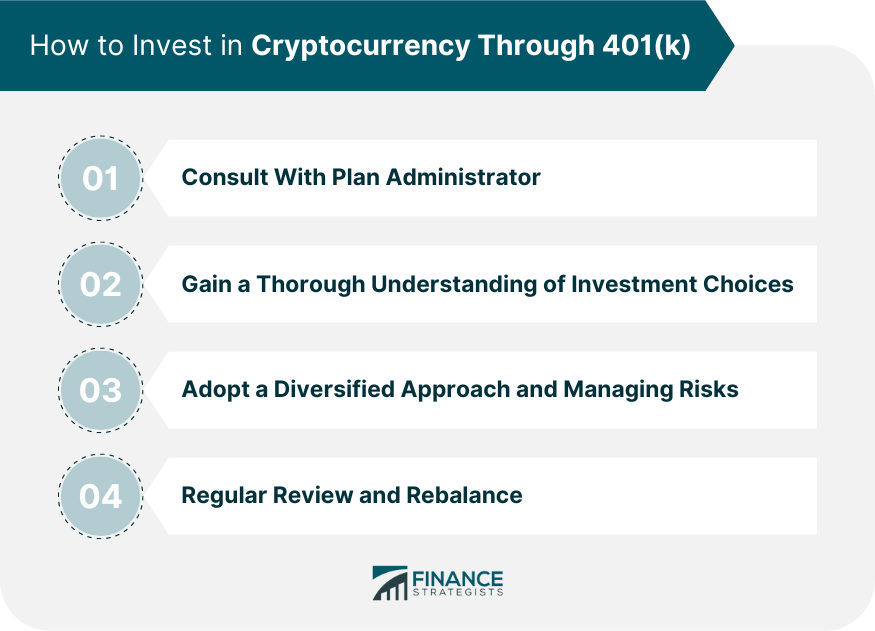

How to Invest in Cryptocurrency Through 401(k)

Step 1: Consult With Plan Administrator

It's crucial to note that not all 401(k) programs permit cryptocurrency investments. Therefore, the initial step in your journey towards cryptocurrency investment through your 401(k) should involve consulting your plan administrator.

In scenarios where your current plan doesn't support such investments, exploring alternatives like self-directed 401(k) plans may be beneficial.

Step 2: Gain a Thorough Understanding of Investment Choices

Provided your 401(k) accommodates cryptocurrency investment, it's essential to delve deep into the variety of options at your disposal.

This involves a comprehensive understanding of the various cryptocurrencies available, an overview of their market trajectories, and an acknowledgment of the potential risks each might carry.

Step 3: Adopt a Diversified Approach and Managing Risks

Maintaining a balanced, diversified portfolio is of paramount importance when dealing with investments, especially in high-risk areas like cryptocurrencies.

Here, diversification may imply diversifying your investments across a range of cryptocurrencies, making sure that they constitute only a fraction, and not the entirety, of your overall portfolio.

Step 4: Regular Review and Rebalance

Just like any other investment, keeping a regular check on your portfolio is crucial when investing in cryptocurrencies.

Given the highly volatile nature of the cryptocurrency market, your portfolio value can change rapidly, necessitating frequent rebalancing to maintain your preferred asset allocation.

Cryptocurrency-Focused 401(k) Platforms

Overview of Platforms That Allow for Cryptocurrency Investments

In today's digital era, a multitude of platforms caters to retirement accounts intending to invest in cryptocurrencies.

Gaining an understanding of the subtle distinctions of these platforms is key, and this involves comprehending their fee structures, security protocols, and the range of cryptocurrencies they permit for investment.

Assess a Cryptocurrency Platform

When it comes to scrutinizing a cryptocurrency platform, there are several factors to weigh. The security measures in place are crucial, given the digital nature of cryptocurrencies. Transparency regarding transactions and fees can inspire trust.

The user-friendliness of the platform can ensure a smooth investment process. Adequate customer support is valuable for resolving issues, and the diversity of available cryptocurrencies can offer opportunities for diversification.

Cryptocurrency as Part of a Balanced Retirement Plan

Importance of Diversification and Risk Tolerance

Including cryptocurrency in your retirement plan requires an understanding of your risk tolerance and the need for diversification. While it's possible to see significant gains, the potential for losses is equally high.

Potential Role of Cryptocurrency Within the Broader Investment Strategy

The role of cryptocurrency in a portfolio largely depends on individual investor preferences. For some, it may serve as a speculative asset with high return potential, while others may view it as a long-term investment in groundbreaking technology.

