Risk tolerance refers to your ability to withstand potential losses in your investments. Everyone's risk tolerance is different, and it usually correlates with their investment time horizon. Generally, the longer your investment time horizon, the more risk you can afford to take on, as the markets have more time to recover from potential downturns. It's essential to assess both your risk tolerance and investment time horizon when deciding how to allocate your 401(k) funds. Deciding whether to contribute pre-tax dollars to a traditional 401(k) or post-tax dollars to a Roth 401(k) is a vital choice. The primary difference lies in the tax implications: traditional 401(k) contributions lower your taxable income now, but you pay taxes upon withdrawal. Conversely, Roth 401(k) contributions are made with after-tax dollars, but withdrawals are tax-free in retirement. Your choice may depend on your current income bracket and where you think it will be in the future. Diversification means spreading your investments across various asset classes, sectors, and geographic regions to mitigate risk. Your 401(k) should contain a mix of investments such as domestic and international stocks, bonds, and possibly other asset classes. A diversified portfolio can help smooth out returns over time, reducing the likelihood of substantial losses. Setting up your 401(k) contributions is typically straightforward. Your employer's human resources department or plan administrator should provide instructions. Typically, you'll decide how much of your salary to contribute (up to the annual limit set by the IRS), and which investments to allocate these contributions to. Your 401(k) plan will offer a selection of investment options, often mutual funds, that represent different asset classes. It's crucial to understand these options and select a mix that aligns with your risk tolerance and investment horizon. A well-rounded portfolio often contains a mix of equities (for growth) and bonds (for income and stability), along with other asset classes. Many employers offer a match on 401(k) contributions, which can significantly boost your retirement savings. Be sure to contribute at least enough to receive the full match – it's essentially free money. When you contribute to your 401(k), you're implementing a strategy called dollar-cost averaging. This is where you invest a fixed amount of money at regular intervals, regardless of the market conditions. This strategy can help mitigate the effects of market volatility, as you buy more shares when prices are low and fewer when prices are high. Over time, your portfolio's asset allocation can drift from its original state due to the varying performance of different assets. It's crucial to rebalance your portfolio periodically to ensure it aligns with your risk tolerance and investment goals. Rebalancing involves buying and selling assets to restore your portfolio to its target allocation. One of the significant benefits of a 401(k) is the ability to leverage compound interest. This occurs when the returns on your investments are reinvested, and they start to earn returns of their own. The longer your money is invested, the more potential it has for compound growth, reinforcing the advantage of starting to invest early in your career. Target-date funds are a type of mutual fund that automatically adjusts the asset mix over time based on your estimated retirement date. They can be a convenient choice for hands-off investors but may not be right for everyone, especially if you have a non-standard risk tolerance or investment goals. Some 401(k) plans offer managed accounts, where a professional manages your investments for a fee. While these can provide customized investment strategies, the higher fees can eat into your returns. It's crucial to weigh these costs against the potential benefits. Some plans allow for in-service withdrawals, where you can roll over funds to an IRA while still employed. This can open up more investment options, but there are often restrictions and potential tax implications, so proceed with caution and consult with a financial advisor. Regular reviews of your 401(k) are crucial to ensure your investments align with your goals. While daily checks are unnecessary and could lead to unnecessary stress or rash decisions, a semi-annual or annual review is often appropriate. If you find that your portfolio has drifted from your target allocation or if your investment goals have changed, it may be time to adjust your investments. Remember, frequent changes can incur costs and potentially hinder long-term growth, so changes should be considered carefully and infrequently. Market volatility can be stressful, but it's important to remember your long-term goals. Reacting impulsively to market downturns can hinder your long-term growth. Stay the course and remember that downturns are often followed by recoveries. If you change jobs, you'll need to decide what to do with your 401(k). Options typically include leaving it in your old employer's plan, rolling it over to your new employer's plan, rolling it over to an IRA, or cashing it out. The last option often incurs penalties and should be considered carefully. If you're age 50 or older, you're allowed to make catch-up contributions to your 401(k) above the annual limit. This can help boost your retirement savings if you're behind. Effectively investing your 401(k) is a pivotal step towards a secure retirement. Key principles include understanding your risk tolerance and aligning it with your investment horizon, choosing wisely between Traditional and Roth contributions, and ensuring diversified portfolio allocation. The power of dollar-cost averaging, the importance of regular rebalancing, and the magic of compound interest are essential elements to grasp. More advanced strategies like target-date funds, managed accounts, and in-service withdrawals cater to specific needs. Continual monitoring, making calculated adjustments, and staying informed during market volatility or job changes can significantly optimize outcomes. Regardless of where you are in your career, understanding and utilizing these principles and strategies will position you for financial success in retirement.Understand How to Invest Your 401(k)

Assess Risk Tolerance and Investment Time Horizon

Choose Between Traditional and Roth 401(k) Contributions

Understand the Importance of Diversification in 401(k) Portfolio

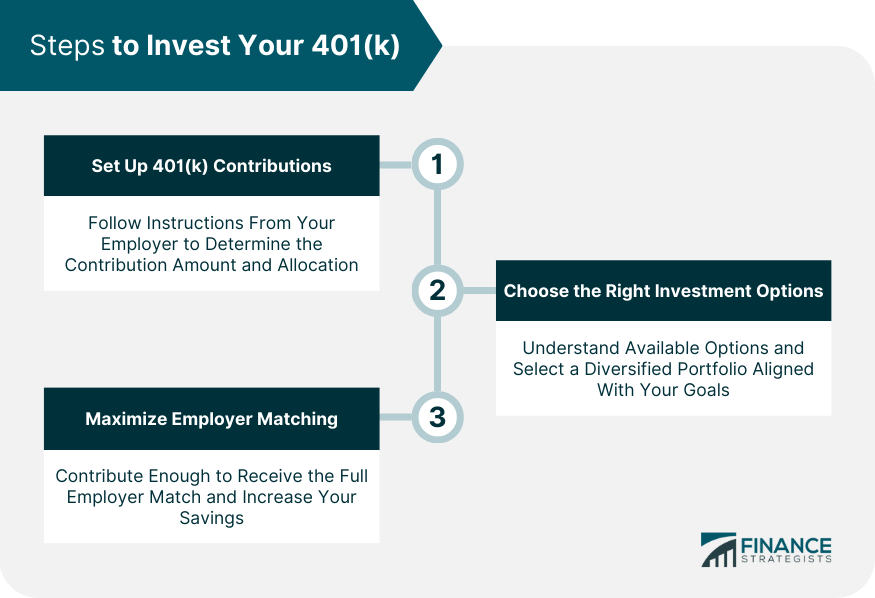

Steps to Invest Your 401(k)

Set Up 401(k) Contributions

Choose the Right Investment Options

Maximize Employer Matching

Key Principles of 401(k) Investment

Concept of Dollar-Cost Averaging

Rebalance of Portfolio

Compound Interest and Long-Term Growth

Advanced 401(k) Investment Strategies

Target-Date Fund

Managed Accounts

In-Service Withdrawals

Tips to Monitor and Adjust 401(k) Investments

How Often Should You Review 401(k) Performance?

Make Changes to 401(k) Investments

Deal With Common 401(k) Investment Challenges

Navigate Investment During Market Volatility

Handle Job Changes and Rollovers

Catch-up Contributions for Those Closer to Retirement

Conclusion

How to Invest Your 401(k) FAQs

The primary difference lies in the tax implications. Traditional 401(k) contributions are made with pre-tax dollars, reducing your current taxable income, but you pay taxes when you withdraw funds in retirement. Conversely, Roth 401(k) contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the market conditions. It can help mitigate the effects of market volatility as you buy more shares when prices are low and fewer when prices are high. It's a strategy inherent to 401(k) investing, as contributions are typically made with each pay period.

Target-date funds are a type of mutual fund that automatically adjusts the asset mix over time based on your estimated retirement date. They can be a convenient choice for hands-off investors. However, they may not suit everyone, particularly if you have non-standard risk tolerance or investment goals.

Regular reviews of your 401(k) are essential, but daily checks are not necessary and could lead to undue stress or rash decisions. A semi-annual or annual review is often appropriate. As for making changes, frequent adjustments can incur costs and potentially hinder long-term growth, so changes should be considered carefully and infrequently.

If you change jobs, you have a few options for your 401(k). You can leave it in your old employer's plan, roll it over to your new employer's plan, roll it over to an Individual Retirement Account (IRA), or cash it out. The last option often incurs penalties and should be considered carefully. It's wise to consult with a financial advisor in these situations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.