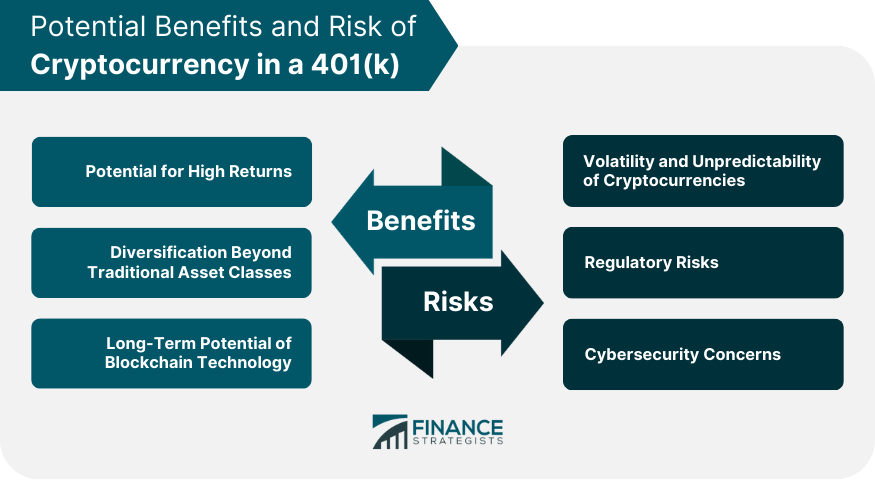

Potential Benefits of Cryptocurrency in a 401(k)

Potential for High Returns

Cryptocurrencies' allure lies significantly in their potential for high returns. Digital currencies such as Bitcoin have experienced significant expansion over the past decade, although this growth is marked by substantial fluctuations.

Diversification Beyond Traditional Asset Classes

Cryptocurrencies can offer a valuable counterbalance to traditional asset classes due to their generally low correlation with them.

This diversification advantage can prove particularly beneficial during market instability when traditional assets uniformly exhibit a downward trend.

Long-Term Potential of Blockchain Technology

When you invest in cryptocurrencies, you're indirectly investing in the underlying blockchain technology, too.

This technology holds the potential to revolutionize numerous sectors, including finance, supply chain management, and healthcare. Recognizing the Risks and Considerations for Cryptocurrency Investments

Risks and Considerations for Cryptocurrency Investments

Volatility and Unpredictability of Cryptocurrencies

Cryptocurrency markets are renowned for their extreme volatility. Cryptocurrencies can experience considerable value swings within short time frames, thereby introducing a notable level of investment risk.

Investors must brace for these abrupt changes and factor them into their decision-making.

Regulatory Risks

The regulatory environment for cryptocurrencies is continually evolving. This constant flux carries the potential risk of future policy shifts that could negatively affect cryptocurrency investments.

It's essential for investors to stay informed about potential changes and consider how they might impact their portfolios.

Cybersecurity Concerns

Being purely digital, cryptocurrencies can be susceptible to cyber threats like hacking and theft.

It's paramount for investors to adhere to best security practices when dealing with cryptocurrencies to safeguard their investments from potential cyber-attacks.

Bottom Line

The integration of cryptocurrency into a 401(k) portfolio offers a new avenue for potentially high returns and diversification, acknowledging the long-term prospects of blockchain technology.

However, this must be balanced with an understanding of the unique risks, such as extreme volatility, regulatory changes, and cybersecurity concerns.

The decision to invest should start with confirming whether your plan allows for cryptocurrency investments, followed by a diligent study of available options.

A diversified portfolio is crucial, with cryptocurrencies forming just a part of it based on your risk tolerance. Regular review and rebalancing are essential, given the quick-paced nature of the cryptocurrency markets.

It's vital to select a reputable cryptocurrency platform considering factors like security measures and available cryptocurrencies.

Ultimately, including cryptocurrency in a retirement plan is a personal decision based on individual risk tolerance and investment strategy.

How to Invest in Cryptocurrency Through 401(k) FAQs

No, not all 401(k) plans currently allow investments in cryptocurrency. It is important to check with your plan administrator to understand your plan's specific rules regarding cryptocurrency investment.

Potential benefits include the opportunity for high returns, diversification from traditional asset classes, and a stake in the long-term potential of blockchain technology. However, these should be balanced against the risks and your personal risk tolerance.

The primary risks include extreme volatility and unpredictability of cryptocurrencies, regulatory risks as policies are still evolving, and cybersecurity concerns due to the digital nature of cryptocurrencies.

Diversification plays a critical role in risk management within a 401(k) portfolio, even more so when it includes cryptocurrencies. By spreading investments across a range of asset types, including different cryptocurrencies, you can potentially reduce the risk of significant losses.

When evaluating a cryptocurrency platform, consider the platform's security measures, transparency, ease of use, customer support, and the range of available cryptocurrencies. Always read reviews and potentially consult with a financial advisor before committing to a specific platform.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.